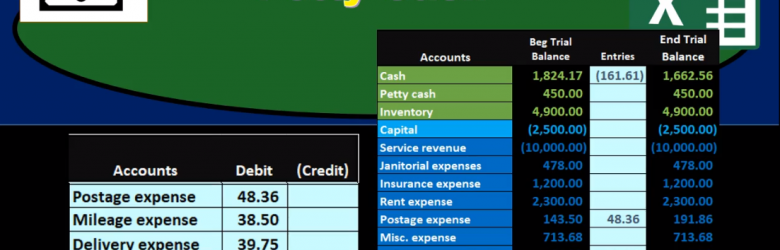

In this presentation we will talk about how to set up and record a petty cash fund. Setting up a petty cash fund seems like an easy thing to do to have a minimal amount of cash that we can have expenditures for small purchases for however, it can be a little bit tricky to set up the petty cash fund and there is kind of a shortcut to recording transactions for the petty cash fund. So we’ll go over the process of setting up the petty cash fund recording the initial investment in the petty cash fund and then recording the activity from the petty cash fund. Now the objective of course in this will be to have not just the checking account where we need authorization in order to take money out of the checking account, we would typically want anything going out of the checking account to be by electronic fund transfer or by cheque so that we have a clear paper trail of what is going on the petty cash However, if we just have some small items that we need to take care of with cash and as to convenient to have small items with cash to be paid.

Author: Bob Steele CPA - Accounting Instruction, Help & How To

Bank Reconciliation-Accounting%2C Financial

Hello, in this lecture, we’ll discuss a bank reconciliation. At the end of this, we will be able to describe what a bank reconciliation is perform a bank reconciliation, make a needed adjustments to our books in the reconciliation process, as well as record those adjustments. So this is going to start off the bank reconciliation process. We’ll start off with, of course, the bank statement. So the bank statement is going to come from the bank, generally, it happens at the end of the month, although we could get it electronically at any timeframe. But typically, it’s still good to get it as of the end of the month so that we can have a set timeframe as to when we’re going to reconcile our account and deal with the timing differences at that time. So this bank statement coming from the bank is going to be as of the end of February in this case, and we’ll have a typical information on a bank statement, which will be that we will have the beginning balance, and then we’re going to have the additions to it generally our deposits and then we’re going to have the corrections to it.

Cash Disbursements Internal Controls

In this presentation, we’re going to talk about Cash Disbursements, internal controls. Now we’re going to talk about a voucher system for the payment process. But before we get too into the voucher system, note that the systems will change depending on the type of organization and what industry we’re in and how large the organization is. So if we just have a small organization, then we probably just want to have some internal controls for the owner of the company, the owner, being a key component of the internal control system and having a lot more oversight over many of the things that happened. For example, for the payments that happen, we may have someone that requests something on an employee that wants to request a payment may even you know, enter the payment into this system. However, we want to make sure that the owner still has some control over such as the cheque signing.

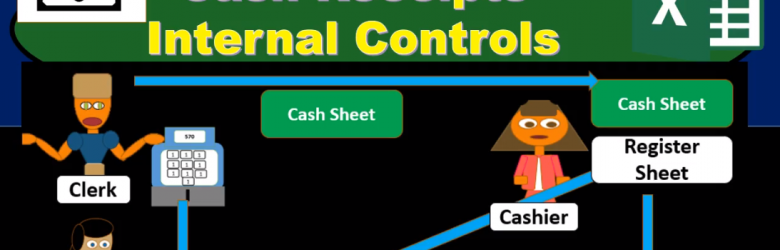

Cash Receipts Internal Controls

In this presentation, we will talk about cash receipts, internal controls. Now we’re going to talk about a voucher system for the payment process. But before we get too into the voucher system, note that the systems will change depending on the type of organization and what industry we’re in and how large the organization is. So if we just have a small organization, then we probably just want to have some internal controls for the owner of the company, the owner, being a key component of the internal control system and having a lot more oversight over many of the things that happen. For example, for the payments that happen, we may have someone that requests something on an employee that wants to request the payment may even you know, enter the payment into the system.

Cash Internal Controls Overview

In this presentation, we’re going to introduce the internal controls related specifically to cash, cash internal control goals, these are going to be the objectives of the internal control system over cash, we want to have the cash handling separate from the record keeping. So whoever is handling the cash, we would like to have them not be the same person doing the record keeping. And therefore we have that separation of duties. We have the person that is entering the data, not having as much of an incentive to steal the cash because they’re not the ones handling the cash, the people handling the cash, know that if they do steal it, the record keeping should pick that up, and they are a separate person. cash receipts are deposited to the bank. We want to make sure that the cash receipts are going to the bank as soon as possible, hopefully on a daily basis, so that we’re not actually emulating cash. We don’t want a cash to be piling up, because if it is then we have a greater risk of theft to happen and greater loss if that does happen.

Internal Controls

In this presentation we will introduce the topic of internal controls. Internal Controls been policies within an organization in order to achieve certain objectives those objectives including the safeguarding of assets, having reliable accounting records, efficient operations, and company policy alignment. We’ll get further into what each of these categories mean in detail. However, first we want to discuss the fact that internal controls will change from organization to organization and industry to industry will have similar objectives between organization to organization industry to industry, however, the customization of the internal controls will differ in order to have an optimal amount depending on size of company and type of industry. For example, a small company often one run by one individual will have very much fewer internal controls for multiple reasons. One that that individual can really monitor A lot more of the transactions for a small company and have direct contact with the transactions that are taking place.

Average Inventory Method Explained

Hello in this lecture we’re going to be talking about the average inventory cost method we will be selling our coffee mugs again we will not be using a specific identification but rather a cost flow assumption VAT assumption being the average method, we will be using the same worksheet I highly recommend working on a worksheet such as this when when doing any cost flow assumption for inventory, which will include a purchases section, a cost of merchandise section and an ending inventory section in which pieces we can then calculate the unit cost times the quantity to give the total cost for each of the sections. This can answer the most amount of questions that can be asked for this top. If we take a look at a trial balance, we can see that the inventory on the trial balance is at 5000.

Last In First Out LIFO Inventory Method Explained

Hello in this lecture we’re gonna be talking about the lastin first out inventory method, we will once again be selling our coffee mugs. Here, we will not be specifically identifying the coffee mugs that we sell, but rather using a cost flow method, that method been a lastin. First out this time, whenever doing a cost flow method, I do recommend setting up a worksheet such as this with three parts to it having the purchases, the cost of the merchandise and the ending inventory, and then calculating the units that we’re going to sell the unit cost and the total cost for those particular categories. As we will do here. This will answer the most amount of questions in any format that those questions could be asked. What we are trying to do here is of course, say that the inventory that is reported on the trial balance needs to be backed up in terms of a worksheet Why? Because on the trial balance, it’s reported in terms of dollars.

First In First Out FIFO Explained

Hello in this lecture we’re going to be taking a look at first in first out inventory method, we will be selling coffee mugs and we won’t be specifically identifying the coffee mugs. In this case, as we’ve talked about in a prior lecture of this time, we’re going to be using a cost flow assumption VAT cost flow assumption being the first in first out assumption this time to set up this problem in any cost flow assumption, I highly recommend putting together a worksheet that worksheet including headers of purchases columns, and then we got the cost of merchandise columns, then we have the ending inventory. I highly recommend setting up a worksheet like this, whether it’s by hand or in a computer or in Excel because it answers all the types of questions that could come up with an inventory cost flow type of assumption within those sections, we will then have the quantity and then the unit cost and the total cost we’re gonna have, if we sell something, we’re calculating the cost of that sale.

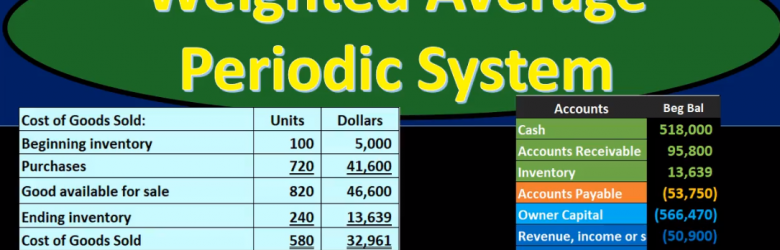

Weighted Average Periodic System

In this presentation we will discuss the weighted average inventory method using a periodic system. The weighted average method as opposed to a first in first out or last In First Out method, the periodic system as opposed to a perpetual system. We want to keep the other systems in mind as we work through this comparing and contrasting. We’re going to be working with this worksheet entering this information here. It’s important to note that this worksheet is a worksheet that can typically be used with any of these inventory flow type problems of which there are many. We have first out last in first out the average method. And then we have a perpetual and periodic system which can be used with any of those methods. It’s also possible for questions to ask for just one component such as cost of goods sold or Indian inventory, and therefore it can seem like there’s more types of problems that we can have in that format as well. If we set up everything in a standard way, even if that weighs a little bit longer for some types of problems, it may be easier because we can just memorize that one format to set things up, this would be a format to do that.