Hello. In this lecture we’re going to talk about the accounts payable subsidiary ledger accounts payable subsidiary ledger will be backing up the accounts payable account on the trial balance or the balance sheet. As we can see in the example here we have a balance of 1640 in accounts payable. If an owner asks the question of how much money do we owe to vendors? The answer would then be 1006 40, which we can see on the balance sheet or the trial balance. But the next question that will follow will be who do we owe that money to? And how do is it which of these vendors should we be paying? First? In order to answer that question, we may try to go to the detailed account, which is the general ledger. Typically every account is backed up by the general ledger, we can see that we have the same balance here and we can see that we have activity however, the activity is in order by date. And that’s not really helpful for us to determine who exactly we still owe at this point in time. In order to determine who we owe, we need to organize this information.

Posts with the trial balance tag

Accounts Receivable AR Subsidiary Ledger Explained 5

Hello, in this lecture we’re going to talk about the accounts receivable subsidiary ledger, the subsidiary ledger being the ledger that will be backing up the account of accounts receivable showing on the trial balance with 27,000. In it, in this case, accounts receivable being that accounts that represents what is owed to us. If we were the owner of the company, we might ask our accounting department, how much money do people owe us? In this case, it would be 27,000 would be the reply. Next follow up question would most likely be who owes us that money? And have we called them when are we going to get paid that money? In order to answer that question, we cannot look at the normal backup balance for all accounts that being the general ledger accounts. If we look at the GL we do get some detail in terms of the activity that has happened. However, that activity is not going to be in terms of who owes us the money. It’s in terms of date.

Special Journals Subsidiary Ledgers 2

In this presentation, we’re going to talk about special journals and subsidiary ledgers. First, we’re going to list out the special journals and talk about when we would use them, why we would use them and how they fit into the accounting system. The special journals are basically going to group types of transactions. So when we think about all the transactions that happened during the month, we typically see them in order of when they happen in the accounting system, we’re going to record transactions in other words, by date as they occur. But if we are able to group those transactions into special journals that can simplify the process.

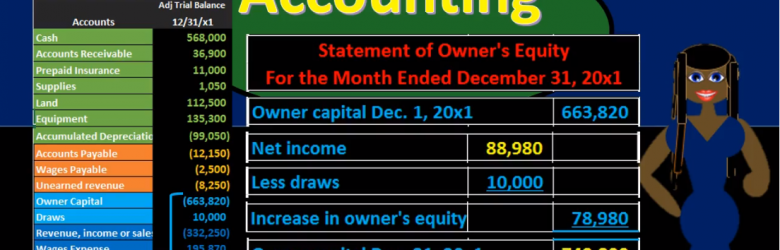

Statement of Equity From Trial Balance 17

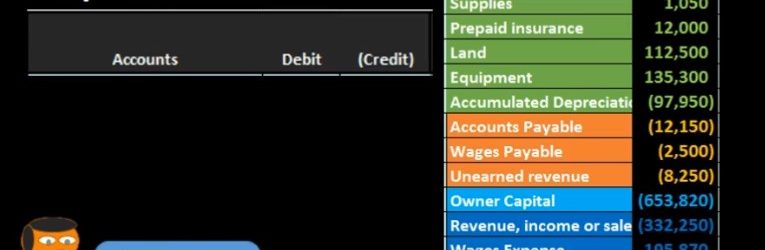

More in this presentation we will take a look at the statement of owner’s equity and see how to construct the statement of owner’s equity from the trial balance. When looking at the trial balance, we can see the accounts will be in order with the assets and then the liabilities, then the equity and then the revenue and expenses. The equity accounts being broken out here of owner capital and draws. But it’s a little deceiving to break out this equity section. Because the trial balance really is showing both a point in time the balance sheet account permanent accounts up top and timing accounts which are going to be the revenue accounts down below. When we think about the point in time for total equity as a whole. We’re really considering the entire blue area here. This is one of the most confusing concepts to really know when you’re looking at these financial statements.

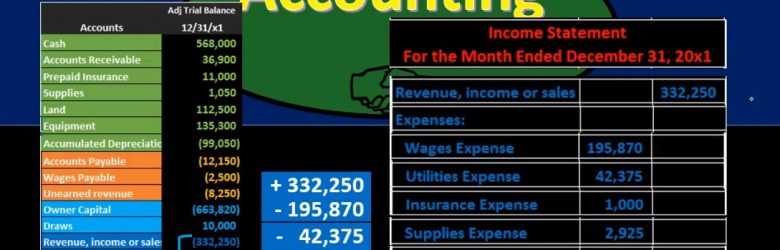

Income Statement from Trial Balance 16

Hello in this presentation we’re going to take a look at the creation of the income statement from the trial balance. First, we want to take a look at the trial balance and consider where the income statement accounts will be. When looking at the trial balance, it will be in order we have the assets in green, the liabilities in orange, the equity in light blue, and then the income statement accounts including revenue and expenses. That’s what we are concentrating here we’re looking at those income statement accounts. And that is what will be used in order to create the financial statements to create the income statement. Note that all the blue accounts represents the equity section. So the income statement really is going to be part of total equity. If we consider that on the balance sheet, then we’re really looking at a component of this capital account.

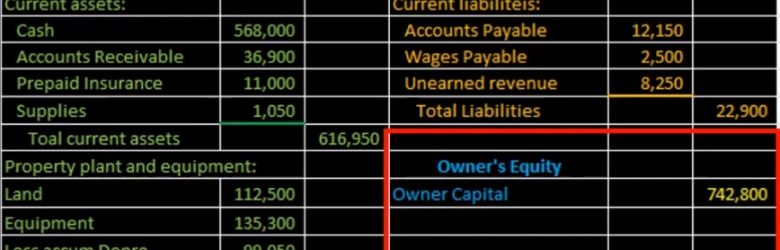

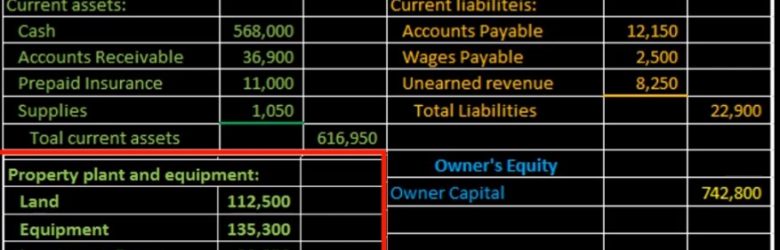

Balance Sheet Equity Section Creation from Trial Balance 15

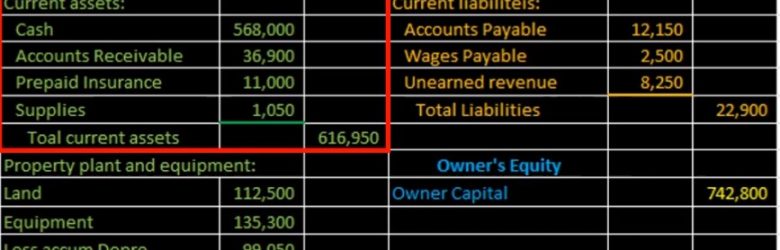

Hello in this lecture we’re going to be creating the equity section of the balance sheet. In prior lectures, we have taken a look at the current assets section, the property plant and equipment section and then the liability section. This will be rounding out the balance sheet where we will finally get to total assets being equal to total liabilities and equity represent in the double entry accounting system. In terms of the balance sheet in terms of the accounting equation, we of course, are pulling these numbers from the adjusted trial balance. the adjusted trial balance also represents the double entry accounting system. However, it represents that double entry accounting system in the format of the building blocks of debits and credits. All we’re doing is taking those building blocks in terms of debits and credits, rearranging them to the accounting equation, so that readers who don’t understand debits and credits can then read them. Now when we look at the equity section, this is a bit confusing when we convert from the trial balance to the equity section.

Balance Sheet Property Plant %26 Equipment From Trial Balance 13

Hello in this lecture we’re going to put together the section of the balance sheet of property plant and equipment from the trial balance property, plant and equipment will be part of the assets can be the subcategory of assets, we talked last time about the creation of the current assets. And now we’ll be moving on to property, plant and equipment, which will then sum up everything for total assets. We will be picking these numbers up from a trial balance. And once we have completed all the financial statements, what we’re basically doing is taking a debit and credit format from the trial balance, converting it to a plus and minus format in terms of the financial statements, assets, equal liabilities plus owner’s equity so that people can read it even if they don’t understand debits and credits. In this lecture, we’re focusing in on this section here, which will be a land equipment and each cumulated depreciation.

Balance Sheet Current Assets from Trial Balance 12

Hello in this lecture, we’re going to create the current asset section of the balance sheet, we’re going to create this current asset section from a trial balance, we’re going to piece together the financial statements piece by piece as we go through a series of lectures, the trial balance being here at this is going to be the adjusted trial balance. And what will happen is we will then find a home for all of the accounts on the financial statements. Once we then do that, that means that we have then converted this from the double entry accounting system being in the format of debits minus credits equaling zero or debits equaling the credits to the assets equals liabilities plus the owner’s equity, basically the accounting equation, which is reflected on the balance sheet. So we’re going to start off by doing the current assets section, which will just be this part we’re going to find a home for these first few accounts.

Adjusting Entry Depreciation 10

Hello in this lecture, we’re going to record the adjusting entry related to depreciation were recorded on the left hand side, that’s where the journal entry will go. And then we’ll post that to the trial balance on the right hand side trial balance being in the format of assets in green liabilities in the orange. Then we have the equity section in the light blue and the income statement, including revenue and expenses in the darker blue. We’ll first talk about what accounts are affected and then we’ll go back and explain why this is the case. So first, we know that it’s an adjusting entry. So that’s going to have some added rules, you want to keep the adjusting entry separate in your head from just normal journal entries. all entries have at least two accounts and an equal number of debits and credits as well as adjusting entries. But adjusting entries are all made of as of the cutoff date, we’re gonna say 1231 in this case, and they generally have one account above this equity line above the capital meaning a balance sheet account and one account below that line meaning an income statement accounts.

Adjusting Entry Wages Payable 7

Hello, in this lecture, we’re going to record the adjusting entry related to payroll, we’re going to record the journal entry up here on the left hand side and post that post that to the trial balance over on the right hand side trial balance in terms of assets and liabilities, then equity and the income statement, including revenue and expenses, all blue accounts, including the income statement being part of equity, we’re first going to go through and see if we can find the accounts that will be related to a payroll adjusting entry. And then we’ll go explain why we are going through this process. So just if we have the trial balance, and we know it’s an adjusting entry related to payroll, we know that there’s going to be at least two accounts affected. And we know that because it’s an adjusting entry, it will be as of the end of the time period. In this case, let’s say it’s the end of the year 1231.