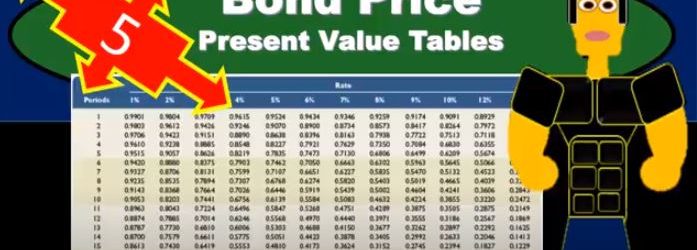

In this presentation, we will calculate the bond price using present value tables. Remember that the bonds is going to be a great tool for understanding the time value of money. Because of those two cash flow streams we have when with relation to bonds, meaning we’re going to pay the bond back the face amount of the bond, and we’re going to have the income stream. And those are going to be perfect for us to think about time value of money, how to calculate time value of money, our goal being to get a present value of those two streams. So we’re going to think of those two streams separately generally, and present value each of them to find out what the present value of the bond will be. We can do that at least three or four different ways. We can do that with a formula actually doing the math on it. We can do it now, which is probably more popular. Now. Do it with a calculator or with tables in Excel, I would prefer Excel or we can use just tables pre formatted tables. The goal here the point is to really understand what we’re doing in terms of what what is happening, what can it tell it? What can it tell us, and then understand that these different methods are all doing the same thing.

Posts with the pay tag

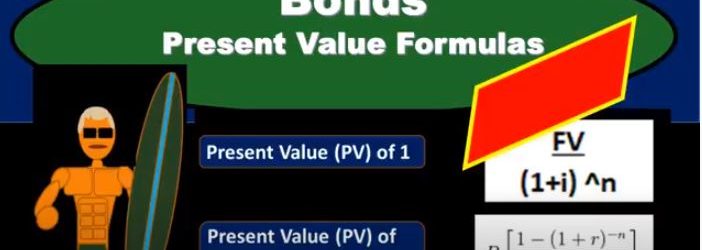

Bonds Present Value Formulas

In this presentation, we will take a look at present value formulas related to bonds. One of the reasons bonds is so important to accounting and finance is because they’re a good example of the term of present value of money. We’re trying to look for an equal measure of money, when we think of bonds and bonds is going to have this relationship between market rates and the stated rate, which helps us to kind of look through and figure out these types of concepts. So even if we don’t work with bonds, in other words, if we’re not planning on issuing bonds, or buying bonds, or knowing anything about bonds not being important to us, the time value of money is a very important concept and bonds is going to be a major tool to help us with that. Why is bonds so useful for learning time value of money, because there’s two types of cash flows with bonds meaning at the end of the time period, we typically are going to get the face amount of the bond that 100,000 similar to a note and then we’ve got the interest payments that are going to happen on a periodic To basis, and therefore we have these two different types of cash flows, that we can use two different formulas for, to think about how to equalize.

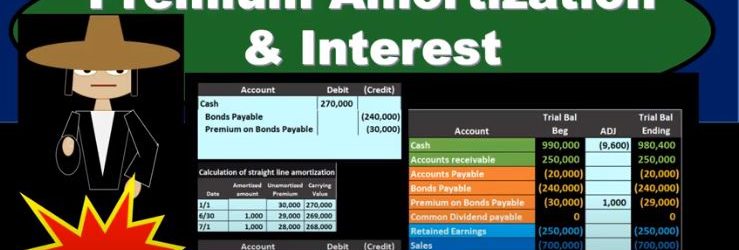

Premium Amortization & Interest

In this presentation, we will discuss the amortization of a bond premium and the recording of interest expense on bonds. This is going to be our starting point. This is the initial transaction in order to get the bonds on the books. Here’s our data down here we’ve got the number of years we’ve got the face amount of the bonds, we’ve got the issue price 270, we see that the interest on the market rate is different than the contract rate. The result then is that cash is going to be increased by the 217. The bonds payable went on the books for the face amount of the bond, the amount that’s on the bonds of the 240, which is a liability. And then we have the premium being the difference increasing the premium here by the 30. The 240 plus 230 is going to be equal to the 270,000 carrying amount book value of the bonds. Now we’re going to go through the process of recording the interest we can see that this is going to have 15 years bonds, we’re going to pay the bonds semi annually. So we’re going to have to record the interest on them. And we’re gonna have to reduce this premium in some way as well. Remember, at the end of the bonds, we’re not going to pay back the 270. We’re only going to pay back 240. So how are we going to get rid of that the premium on the bond and why are we going to do it in the way we will. We’ll start off by amortize in the premium using a straight line the method. Note that the effective method is the preferred method for amortize in a premium for generally accepted accounting principles, but the straight line method will be appropriate in some cases, if the difference is going to be a non material. And the straight line method is a simplified method and it’s easy for us to see what is going on. So we’ll start off with the straight line method.

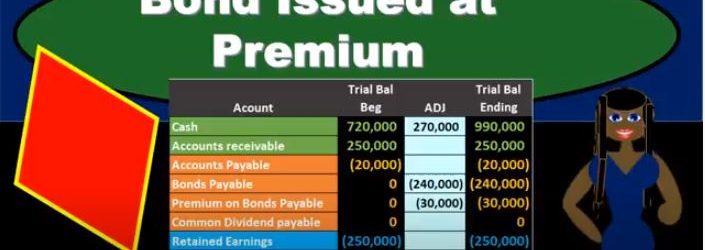

Bond Issued at Premium

In this presentation, we will take a look at the journal entries related to issuing a bond at a premium. When considering the journal entry for a bond, remember what can change and what is the same for a bond. When we think about a bond, it’s already been printed, we know the amount of the bond, the interest on the bond, the maturity date of the bond, these are already set. So if we’re making a negotiation with the bond after it had already been printed, then we can’t change the face amount. We can’t change the interest due dates. What can we change in order to negotiate and make a sales price on the bond, we can change the amount that we issue it for. So keep that in mind. Whenever you think about these bond problems. That’s the thing that’s going to differ from a bond to a note. The thing that changes when we want to loan is the interest rate. The thing that changes when we want to issue a bond that’s already been made is going to be the amount we receive For the bond being different than the face amount of the bond if there’s a difference in the market rate and the contract rate. So in this example, we’re saying that we issued a bond. Now note that when we think about the issuance of the bond, just like a note, we often have more information than we really need. And that can be a little bit confusing for us.

Allowance Method VS Direct Write Off Method

In this presentation, we will take a look at a comparison between the allowance method and the direct write off method. When considering both the allowance method and the direct write off method, we are considering the accounts receivable account. Remember that the accounts receivable account represents some money that is owed to the company, typically from sales made in the past, on account haven’t yet received the funds for sales made in the past and therefore, the company is owed money. We see this amount on the trial balance in this case 1,000,001 91. We then want to know information about that, including who owes us that money. We can’t find that typically in the GL as we have a GL for every account the GL only giving us the information by date. Typically, we want to see that information also broken out in the subsidiary ledger saying who owes us this money.

Allowance Method Accounts Receivable-financial accounting

Hello in this presentation we’re going to take a look at the allowance method which is of course related to the accounts receivable account, we will be able to define the allowance method record transactions related to recording bad debt recording the receivable account that has been determined to be uncollectible recording every single account that has been collected after being determined that it was uncollectible. So we’re going to take a look at some different transactions, the most common transactions when dealing with the allowance method and see what those look like and why we use the allowance method. We’re going to work through a problem. So what we’re going to have here is we’ve got our accounting equation, of course we have our trial balance, I do suggest working problems to take a look at a trial balance because it can give you the context in which to work problems. So here’s what we have. We’ve got the assets in green, the liabilities are going to be orange, the light blue is the capital account and the equity section.

Receivables Introduction

In this presentation we will take a look at receivables. The major two types of receivables and the ones we will be concentrating on here are accounts receivable and notes receivable. There are other types of receivables we may see on the financial statements or trial balance or Chart of Accounts, including receivables, such as rent receivable, and interest receivable. Anything that has a receivable, it basically means that someone owes us something in the future. We’re going to start off talking about accounts receivable that’s going to be the most common most familiar most used type of receivable and that means something someone, some person some company, some customer typically owes us money for a transaction happening in the past, typically some type of sales transaction. So if we record the sales transaction, that would typically be the way accounts receivable would start within the financial statements, meaning If we made a sale, we would credit the revenue account, we’ll call it sales. If we sell inventory, it would be called sales. If we sold something else, it might be called fees earned, or just revenue or just income, increasing income with a credit, and then the debit not going to cash. But going to accounts receivable.

Inventory Costs

In this presentation we will discuss what will be included or should be included in inventory costs. So when considering inventory cost, clearly we have the cost of the inventory which would be included. But there are other components that we want to keep aware of. And keep in mind that could be included in the cost of inventory as we record that inventory cost that purchase price or the amount in dollars of inventory on the financial statements. One is going to be Do we have to pay for the shipping costs and that typically will have to do with the terms of fo B shipping point, or fob destination is going to be a common question that is asked and a common factor in practice that we need to consider.

Prepaid Insurance Adjusting Entry 10.40

In this presentation and we’re going to enter an adjusting entry related to insurance recording prepaid insurance and insurance expense. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re going to be opening up our reports. First, we’re going to go down to the reports on the bottom left. So we’re going to be opening up our favorite report that being the balance sheet report changing the dates up top from a one on one to zero, this time to our cutoff date at Oh to 29 to zero.

Short Term Loan Adjusting Entry 10.10

This presentation we will look into recording and adjusting entry related to a short term loan. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. Let’s first take a look at our reports our balance sheet report for this transaction that we’re going to be recording or this adjusting entry, we’re going to be opening up our favorite report that being the balance sheet report, we’re going to change the dates up top the dates from let’s make it a 1012020 229 to zero. Now, when we think about the adjusting entries, we’re always going to be thinking of them as kind of like the cutoff dates, we’re trying to make things correct as of the cutoff date, which in this case, it’s going to be the end of the second month.