QuickBooks Online 2021 purchase and finance equipment and add sub accounts. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, we’re going to be opening up a few reports up top balance sheet income statement trial balance,

Posts with the journal entry tag

Enter Payroll For Second Month 8.80

QuickBooks Online 2021 enter payroll for the second month. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice problem, we’re going to be opening up our reports by going up top, we’re going to right click on the tab up top duplicate, we’re going to do it again, right click on the tab up top, duplicate, do it again, right click on the tab up top and duplicate we’re going to be having our trial balance here, our income statement or p&l here, our balance sheet there, this is our our starting routine at this point.

Adjust Opening Balance Equity Accounts 6.85

QuickBooks Online 2021 adjust opening balance equity accounts. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars a practice problem, we’re going to continue on entering our beginning balances into our QuickBooks system. In prior presentations, we’ve been taking this trial balance, we’ve been entering all the beginning balances in these accounts, our objective and goal being to enter the beginning balance account by account, and then having the other side be placed by QuickBooks in the equity section in one way or another, either by putting it into the default account of opening balance equity, or into an income statement account as of the prior year to the one that we’re going to start our business in.

724 Economic Ordering Quantity (EOQ) Prob 2 6.80

QuickBooks Online 2021. Now, opening balances and add accounts to chart of accounts. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, we’re going to be continuing to enter our beginning balances and add any necessary accounts to do. So if we go back on over to our trial balance, we’ve been entering those balances that have kind of like special needs as we enter the beginning balances.

Journal Report 4.60

QuickBooks Online 2021 journal report. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive practice file, which you can find by searching in your favorite browser for QuickBooks Online test drive or in Craig’s design and landscaping services, we’re going to go down to the reports on the left hand side, we’re going to go all the way down to the accounting reports looking for the journal report, which after this point in time, you might find by simply typing up top for it, but right now we’re going to scroll on down.

Net Assets Released From Restriction 172

This presentation we will record a transaction related to net assets being released from restrictions. In other words, we have net assets that had some restrictions put on them, we’re going to be spending money in such a way that it will be releasing the net assets from restriction will record the journal entry to move those net assets from a restricted area to unrestricted so that they can be used and reflected on our statement of activities and statement of net position. Get ready, because here we go with aplos. Here we are in our not for profit organization dashboard. Let’s head on over to our Excel worksheet to see what our objective will be. We’re over here in tab 10. So tab number 10. On the Excel worksheet, you’ll recall in previous presentations, what we have done thus far is we’ve been thinking about recording transactions in terms of journal entries, the accounts that are affected, and then putting them into our trial balance.

Allocate Expenses to Categories Part 2 171

https://youtu.be/H1D3e6dKlTI?list=PL60SIT917rv6ERsGZxM9V_IZLVybpgfNU

This presentation, we’re going to continue on allocating our expenses by category by function, including by program, admin, and fundraising with the use of our tax feature within our accounting software, get ready to go with aplos. Here we are in our not for profit organization dashboard, we’re going to go on over to our Excel file to see what our objective will be. We’re continuing on with the allocation of our expenses, you’ll recall the objective being that normally we have our expenses broken out in the statement of activities here. And we need to break them out both by function and what they’re used for by nature and by function.

Allocate Expenses to Categories Par 1 170

https://youtu.be/F4FtVtXckPo?list=PL60SIT917rv6ERsGZxM9V_IZLVybpgfNU

This presentation and we’re going to start breaking out our expenses by nature. In other words of what the expenses are used for with the use of the tags, the categories being the education, the community service, the administrative and the fundraising for that 4020 2020. Being the allocation percentages, we will be using, get ready, because here we go with abalos. Here we are in our not for profit organization dashboard, we’re going to be heading on over to Excel to see what our objective will be.

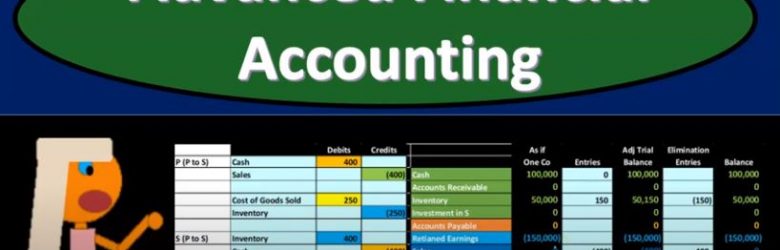

Sale From Parent to Sub Sub Has Not Resold

Advanced financial accounting PowerPoint. In this presentation we will discuss a situation where there is a sale of inventory or transfer of inventory from parent to subsidiary, the subsidiary not having yet sold the inventory. So in that sense, we have an intercompany type of transfer. When we consider the parent and subsidiary as a whole with regard to a consolidation process, the parent sold to the subsidiary the inventory, the subsidiary still holding on to that inventory has not resold it externally at this point, get ready to account with advanced financial accounting. What we want to do now is think about the transaction on p side and then on SSIS, and then what the elimination entry will be. So there’s a couple ways you can think about this, you can kind of memorize what the elimination process will be what the elimination entry will be and put together worksheets to do that elimination process kind of by just routine by just filling out the worksheet. And then you also want to analyze the worksheet and think about it in detail in terms of what is actually happening.

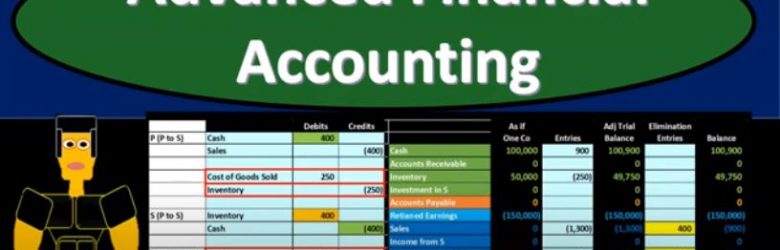

Parent Sale to Sub & Sub Resold

Advanced financial accounting. In this presentation we’re going to discuss an intercompany transaction where a parent makes a sale to a subsidiary and then the subsidiary resells it. In other words, we have this intercompany transaction, we want to think about how that is constructed. And then how we can do the reversing entry for it or a consolidation entry in the case of a consolidation of a parent and subsidiary in a consolidated financial statements, get ready to account with advanced financial accounting. So within a situation where we have a sale from P to s, and then S sells it to an outsider remember that as it goes to the outsider, that’s going to be the legitimate type of so that’s the arm’s length transaction, the sale from PETA is not so and therefore we kind of have to eliminate that. Now if it’s been sold to an outsider, then we have a situation where the inventory is still gone. There has been a sale being taken place. And so we so that’s good, but we still have to do the reversal of part of that intercompany transfer and it’s gonna boil down At the end of the day, basically debiting, the revenue account reversing revenue, and reversing the cost of goods sold. So this is the boiled down version. Now if you think about it, you might say what happy because if p sales to s, then you’re going to like debit cash credit, you know, you’re going to credit the sales, and then you debit cost of goods sold, and credit inventory and then asked is going to be recorded cash, and then they’re gonna be recording, then the other side go into inventory, and then right, there’s more, and then they made the sale to the outsider. So how do we boil this down? How does the intercompany boil down to just this right? We kind of kind of have an idea of that in our mind.