Hello in this presentation we will take a look at a two step closing process. In other words, we will perform the closing process using two journal entries. There’s a couple different ways we can see the closing process, each of them having a pros and cons. The two step process is nice because it allows us to see net income broken out and being closed out directly to the capital account, followed by draws, which is similar to what we see when we actually do the statement of equity, meaning that when we do the statement of owner’s equity, we start with beginning balance and then we increase it by net income and decrease it by drawers or dividends. Because this process is similar to that process, it’s often easy to remember it’s the easiest for me to remember in any case, so we will take a look at the two step closing process.

00:49

First, our goal once again, we’re going to go from the adjusted trial balance to the post closing trial balance. It’s important to know where we stand in the process. We’re at the end of the process. Where the process is basically over, and we’re setting up for the next time period. So we’ve already entered all the normal transactions in the accounting department, the invoices, the bills, and the checks and whatnot. Then we have the unadjusted trial balance we put into our worksheet, our adjusting worksheet, in order to then generate the adjusting journal entries to create the adjusted trial balance, which we use to create the trial balance the financial statements with then we need to set up for the next time period that’s where we are at in the closing process. We’re moving from the adjusted trial balance, getting our accounts ready for them to be recorded in the next time period. The way we do that is we reset all the temporary accounts all the accounts below the capital account.

01:46

So remember that the adjusted trial balance is the same as the post closing trial balance down to well including assets liabilities, and then the equity section will defer our case we have a sole proprietor therefore we’re talking And owner’s equity. And we see that it’s gone from 658 820 to 740 to 800. And it’s in essence been increased by all of this information, all the temporary accounts below that owner capital account. So our goal to make all these accounts go to zero, to reset them so that they can start from zero and count up in the next time period, and put those account balances into the owner capital account. Now when we see this with a one step process, we just started, withdraws and went straight down. But if we think about how this happens on the statement of owner’s equity, typically, we take net income and add it to the capital account.

02:41

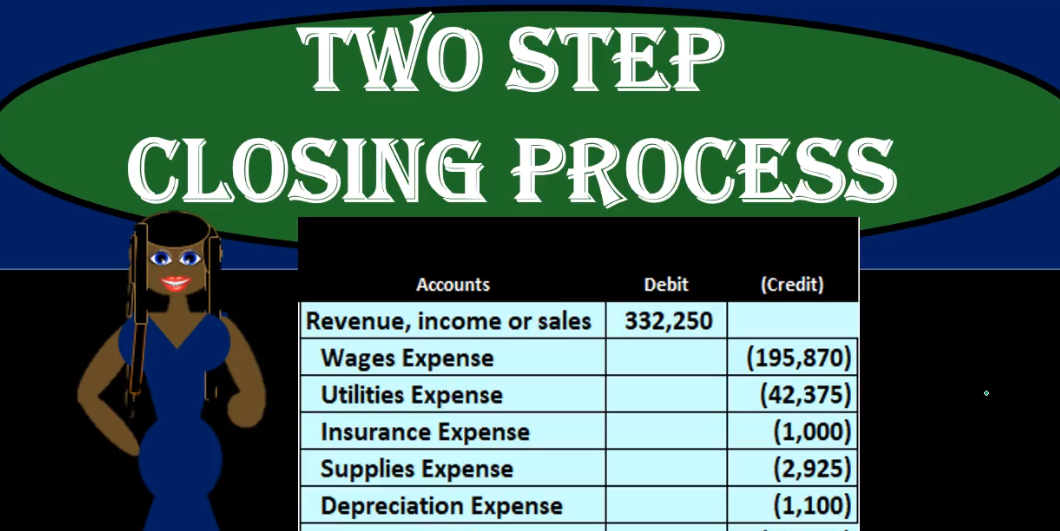

That’s what we’re going to do. First, we’re going to close out the income statement accounts revenue expenses, and we will then close that out that 88 980 that will result from closing those accounts out to the capital account here in a similar fashion, as we see in the statement of owner’s equity. So we’re just going to build this out As we go, we’re going to start with the revenue, we can see that the revenue has a credit balance, we’re just going to start with all the income statement accounts. Of course, revenue is the first income statement account, we can see that it has a credit balance here, by the fact that it has brackets, we’re going to do the opposite thing to it to make it go down. We’re just going to do whatever we need to do to make these accounts at zero. And then we’ll see what to do once we get there. So we’re just building our journal entry.

03:24

As we go, we’re going to start with a debit to the revenue or income or sales, whatever we call it, depending on the type of business and what they decided to call the revenue account, and we will debit it the opposite of what it is to make it go down. Once we then posted to our worksheet, we have a credit and then the debit will bring it down to zero. So we’ll just build in our transaction as we go. We’re going to build our journal entries as we go. The second piece, of course will be wages expense, it has a debit balance, we’re going to do the opposite thing to it to make it to go down. So the opposite then is of course a credit. So we’re going to take wages expense, we’re going to credit it by that 195 870.

04:05

Once we post that, then we have a debit balance followed by the credit bringing the total down to zero, then we’re just going to continue this process. Next with utilities expense. utilities expense have a debit balance, just like all the expenses this this process will repeat itself because all the expense accounts will have debit balances, we’re going to bring it down by doing the opposite thing to it. Therefore, we’re going to create another piece to our journal entry, just creating the journal entry as we go. crediting in this case, utilities expense for that 40 to 375. Once we then post that, we’ve got the debit 42 375 the credit 42 375 bringing the balance down to zero.

04:50

Next, we’re going to do the rest of them all together here. They’re all the same. So we got insurance supplies, depreciation, debit, debit, debit, because expense expense expense, and therefore we are going to bring those down by doing the opposite thing to them. So here is the expenses that we’re just adding to our journal entry. It’s that long journal entry, but we’re just building it as we go. And if we see this side by side, as we post it, we can see why we’re doing it and how we’re just going to construct this thing. So we’re just going to put a credit to the thousand to two insurance expense a credit to supplies expense 2009 25, a credit to depreciation of 1000 to 100. And then if we post these three out, that will then do what we wanted to do, closing those account balances down to zero. Once we do that, we’ve done what we needed from the first of two journal entries. We’ve closed all of the income statements down to zero, but we’re out of balance.

05:50

We’re out of balance here and we need to do something to fix that. What are we out of balance by? We’re out of balance by net income, because we closed out all the revenue And expense accounts leaving us with that net income amount we need to record somewhere. If we calculate that on the journal entry, we can say, well, all the debits I’m just adding up all the debits. And I’m going back up to this journal entry we just made. If we just add up all the debits, it’s, of course 330 to 250. If we add up all the credits, it’s 243 270, leaving a difference of 88 980. That then is net income. And we’re going to post that to the credit here capital account. So here’s our our completed first of two journal entries debiting revenue for whatever we need to do to make it go to zero, crediting all the expenses for whatever we need to do making it go to zero.

06:43

And then we’ll left with this credit of 88 980, which should be equivalent to net income that given us a kind of a check. It’s equivalent to the net income we had posted on the financial statement before the closing process. It’s equivalent to net income that could be calculated On the adjusted trial balance before we closed it out, then if we if we post that, then we have the credit to the capital accounts and we got the owner capital, then we’re going to credit it by that amount. And that brings the balance up to 747 800. Now this should kind of make sense it should you should see the parallel here or think about the parallel here, between calculating the statement of owner’s equity which starts with the beginning equity account, then increases by net income to get to the two and then it decreases by drawls which we’ll do next time to get to the ending capital account. here instead of doing it with plus and minuses, we’re doing it with debits and credits, we have a beginning amount of 658 870 because it’s not including all of this stuff, which is really part of the equity section not included in the capital account.

07:50

Until we do this process. Then we increase it by doing the same thing to a credit to a credit making the imbalance 747 800 Now, we’re left with just one temporary account, that being a draws account and not an income statement account not affecting net income. But one that is temporary goes up with time, one that needs to be reset at the end of the time period. That will be our second journal entry. It’s an easy one because it’s short. But it’s often confusing to know whether draws has a debit or credit balance. If you have the trial balance in front of you, it’s a lot easier because we can look at the trial balance. And we can see that this is going to be a debit balance here because it doesn’t have brackets. So anytime you can have the trial balance in front of you if you’re doing multiple choice questions, and if you can have a multi a mock trial balance in front of you recommend doing that it’ll answer a lot of questions.

08:43

So we’ve got this 5000 we’re going to do the opposite thing to it to make it go down, which is a credit. And we don’t have the other side yet but if we just build this as we go, we’re going to credit draws so well credit draws bringing the account balance down and then the other side Gonna go to capital. And this should seem familiar as well, if we think about the statement of owner’s equity, remember what happened. We started with the beginning balance, not including all this information here, we increased it by net income, which was this first journal entry. And then we decrease it by the draws, which is the second journal entry. And that’s going to be the same process we see in the statement of owner’s equity. We’re left with 740 to 807 40 to 800. And we achieved our goal of zeroing out all the temporary accounts now being ready for the next time period to start counting at zero, that’s 740 to 800.

09:40

Also found here on the statement of owner’s equity. So when we see the adjusted trial balance note that you’d have to add all of this up to get to that ending number that 740 to 800 that we see now on the post closing trial balance. So we only have this number We’re here now, because we crunched all this up to that one number. When we sell the the statement of owner’s equity note the process is much the same. We have the beginning balance 658 20, this number here, net income at eight nine at that number there, we’re increasing it less minus draws 5000 5000. That is the difference this minus this 83 980. So our beginning balance here, plus the difference which is net income minus draws, gives us our ending number 740 to 800. That is similar to what we did in our closing process beginning balance plus the net income minus the draws giving us the 740 to 807 40 to 800