Hello. In this lecture we’re going to talk about the idea of tracking inventory and recording inventory, both in terms of the balance sheet as well as the income statement in the format of cost of goods sold. In our example, we’re going to be purchasing and selling forklifts, meaning we’re going to purchase forklifts from the factory and then we’re going to sell those forklifts. That means that forklifts to us will be inventory their inventory because we are purchasing the forklifts in order to resell them for the generation of revenue. That’s really going to be the definition of inventory the purchasing of something for the resale of it as opposed to if we were someone else purchasing the forklift in order to help us generate revenue in another way through the use of the forklift, in which case it would then be property plant and equipment.

Posts with the net income tag

Financial Statement Relationships 18

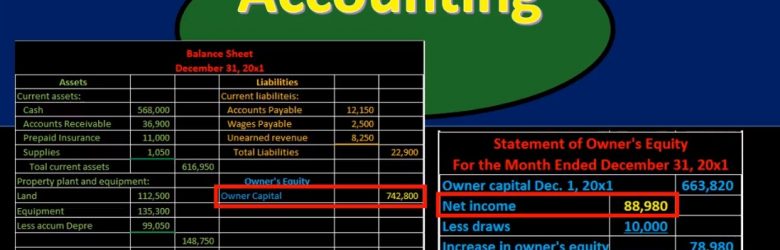

Hello in this presentation we’re going to take a look at financial statement relationships. In other words, how do these financial statements fit together? How do these financial statements represent the double entry accounting system in the format of the accounting equation that have assets equal liabilities plus equity? First, we’ll take a look at the balance sheet. Note that most textbooks will talk about this relationship and constructing the financial statements by first saying to construct the income statement, then the statement of equity and then the balance sheet. If you’re constructing things by hand with a paper and pencil, that does reduce the number of calculations that you would need to do, however, if you’re using something like Excel, then it’s a lot easier to sum up columns of numbers and it might be useful to take a look at the balance sheet. In any case, the relationships will be the same when we consider the relationships between the financial statements.

Statement of Equity From Trial Balance 17

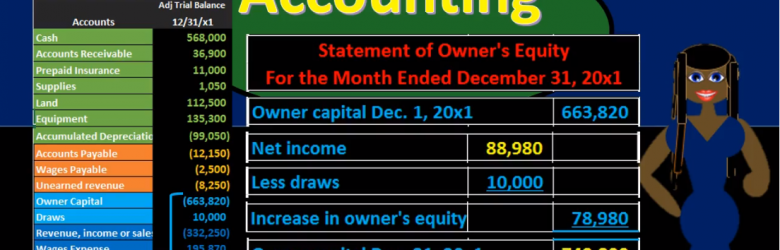

More in this presentation we will take a look at the statement of owner’s equity and see how to construct the statement of owner’s equity from the trial balance. When looking at the trial balance, we can see the accounts will be in order with the assets and then the liabilities, then the equity and then the revenue and expenses. The equity accounts being broken out here of owner capital and draws. But it’s a little deceiving to break out this equity section. Because the trial balance really is showing both a point in time the balance sheet account permanent accounts up top and timing accounts which are going to be the revenue accounts down below. When we think about the point in time for total equity as a whole. We’re really considering the entire blue area here. This is one of the most confusing concepts to really know when you’re looking at these financial statements.

Income Statement from Trial Balance 16

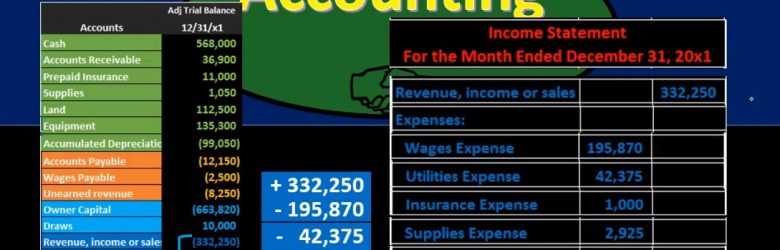

Hello in this presentation we’re going to take a look at the creation of the income statement from the trial balance. First, we want to take a look at the trial balance and consider where the income statement accounts will be. When looking at the trial balance, it will be in order we have the assets in green, the liabilities in orange, the equity in light blue, and then the income statement accounts including revenue and expenses. That’s what we are concentrating here we’re looking at those income statement accounts. And that is what will be used in order to create the financial statements to create the income statement. Note that all the blue accounts represents the equity section. So the income statement really is going to be part of total equity. If we consider that on the balance sheet, then we’re really looking at a component of this capital account.

Adjusting Entry Accounts Receivable 8

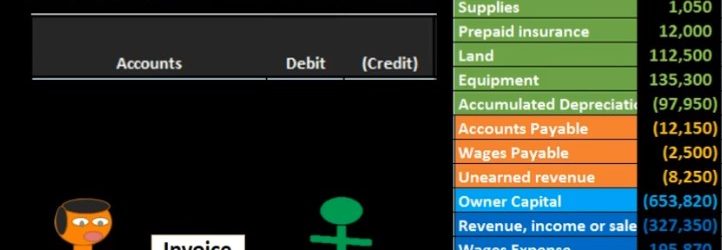

Hello in this lecture, we’re going to record an adjusting transaction related to accounts receivable. We’re going to record the journal entry over here on the left hand side and then post it to the trial balance on the right hand side trial balance and format of assets in green liabilities in orange equity in the light blue and the income statement in the darker blue including revenue and expenses, we’ll first walk through which accounts will be affected and then explain why that is the case. So we know that it is an adjusting entry and knowing that it’s an adjusting entry means it’s slightly different than a normal journal entry in that it does have two accounts like normal journal entries, but it also generally has one income statement account below the blue line and one balance sheet account above the blue line the light blue line, so it’s going to be one account above owner’s equity, one account below owner’s equity.

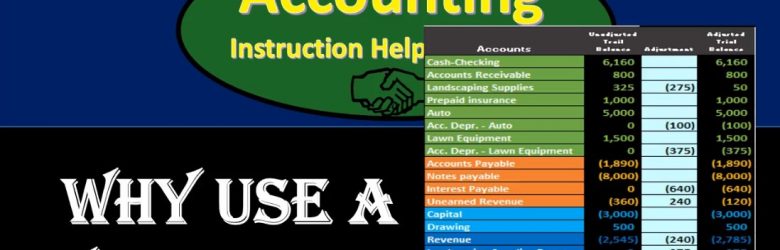

Why Use a Worksheet in Adjusting Process 3.5

Hello in this presentation we will discuss the reasoning for using a worksheet within the adjusting entry process, a worksheet like the one on the right where we have an unadjusted trial balance adjustments and then an adjusted trial balance. We typically think of this worksheet as outside of the normal journal entry process, meaning the normal journal entries that we are going to input will be in the general journal posted to the general ledger giving us more detail and then posted to the trial balance. And this case, we’re going to use a worksheet which will go straight to this adjusted column, and then show us the unadjusted balance the change and then the adjusted balance. If we were using accounting software like QuickBooks, then we would have the normal data input in the system we would produce then the unadjusted trial balance and put that into a worksheet such as this, and then work through this process to have our worksheet show the balances here. idea being that the worksheet in the adjusting process is going to be outside of the normal system.

Accounts Payable Journal Entries 240

Hello in this presentation we will be recording a business transactions related to accounts payable or the purchases cycle recording these transactions with debits and credits. At the end of this we will be able to list transactions involving accounts payable, record transactions involving accounts payable using debits and credits and explain the effect of transactions on assets, liabilities, equity, revenue, expenses and net income. We’re going to be recording these transactions up here in the left hand side in accordance with our thought process. We will then be posting these not to the general ledger but to a worksheet format so that we can see a quick calculation as to what is the impact or effect on the individual accounts as well as the effect on the account groups as a whole. Remember that all the groups for the accounts will always be listed in order when you’re looking at a trial balance. Which is why I recommend looking at a trial balance.

Accounts Receivable Journal Entries 230

Hello in this presentation we will be recording that journal entries for business transactions related to accounts receivable otherwise known as the revenue cycle. We will be recording these using debits and credits. At the end of this we will be able to list transactions involving accounts receivable record transactions involving accounts receivable using debits and credits and explain the effect of transactions on assets liabilities, equity, revenue, expenses and net income. We’re going to be recording these transactions up here on the left hand side constructing those journal entries in accordance with our thought process our list of questions to most efficiently construct the journal entries.

Cash Journal Entries with Cash 225

Hello in this presentation we are going to record business transactions involving cash using debits and credits. At the end of this, we will be able to list transactions involving cash record transactions involving cash using debits and credits and explain the effect of transactions on assets, liabilities, equity, revenue, expenses and net income. We’re going to record these transactions on the left hand side in accordance with our thought process. We’re then going to post them to a worksheet format, not necessarily or in this case, not a general ledger. But in a similar way, we will post it to this worksheet in order to see what is happening to each of these accounts individually as well as the groups of accounts in terms of assets, liabilities, equity, revenue and expenses, notes the order of the trial balance, always in the order of acids in this case in green liabilities in orange, and then we have the equity and revenue and expenses, the income statement accounts and net income at the bottom calculated as revenue minus expenses.

Accounts Payable Transactions Accounting Equation 170

So there’s gonna be problems later on where they’ll basically say, you know, you got to pay off something on account and you have to assume that the prior transaction took place. You got to kind of know in your mind how these things are related. So if we go through them by cycle that will help to achieve that goal. first transaction, we’re going to say purchase supplies on account. If we go through our list of questions, we’re going to say is cash affected? In this case? No, because we purchased it on account, then we’re going to ask what we’ve received, in this case supplies. So we got supplies, that is here, it’s going to be an asset. Therefore the asset is going to go up because we got more of them, then the only question is, what is the other account? It’s not a decrease to cash because we didn’t pay cash. And therefore we must be doing something somewhere else. That will be accounts payable, so accounts payable is going to increase by the same amount.