QuickBooks Online 2021 products and services list or item list, let’s get into it with Intuit QuickBooks Online 2021. Here we are in the free QuickBooks Online test drive file, which you can find by typing into your favorite browser, QuickBooks Online test drive, we’re in Craig’s design and landscaping services. So we’re looking at the another item that can be classified under the category of lists. So one way to get there would be go to the cog up top. And then under the lists, here, we’re looking at the products and services. So that’s one way you can get into this particular list. fairly quick way to get into it, I think more often, or at least more often for me,

Posts with the QuickBooks Desktop tag

Lists 1.69

QuickBooks Online 2021. lists, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free test drive file that you can find by searching in your favorite browser for QuickBooks Online test drive. We’re in Craig’s design and landscaping services, this time, considering that lists lists is one grouping, or one way to groups items within QuickBooks Online, that are often very important for the setting up of the system of QuickBooks Online. And then they’ll basically be working behind the scenes, as we do our normal processes, those normal processes being the customer cycle, the vendor cycle, and the employees or payroll cycle.

30 Day Free Trial Setup 6.07

QuickBooks Online 2021 30 day free trial setup. Let’s get into it with Intuit QuickBooks Online 2021. Here we are on the Intuit website Intuit being the owner of QuickBooks, this is the first place I would go for anything that’s going to be QuickBooks related. Because if you just do a search into your favorite browser, such as Google, it might take you to some other websites. And you want to go here first, because this is the source. These are the owners of QuickBooks.

Day Free Trial Setup – .7 30

QuickBooks Online 2021 30 day free trial setup. Let’s get into it with Intuit QuickBooks Online 2021. Here we are on the Intuit website Intuit being the owner of QuickBooks, this is the first place I would go for anything that’s going to be QuickBooks related. Because if you just do a search into your favorite browser, such as Google, it might take you to some other websites. And you want to go here first, because this is the source. These are the owners of QuickBooks. So it’s Intuit, i NTU, i t.com, that’s into it, I empty you it.com. What we’re looking for here is to set up a free 30 day trial version of the software, which we will have for a limited time, that to been 30 days.

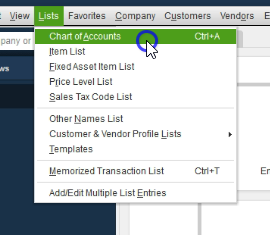

Lists QuickBooks 1.37

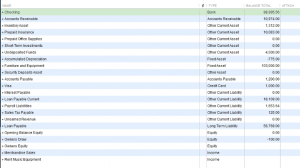

This presentation we will take a look at lists within QuickBooks lists within QuickBooks is going to be a categorization of items. The major two items that will be included within the lists will be the chart of accounts and the item lists. We’ll take a look at this in QuickBooks Pro 2020, QuickBooks desktop 2020.

0:20

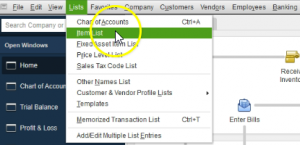

Here we are in our get great guitars file, we currently have the open windows open, you can open the open windows by going to the view drop down and go into the open windows list, we’re not going to consider the lists drop down within QuickBooks, when you think about lists. It’s another one of those terms that you kind of want to keep familiar as a separate term within QuickBooks, because you’re going to be grouping separate type of items or specific kind of items within lists.

0:46

And people might actually use the term lists in practice or a while using the QuickBooks software in describing certain things. And they will definitely use it when they’re trying to group or locate these these different types of items where they will be within QuickBooks. So the lists drop down will be here, the major two lists that we will be focusing in on will be the chart of accounts and the item list.

1:13

These are two items. Once again, if you were to talk to someone outside of QuickBooks, if you were to try to talk about the chart of account as that list, that it wouldn’t be something that really rings a bell to people that are just learning financial accounting, that aren’t using QuickBooks, it just so happens that QuickBooks then use the term and grouped all these things under the subheading of lists.

1:35

And now, so within QuickBooks, when you talk about lists, item lists and whatnot, then these things are going to be important and be thought of kind of as lists. So of course, first we have the chart of accounts Chart of Accounts is going to be our most important type of list. The first thing we’re going to set up in essence with the QuickBooks set up. This will give us a list of all the accounts that we will be using.

1:58

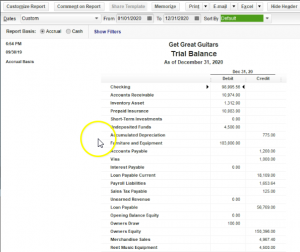

So you’ll recall that we have taken going to look at the trial balance, we’ve taken a look at the balance sheet and the profit and loss statement, those the profit loss and balance sheet or the major to financial statements. These are the accounts that will be making up those major to financial statements. Let’s take a look at those now. We’re going to go to the reports drop down, we’re going to go to the company and financial will scroll down to the balance sheet standard.

2:23

Within the balance sheet standard will change the dates up top in the customized reports from a one on one to zero to 1230 120. That’s January through December 2020. I’m going to say okay, here’s our balance sheet. You’ll note that we have all these accounts here and the subcategories within these accounts. They are in order assets, liabilities and then equity, then we’ll go to the reports up top company and financial will take a look at their profit and loss standard report.

2:51

Within the profit and loss standard will change the date range from one on one to zero to 1231 to zero, and so January through December. We then have our income statement accounts which in essence are in order of income cost of goods sold a type of expense. And then expense accounts finally will open up our trial balance, which is under the reports drop down accounting and taxes and the trial balance, changing the dates up top once again from 10120 to 1230 120.

3:21

That’s January through December 2020. This gives us our list of accounts which is similar to our chart of accounts because it gives us our listing of accounts and it gives us the account balances but they’re going to be in the format of debits and credits basically removing the sub totals having the balance sheet and income statement in the same in the same place. The chart of accounts then are going to be these list of accounts. Notice in the trial balance we have a similar kind of format in the trial balance, the listing of the accounts will be balance sheet, and then profit and loss.

3:54

In other words, assets liabilities equity balance sheet accounts, then the profit loss or income statement Revenue and Expense Type of accounts. Same thing will be true with the chart of accounts. The chart of accounts will be ordered in by default. And by the chart of accounts. Now you can change the order. And if you were to select this items, you can change it to alphabetical order.

4:16

However, it’s really useful to get used to it looking like the chart of accounts sorting it by type, because that’s the way the trial balance will be located and you’ll get a better feel for the way the financial statements will be formatted. This list of accounts can be kind of daunting to look at it it can look like a lot of information to put in place. When you’re setting up QuickBooks, you might think well how am I going to set up all those accounts. Just note that when we set up QuickBooks from scratch, then we typically will be picking a list of the chart of accounts by the type of industry we are in. So QuickBooks will ask us common type of industry that we are in

4:50

will select the closest industry that will typically give us then QuickBooks will generate for us a chart of accounts that will have accounts that are typical to that type of thing industry doesn’t mean we’re not going to have to add more accounts, we will, however, we’re going to have a good basis start in that format. Now if we don’t want that chart of accounts, and we want to we want to build from scratch, we can do so we could just not choose an industry.

5:14

But typically for most people, especially beginners, and like QuickBooks file, we want the chart of accounts. And then we can basically use the QuickBooks setup to guide us as to what the accounts will be most likely used within the particular industry that we are in. And then we can make our deviations from that as we as we so choose, we can first think, Hey, is this account on the chart of accounts that QuickBooks has been provided to us, if it’s not, then we can consider adding, adding it or not. So the chart of accounts is going to be ordered in order by type.

5:49

And once again, balance sheet on top, and then the income statement, the balance that you can break down into what we would call the accounting equation, assets, liabilities, equity, and then the income statement is revenue and expenses or income and expenses. And then we break it down even further to basically most liquid type of assets. So in other words, if we were to think about this, in terms of the account types, the types of accounts we’re going to set up, we’ve got the checking account, that’s going to be a cash type of account or banking account.

6:19

So it’s it’s our most liquid kind of accounts a bank account, then we have accounts receivable, QuickBooks will break out accounts receivable as a separate account type. Because accounts receivable, it has a sub ledger that it’s going to have to tie into it. In other words, accounts receivable represents the accounts that are owed to the company. And therefore we need to track not only the amount that is owed to the company, but who owes it to the company.

6:44

And therefore we need another list of reports that are going to be attached to accounts receivable, basically giving the people that owe us the money, then we have the other current asset type of accounts. So these are all the other current assets, then we have the fixed assets, which are going to be things like property, plant and equipment, sometimes called appreciable assets, long lived assets. And so those are going to be and the depreciation related to it.

7:11

And then we have the other assets, which are going to be the more long term type of assets, they’re not the current assets, we have a security deposit account here. Then we have the accounts payable, accounts payable is a liability account. So now we’re into the liabilities, like the accounts receivable, the accounts payable is going to need a sub account that’s sub account tracking by vendors. So we have to track by vendors within the accounts payable, therefore we need its own special category for that the visa account credit card accounts, they’re going to be another type of liability account.

7:44

And they’re going to have a special kind of account title as well, so that you can track the outstanding balances that would be in a credit card type of account. Then we have the other current liability accounts, long term liability accounts, those that are going to be over a year that will be do and then we have the equity accounts, things like you know the equity section capital, if it’s a sole proprietor or equity, it’s going to be called owner’s equity for a sole proprietorship retained earnings if it was a corporation. And then we have the income and expense accounts. So now we’re in the income statement income or revenue type of accounts.

8:21

Then the cost of goods sold, which is a type of expense, but a special type of expense related to the inventory. And then all the expenses, all the typical accounts that we would think of as expenses, insurance expense, janitorial meals, and miscellaneous. And all these accounts would be helped to be set up by QuickBooks for it. Underneath that we have the other income and other expenses, these are going to be items that are that are not part of normal operations, and therefore will show up at basically the bottom of the income statement.

8:52

Now when we start to construct this list and build our information in input data input, we will be adding to this list. And we can do with the drop down or the rise up down here at the bottom and the account. And we can add new items here. And we can edit of course the items in here. Notice up top, they actually gave us the balances. These are the most current balance, but they only give them for balance sheet accounts. Why? Because the income statement accounts need a timeframe or else they don’t make any sense. There’s nothing we can put into the income statement accounts unless we specify a timeframe because they are performance type of accounts. Whereas the balance sheet or as of a point in time, so they basically put in the last balances the the latest balances in the balance sheet accounts.

9:35

Also note that if we go back to the homepage here, if I go back to the homepage, the chart of accounts can also be found on the homepage here. So we have the chart of accounts up top, I typically go to the chart of accounts with lists. That’s why I think of it as you know, a list item. And then the other major list item which you can also find here in the company section of the homepage.

9:58

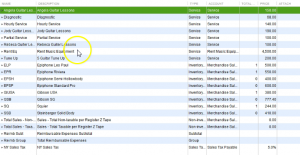

Again, I always go to the list define this, I think of it basically as list, a list type item would be the item list. So if we select the item list, this is probably the most confusing kind of list factor that we have, that’s going to be a major part of the QuickBooks set up process, people have some time, it takes some time to get used to what these item lists do. So I’m going to put my cursor on the three dots here and drag it a little bit wider so that we can see more of the screen.

10:26

The reason is for that because when we when we learn normal debits and credits accounting, or people that have gone through normal accounting, setup, or financial accounting, don’t learn about items. So this is going to be another kind of thing where if you’re talking to somebody that learned accounting in terms of debits and credits, and you’re learning and you’re thinking about in talking about QuickBooks, then it’s not something that will possibly register for them, you got to basically explain what the item is, and in order to, you know, make that function.

10:56

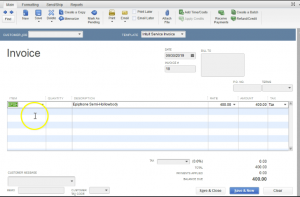

So what kind of items do we have, the major two sections of our items that we’re going to have are going to be called service items. And they’re going to be called the inventory items. Now I’m going to make this a little bit wider two, or maybe this one. Now, why would we need these these types of items, these are going to be used to drive some of some of the data input screens, these screens are going to make it easier to make to put things together forms together, such as invoices and sales receipts. So in other words, if we go to say the homepage, and we were to create an invoice,

11:31

then we’re going to need to fill out the customer name. And then we’re going to need to fill out the item if we select an item, then all we have to do is then populate either a service item or inventory item. And then in essence, it’ll populate the information for us given us the rate given us the description, given us the calculation down below. So this makes it really easy for the data input.

11:55

When you make an invoice, it should be really easy to make an invoice if the item them lists are set up correctly. If they’re not, then every time you make an invoice, you’re going to have to basically figure out what you’re what you’re trying to put in the invoice, type it in there, figure out what the rate is for that figure out what the cost is for that, that’s going to be difficult. But in obviously, you can put multiple things in the invoice and it’ll calculate it for you as well.

12:20

But if you have everything that’s going to be in the invoice already driven by the items, then it should be the case that the invoice creation is easy. That means someone else can do it, someone else has no clue how to do the thing, how to set things up, and we can do it. So even if we’re setting it up for ourselves, we want to make the invoice as easy as possible. I don’t want to have to type in here that this is going to be an Epiphone whatever on the guitar in the process of a sale, I want to be concentrated on the client, or some other thing. I do not want to be thinking all the time, what am I going to charge for this?

12:53

I want to know exactly what I’m going to charge have it already in the system. So that actually filling out the invoice will be very easy to do. We need to think about things like rates in terms of how we’re going to charge for our rate, do we charge an hourly rate? Do we charge just by our service, if we do some service, do we just give a flat rate for whatever the services no matter what the time that will be involved? Do we charge for some period of time or something like that, we want to have those things all set up all ready to go.

13:21

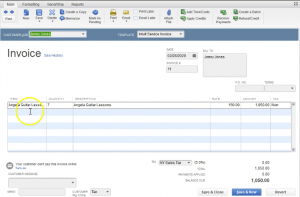

Because if you do not, it’s going to waste a lot of time basically creating the invoice. So I’m going to close this back out, we’re not going to save it, I’m going to say no, we’re going to go back to the item lists in the homepage. So those are going to be the major kind of items that we have if you were to think about how we’re going to put that together. If I selected an item, say a hourly service, I would say Angeles guitar lessons, this is a service item. And the way that you make an item is one way you can make an item from this screen is go to the drop down or rise up once again on the items down below and create a new item.

14:00

So let’s go into an item right now that has been created, we’ll take a look at the Angela guitar lessons. And what we have in here is the name of the item that’s going to be what appears in the description and the description that will happen in the invoice of the sales receipt will have the rate and then we’ll have whether or not there’s going to be tax apply to it, and the account that will be involved. So the item then is telling us Hey, when you choose this in an invoice, this is the rate that’s going to be charged This is what’s going to be in the description screen. And it’s going to be when you record it.

14:33

When you record the invoice. In other words, the sales account is going to go to service, this is going to be an income step type account on the income statement. So when you think about the income statement, then the profit and loss let’s take a look at the profit and loss. The account here the service account, that’s an income account, if I double click on that, it’s being driven by invoices in sales receipts. If I double click on those invoices in sales receipts, it’s being driven by passion pick the Angela guitar here, it’s being driven by the items, the items are what’s driving that whole process.

15:07

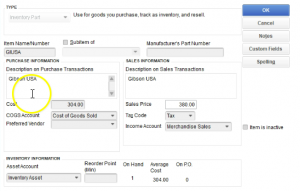

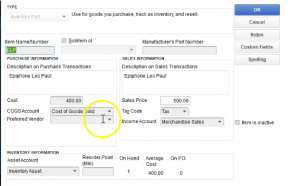

So closing this back out, closing this back out, we’re going to go back to the item list then. And then let’s go back into the Edit item. So edit item in the open screens. And so here is our item. So that’s going to be this one. Now let’s take a look at a different type of item, I’m going to close this out with the x not the big x not the blue x but the one underneath. If we look at an inventory item, it’s actually a bit more confusing to think about an inventory item. So these are inventory items. Let’s take this one, double clicking on it, we’ve got the item, we’ve got the description just as we did before.

15:40

But now we’ve got two fields, we have to record the cost of goods sold on the invoice and we have to record the account the expense account that will be involved cost of goods sold, we need the sales price, and we need the sales tax and then the sales account. So this is really important. This is the most confusing component when you’re selling inventory. So an inventory because this will drive what’s on the invoice. And again, if you think about the invoice if we go back to an invoice and I go into an invoice here, and let’s go back to a prior invoice. This is an LP guitar. If I was to fill out this invoice, I would I may have no idea what what I’m doing. I just know that I’m filling out this invoice is going to be charged $500 plus to 25 on the sales tax.

16:30

Now someone was to ask me, How much was the cost? How much did you pay for that guitar? How much did the company pay for the guitar? Most people data inputting would have no idea. They would just say I don’t I don’t know what the cost was for that. I don’t even know what you’re talking about, you know, it’s not on, it’s not on the forum. That’s something I’m not aware of right.

16:48

But this this invoice is the thing that’s going to be driving the cost. And how do we get that going to be set up, it’s going to be in the item list. So in the item detail, it’s going to give us that information. So we we want to be we want to be able to know that because in order to set up these invoices and sales receipts properly, we got to set up these items properly. So this item is what’s driving what’s going to happen here what’s going to happen here, the invoice itself is going to increase accounts receivable accounts receivable is going to go up by the full amount plus sales tax 525, the invoice is going to increase sales by the sales price the 500, the difference between the two is going to go to the sales tax payable, the $25 increase in a liability and the cost of goods sold expense account related to using up the inventory is going to go up by an amount that’s not on this form.

17:43

Because it’s going to be in it’s going to be in the items. So in other words, if I go to the item, the Edit item I’m currently in, let’s close this one out, I’m going to go this this was a lp if I double click PLP, the cost is 400. So it’s going to record that 400 as a decrease in inventory, and the other side go into cost of goods sold and expense account driven by what we have put in on this side. Now the screen looks a little confusing and stuff too bad. Because notice it’s it’s all it’s always going to be cost of goods sold generally, you know, for the expense item. And the income item is always always going to be you have a merchandise inventory type of item.

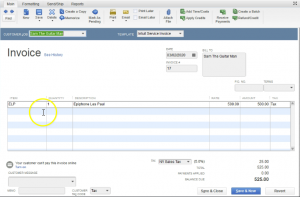

18:28

So let’s see what that would look like then if we if we then go to our balance sheet. If we think about an inventory invoice that’s being recorded it let’s try this from the trial bounces time let’s go to the trial balance because it’s going to have all of our accounts get a little practice maneuvering around the trial balance since we have seen a similar process to this before. If we go into say the accounts receivable and we pick up an invoice, let’s take up an invoice which is going to be let’s take up this one. Let’s do the one on the 19th.

19:00

So we got to 19 this is musics stuff store, if I double click on it, we have our invoice our invoices going up by the total invoice of 630, which is again, it’s being driven by the item. If I close this back out the other side of it’s going to be in in the income side of things in revenue that’s on the income statement or Profit and Loss this son to 19. So if I scroll down, we’re then going to be in the income statement. And that’s going to be in the merchandise sales. This is part of the profit and loss statement.

19:35

Now, don’t worry about the debits and credits. If I double click on that, then we’re going to say here’s the music stuff store, it’s got the 600 double clicking on that. That is of course the sales price driven by the item, the difference between the sales price and the receivable $30. That’s sales tax that should go into a payable account. closing this back out back closing this back out, back up to the library ability kind of Section within the trial balance, we’re looking for sales tax table, which is here, the 125 if I double click on that, then we should be able to find that 19th right there for the sales tax payable, closing this back out, then the other side is going to be inventory is going to be going down.

20:21

So here’s inventory, if I double click on the inventory, and I look for the 19th again, here it is music stuff store. If I double click on that, notice you have 480 decreasing inventory going in there, there’s no one no 480 on this invoice. Why? Because it’s driven by the item. And the item is what’s helping QuickBooks to record it even though we don’t want it on the invoice because we’re giving the invoice to the client, we don’t want to have the cost on the invoice that we paid on the invoice.

20:52

So it’s going to that it’s going to drive the invoice is going to drive the recording of it because of the item, but it’s not going to be on invoice. closing this back out closing this back out the other side then is going to be in the cost of goods sold. Here’s the cost of goods sold and expense type of account back to the profit and loss type of account. Double clicking on it. If we go into February, we have 400 at once again, double clicking on it, there is our invoice, then I’m going to close this back out once again and close this back out, then we’ll go back to our item list.

21:28

Those are the major two kinds of items that you that you’re going to be considering when you set up a sales receipt. And when you set up a sales receipt or an invoice, the other kind of items you’ll have to be dealing with are going to be things like sales tax items. So when we when we set up sales tax, we’re going to have to think about whether something is going to be taxable or not. And the type of items that will be set up for relation to sales tax, we’re also going to have payroll items that are going to be important. Now the payroll items aren’t going to be something we’ll see setup in this problem because we’re not going to set up the paid payroll for it however.

22:04

So we will have another kind of section that’s going to be going into the paid payroll so you can see what it would look like and if you want to purchase the paid payroll at that time to work along with it, you can but this one, we’re not going to have the paid payroll. Notice if you select the lists drop down and you go to the sales tax code list. You can have basically the sales tax code will set up sales tax later and that’ll basically tell you something that’s going to be taxable or not taxable with regards to sales tax things like other things, we sell goods and services. Are they going to be taxable or not with regards to sales tax?