This presentation we will enter and adjusting entry related to accrued interest. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. We’re going to start off by opening up our reports. Once again, we’re going to go to the reports on the bottom left hand side, we’re opening up the trusty balance sheet or our favorite report the balance sheet, not the trustee trial balance the balance sheet up top, we’re going to go back up top, we’re going to change dates from 1012020 229 to zero, remembering that this is the cutoff date that we want to enter our adjusting entries as of we’re going to go back up top and then duplicate the tab by right clicking on it and duplicating it.

00:41

Then I’m going to close the old hamburger hold down Control scroll up to that 125 It’s where I like to be and then we’re going to scroll back down back to those loans. Again, we’re going back to the loans. So we’re going to go back down we have the note payable here. Now in the current portion. This includes the one loan that we’re going to be concentrating on now. Had the 50,000 in it. And we’re going to think about interest accruing on that 50,000. You’ll recall that that $50,000 loan, we said isn’t going to be paid until the end of the loan, where we pay the full 50,000 plus the interest at the end. And that means interest is accruing upwards as time passes. So if I then go back down to our schedule, let’s think about what that would look like.

01:22

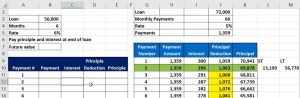

Let’s reconstruct this, I just want to reconstruct this loan so you can get an idea about it about this kind of loan. What if we had the 50,000 loan? And it was for six months and the rate was 6%? Well, then how much would we pay at the end of that six month time period. And that sounds like a fun problem to solve. And we have a formula for that very common formula within QuickBooks for a future value. So we’ll use a future value formula to look at that. Well, let’s let’s take a look at that real quick. We’re going to go to the formula over here. We’re going to go to the formula box and we’ll do this with a like a search future value. And that’s going to be the F v value returns the future value of investments.

02:05

Typically, we would often be using this in investments. So I’m going to say, okay, we’re looking for the future value, we’re going to be picking up the rate, there’s the 6%. But we’re going to say the rate is per month though. Remember, anytime you see a rate, it’s usually per year, we need to take that into divide it by 12. Next, we have the number of periods. So we’re gonna have the number of periods, sometimes I say payments here, it’s not the payments, this is going to be the number of periods which is going to be six, we’re gonna have six months, we’re going to hit the month or the periods, then we have the payments.

02:35

Now we’re going to say this is where it gets a little bit tricky, because we’re going to say the payments are zero, we’re not making any monthly payments per period. So we’re going to say zero here, and you’ll see that these two items are gray or they’re not bolded, let’s say so they’re not used depending on how we’re going to use the future value formula here. We’re going to need it we’re going to take up the present value, the present value is what the loan amount is as a This point in time, which is the 50,000. So that’s what we’re going to have there. And then it’s going to, we’re going to say, okay, and that means the future value is 51 519 5519.

03:12

Now I want to see that as a positive number, so I’ll typically go into there here, I’ll put a negative in front of the future value, and that’ll flip it to a positive number. Now, note, you might also be in a situation where they basically give you this number, possibly, right? And they maybe they don’t give you the interest. Let’s just imagine that being the situation, I’m going to set up the same amount of data. And then I’m going to keep the formula down here. And I’m going to say this is the unknown. Now, even with that being the unknown, I’m going to use this same formula, and then we’re going to use that goal seek to figure this this number out.

03:49

So in other words, what you might know in the loan, they might not give you the interest, they might say, Hey, I you know, the loan amount with 50,000 it’s going to be six months is when it’s going to be due and you’re going to owe us 50 51,005 19 because they gave you all the information, you need to basically impute or figure out what the interest rate is at that point in time. So they could just give you that that number and they basically gave you everything that you need. Although it would be nice to get the interest rate. So then we would say, Okay, well, let me figure out what the interest rate is if you’re only going to give me that information. So to do that, I’m going to click anywhere off the sales, I’m just going to click over here somewhere, we’re going to then go to the Data tab up top, we’re going to go then to the forecast, what if analysis.

04:31

Now note I have the same formula, and I got the same formula down here, even though I have nothing filled out in the rate. And I’m going to change that rate, like just like this.I mean, if I was just picking a rate like 2%, let’s try 3%. Let’s try 4% and so on. That’s what excels basically going to do for us. I’m going to go into the what if analysis, we’re going to go to the Goal Seek and I’m going to ask Excel, I’m gonna say Hey, would you please set this cell to be what I know It should be because they told me what the end number is, which is 51519 by changing then this cell.

05:10

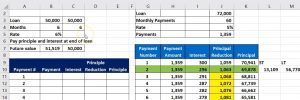

So once again, would you please set this cell to be that hard coded number, which I know what I’m gonna have to pay at the end by changing this cell, which is the unknown, that’s the interest rate that we want it to gather. So if I say, Okay, then it’ll basically, you know, populate that interest rate for So just a couple things to note, I like to point out that that goal seek whenever possible here. Now, if I was to think about this one other way, well, how how would this work in terms of our amortization table, we did an amortization table before it would look something like this. There are no interest payment, there are no payments, we’re not making a payment till the end.

05:45

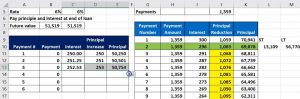

So the interest then would be calculated it would keep on increasing. So if we were at the after the first time period, it’s going to be the interest is going to be this 50,000 times the 6% divided by 12. And there’s the 215, the principal, then the principal is going to be going is going to be, you know, it’s not going to be reducing, it’s going to be increasing basically by the 250. So you’re going to say it’s not really a principal reduction, it’s going to be a principal increase, increase. So it’s just the same number. And I spell principle wrong here as well, for those that that will bother, which I’m sure there’s a few that are bothered by that. And that’s fine. It’s my fault. So I’m going to say there’s the 50,000 plus the 250.

06:36

So there we have that. And then if we were to do this again, now we’re going to say the interest is now the larger amount here at times the 6% divided by 12. And now we have a bit more interest because we’re now basically paying interest on a heart on a higher principle. And this is going to basically be the same number and now I got this plus that. Let’s do it one more time. Now we’ve got the new principal times the interest, divided by 12. And so that goes up a bit. Now we got the principal plus the interest.

07:11

Let’s see if I can copy that down. Let’s use the autofill by putting our cursor on those autofill handle, scrolling down didn’t work. Why? Well, if I double click on this one, it moved the interest rate down. That’s not what I want. So I’m going to say, all right, this cell, I’m going to delete that this cell, I don’t want you to move that 6% down, that’s in cell C, five, C five, I’m going to make an absolute reference by clicking on it and selecting f4. Or you can put $1 sign before the see $1 sign before the five. You technically only need a mixed reference, but the absolute reference will be fine. In other words, you only need $1 sign, but I’m going to put two in there, and that’ll work.

07:53

Now let’s do it again. Let’s autofill down just one cell. Does that work? Does that do what we want? Looks like it does. Looks like it does look like it does, that’s autofill it down to the bottom. And see if we get to this number, which should match this number, the end payment. So just so you can see how that that you know, can work out. So what we’re going to do now is say that we’re in, we’re at the end of the first month here, right here. And that means that there’s there’s going to be interest that has accrued, which we have not yet paid. So I’m going to record the interest that has accrued that we have not yet paid. That’s going to be our adjusting entry.

08:31

So we’re going to go back to then our balance sheet, we’re going to put this into an other current liabilities, I’m going to call it you know accrued interest or interest payable, we’re going to be increasing that and the other side’s going to be going to an expense, we could do that with a journal entry. Or we can do it with the registers and use a journal entry within the registers. We’re going to use the registers for it. And so what I’m going to do is I’m going to create an account first because because I can’t use the register on the income statement. account because there is no register because it’s a temporary account, I need to use the balance sheet account, which is going to be accrued interest or I’m going to call it interest payable. And I haven’t made it yet.

09:11

So I’m gonna have to make an interest payable account and then use the register. So let’s do that we’re going to go back to the left, I’m going to hold down Control, scroll down just a bit, we’re going to be then going down to the accounting on the left hand side, then I’m going to make a new account in the in this field, we’re going to make a new account. Let’s close the old hamburger over here. Give us a little bit more room to do so. And then I’m going to go up top to new and we’re going to make a new with the green button. We’re going to make a new account. It’s going to be an other current liability, other current liability. That’s what we want. And let’s see what we have here.

09:49

We’ve got I’m just going to put it into other current liability, and I’m going to call it interest Hey a bowl till it’s a liability interest payable no other description. sub account, then I’m going to save and close that. And then I’m going to find that account that I just set up, which is an other current liability. So it’s going to be in order assets, like are still in assets and then liabilities. And then here’s like the current liabilities other current, so it should be in here somewhere. There it is, there’s the interest payable. Now I’m going to use the register with that account. So I’m going to go into that register. And we’re going to see the drop down, we’re going to be using the journal entry type of form. So I’m going to use the journal entry type of form.

10:30

We’re going to put this in as of Oh to 29 to zero the end of the month, the cutoff date, then the memo, I’m going to put this as an adjusting I’ll just put a DJ in tree. And we’re going to say that this is going to be increasing by the amount of interest that has passed up to this time period. So 50,000 principal interest has passed we’re not paid the interest. We haven’t yet paid the interest because we’re not going to pay interest or principal until the end of the loan where we will pay the full 51,005 19 therefore, we’re going to increase this by that amount. And I totally forgot what it was already, because I was talking as 250, what’s going to be 250 and the other side is going to go to interest expense, which you would you would think QuickBooks would have given us like an interest expense type of account, down here somewhere, there it is interest expense.

11:20

So now note, I recorded the other side to the wrong account, I recorded it to internet expense instead of interest expense. So I’m going to go back in there, I like I recorded it. And this is what the register look like. It looks like if I go back into it, if you record it, and then go back into it, it looks like this. And then I’m going to go down here to the splits option. If I go to the split option, it’s going to give me more information back into our register. And then I’m going to go here and edit this. So so what you have right now is the 250 adjusting entry. And then the other side is going to go to an account called interest paid.

11:55

That’s what they call their interest expense account and I put it into internet expense and now I have to go back And now I’m kind of fixing it. So here, so I’m going to go into Edit here. And so then I’m going to have to see it in a journal entry format. So in a journal entry format, you can see that I put the debit to the internet expense, which would be interest expense. So I’m going to change that now. And let’s start I mean, they called it knotless. QuickBooks called it interest paid instead of interest expense. So I’m going to say interest paid is the account that they’re using, that’s the one I’m going to pick up. So internet expense would be wrong. So I’m going to fix that. And then I’m going to say Save and Close. Then I’m going to go back to the balance sheet.

12:33

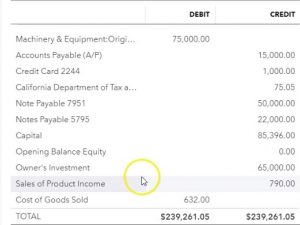

Let’s take a look at what has happened back to the balance sheet. We’re going to refresh the balance sheet. So I’m going to refresh that and then going to close the hamburger. I’m going to scroll up a bit and we’re looking for that liability account to the current liability. That’s going to be the interest paid. So here it is interest paid if I open up that interest paid. There it is there’s our journal entry for the 250 if I go into that 250 then we’ll find our journal entry. Going to closes back out. Let’s open up the let’s go back up top and go back to our balance sheet. Let’s go back to the left. Let’s open up our profit and loss Report.

13:09

I’m going to hold down Control scroll down just a bit, we’re going to go back down to the reports open up our second favorite report, or at least my second favorite, and column Mike in the balance sheet better personal, I don’t know. And then we’re gonna have the second favorite the financial statement report, which is going to be the PnL. We’re going to go back up top change today’s from a 1012020 229 to zero, then we’re going to run that report. I’m going to duplicate the tab up top right clicking on the tab up top and duplicating it. Let’s close the old hamburger here hold down Control, we’ll scroll up a bit to the one to five or looking for the interest. interest paid.

13:45

There it is there’s the interest paid at the 846 opening that up. Then we see the interest paid here of the 250. There’s our journal entry, going back to the left and then I’m going to go back to our report. Now note the interest paid is Another thing that you might think of as something that you want down below in the in the other expenses down here, because you might think of it as, as something like if I didn’t have financing, I wouldn’t have interest expenses. Not you might think of it as not kind of our normal business operations is the financing thing. And so you might want it down here. And in my opinion, this other miscellaneous expense doesn’t belong down here, just because it’s miscellaneous and it wasn’t categorized as a normal expense, I would think that would be up here.

14:28

So if you wanted to change those, if you wanted to change this kind of grouping, I would think this investment for sure, I would put down here because I’m not in this in the business of investing in stocks and bonds, I would put that down here, miscellaneous, I would put up top but the QuickBooks account that we use in their chart of account, put it down there, and the interest expense, possibly I would move down below, and I would rather call it interest expense rather than interest payable. So let’s just think about some of those kind of changes.

14:55

Let’s first go to the miscellaneous expense and change that To be up top and the normal expenses. So I’m going to go back up back to the tab to the left, hold down Control. And I’m going to go to the accounting. And then we’re going to be in the chart of accounts, I’m going to then find the miscellaneous expense, let’s close the hamburger while we’re working in here, give us a little bit more room, it’s going to be on the very bottom because it’s the other other expense accounts. So here’s the the other miscellaneous, I’m going to go to the right to the drop down, not into the register, but drop down, edit that, then I don’t want it in other current I just other expenses. I just wanted in the normal expenses.

15:39

So I’m going to select the drop down and say could you just put that in the normal expenses? And then I’m going to say Save and Close and it’s going to give me those little errors and hey, I’m you know, you sure you want to do that because it could make some changes to reports and whatnot. We’re going to say yes, please. And then it should do it for us. And then if I go to the profit and loss and refresh the profit and loss Close the old hamburger and and scroll up a bit, then if we go all the way down now that it’s not down here anymore, it’s been put up top in our in our expenses. That’s where I would rather see it.

16:10

Typically, if you wanted to go the other way and move the interest down, let’s do that let’s move the interest down and rename it to what I would prefer to call it interest expense. So I’m going to go back to the to the left, and I’m going to look for for the interest paid account, which is going to be an expense type of account. So interest paid. We’ve got it’s going to be down to their interest interest paid. There it is, I see it, I see it. I’m going to select the drop down we’re going to edit that and then it’s going to be not an expense I’m going to put it down at the bottom and other expenses so it’s down below. I’m going to change the name from interest paid to interest expense I don’t know why they call it interest rate because we didn’t pay some of it right. It was a crude and we didn’t pay the interest.

16:54

So it’s like a life not even like that would be like line it would be wrong. So I’m going to say yes. Then we’re going to go back to the profit and loss and then refresh the report again. And then I’m going to close up the hamburger, we’re going to scroll back down. And then now that interest expenses down below, and then if the interest expenses down below, you can kind of think about it this way, hey, this is my normal operations up up top, as if I didn’t have any financing, and not including like capital gains on investments.

17:24

That’s not part of my normal business. Here’s the financing costs down below that I wouldn’t have if it wasn’t for the fact that I have to these financing costs and the gains on investments which again, are gains on things that I don’t normally do with my business, it was just kind of a game that generally happened. And that’s how I would basically think of it. Now you can also get your trial balance over here. So I’m going to open up the hamburger one more time and go to the report. So let’s open up the trust the trial balance, trial balance.

17:55

Note that when you’re working with these adjusting entries, it’s traditional to be working with basically a trial Balance report. And if I go back up top and change the dates from 1012020 229 to zero, and run that report, close up the old hamburger, you can see of course, both sides of the transaction here, one in the payable which is going to be a liability account up top and then down below. Now in the interest expense which is all the way at the bottom, you can check your numbers here will also going to be printing the trial balance after the end of each of these sections. So you can take a look at your numbers and at the end of each part