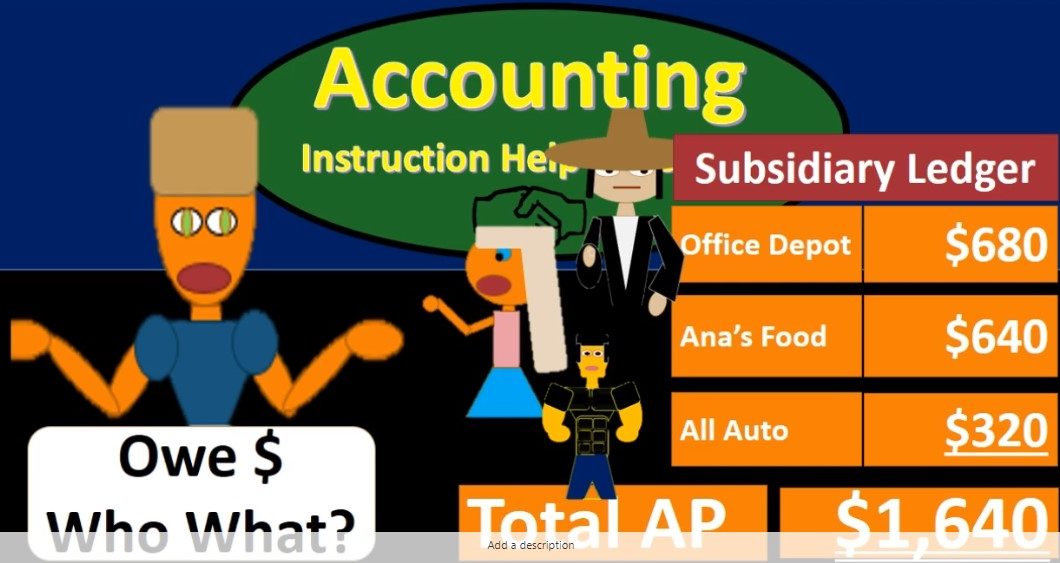

Hello. In this lecture we’re going to talk about the accounts payable subsidiary ledger accounts payable subsidiary ledger will be backing up the accounts payable account on the trial balance or the balance sheet. As we can see in the example here we have a balance of 1640 in accounts payable. If an owner asks the question of how much money do we owe to vendors? The answer would then be 1006 40, which we can see on the balance sheet or the trial balance. But the next question that will follow will be who do we owe that money to? And how do is it which of these vendors should we be paying? First? In order to answer that question, we may try to go to the detailed account, which is the general ledger. Typically every account is backed up by the general ledger, we can see that we have the same balance here and we can see that we have activity however, the activity is in order by date. And that’s not really helpful for us to determine who exactly we still owe at this point in time. In order to determine who we owe, we need to organize this information.

01:00

Not just by date, but by vendors. So that will be the subsidiary ledger, for example, we might have Office Depot 680. And we might owe and food 640, we might owe out all 320, that would then sum up to the 1006 40. That is on the general ledger. And that is on the trial balance and which would be on the balance sheet. And this gives us some indication of who we owe, and gives us an idea of how we should then go about making the payments. Who should we make these payments to? Well, let’s look at some transactions to see how this works. Let’s say we got a bill here, we’re going to receive a bill we’re going to record the transaction for the bill. And the bill was for supplies, we’re going to debit supplies, and we will then credit accounts payable. We have not yet paid the cash for the bill. We’re just recording the bill. I’m going to record the supplies first.

01:48

I’m just going to record it to the trial balance to see the activity on the trial balance not to the general ledger for supplies, although supplies of course would have a GL account but we want to focus in on accounts payable so the supplies lies within increase, so we’d have an increase in supplies, then the accounts payable, I’m going to post it to the general ledger note the general ledger is in order by the order of transactions that are happening here, increasing the balance to that 680 that 680 would also then be reflected in the trial balance. Therefore, we would then have this 680 on the trial balance on the balance sheet, and then it would also be on the general ledger, but we also want to track that information by vendor who is it that we owe this 682 in this case, Office Depot, increasing Office Depot subsidiary ledger account in terms of accounts payable now if we add up all the subsidiary ledger accounts to the people we only owe Office Depot, it adds up to that 680 the subsidiary ledger ties out to the general ledger ties out to the trombones would tie out to the balance sheet as well.

02:51

Note that the subsidiary ledger is really just posting the same information that has been posted to the general ledger, but it will be by vendor if we haven’t Another transaction in which we’re going to pay off the vendor in this case, then we know that the journal entry would say that cash is going down with a credit. And we would then debit the accounts payable, reducing the accounts payable, I’m going to post the cast. Just because we’re not focusing on cash, we’re focusing on accounts payable, so cash would obviously go down, we’re going to post the accounts payable to the general ledger. So we’re going to show the detail decrease in the general ledger that would bring the balance down to zero, we can do that two ways, we can say it’s the running balance of a credit of 680 minus the debit or we can add up the debit 680 out of the credit 680 and subtract them either way we get to that zero, which then would appear on the trial balance as well. Therefore, we can see that the trial balance matches the general ledger. We also want to see that information.

03:47

However, in terms of vendor, that’s what the accounts payable subsidiary ledger will do. In this case, we’re going to say that this transaction is reducing the amount for Office Depot bringing that balance down. We’re back down to zero in the subsidiary ledger, the general ledger and the trial balance as well as the balance sheet. Let’s see, we have another bill. So we got another bill. In this case, the bill is for auto service. So we’re going to debit auto expense, and we’re going to credit accounts payable, we have not yet paid for it. I’m going to record the auto expense first because we’re focusing on the payables so I’m just going to record the expense directly to the trial balance, that would of course, increase the expense for auto expense, then the accounts payable we want to focus in on we’re going to record to that general ledger account, general ledger account goes back up with a credit and that would increase the balance.

04:37

Again, we could do this by saying it’s the prior balance the running balance of zero plus the credit bringing us up to a credit balance of 320. Or we can add up the debit 680 out of the credit 680 plus 320 subtract them and see that the credits are winning by the 320. That would of course also be on the trial balance that 320 therefore, the trial balance Accounts Payable would match the general ledger. And we would need to record that also, however, in terms of who do we owe, what’s the vendor, that’s where the accounts payable subsidiary ledger comes in. And in this case, we owe our auto that 320 increase in the 324 hours auto. If we add up all the people in the subsidiary ledger, all the vendors in the subsidiary ledger, we then get to that 320 subsidiary ledger matching General Ledger matching the trial balance. Next transaction. Let’s say we got another bill, we’re going to record another bill for the 700 that 700 been for entertainment, meals and entertainment, we’re going to increase the 700 with a debit and we’re going to credit the accounts payable, we haven’t yet paid for it.

05:40

Again, we’ve got another bill that we are then entering, we’re going to record the entertainment first, because we’re not focusing on that we’re focusing on an accounts payable, that’s going to increase the expense. Then we’re going to record the accounts payable to the GL. So the GL is then going to increase again by the 700. That’s gonna increase the balance to 1020 can be calculated two ways. One it could be the balance before 320 plus 700, bringing us to 1020. Or we can add up the debits 680 out of the credits 680 plus 320 plus 700, subtract them out and see that the credits are winning by $1,020. That would of course also be reflected on the trial balance. Therefore, we can see that once again, the trial balance matches the general ledger. But we also want to see that in terms of the subsidiary ledger, so the subsidiary ledger by vendor would then show that and food has been increased by that seven 700. Therefore, if we add up the balances of 07, hundred and the 320, we see that we have a balance of the 1020 in the subsidiary ledger as well as the general ledger as well as the trial balance.

06:50

So the subsidiary ledger is going to be basically the the same information as the general ledger. It’s going to be broken out in a different way by vendor first and then by date. If we’re using computerized systems, oftentimes this will happen. at the same point in time a computerized system will often not let us post to the accounts payable account unless we assign a vendor because the system saying hey, if you want me to post to the accounts payable account, I need a vendor so we can create the subsidiary ledger by vendor as we do this.