This presentation and we’re going to apply a credit or an advanced payment to an invoice. In other words, we got paid in advance by a customer recorded that into the system. Now we’re going to create an invoice and apply that event advanced payment to it. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re first going to take a look at our flowchart in the desktop version.

Author: Bob Steele CPA - Accounting Instruction, Help & How To

Advanced Payment From Customer 8.30

This presentation and we’re going to record and advanced payment or customer deposit. In other words, we’re going to get paid before we do the work or in our case, provide the inventory of a guitar. Let’s get into it with Intuit QuickBooks Online. So here we are in our get great guitars file. Let’s first take a look at the flowchart in the desktop version just to consider the normal flow and what we are going to be doing here.

Sales Receipts & Deposit 8.25

This presentation and we’re going to record a sales receipt and deposit. In other words, we’re going to imagine there’s a sale that takes place, we’re going to make that sale, record that sale with the sales receipt and then go to the bank with that deposit, deposit that into the bank and record that deposit as well into our system. Let’s get into it with Intuit QuickBooks Online.

Receive Inventory Requested With P.O. Enter Bill 8.20

In this presentation, we’re going to record the receipt of inventory with a bill. In other words, in prior presentations, we entered a purchase order requesting inventory. Now we’re going to receive that inventory along with the bill and enter that into the system. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars practice problem. Let’s first take a look at our flow chart. So we’re going to go down to QuickBooks desktop.

Purchase Order With New Inventory Item 8.15

In this presentation we will enter a purchase order and add a new vendor as well as a new inventory item as we do. So let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. Before we go further further, let’s take a look at the flowchart on the desktop versions of the desktop version here just to take a look at that flowchart. We’re going to be up here in the vendor section, we’re going to be entering the purchase order. So just recall that the purchase order doesn’t actually have a financial transaction. We haven’t received the inventory, we haven’t paid for the inventory and no financial transaction, we’re simply requesting the inventory.

Short Term Investment Deposit 8.10

This presentation and we’re going to record a deposit related to selling a short term investment. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re going to be opening up our reports. First, we’re going to go be go down on the left hand side, we’re going to be opening up the balance sheet report. So we’ll open up the old balance sheet. And then we’re going to change the dates up tops, I’m going to scroll up top and change those dates from a one a 120 to 1230 120, we’re going to go ahead and run that report. I’m going to duplicate this tab, I’m going to right click on the tab up top, duplicating it, put it to the right, then I’m going to go back to the left we’re going to do the same from the profit loss report.

Make Loan Payments 8.05

In this presentation, we will make loan payments with the help and the use of an amortization schedule. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re going to start off by opening up our reports down below, we’re going to be opening up three reports. This time, we’re going to be opening up the balance sheet report, our favorite report the balance sheet reports, we’re going to scroll back up top, change the dates from 1120 to 1231 to zero, then we’re going to go ahead and run that report. Then I’m going to go back up top and duplicate the tabs. I’m going to right click on the tab, I’m going to duplicate that tab. Going back to the left and we’re going to do this again. We’re going to go back down to the reports down below. We’re going to be opening up the profit and loss our second favorite report the profit and loss, the p&l the income statement, we’re going to be changing the dates up top again.

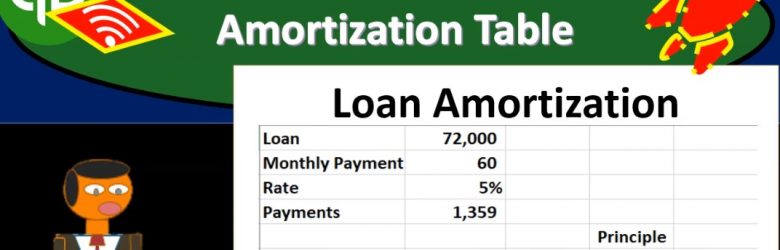

Loan Amortization Table 8.03

This presentation and we’re going to create a loan amortization table. And this will help us to track our loan payments and break out the principal portion and the interest portion of them. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re going to first start off with our reports, we’re gonna go down to the reports down on the left hand side and then we’re going to be opening up our favorite report that being the balance sheet report, opening up the balance sheet report scrolling up top, we’re going to be changing the dates from a 10120 to 1230 120. Then we’re going to run that report. Then I’m going to close up the hamburger to get it out of the way so I don’t doesn’t bother me and I’ve got the 125 on the zoom holding down control scrolling up to get there.

Consolidate Loans 8.02

This presentation and we’re going to consolidate two loans and reflect that in our bookkeeping. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re going to start off by going to our reports down below and taking a look at the balance sheet, we’re going to be opening up our balance sheet report to consider the loans that we currently have on the book. I’m going to scroll back up top, we’re going to change the dates up top from a one a 120 to 1231 to zero, and then we will run that report. I’m going to then duplicate the tab up top.

Generate Report Export to Excel 7.80

This presentation and we will generate, analyze, print and export to Excel our month in financial statement reports that’s going to include the profit and loss report or income statement report, the balance sheet report, and then we’ll take a look at that transaction detailed report that’s going to give us a lot of information to see what we have done over the month. It’s really good information that some people use for billion for the month.