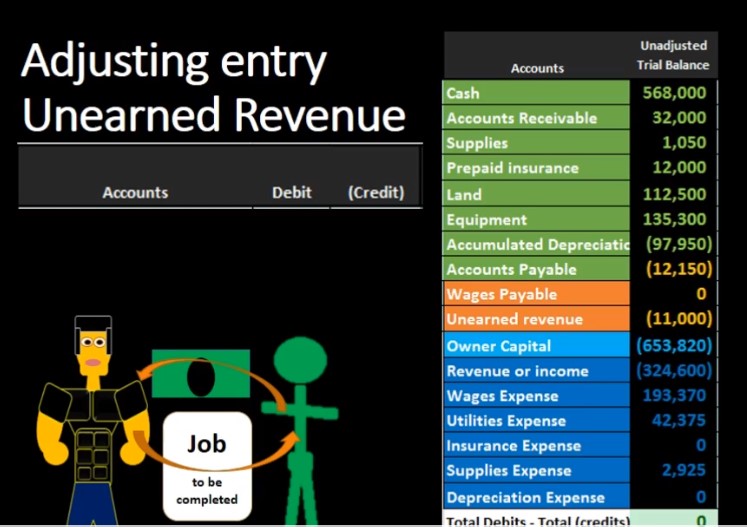

Hello in this lecture we’re going to record the adjusting entry related to unearned revenue. Remember that the adjusting entry is going to be a separate process. It’ll have the same rules as every journal entry. But we can add some added rules when we know that we are working with the adjusting entry process. For example, all adjusting entries will be as of the time period, the end of the month, or the end of the year. In this case, we have the unearned revenue. We know that all adjusting entries for the most part will have an account above the owners capital meaning and balance sheet account. So if we look at our trial balance, looking for an account related to unearned revenue, we see here unearned revenue. So we know that that’s going to be part of our journal entry.

00:41

We have unearned revenue, what’s going to be the account below we know that there’s also going to be account below the owner’s capital on the income statement. So if we look at a trial balance, look for an account related to unearned revenue. We might say boom, how about revenue? Those are the two accounts that are going to be affected here. We know that without even really knowing what it is going on, we can figure that out by just looking at it’s an adjusting entry related to unearned revenue. We can also figure out which way we’re going is it going to be a debit or credit how, because the revenue account has a credit balance, and all income statement accounts revenue and expense accounts only go up. So if it’s a credit balance, it has to go up by doing the same thing to it, which in this case is another credit. So we know that we’re going to credit the revenue account.

01:24

So we’re crediting the revenue account. And that of course means that we’re going to debit the other account, which will be the unearned revenue. So we’re going to credit revenue, we’re going to debit unearned revenue. We know all that before we even really know what even unearned revenue is. So now let’s talk about what unearned revenue is and why we are doing this. We can see that unearned revenue is in the liability section and it has a credit balance. It represents the fact that we have received money before we did any work that might happen in case where we did a security deposit. If we’re trying to do a job and we need to buy materials and we want to get a security deposit. We might get money Before we do the work, and then at the end of the time period, what we need to decide then is how much of this unearned revenue that we have been received in terms of cash but that we have not yet earned? How much of it has now been earned? That is the question.

02:14

In this case, a book problem is typically going to give us the number that unearned revenue should be at the end of the time period. So what we’re going to do is we’re going to take the trial balance unearned revenue of the 11,000 whatever the problem says that problem is going to say this is the amount of unearned revenue that will still be unearned as of the end of the time period, the end of the month or the end of the year, which in this case is 8002 50. We take the difference between that we get in 2007 50, meaning this 11,000 needs to go down by 2007 50 to end up with the amount that we were told is still unearned of 8250. How would we do that? Well, we already see our journal entry. We’re just going to plug the numbers into our journal entry. Now we’re going to debit the unearned revenue by 2007 50 credit the revenue or income by the 2007 50. Let’s post that out, see what happens. unearned revenue has a credit balance, we’re going to do the opposite thing to it debiting it making the balance go down from 11,000 by 2000 to 750 to 8250.

03:17

The revenue account is going to be credited so it had 324 600 crediting it by 2007 50, bringing it up to 327 350. On our accounting equation, assets remain the same, we see that liabilities have increased and the equity has increased. Why has equity increased, because revenue increased revenue minus expenses is net income, therefore net income increased. And that is part of the equity section which has also increased. So we can see our totals here in terms of all of our numbers, we can see that the net income went from a credit which was revenue here minus all the expenses credit winning of 85 930 income, then we increase it by another 2700 50 representing the unearned revenue that we have now earned in this time period bringing the balance up to 88 680 also calculated as the revenue minus the expenses on the right hand side on the adjusted trial balance.