Corporate Finance PowerPoint presentation. In this presentation, we will discuss financial markets Get ready, it’s time to take your chance with corporate finance, financial markets, financial markets help to provide indicators for maximizing shareholder value. So when we’re thinking about financial markets, we’re thinking about markets. In general, we’re thinking about purchasing and selling things, a place where people purchase and sell items, that means there’s competition, there’s different people competing within a market, that will typically lead to better information about the value of the items being sold.

Posts with the valuation tag

Financial Management Goals 125

Corporate Finance PowerPoint presentation. In this presentation, we will discuss financial management goals Get ready, it’s time to take your chance with corporate finance, financial management goals. Now, as we’re thinking about the financial management goals, we’re thinking about corporate finance, we’re typically thinking about a corporate structure. So management, how does management fit into the structure of a corporation, the owners of the corporation are going to be the shareholders of the corporation. So if you think about a large corporation, then you’re thinking, well, the shareholders shares are trading all the time, possibly on an exchange for a large corporation.

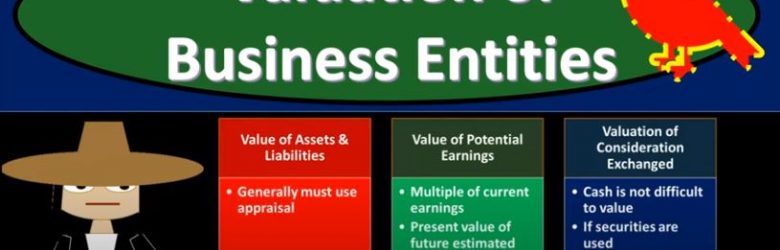

Valuation of Business Entities

In this presentation we’re going to talk about valuation of business entities when there’s going to be an external expansion. In other words, a merger or consolidation, get ready to act because it’s time to account with advanced financial accounting. We’re continuing on with our discussion of external expansion. That means we’re have two separate entities that are going to be combining in some way shape or form. The two types that we want to keep in mind at this point is the acquisition of assets and the acquisition of stocks. So if the acquisition of assets we have one company acquired another assets using negotiation with management, so that means you have two separate entities and one entity is basically going to be purchasing the assets of the other entity versus the acquisition of stock, where we have a majority of outstanding voting shares is generally required, unless other factors result in the gaining of control. So in other words, you have two entities, one entity in essence buying a controlling share or controlling ownership over 50% typically 51 and above. Have another entity. So from an accounting perspective, then the question is, well, how are we going to value the assets and liabilities. Now when we think about the assets and liabilities, we may have to use an appraisal oftentimes, in order to do so because remember, if you’re talking about some assets, they might may be on a fair value method, because you might be talking about cash or something like that, or possibly stocks or investments in that way, that may be easy to value with a market method. However, if you’re talking about things like property, plant and equipment, then it’s going to be more difficult to know what the value is. That’s the problem because there hasn’t been a market transaction for that exact same piece of equipment for some time.

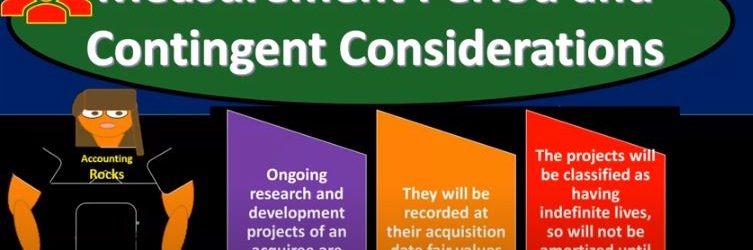

Measurement Period and Contingent Considerations

In this presentation, we will discuss measurement period and contingent considerations within an acquisition process, get ready to account with advanced financial accounting. At this point with the discussion of the acquisition process, you’re probably thinking, Okay, I kind of see how this fits together. I’ve see how this works. But logistically, it could still be a little bit tough. If you were to apply this in practice, you’re probably saying, Hey, there could be some problems. In practice. If we were to apply this out. For example, if we’re saying, okay, we’re going to revalue the assets and the liabilities. And we’re going to value the consideration we’re going to make a comparison of the value of the assets and liabilities to the consideration that’s being given for the company that in essence is being acquired in the acquisition process. Well, then what about that valuation process? That’s going to be difficult because how do we revalue the assets and liabilities because normally, when you value something, you value it from a market perspective, which means there’s actually a transaction a sale that’s taking place. So note obviously that valuation process is going to be somewhat of a tedious process for us to go through and revalue. And how long do we have for that to take? I mean, if this isn’t happening basically instantly with regards to this process, this is going to be taking some time.

Other Intangibles

In this presentation we can continue on discussing acquisitions, this time talking about other intangibles other intangibles other than goodwill, get ready to account with advanced financial accounting. We are talking here about intangibles that must be recognized separately. So in prior presentations, we talked about an acquisition process and the recording of goodwill and the calculation of goodwill. Through that process, you’ll remember that we talked about the revaluation we had to reevaluate the assets and liability of the company that’s been acquired to their their value and then consider that or compare that, to the consideration that’s being given we can think about goodwill. Now in that process, however, we might have some other intangibles that need to be valued at that time as well, other than just simply the goodwill. So for example, we might have marketing related intangibles things like Internet domains and trademarks. So instead of just basically lumping everything into goodwill, we got to say okay, all right. They’re going to be marketing related intangibles like the internet domains and the trademarks that we need to apply some of that intangible amounts to we need to value in essence, those things as well breaking them out from just basically a kind of a lump sum valuation of goodwill.