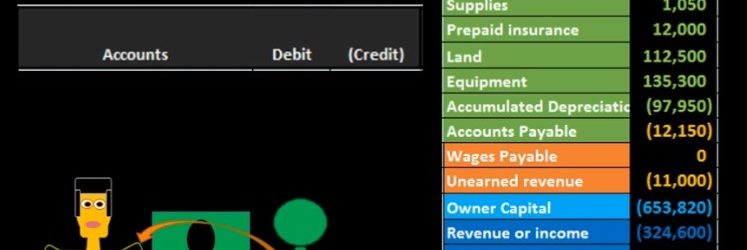

Hello in this lecture we’re going to record the adjusting entry related to unearned revenue. Remember that the adjusting entry is going to be a separate process. It’ll have the same rules as every journal entry. But we can add some added rules when we know that we are working with the adjusting entry process. For example, all adjusting entries will be as of the time period, the end of the month, or the end of the year. In this case, we have the unearned revenue. We know that all adjusting entries for the most part will have an account above the owners capital meaning and balance sheet account. So if we look at our trial balance, looking for an account related to unearned revenue, we see here unearned revenue. So we know that that’s going to be part of our journal entry.

Posts with the trial balance tag

Adjusting Entry Supplies 5

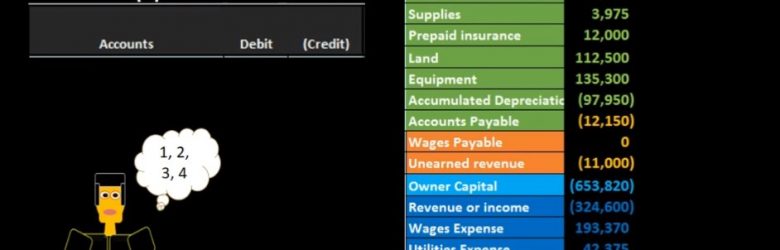

Hello in this lecture, we’re going to record an adjusting entry related to supplies. Remember that adjusting entries are going to have their own set of rules, you want to keep them separate in your head. They are still journal entries, and they follow the journal entry rules. But if we know that we are dealing with adjusting entries, we can apply an additional set of rules to help us to understand what the journal entry will be. For example, the adjusting entries will all be at the end of the time period, the end of the month or the end of the year. And if we take a look at the supplies account, we also know that typical adjusting entries will always have an account in the balance sheet section in terms of the trial balance that’s going to be somewhere up above this owner’s capital account. So we look for an account on the trial balance related to this supplies. on the balance sheet we said how about supplies and we also note that the supplies, the adjusting entries will have an account below the equity section below the owner’s capital in the income statement, revenue and expenses.

Why Use a Worksheet in Adjusting Process 3.5

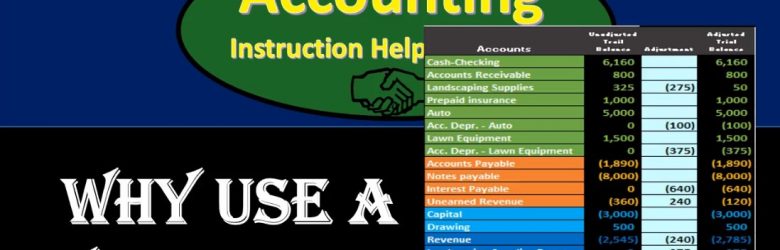

Hello in this presentation we will discuss the reasoning for using a worksheet within the adjusting entry process, a worksheet like the one on the right where we have an unadjusted trial balance adjustments and then an adjusted trial balance. We typically think of this worksheet as outside of the normal journal entry process, meaning the normal journal entries that we are going to input will be in the general journal posted to the general ledger giving us more detail and then posted to the trial balance. And this case, we’re going to use a worksheet which will go straight to this adjusted column, and then show us the unadjusted balance the change and then the adjusted balance. If we were using accounting software like QuickBooks, then we would have the normal data input in the system we would produce then the unadjusted trial balance and put that into a worksheet such as this, and then work through this process to have our worksheet show the balances here. idea being that the worksheet in the adjusting process is going to be outside of the normal system.

General Ledger 245

Hello, in this presentation we will discuss the general ledger. At the end of this, we will be able to define what the general ledger is. We’ll list components of the general ledger and explain how the general ledger is used. When looking at transactions in terms of journal entries and posting those journal entries in track prior presentations, we were posting those journal entries mainly to a worksheet in order to see a quick computation over the beginning balance and what is happening to that balance, posting it to a format of a trial balance than an adjusting column and then an adjusted trial balance. Note, however, that we typically think of the journal entries being posted to a general ledger. The general ledger can be very complex when we look at it which is why it is often useful to not look at it when we first start posting the transactions but to see that how those transactions affect interest Visual accounts.

Accounts Payable Journal Entries 240

Hello in this presentation we will be recording a business transactions related to accounts payable or the purchases cycle recording these transactions with debits and credits. At the end of this we will be able to list transactions involving accounts payable, record transactions involving accounts payable using debits and credits and explain the effect of transactions on assets, liabilities, equity, revenue, expenses and net income. We’re going to be recording these transactions up here in the left hand side in accordance with our thought process. We will then be posting these not to the general ledger but to a worksheet format so that we can see a quick calculation as to what is the impact or effect on the individual accounts as well as the effect on the account groups as a whole. Remember that all the groups for the accounts will always be listed in order when you’re looking at a trial balance. Which is why I recommend looking at a trial balance.

Trial Balance 220

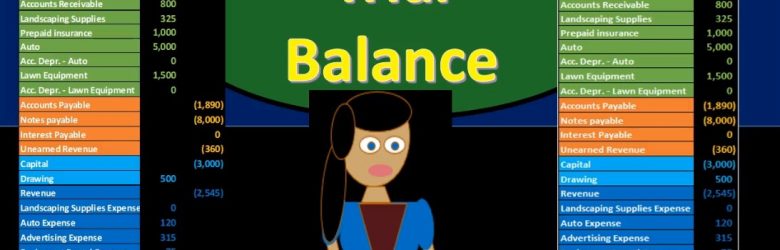

Hello in this presentation we will be discussing a trial balance objectives at the end of this, we will be able to define a trial balance list components of a trial balance and explain how a trial balance is used. When considering the trial balance, we first want to think about where the trial balance falls within the construction of the financial statements. In other words, what processes go before the trial balance, what goes after the trial balance, where’s the trial balance fit into our process? Remember, the ending goal, the ending process of the accounting been to compile the data in such a way to create the finance financial statements. Those financial statements have been the end product. Typically if we’re thinking about a linear process, then we’re thinking about all the transactions that would happen during the month.

Statement of Owner’s Equity 131

Hello in this presentation we will describe the statement of equity objectives, we will be able to at the end of this describe the statement of owner’s equity, list the components of the statement of owner’s equity and explain the reasons for a statement of owner’s equity. When we consider the statement of owner’s equity, we are like the income statement and unlike the balance sheet, talking about a timeframe, meaning we have a beginning and end point, unlike the income statement, the beginning point is not zero meaning we are going to start at the beginning point of the net value or the equity section of the prior balance.

Journal Report & Financial Statements 10.57

This presentation and we’re going to take a look at our reports our financial statement reports and journal entry reports. After we have entered the adjusting entries, we’ll take a look at the familiar balance sheet and income statement. We’ll also take a look at a journal entry report. That’s going to be a very useful report when we enter adjusting journal entries because it will reflect those adjusting journal entries. Let’s get into it with Intuit QuickBooks Online.

Accounts Receivable Reversing Entry 10.35

In this presentation, we’re going to take a look at an accounts receivable reversing entry. So the story goes like this, we had an invoice that was entered into the system in March after the cutoff date, we pulled it back before the cutoff date. So that income was reported correctly as of the cutoff date, which is going to be February 29. Now we’re going to do a reverse in entry, so that everything is correct and the following period in February as of the date of the original invoice. Let’s get into it with Intuit QuickBooks Online.

Accrued Interest Adjusting Entry 10.15

This presentation we will enter and adjusting entry related to accrued interest. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. We’re going to start off by opening up our reports. Once again, we’re going to go to the reports on the bottom left hand side, we’re opening up the trusty balance sheet or our favorite report the balance sheet, not the trustee trial balance the balance sheet up top, we’re going to go back up top, we’re going to change dates from 1012020 229 to zero, remembering that this is the cutoff date that we want to enter our adjusting entries as of we’re going to go back up top and then duplicate the tab by right clicking on it and duplicating it.