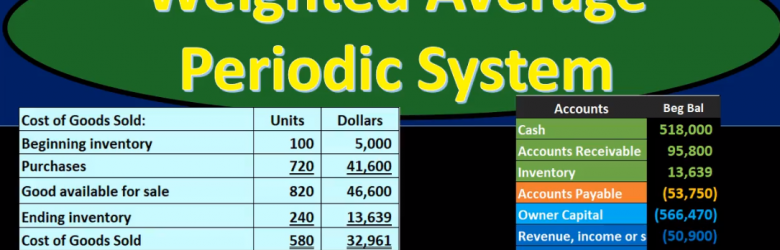

Hello in this lecture we’re going to be talking about the average inventory cost method we will be selling our coffee mugs again we will not be using a specific identification but rather a cost flow assumption VAT assumption being the average method, we will be using the same worksheet I highly recommend working on a worksheet such as this when when doing any cost flow assumption for inventory, which will include a purchases section, a cost of merchandise section and an ending inventory section in which pieces we can then calculate the unit cost times the quantity to give the total cost for each of the sections. This can answer the most amount of questions that can be asked for this top. If we take a look at a trial balance, we can see that the inventory on the trial balance is at 5000.