QuickBooks Online 2021 applied customer deposit or credit to an invoice. In other words, we got a pre payment from a customer in the past which we will now apply in the format of a credit to the invoice that we will create to complete the sale complete the transaction. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, we’re now going to be creating an invoice for a customer who made a deposit in the past. Let’s first open up our financial statements, we’re going to right click on the tab up top and duplicate it.

Posts with the Adjusting Entry tag

Advanced Customer Deposit Payment 8.30

QuickBooks Online 2021 advanced customer deposit payment. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in the get great guitars practice file, we’re going to be recording a pre payment from a customer or a deposit sometimes called unearned revenue. So let’s first open up our balance sheet and income statement reports. We’re going to go up top right click on the tab up top, duplicate, we’re going to duplicate again, right click on the tab up top and duplicate again. So we got the double duplications.

Customer Prepayment Unearned Revenue Two Methods 8.45

QuickBooks Online 2021 customer prepayment or unearned revenue, we’re going to take a look at two different methods to record the unearned revenue. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice problem, we’re going to take a look at the trial balance.

00:18

First, let’s first duplicate a tab up top, we’re going to right click on the tab up top and duplicate it, then we’re going to go down to the reports down below, we’re going to be opening up then a trial balance typing into the find area trial balance and open that up range, change it up top Indian ads, we’re going to say 1230 121. And then we’re going to go ahead and run that report. Let’s close up the hamburger for this tab, hold down Control scroll up just a bit.

Closing Entries 175

https://youtu.be/OdjLcvkWPfY?list=PL60SIT917rv6ERsGZxM9V_IZLVybpgfNU

This presentation, we’re going to discuss the closing process for our accounting system. Get ready, because here we go with aplos. Here we are in our not for profit organization dashboard, let’s head on over to our Excel file to see what our objective will be, you’ll recall, we’re going to be in tab 10. By the way, we’re over here in tab 10. You’ll recall that we’ve been looking at each transaction with the accounts that will be affected, posting those over to our Excel worksheet to see the effect on the trial balance on the accounts. Now, we did this in terms of posting to our first trial balance up top and so row one. And then we said, okay, what if we break this information out, and I want to break this information out by not just the expenses by their nature, but by their function. Now, in aplos, we have a nice system to do that we’re going to use the phones and the classes, or the funds and the tax to do that here.

Salaries Expense 145

In this presentation, we will record a transaction related to salaries expense into our accounting system. Get ready, because here we go with aplos. Here we are in our not for profit organization dashboard, we’re going to jump on over to our Excel file to see what our objective will be here, we’re going to be in tab number six, tab number six, where we have our transaction. Here we are in our not for profit organization dashboard, we’re going to be jumping on over to Excel to see what our objective will be, we’re going to be in tab number six. So we’re in tab number six, we’re going to be recording the salaries expense.

Intercompany Transactions

Advanced financial accounting. In this presentation we’re going to discuss intercompany transactions. So typically we have a situation where where we have a parent subsidiary relationship or thinking about a consolidation type of process within it. And then we have those intercompany transactions between the companies that need to be consolidated between parent and subsidiary, get ready to account with advanced financial accounting intercompany transactions, the intercompany transactions we’ll be focusing in on here and working some practice problems in on will include the intercompany receivables and payables need to be eliminated for consolidated financial statements.

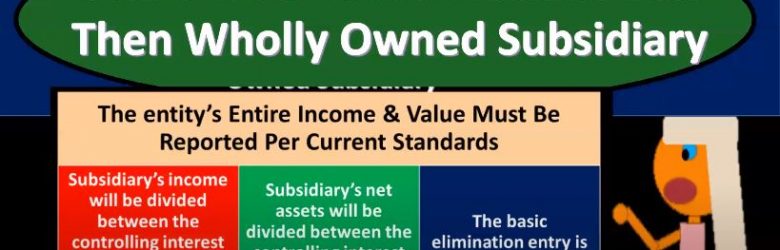

Consolidation Calculations Less Then Wholly Owned Subsidiary

Advanced financial accounting. In this presentation we’re going to talk about consolidation calculations for less than wholly owned subsidiaries. So we have a parent subsidiary relationship, we’re going to be looking at the consolidation process to put the financial statements of the parents and the subsidiaries as if they are one entity, but we don’t have a wholly owned subsidiary. In other words, the parent does not own 100% of the subsidiary. How do we do the consolidation? in bad case, consolidation calculations less than wholly owned subsidiaries, that entities entire income and value must be reported per the current standards? So in other words, once again, we might think, well, on the income statement, maybe we would just report the part of the subsidiary that belongs to or is controlled by the parent, but that’s not typically the case. That’s not the case under generally accepted accounting principles.

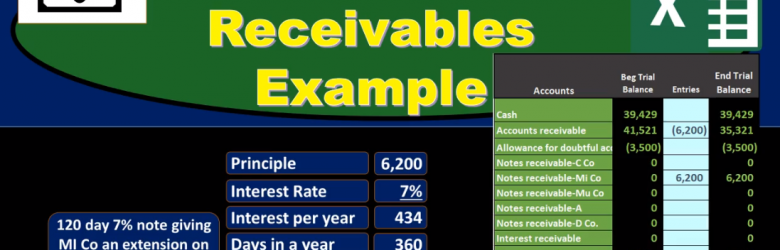

Note Receivable Example

In this presentation we will discuss notes receivable, giving some examples of journal entries related to notes receivable and a trial balance so we can see the effect and impact on the accounts as well as the effect on net income of these transactions. first transaction, we’re gonna have 120 day 7% note giving the company EMI and extension on past due AR or accounts receivable of 6200. When considering book problems and real life problems, one of our challenges is to interpret what is actually happening what is going on, which party are we in this transaction in? Therefore, how are we going to record this transaction when we’re looking at notes receivable? A common problem with notes receivable is the conversion of an accounts receivable to a notes receivable. So in this case, that’s what we have. We have an accounts receivable here that includes an amount of Due to us by this particular company in AI so these are our books, we have a receivable people owing us money for prior transactions goods or services provided in the past and they owe us in total, all customers owe us 41,521 this customer in particular owes us 6200 of this amount in the receivable that could be found not in the general ledger which would give backup of transactions by date.

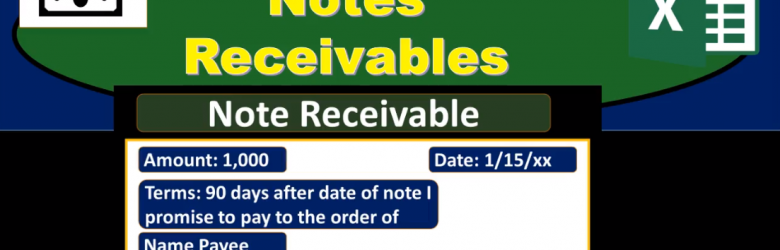

Notes Receivable

In this presentation, we will take a look at notes receivable. We’re first going to consider the components of the notes receivable. And then we’ll take a look at the calculation of maturity and some interest calculations. When we look at the notes receivable, it’s important to remember that there are two components two people, two parties, at least to the note, that seems obvious. And in practice, it’s pretty clear who the two people are and what the note is and what the two people involved in the note our doing. However, when we’re writing the notes, or just looking at the notes as a third party that’s considering the note that has been documented. Or if we’re taking a look at a book problem, it’s a little bit more confusing to know which of the two parties are we talking about who’s making the note who is going to be paid at the end of the note time period? We’re considering a note receivable here, meaning we’re considering ourselves to be the business who is going to be receiving money. into the time period, meaning the customer is making a promise, the customer is in essence, we’re thinking of making a note in order to generate that promise, that will then be a promise to pay us in the future.

Prepaid Insurance Adjusting Entry 10.40

In this presentation and we’re going to enter an adjusting entry related to insurance recording prepaid insurance and insurance expense. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re going to be opening up our reports. First, we’re going to go down to the reports on the bottom left. So we’re going to be opening up our favorite report that being the balance sheet report changing the dates up top from a one on one to zero, this time to our cutoff date at Oh to 29 to zero.