In this presentation, we will be taking a look at the allowance method for accounts receivable focusing in on the calculation of the allowance for doubtful accounts. There are two methods that can be used in order to calculate the allowance for doubtful accounts accounts. One being the percentage of accounts receivable, the other is the percentage of sales, we will take a look at them both and look at the pros and cons of them. First, we’re going to look at the accounts receivable method. We’re going to start off with the percentage of accounts receivable method for a few different reasons. One, it’s the one that’s most often tested. And two is the one that may be most often used in practice often making the most sense to people that are looking at the two methods. It’s also a bit more complicated. So when we’re looking at test questions, they typically would focus on this method in order to have a bit more complicated process to do the calculation.

00:57

It’s important to note however, that there is a Another method and that’s going to be the revenue method or the percentage of sales method that we want to be able to compare and contrast those two, we can ask a lot of theory type questions in terms of what are the pros and cons between the two methods. And there are pros and cons between the two methods. Remember that the overall goal here is to say this is our accounts receivable account, we are recognizing that there’s going to be a significant amount of these receivables that will not be collectible. And therefore, we need to tell our reader that we need to tell our reader that for two different reasons, one being a timing issue, which is going to be on the income statement. And the other being a balance sheet issue a point in time issue, which is the balance sheet on the balance sheet side, which is where the accounts receivable method will be focused.

01:44

We have this receivable this asset on the books showing that people owe us this amount of money and we’re telling people the reader of our financial statements, hey, look, we’re going to get this much money and therefore, you know, make decisions based on the money we’re going to receive on the financial statements however, we know that we’re not going to get some of it. So it’s our responsibility then, to show our reader Hey, look, based on past experience, we believe that this amount is not going to be collectible. So that’s gonna be one objective of the method here either method is to show the allowance for doubtful accounts, which will match up against the accounts receivable, the accounts receivable being a debit here, the allowance being a credit, the difference between the two, the net receivable, the amount that we actually believe that we will collect, based on prior experience, that number then should be more accurate in terms of what our true assets are in the company.

02:42

As we do this, we’ll also be looking at the income statement side and writing off the bad debt related to the revenue and this is the part that’s a bit more confusing when using the accounts receivable method us then focusing in on the balance sheet focusing in here on what we think Is uncollectible, the byproduct of that tends to be what the bad debt will be. But they’re both important because the bad debt is going to be an expense related to revenue happened in the same time period. That will be decreasing the net income for the amount of this revenue during this month this year that we think is going to be uncollectible based on past history. This concept, the income statement concept, makes more sense when we look at the revenue method, which we’ll take a look at later. That method then focusing here on the bad debt and matching principle of the current time period, whereas the allowance method tends to focus more on the balance sheet where we are at a certain point in time, how much of the current receivables are uncollectible under the balance sheet method, there’s a couple different ways we can do this.

03:51

But what we need to do is just say, how much of these receivables are not going to be collectible. One common way to do that is to look at something like an agent account and try to list out these receivables in terms of how old they are, and then go through past experience and say Hmm, the older accounts, of course are less likely to be collectible, and try to figure out some type of percentages, that would be reasonable, that would be uncollectible based on past experience. So if we say that here’s our total here, here’s our total. And we’re going to break that out between 30 between 30 and 6060. And 90 in over 90 days, that something is either current or still due within 30. And then 30 and 60, past two and 1690 some type of breakout in terms of timeframe that we believe these accounts are past due by and thereby not judging people based on who the customer is, but just by how old the accounts are as to whether they’ll be collectible or not.

04:51

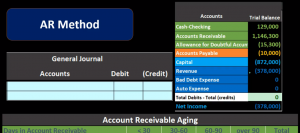

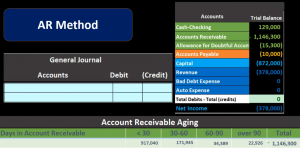

Notice we don’t have any names here. We’re just recording them in terms of how old they are. So if we take this and we say okay, if we go through all these things, counts. And we were able to break this out. And of course software can do this very easily for us give us an agent account, we’re going to say that 30 there with either current or past due for 30 days, we’re going to say it’s current, I guess. And then we’re going to say between 30 and 60. This is how much of this amount is 1,000,001 46. Three belongs here. 60 to 90, we’re saying is this amount of hear of the accounts receivable falls into the 60 and 90 range, and then over 90 days past due, we’re gonna say it’s the 22 926. point being is that we broke this out if we add up the 917 14, the 171 945 and the 34 389.

05:41

And the 22 926 we get to the total 1,000,001 46 300 broken out in terms of how old this debt is, then we’re going to come up with some type of reasonable estimate based on how old the debt is to calculate how much will be uncollectible so if this is current or if This is 30 days past two, we’re going to say that 2% of it, we think it’s going to be uncollectible. If it’s current, then we’re saying not very much of it will be uncollectible, we’re hopeful that we’re going to collect most of it. So we’re going to say that of that the 917 40 times 2% is 18 341. between the 60 and 90, how old the aging is, we’re going to say, well, these are a bit older. And therefore, we’re going to say that 4% is not collectible, because we haven’t been able to collect it yet. We’re past the collecting date due date. And therefore we’re going to say that 6008 78 is going to be not collectible. And, again, you could ask, Well, where do we get this 2% this 4% it’s an estimate. We have to come up with some reasonable estimate based on past experience, and or industry standards.

06:51

And then we’re going to say of the 34,003 89 10% is uncollectible based on past experience industry standards, though, so this times that equals to 3004 39. And over 90, we’re going to say is very unlikely we’re going to collected. And so if we take the 22 926 times 95, we get the 21 780. Now, you might be saying, Well, you know, these you can question these percentages or whatnot, but they would be based on industry standards, past experience, they should be reasonable in accordance with the industry based on past research. If we then add these up 18 341, that’s 6008 78, the 3004 39 and the 21 780, we get to the 50,004 37. This number then, is what we believe of this number. receivables, people old enough money will not be collectible. We don’t know who no names here. We just know that we believe that that much will be uncollectible, it’s a complete estimate. And this is kind of disturbing to some people. They say, well, it’s just an estimate.

07:56

And we don’t really know there’s no certainty However, it’s more reasonable to do this, we this is obviously a very significant number on the receivables. We need to tell our reader that people owe us money because that’s important to decision making. And we can’t wait until people don’t pay us. That would be unfair to readers of the financial statements because we wouldn’t be matching it up at the proper time period we’d be overstating the receivable. So although this is an estimate, it’s much more fair representation as long as the estimate is fair, then either not recording receivables or not recording how much we believe is going to be uncollectible so we have to come up with some type of reasonable estimate in order to make them as fair as possible. Now, note that under this method, there’s already something there in the in the allowance account. So we can’t just use this number. To make our journal entry. We have to determine what we need to do in order to make this account. That number we want to make this number that number So we can’t just use what we came up to here. That’s common error on test questions.

09:05

Did you use this number in the journal entry? We have to do a subtraction problem. Why is there something here already, because it was just an estimate from last time period. And it’s never going to be exact. It’s just an estimate. So we’re just updating what this allowance account should be based on our our best guests. We think it should be that, therefore, the adjusting entry if we take out the trusty calculator, it’s going to be the 50,004 37 minus the 15 300. That’s how much it needs to be increased by now, it’s possible for this account before we start to actually have a debit balance. And why would that happen? That would mean that in the prior time period, we estimated that we have so much that would be uncollectible and more happen to be uncollectible than we had estimated, flipping this account to a debit balance. That doesn’t happen too often, but if it does, and we need to get to this 50,000 and this was a debit, then we would have to credit it by something to get it back to zero, and then add another 50,000 to it in the credit direction. In other words, if this say was a debit balance of 15,300, we’d have to take the 15,300 plus the 50,000 for 37, to get it to the credit balance of 50,004 37.

10:22

If this is a credit balance, then that means that we had less people that would actually be uncollectible in the prior time period, then we had estimated, probably the normal case, that being the normal case, and therefore we have to do a subtraction problem. In order to get this up to 50,000. We need to increase this in the credit direction. So if we record the journal entry, then we’re going to record the bad debt expense, a debit here, and we’re going to record the credit of that 35,003 78. Here, we see that recorded out then we see that the 35 378 and that amount is going to be on the allowance account bringing the 15,300 up by the 35 335 178 to 50,004 37. That then on the trial balance on the bad debt, we’re bringing the balance up, but it started actually it started at zero here, it should have started 00 by a 35 137 to the 35 137. That amount here. Now note what’s happening here is we are recording on the revenue side, the expense bringing down net income.

11:30

So this is the point in time that we bring down net income, and this 35 137 should be matching up to this revenue account. It’s less intuitive here to know that that’s the case, but by us making the accounts receivable correct in terms of the allowance account, then the other side of it should be matching up the revenue and bad debt. This will be more apparent when we focus on this side and focus less on the balance sheet in the sales method on the balance sheet side under the allowance method seems very straightforward and very useful the balance sheet being as correct as possible by us looking at the receivable, analyzing the receivable in a logical way, determining how much of the receivables that are due to us will not be collectible 50,004 37 and then showing that on the financial statements so the reader could say okay, this is how much is owed to the company, this is how much they believe is not going to be collectible based on a reasonable estimate of this number. And therefore, the net of those two is how much we are going to collect.

12:30

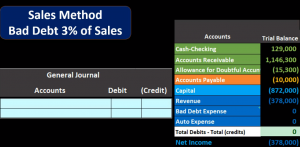

This makes good sense under the receivable method. This side is more confusing under the receivable method because we’re not focusing here. So now we’ll look at the other method which is going to be the percentage of sales method. And we’re just going to focus then on the receivable side, again, not shown as often because one, it’s an easier method. So therefore, textbooks don’t focus on it to a lot of people probably intuitively look more on the balance sheet here and have the income statement kind of fall out, they kind of say if I if I make the balance sheet right and make the receivable and the allowance method right, then the the income statement will fall out. And it’ll it’ll make itself work. And whatever problems will happen will then roll out into the equity section after we close out the temporary accounts. And we’ll be good going forward. So probably most people focus more on on making the balance sheet correct. But this is going to be a valid method to the sales method and it focuses more on the income statement showing the income statement analyzing the income statement accounts and making sure that bad did is right, and letting the allowance side fall out and just be correct. Now one way to do it, a simple way to do it would typically just be let’s take a look at the revenue and take a look at a percentage of the revenue based on past experience that we believe is not going to be collectible. Now, a lot of textbooks will basically say in practice To say we need to look at the revenue on account, we need to look at those sales that we made, not for cash sales, but sales on account. Or the text might just say that we make all sales on account.

14:13

And therefore we can take the entire revenue amount. So that’s going to be a slight difference that you might see based on different textbooks or different situations in real life. How would you want to do it in real life, you probably want to look at those sales that are on account. And then try to look at past history and see of the ones that were made on account meaning we didn’t collect sale revenue at the time of the sale. We collected it, we’re going to collect it in some other point, therefore it’s in receivables. So how much of those sales that we make on account where we don’t collect cash at the point of sale, do we think are uncollectible based on past history. And then if we say that it’s 3% we’re going to just take that number the 370 thousand times 3% point oh, three 3% point oh three gives us the 11 Thousand 340. And that’s it. That’s straightforward calculation. And we’re going to say that the bad debt then should be that number.

15:08

So the bad debt, it’s going to be the 11,340. And then the other side just falls out, we’re not focusing on this side here, the allowance, we’re just going to make it whatever it needs to be, in order to make what we think our bad debt should be in order to have a correct matching principle for this time period. So note here, that we’re focused on this number. And we’re really making net income as accurate as possible by focusing on this current revenue. Whereas when we focus on the accounts receivable, we’re really focusing on things everything that’s happened up to this point in time where we stand at this point in time. And therefore, when we use the allowance, the accounts receivable method, we’re kind of fixing possible errors that might have happened in the past and really looking at everything that’s happening. The past to make a receivables correct and Miss number than falling out. on the income statement side, we’re focusing on this time period only. And the side that falls out then will be the balance sheet side. So this will give us more focus. And it’s easier to see in this method that we are indeed, following the matching principle.

16:23

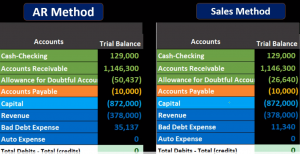

We are trying to look at this current revenue and see how much of that current revenue is not going to be collectible based on some type of reasonable estimate. And therefore, right off the bat did not bad debt for sales made prior period prior month prior year. But the sales that were made this year, that’s going to be the point and therefore net income for this time period we would think is as accurate as possible. Note however, it still achieves the goal of making the allowance account what we think it should be. It just falls out differently if we did this correctly throughout the entire period. The allowance account should fall out correctly and be correct as well meaning the accounts receivable what is owed to us minus and estimate what we think is uncollectible should still give us a reasonable estimate of what the net receivables should be. For looking at a comparison between the percentage of accounts receivable and the percentage of sales method, note that they’re almost never going to be the same. So we didn’t make an example where they happen to come out the same here because it just doesn’t happen typically.

17:30

So in here, we have a different type of allowance account under the two methods. And and it could be more it could be less just depending on what what time period we are using. So in other words, the allowance account here could be higher or lower. Under the accounts receivable method versus the sales method point being it’ll typically be different. And the bad debt, same thing. It’ll typically be different under the two methods. It could be higher, it could be lower. Depending on what our focus has under the two methods, so notice they are estimates, these are both going to be estimates, they’re not going to be perfect. And, but they are better than not estimating, they’re better than waiting until this is going to be uncollectible and therefore better than not showing the accounts receivable at all. Because the readers tip real, obviously want to know what the accounts receivable is how much is owed, and they want some type of estimate of what is not going to be collectible. Also note that once we have a method here, because we are using some type of estimating method, we want to be consistent with that method so that we have comparison from time period to time period.

18:40

So if we’re using a percentage of accounts receivable, we typically want to use that next time period next month next year as well. We’re using a sales method we typically want to be consistent. Our goal here is to have consistency is to have a matching principle that we can compare time period to time period going forward.