This presentation we’re going to continue on with our discussion of acquisition accounting, and this time focusing in on a bargain purchase, get ready to account with advanced financial accounting. First off, we can basically think of the bargain purchase as the opposite of goodwill. So in a prior presentation, we talked about the concept of goodwill within an acquisition, which would be resulting if the fair market value of the amount that was given like basically the purchasing price was greater than the fair market value of the net assets. So in other words, we take we look at the books of the company that’s being acquired, we’ve revalue their assets and liabilities to be on a fair market value, then assets minus liabilities, the equity section, the net assets now at a fair market value, we take a look at that. And if there’s a consideration that’s given that is greater than that amount, that then would result in goodwill. Now goodwill is quite common, because it’s unlikely even if you even if you re assess all the assets and liabilities to their fair value. Then you would typically think that the price would either be that that would be given the the amount that would be exchanged, the fair market value of the consideration would be the same as the assets minus the liabilities at fair market value, or more, because there’s some type of goodwill, that’s going to be that’s going to be in the organization. Now, you might be thinking, Well, what what if it was the opposite? What if you took the fair market value of the net assets, and the amount that was given the exchange amount was less than the fair market value? Now that could happen, but just note that that’s a lot more unusual.

Posts with the journal entry tag

Creating a Statement of Cash Flow-Indirect Method-Accounting%2C financial

Hello in this lecture we’re going to talk about creating a statement of cash flows using the indirect method, we will be able to define a statement of cash flows, create a statement of cash flows explain a process of creating a statement of cash flows designed to limit mistakes and define the indirect method. So what we’ll do is we’ll work through basically a problem and look through the statement of cash flows. We want to think about a few things we want to think about how to create a statement of cash flows, we want to think about a few definitions of what is a statement of cash flows, we want to kind of explain what the purpose is of a statement of cash flows and going through the process can help us to do that. Also want to point out that creating the statement of cash flows can help us with setting up a problem in such a way that we can limit the amount of mistakes that we will make. So a statement of cash flows is something that in a lot of firms, people generally often have problems to create the statement of cash flows. And it’s good practice to go in there and and create the statement of cash flows and try to create a system in which it’s easy for us to have checkpoints and see where a problem is going to happen.

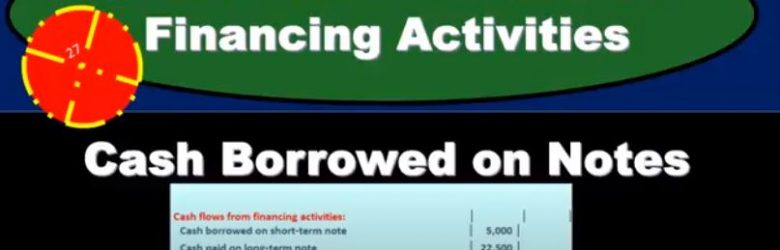

Statement of Cash Flow Financing Activities Cash Borrowed on Notes

In this presentation, we will continue on with the statement of cash flows. Looking at the financing activities looking at cash borrowed on notes, we’re going to be using the information with our comparative balance sheet, the income statement and the additional information focusing on the comparative balance sheet. First, it will be used to create this worksheet, we have going through this worksheet looking for all the differences and finding a home for them starting Of course, with cash down here, and then we kind of skipped around to pick up all of the cash flows from operating activities. And that’s really how people usually start this thing out. And rather than going just from top to bottom, picking out the operating activities, then we went back and we picked up the cash flows from investing activities. Now we’re going to go down and pick up the financing activities. And those deal with notes payable here. So we have the notes payable, and we have this common stock issuance. So those are going to be things that are typically going to be in the final financing. And you might think of as well, how would I know this? What? Why would I know that’s going through? Well, if we go through these, remember that the cash is obviously down here, that’s where we started. And then the current assets versus current liabilities, most of them are going to be up here. And that’s going to be the accounts receivable, the inventory, prepaid expenses, and then equipment.

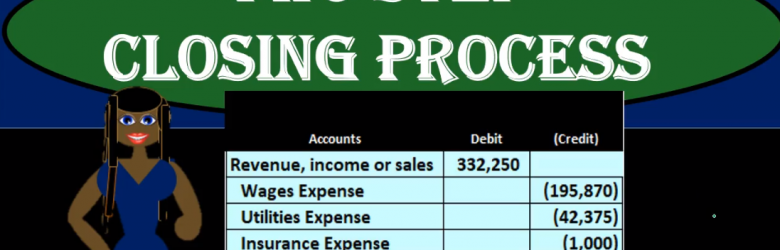

Closing Step 2 of 4 – Journal Entry 2 of 4

Hello in this lecture, we’re going to talk about the closing process. Step two of the four step process being closing the expense accounts to the income summary. Remember that the goal of the closing process is to close out the temporary accounts that would include the drawers as well as all the income statement accounts, including revenue and expenses to the capital account. So we want our adjusted trial balance to thing we used to make our financial statements to look like the post closing trial balance with all the zeros from the capital accounts down. How do we do that? Last time we did the first step step one, which was to close out income to the income summary. This time we’re going to close out expenses to the income summary. Next time we’re going to close out the income summary to the capital account. And finally closeout draws to the capital account.

Two Step Closing Process

Hello in this presentation we will take a look at a two step closing process. In other words, we will perform the closing process using two journal entries. There’s a couple different ways we can see the closing process, each of them having a pros and cons. The two step process is nice because it allows us to see net income broken out and being closed out directly to the capital account, followed by draws, which is similar to what we see when we actually do the statement of equity, meaning that when we do the statement of owner’s equity, we start with beginning balance and then we increase it by net income and decrease it by drawers or dividends. Because this process is similar to that process, it’s often easy to remember it’s the easiest for me to remember in any case, so we will take a look at the two step closing process.

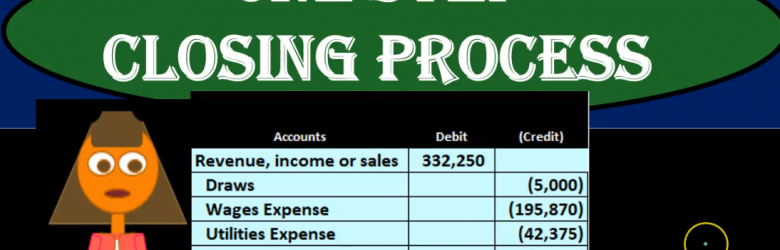

One Step Closing Process

Hello in this presentation, we will be looking at a one step closing process. In other words, we will be closing out temporary accounts using one journal entry. There’s a few different ways that we can perform the closing process. And there’s benefits and cons to each way of doing it. The one step closing process is the simplest way to do it. And it’s also a way that we can imagine what is happening within the closing process as easily as possible a skill useful when considering what’s happening from time period to time period, and how the financial statements are working. So here we’re going to look at a one step closing process. Remember what the closing process is, it’s going to be a process at the end of the time period that we will be performing.

Closing Process Explained

Hello in this lecture we’re going to talk about the objectives of the closing process the closing process will happen after the financial statements have been created. So we will have done the journal entries where we will have compiled those journal entries into a trial balance, and then we will have made the financial statements. And then as of the end of the period in this case, we’re going to say as of December, when we move into the next time period, January, what we need to do is close out some of the temporary accounts those accounts including the income statement and the draws account so that we can start the new period from start in a similar way as if we were trying to see how many miles we could drive say in a month. If we wanted to Vince in December, and then see how many miles we’re going to drive in January of next year.

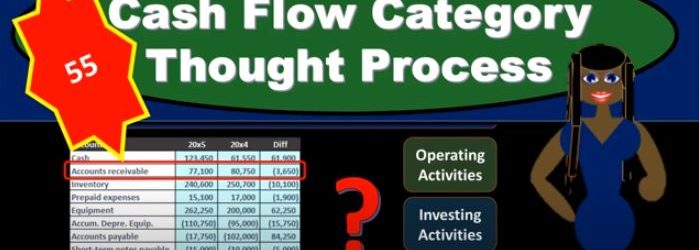

Cash Flow Category Thought Process

In this presentation, we will think about the thought process to know which category a cash flow should be entered into whether it should be operating, investing or financing activity. When putting together the statement of cash flows, we’re usually going to have a worksheet, which will typically have a comparison of balance sheet accounts. And we also might just have test questions that will ask us, where should this cash flow go? And that’s going to be a common kind of question that we’re going to have whether we build the entire cash flow statement from scratch, or whether we’re just asking test test questions and trying to know what types of Cash Flows we’re talking about. It’s also important for practice as well so that we can understand when we’re thinking about cash flows, where do they belong? What are these cash flows mean? What are they doing for us? What are they doing for the company? Are they part of the operations? Are they part of investing? Are they part of financing? If we look at a worksheet like this to build the statement of cash flow, typically we’re going to look at a balance sheet for two periods. So here our balance sheet for these two periods. And we’ll have the difference between the two periods in terms of the balance for these balance sheet accounts. So we’ve got cash, accounts receivable, inventory, prepaid expenses.

01:13

Now what we’re going to do is we’re going to take the change in cash, that’s going to be the end result on our statement of cash flows. And we’re going to kind of back in to that end result by looking at the change in the other balance sheet accounts and tried to figure out what’s causing this change. So we’re going to go through all the other balance sheet accounts, look through these changes. And we know that if we look if we add them all up, they add up to zero. Why? Because the debits and credits for one year, add up to zero the debits and credits for the other year add up to zero. In other words, the debits minus the credits equals zero. And therefore the difference between the two years debits and credits the change will add up to zero. So we know that’s the case and we know that if we add up then everything except cash Then the result will be the difference in cash. So that’s how we’re going to kind of work and put together our statement of cash flows. So what we need to do then is we’re going to take a look at these changes in receivables, changes in inventory changes in prepaid expenses, and then try to determine where does that change belong? Before we get into any other question is, is the change of inventory and operating, investing or financing activity? And is the change in long term notes payable? Is that going to be an operating investing or financing activity? Our goal here is to go through a thought process to see if we can think through more clearly which category these these should be belong to. So what’s the most common journal entry in this account? It’s going to be our first question.

02:48

Whatever account they’re given us here, we’re going to say it let’s think about the most common journal entry that’s related to this account, there’s typically going to be one or two journal entries that are going to be very common and we want just right down first, once we know the most common journal entry, then we’re going to ask is an income statement account involved? So when we think about whatever account we’re dealing with, we’d write down the journal entry and say, Okay, is there an income statement account involved? Is there a revenue account or an expense account involved? If the answer is yes, then it’s probably the change that we’re dealing with is probably something that should be in the operating activities. Because remember, the operating activities is kind of like the income statement on a cash basis. So if we’re dealing with something that’s this change has something to do with the income statement, then it’s going to be something on the operating activities. Typically, if the journal entry has nothing to do with the income statement, there’s no revenue or expense accounts involved in the normal journal entries related to these accounts, then we’re going to ask the question, are we purchasing or selling an asset? Because it’s so if it’s not operating, this means that it’s not operating therefore, We’re trying to see if it’s going to be investing activity. And that typically means we’re purchasing or selling an asset. If it has to do with, for example, property, plant and equipment, or some other type of investment, then it’s going to be an investing activity. And then if it’s not, then it’s going to be financing. And of course, financing is going to be dealing with notes, something that we’re dealing with that doesn’t deal with operating activities in terms of the income statement, no revenue and expenses, and typically doesn’t have assets involved either, because what we’re doing is funding the company. So that’s typically going to be something that deals with cash and subtype of liability or the equity section. So this is going to be our thought process if we go through each of those line items, and think about each account on the balance sheet.

04:46

And then try to go through this thought process and think okay, which category are we going to be putting this change to? Now, this looks a little less intuitive than we might think at first glance here because no one We’re doing we’re looking at the balance sheet accounts. And we’re trying to see what category these things are going to fit into. And remember that the operating activities I’m keep on comparing that to the income statement. And you might be thinking, well, these are all balance sheet accounts. Why do you keep mentioning the income statement. And note, what we’re doing here is we’re really kind of backing into the activity is happening by looking at the change in two points in time. So we’re kind of still looking at the income statement activity type of accounts, we’re looking at change, we’re looking at activity, even though we’re doing that by looking at the change in two points in time to balance sheet accounts, which are points in time. So when we look at the change in accounts receivable for example, if we go through our thought process, we’re going to say okay, accounts receivable was at 80,007 50. In the prior year, end of the current year, it’s at 77,100.

05:51

That means it went down by 3650. So our goal here is just to determine which category That change belongs to it’s an operating, investing or financing. And if we think about that, then we could think Well, what’s the normal journal entry related to accounts receivable? We’re going to have a debit to accounts receivable and a credit to sales. That’s going to be our normal journal entry that we’ll have related to accounts receivable. And we can see there that sales is an income statement account. So we know that it is an income statement account involved, we’re going to say yes, therefore, it’s an operating activity. So note what we’re doing here, we’re looking at the change in a balance sheet account. We’re looking at the change in the balance sheet account, then ask yourself, what’s the normal journal entry related to this account? And if we think about the normal journal entry related to accounts receivable, that’s a sale of something on account. So accounts receivable goes up when we make a sale on account, and we credit revenue and revenue is clearly an income statement account. So this Change, then that’s what we’re going to think through, we’re going to say that change looks like it belongs somewhere in the operating activities. Because we’re dealing, we’re really kind of backing into sales. That’s what we’re really looking at. And we’re going to do that by writing down the journal entry. Let’s look at another account. We’re going to pick equipment now. So we’re just going to go through all these changes. And we just got to find a home for all these changes.

07:21

When we when we make the statement of cash flows. We got to find a home for them in either operating, investing or financing. And we’ll end up with the change in cash, which is kind of like the bottom line. The bottom line will be cashed at the end of the day. So we’re going to find a home for the equipment. Where’s that going to go that change? Well, if we think about the journal entry for equipment, then if we buy equipment, we’re going to debit equipment, and credit cash and possibly credit like a note payable, some type of financing. But if we pay cash for it, this would be the most simplified journal entry. Even if we had a note there’d be no Part of it that would be on the income statement, one asset went up, the other asset is going down. So therefore, is the is an income statement account involved? No. So we’re purchasing or weren’t, so it’s not going to be an operating activity. And then the next question is, are we purchasing or selling an asset? In this case, yeah, we’re purchasing an asset. And that means that it’s going to be an investing activity. So and this was the confusing thing for me when I first started learning this thing, because investing activities, I had a different conception of what investing is to invest in something like any asset any anything we purchase in the business that we’re not consuming now is an investment to the future. In terms of the cash flow statement, we’re trying to spend our cash in order to put our money somewhere that’s going to help us make money in the future. That’s going to be some type of investment. So in this case, it’s going to be an investing activity.

Bond Retirement

In this presentation, we will discuss the journal entries related to the retirement of bonds. the retirement of bonds just means that we’re going to pay off the bonds in some form or another at some time or another, meaning the bonds are going to go away. Typically, that’ll happen at the maturity date at the end of the bond. So for example, if we have a bond on these terms, with the face amount of 240, the issue price of 198 for 80, for 15 year bonds, they’re going to be semi annual. What would happen is when we put this on the books, we would put it on the books as cash we got for the 198, the bond payable on the books for 240, and then a discount. And then of course, over the life of the bond, we would be paying interest for that 15 year time period two times that’s 30 payments. And then at the end of this we would also be be amortizing out the discount to get rid of it, to make it go away to the interest and then By the end of this time period, the discount would be zero. And we would only be left with a bond on the books. In other words, at the maturity date, we would have something like this on our trial balance, the discount is now zero. And the bond is on the books at 240, which is the face amount of the bond, if it were a premium, it would be it would be the same in that we would be left with just the bond amount and the premium would be gone to zero. And now it’s just like anything else that we don’t have to deal with interest at this point or anything else, we just need to close out the bond. And so it’s just like any other liability, we’re just going to pay at the maturity date. That’s how we’re going to retire it. So this is a 240 credit, we’re going to make it go down by doing the opposite thing to it a debit, and we’re going to pay cash, cash is a debit balance, we need to make it go down. So we’re going to credit cash. So this is going to be our journal entry. We’ll debit the bond make go away, and then we’ll pay off the cash. When we post this then the bond payable will be here. Here, it’s going to go it’s a credit, we’re going to debit it, making it go away to zero, and then the cash has a debit balance, we’re going to credit it making the cash go down. So it’s a pretty straightforward journal entry.

02:12

The only confusing thing about this journal entry is that it happens at the end of the bond term. So when we’re talking about book questions, we often don’t get asked it because usually we’re concentrating on how to calculate the interest how to calculate the face amount of the bond, how to record the bond, how to amortize the the bond, discount or premium. And we don’t really typically get all the way to the end of the bond, the retirement the maturity date, to record the end transaction oftentimes, and it’s a pretty easy transaction if we were to do so. And it’s a lot easier to if we can actually see the trial balance. When you see the trial balance, you say, oh, there’s a liability there. We’re going to pay it just like we would if it were note payable at this time. It needs to go down and then we’re going to pay it off with cash. Now it is possible for us To have a callable bond that we’re going to retire before the end of the bond date before the maturity date. So in other words, in this case, we have the bond on the books of 240,000. And we have the discount of 338 748. And therefore, if we were to calculate the carrying amount, we’d have 240,000 minus 238 748, or two a one 252. This 201 252 is the carrying amount of this bond payable. This is something that we owe in the future. If we can pay it off at this point in time for some cash that’s going to be less than this amount, then we’re going to have a gain resulting in a gain. And if we are paying it off early for something more than this, we’re going to have a loss. So let’s see what that’s going to look like.

03:52

The gain or loss can be confusing here. When we’re talking about a bond. It’s easier to get to that point by just doing the journaling So if we have all this information, especially if we have the trial balance, because then we can see what accounts are debited and credited on the trial balance or which accounts have a debit or credit balance, then it’s a lot easier for us to construct the journal entry. So the first is going to be given to us, we’re going to say that the cash that we’re paying is 230,000. That’s gonna have to just be given in the problem because that’s the callable price that’s how much we’re able to purchase these bonds for. So cash is going to go down because remember, we are buying them back basically, or we’re we’re paying them off early before the maturity date. So it’s going to be 230. Then we’re going to say that the bond payable has to go off the books. Now the bond payables on the books at 240,000, we can see it’s a liability, it has a credit balance. So to take it off the books, we do the opposite thing to it, a debit for whatever it needs to be to make it go to zero, the discount. Same thing we need to do whatever we need to do to make it go to zero because it’s Gotta go away. So when we construct the journal entry, we just know that we just got to do whatever we need to do to make it go to zero. If you have a trial balance in front of you, that’s easy to do, because we can see the discounts on the books at a debit. And we need to do the opposite to make it go down, which is a credit. If you’re looking at a book problem that doesn’t give you a trial balance, and just tells you that the bond is on the books at a discount, then you got to think through it. And one way to think through it might be to say, well, the bonds is a liability, it must be a credit, that discount means that we’re making the bond go down, because it must be decreasing, we’re having it less than the state, the face amount, the sticker price.

05:40

And since it’s a credit, the thing that makes a credit go down would be a debit. So that discount must be a debit because these two are really combined together. And a discount means that we we really the net of the two are below the face amount price, so this must be a debit. So if it were a premium, then this amount be increasing or greater than the face amount, and it would be a credit normal balance. Once we know that this is a, this is a debit normal balance for a discount, then we can do the opposite thing to it to credit it to make it go down. And then of course, we just need to figure out what the difference is we’ve got credits of 230,038 748 minus the 240. Debit means we need a 28 748 debit. And that of course, in this case, I’m going to say it’s a gain loss account here because it could have gone either way. But if it’s a debit here, then it’s on the income statement. That’s going to be a loss. And you just got to basically start to be able to recognize that why would that be a loss? Well, you can think through that. We paid 230 versus the carrying value, or you can also just think well, if it’s a debit on the income statement, It’s acting more like an expense, meaning expenses have debit balances, they go up in the debit direction, and they bring net income down.

07:08

Revenue has a credit balance, it brings net income up. This is acting like a, an expense because it’s a debit balance. If we debit the income statement, it’s going to make net income go down, that means it must be a loss rather than a gain, which we would think would make net income go up. So the other way we can think about this is to is remember, the carrying value is going to be the 240,000 minus the 38 748. So this is kind of a value that we owe on the bond. And it’s a liability, that’s kind of the value we owe and we paid more than the value that we owe. So that’s going to be a loss in this case. And that’s another way you can think through it being a loss. So if we post this out, then we’re going to say that the gain or loss 28 748 Here, making the income statement accounts go up, kind of like an expense bringing net income down. The bond payable will be posted here, it’s going to make the bond payable go to zero. That’s why we are retiring. It’s making it go away. And then we’ve got the discount, it’s going to make the discount go to zero because we’re retiring it as well. And then the cash is going to be here, cash is going to go down. So there’s going to be our transaction. We have the bond payable and discount going away which has to be the case if we’re retiring the bonds. The cash is going down for the early retirement. And we resulted in a loss in order for us to be able to retire the bonds early.

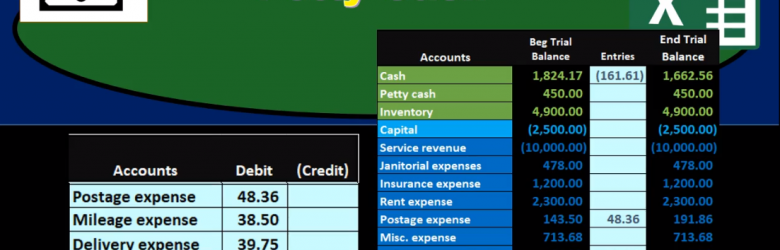

Petty Cash

In this presentation we will talk about how to set up and record a petty cash fund. Setting up a petty cash fund seems like an easy thing to do to have a minimal amount of cash that we can have expenditures for small purchases for however, it can be a little bit tricky to set up the petty cash fund and there is kind of a shortcut to recording transactions for the petty cash fund. So we’ll go over the process of setting up the petty cash fund recording the initial investment in the petty cash fund and then recording the activity from the petty cash fund. Now the objective of course in this will be to have not just the checking account where we need authorization in order to take money out of the checking account, we would typically want anything going out of the checking account to be by electronic fund transfer or by cheque so that we have a clear paper trail of what is going on the petty cash However, if we just have some small items that we need to take care of with cash and as to convenient to have small items with cash to be paid.