Hello in this presentation we will be discussing a trial balance objectives at the end of this, we will be able to define a trial balance list components of a trial balance and explain how a trial balance is used. When considering the trial balance, we first want to think about where the trial balance falls within the construction of the financial statements. In other words, what processes go before the trial balance, what goes after the trial balance, where’s the trial balance fit into our process? Remember, the ending goal, the ending process of the accounting been to compile the data in such a way to create the finance financial statements. Those financial statements have been the end product. Typically if we’re thinking about a linear process, then we’re thinking about all the transactions that would happen during the month.

00:53

Those being recorded in terms of journal entries in the general journal. So we will be recording a bunch of journal entries one looking like this. This is recording draws and checking account for a shareholder who are a drawing from a sole proprietor being pulled out of the company, then we would post all of those to the general ledger. So posting the general journal entries from the journal entries from the general journal to the general ledger, the general ledger being a list of all the accounts. So we’re going to have a list of all accounts in order by assets, liabilities, equity, income, and then expense accounts. And we’re showing all the activity for whatever period that we are now covering. Typically, we’re looking at a month by month period or possibly a year’s period, whichever the case may be, we’re going to see all this activity when considering the general ledger.

01:49

This particular account being a debit to drawings, here’s the debit to drawings, and a credit to cash. Here is the credit to cash that shows all the activity Now the problems that we will be working and also when you’re thinking about a computer system. Note that this tends to happen more all at the same time, meaning, if we’re working this by hand with paper and pencil, we would record all the journal entries, and then record the posting of all those journal entries to the general ledger. And then take those General Ledger balances to create the trial balance. That’s a useful way to think about it when considering how the process works. In reality, in a computer system, and as much as possible in any system that we can put together, we would like to do more of this at the same time, meaning I would like to construct the journal entry and then post it and then record the posting or the trial balance as we go, rather than waiting till the end. In practice, that’s how we will look at it.

02:52

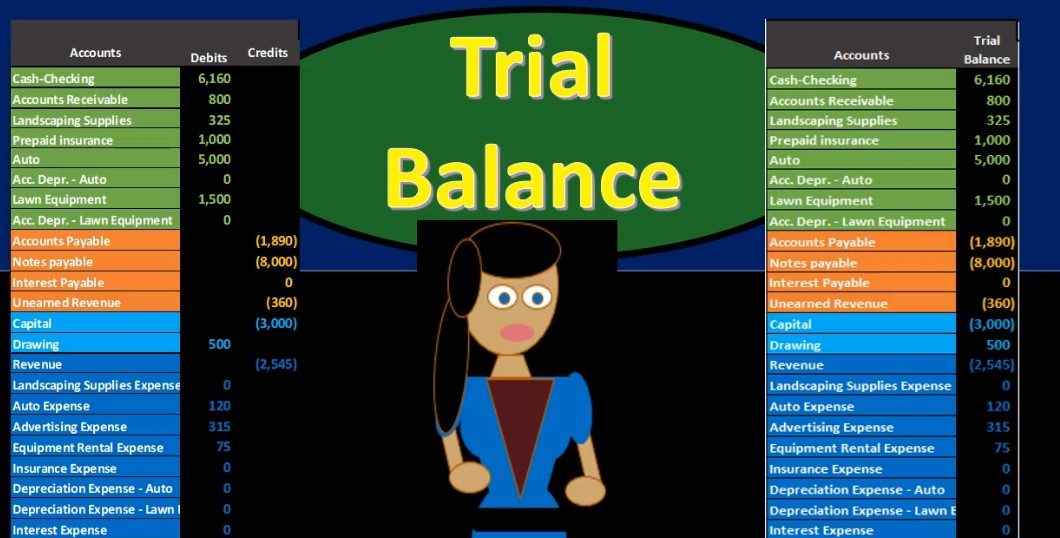

But it’s useful to think of this process as a linear process as we’re just going to do all one, all of the journal entries and then all of the GL and then The trial balance when considering where the trial balance falls. Once we have these balances, then we’re going to take these ending balances here these ending balances and all these accounts the ending balance for cash 6001, six 160 for accounts receivable 800. For the supplies we got 325, we skip over here to two accounts payable, we have a credit balance, represented here by the brackets, credits, beating the debits of 1890 notes payable credit balance of 8000. We’re just going to take those Indian balances then to create the trial balance.

03:36

The Trial Balance then is something that can really be a lot easier for us to look at and get a quick glance at just those ending balances eliminating all the detail for example, in the cash account, we will see on the trial balance 6160 eliminating all of this detail within the trial balance and thereby being able to work with something that’s about Bit more manageable and can tell us some different types of data. So when we look at the trial balance, then it could be formatted in a couple different forms. But we’re typically always going to have the accounts listed in the same order as we find them on the general ledger. That’s going to be the assets in green in this case on top, then the liabilities, then the equity, then the revenue than the expenses. Remember, if you remember that if you are talking about a sole proprietor, your equity will be capital.

04:32

And the drawings will typically be in the equity type area as well. If you’re talking about a corporation, you’re going to have common stock and you’re going to have retained earnings. So you’ll notice here that up here in cash, we’ve got that 6160. Again, we eliminated the detail here. Now the reason we’re going to do that, of course, is that now we can manipulate this data and do more things with it at the end of the day. We’re going to use this trial balance in order to connect strucked the trout and the financial statements the end product. But the trial balance also helps us to kind of see what is going on as we go meaning, we can easily add up these assets and see what our total assets are, see what our total liabilities are, and and make some quick comparisons as we would do with the financial statements with just this trial balance. Note that most textbooks, we’re actually going to introduce the trial balance before we introduce the general ledger.

05:29

Why? Because the trial balance is a lot easier to look at right, it’s a lot easier to look at the trial balance even though if we think about the normal systematic format, we look we do the trial balance after we do the general ledger, the trial balance being constructed from the Indian balances of here the general ledger, but it’s going to be easier to look at. So we want to look at that first. In practice. Note that trial balance will typically be constructed by a computer system as we enter data in To the computer system. And a lot of times, then in that format, we’re looking at the end result, the trial balance or even the financial statements. And we typically want to go back in time, for example, if I want to know how we got to this 6160 in in the cash account, if I’m saying, hmm, that looks too high, or that looks too low, then we oftentimes in that situation, say we’ve already constructed the trial bounds and then go back to the detail and say, let’s see the detail and to the general ledger.

06:30

How is this ending number created? Where am I? Where is my thinking going wrong, and me thinking that this balance is too high or too low, and we go back and find that detail. So that’s another way we can we can kind of consider where the trial balance lies. It’s used in order to construct the data. It’s done from the general ledger, when considering it from practice, a practice standpoint, in terms of how as a company doing oftentimes, we Start from the trial balance the ending balances. And then we can think about looking backwards to that general ledger. Note that the trial balance is a great cheat sheet, meaning if you can have a cheat sheet for any kind of exams or anything like that, or when you’re just practicing with problems, you want to start off with a trial balance as a good cheat sheet. Because even if it’s not related to the problem that you are on, it will give you a lot of information meaning it lists all of the accounts.

07:29

So if you’re picking some of these accounts that you may not really know, such as unearned revenue, it’s kind of an account that takes a little while for most people to get and not only get in terms of I’ve now I know what unearned revenue is I’ve heard it a few times. But then is it a debit or credit balance? Often a question we don’t really know until but we can find it. By looking at the trial balance we can see here that’s in the credit side. It’s going to be a credit balance and the trial balance therefore it is a great cheat sheet to have. So I highly, highly recommend getting used to a trial balance and having it in front of you whenever working any problems. It’ll tell you what the normal balances are for many accounts, when working with smaller problems, especially like multiple choice questions, they’re not going to give you enough information as you would have in real life meaning in real life, you would have access to a trial balance typically, in a book problem, you will not and so therefore, if you can get one in front of you, I highly, highly recommend doing that.

08:33

Note the key component of the trial balance being that the total assets equal the total I mean so and it’s all debits equal the total expenses, which is the trial balance format that debit credit format of the accounting equation with a double entry accounting system of assets equal liabilities plus equity. So if assets equal liabilities plus equity then it must be that total debits and total credits will be equal for all accounts involved. So we broke this out in terms of debits and credits, we can also do very quick calculations, meaning, if I especially if I’m an Excel, I can just highlight these numbers in Excel and add them up, give me total assets, I can highlight these numbers, add them up, give me total liabilities, I can subtract the revenue minus the expenses and get the net income very quickly, I can just add up the total equity and get those numbers very quickly.

09:29

We can actually maneuver around the trial balance a lot quicker than even the financial statements if it’s formatted well, and if it’s an Excel even even faster. The reason we’re going to convert these two financial statements is because we’re trying to convert it to something where people don’t know debits and credits. But if you know debits and credits, this is actually a lot more versatile in many ways than actually the financial statements. You can basically pull a lot more information a bit quicker and in this format, sometimes Then the financial statements. Note that I have represented the credits with brackets. That is not always the case depends on the textbook or the software, you will see, most textbooks will not represent credits with brackets. But many software programs will. And if you work with Excel, I highly, highly recommend, you know, considering this kind of formatting, because it will make your life much, much easier.

10:25

And so I’m going to I’m going to try to, to show that and try to convince people convince you of that if you’re going to be working with debits or credits a lot, you’re going to want to work with Excel, you’re going to want to learn Excel, you’re going to want to make sure that you make Excel part of your learning process. And when learning Excel, it’ll make your life much much much much easier. If you start using formulas and putting credit brackets around the credits will help to do that. The first example of that is to if we were trying to convince a trap, condense a trial balance down We can do so in this format. And note what this does for us, it’s going to convert the trial balance from just two columns to one column. That seems like not a big deal right now. But when we get to later worksheets, where we’re going to basically be looking at the activity that happens, and then an ending trial balance, that would be six columns here.

11:23

And if we can convince, condense those down, we’re getting down to three columns. So the fact that this will increase by two columns each time we add something, and this will increase by only one column, each time we add something is really gonna save time down the road. As you’ll see when we when we start making worksheets. You’ll see worksheets in the book in textbooks that will, you know, have like 10, you know, 10 columns, and that’s a little unnecessary. We’ll also see some complexity and formulas, where if we were doing it by hand, it might be useful to do if we had a calculator, but if we’re doing it in a sell something I highly, highly, highly recommend we get used to, then then the formulas will be a lot more simple if we don’t have the two columns and instead use this format here. So I’m going to try to convince us of this and show us in the problems, how this will work and how to convince how to convert this back to this and back and forth as needed.