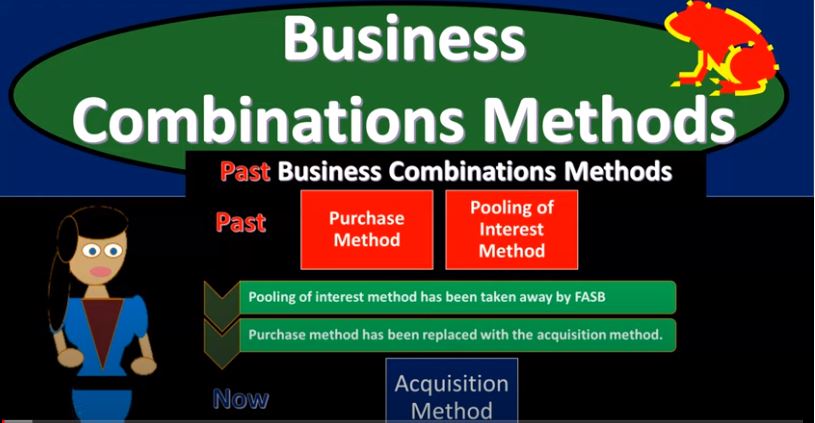

In this presentation, we will take a look at business combination accounting methods, both historic methods and the current methods get ready to act, because it’s time to account with advanced financial accounting. We’re going to start off with business combinations from the past, these are not the current method that we’re going to be using. However, it’s good to have some historical context so that if you hear these methods, you know what you’re talking about. We also want to think about these concepts in terms of just a logistical standpoint. If you were to make these laws, then how would you do it? What are some of the challenges that have happened? And by looking through the historical process, you can kind of think about, okay, these are what were put in place, I see why those were put in place here that changes that are happening, we could see why the changes are happening, therefore have a better understanding of what we are doing, and how the current process is being put in place and why the decisions were made to put it in place. So in the past, we had combinations methods that included the purchase method and the pooling of interest. method. So they then what happened is the pooling of interest method was taken away by faz B. So faz B said, Hey, we’re not going to allow anymore, the pooling of interest method, and then the purchase method has been replaced with the acquisition method. So if you hear the purchase method, that in essence is what we’re currently doing. However, we changed the name from the purchase method to the acquisition method.

01:21

So in the past, we had the purchase method, we have the pooling of interest method, pooling of interest method has been removed, then the purchase method has basically been changed or renamed and modified to the acquisition method. Therefore, what are we talking about? Now when we have the comp, the business combinations, which generally we’re talking about the external expansion of the business businesses expanding, can do that internally or externally, we’re typically talking about an external expansion. And we’re going to be using then the acquisition method for the business combinations related to it. So let’s talk about the pooling of interest method really quick. This is going to be the old method, the old method that has been removed now we can no longer use the pooling of interest method. So that’s going to be the combining of the book values of companies. No, no revaluation to the fair market value under this method. So basically, if you’re considering two separate legal entities, and you’re thinking about if you’re thinking about, okay, how am I going to do this, we got these two separate legal entities that we need to kind of merge in some way, shape or form. How can we do that? Well, one way to think about is, well, we got we’ll just going to take whatever the book values are, and in essence, merge them together. And that would be basically the the pooling of interest method. Now, one kind of issue with that, note that you might have some things on the books like property, plant and equipment, for example, which which we put on the books and historic value and then depreciate it. And usually, if there’s a sale or something like that, if there’s a sale that takes place with, say, the fixed assets, then usually you’re going to recognize a gain or loss at that point in time that the sale took place. So If you’re talking about the pooling of interest method, then if you’re just using the book value, then you’re not really putting the items to the fair market value.

03:07

And if you consider the merger, or the combination that has happened as kind of like a negotiation, which it is, to a sense, there’s a negotiation, there’s some kind of sale taking place, then you would think if there’s a sale taking place, if assets are basically being bought and sold at this point, there should be a triggering of a sales type of transaction and any gain or losses on these items that are currently at the book value should be revalued. And you should have to recognize basically any gains or losses at that point in time. Also, there’s kind of a push to go from from item where you’re on a cost basis or book value basis to more of a fair value, fair market value basis, especially in the global accounting, accounting. So to try to conform basically, with international accounting policies, there’s often this push to to move more towards fair market value type of accounting method, which would be basically revaluing, your your assets and liabilities to reflect current prices is that as best as possible, there’s pros and cons to that we won’t get into the, to the pros and cons of that. But But if we eliminate the pooling method, and we look at the acquisition method, it kind of aligns with that type of that type of movement. So there’s been a move away from the polling method. Now note from from a managerial standpoint, the polling method oftentimes might be a good thing, right? The people that are involved in the actual merger, the people that are emerging, the company may want the you know, maybe you’re looking for the pooling method because there wouldn’t be a revaluation. At that point in time. It wouldn’t trigger all the things that could be triggered with the with a purchase with the idea of this being like a purchase kind of transaction, which would result possibly, in the recognition of gains and losses with regards the revaluation of the of the entities information.

04:56

Also, we have to of course, revalue it which probably would have been taking place if you’re doing some type type of combination, they probably revalued all the assets to come up with, with whatever the terms are of the agreement. But now you’re gonna have to put that into the accounting in some way. And and instead of just pooling the information together on a book value method, if we eliminate the book value, the pooling method, then you’re going to have to revalue the assets. And that can be kind of a cumbersome situation. How do you do that? With regards to some type of assets, which are going to be more difficult, you have to take appraisals and things like that, to get an accurate value. And of course, that’s going to be estimates in some way, shape or form, depending on the type of property. If we were to use the pooling of interest method, that would mean no goodwill as a result of using that method. So we’ll talk more about what goodwill is. But the concept of goodwill when you think about goodwill, you’re basically thinking, hey, there’s something in this company have value above and beyond what’s reflected on the balance sheet. So in other words, if you take away Get the assets minus the liabilities, that’s going to give you the net assets or the equity section. And that’s going to be the value that would be in essence, the book value of the organization. If If you were to have a purchase situation, and the book value was exactly the same value as the market value, then when there was a purchase, you would think that the purchase price would be directly for the equity value of the organization, the net assets, the assets minus the liabilities. However, that’s almost never the case. And usually, there’s going to be a payment oftentimes for more than the assets minus the liabilities, there’s some kind of purchase beyond that, what is that? We don’t really we’re gonna call it goodwill.

06:41

And that goodwill is basically you can think of it as future earning potential. You can think of it as a brand name, investment, the name of the organization results in profits that are above and beyond basically the market standards above and above and beyond just the assets minus the liabilities. So what how would you get goodwill on the books Well, you can’t really do it internally, they won’t, you don’t really report goodwill, on the books, if you just if you’re growing, you don’t just say I’m going to report goodwill, it typically happens as a result of some type of purchase arrangement, in which case, the purchase price is greater than, in essence, the book value. So in essence, you’re saying assets minus liabilities, equity section, net assets, the purchase price is greater than the net assets. Well, if you if you were then to use not the pooling method, but some type of acquisition method, you’re going to have to account for that in some way. Why did someone pay more on a market basis than the assets minus liabilities? Why would somebody pay more than what you would what you would perceive the value of the organization to be? Well, given it’s an arm’s length transaction given it’s a market transaction, and we trust the market. To determine prices we’ve got we’ve got to assume then, that there’s some type of value that’s intangible that’s above and beyond the assets minus the library. that the market is willing to pay for and that intangible asset would be goodwill. Now, now that goodwill being reported, is something that we wouldn’t have to be dealing with with the pooling method. Because even even though there might be certainly goodwill in the transaction, you would just be combining the book value. And due to the fact of not having to adjust the the fair to fair market value, you wouldn’t be dealing with the goodwill. And of course, that’s another reason that the the regulations now don’t like the pooling method. Because again, they want to say, hey, look, there’s a market transaction happening here. There’s some kind of purchase happening. That’s an opportunity for us to get a valid assessment about the value of this company.

08:44

There’s, there’s a transaction, there’s an arm’s length transaction, there’s a market transaction, we would like them to revalue the organization at that point in time and and basically have that the reflecting value reflect that, that transaction that has taken place. So those are some of the Frozen columns, why that why the method of the pooling method has been removed? What do we have left, then we’ve got the acquisition method. So that’s what’s going to be put in place. In other words, like we say that if you look at it from an ACL, like a regulatory type of standpoint, you like the Act, the reason they like the accurate with acquisition method is because again, there is a transaction. In essence, this is kind of like a purchase and sale taking place you’re pooling together. But you can think of it basically as a purchase that’s happening. There’s usually in other words, a dominant kind of Corporation, and the corporation that’s being purchased. In that case, in that case, you can think of it kind of a sales transaction, there’s a negotiation that’s happening. That’s a market activity. And that means that that market activity, we would like to have it drive, what we think the value of the organization is because the market valuation is our best tool to value the organization. So at the point in time that there’s this market, arm’s length transaction, it would be a good time to revalue the organization.

09:59

So now what Again, from a regulatory standpoint, they’re typically going to want that because you get that transparency as we can see here, the acquisition method, because you would think you didn’t get that transparency of the transaction from a managerial standpoint, oftentimes the manager like the book method, right, because then you don’t have to deal with the revaluation. And you don’t have to do possibly with the, from a tax standpoint, you can you can consider the fact that if there’s goodwill being paid for, then there could be gains and losses or gains, typically, that could be could be recognized and it could be tax effects on this and so that could all result in more regulatory burden as well as as a tax burden. So from a from a managerial perspective, you like you probably pulling method probably was preferred from a transparency standpoint, taking taxes aside, because taxes, you know, distort, distort everything. If you take taxes aside, obviously, from a regulation and a transparency standpoint, the acquisition method has a lot of virtues and good values. for it. So, the acquisition method values are based on fair value of the consideration given and the fair value of any non controlling interest that is not acquired. So when you when you think about the acquisition method, you’re gonna, you’re basically thinking, hey, there’s a transaction happening here. And usually you can you can figure out what what the value is by the amount of consideration given meaning how much money was paid for it, and it may not be money, there might have been other things of consideration, stocks, bonds, other types of property, any anything could be given in consideration, but that but that is easier to value, the things that are given and consideration oftentimes, are easier to value. you can you can then look at what the consideration that was given, and then consider the price now, if there it could be a little bit more confusing conceptually.

11:53

If there’s a purchase not of 100% say of the stock of another company they didn’t purchase 100% Then if there wasn’t 100% purchase, then you have this issue of a non controlling interest. So we’d still have to value. In essence, the non controlling interest as well, that’s going to be something that complicates matters a little bit more. So it’s not like acquisition methods is an easy method, which one is easier, you could have pros and cons on a pooling versus the acquisition method, which is easier, the pooling method was probably you know, easier because you just, you just took the book value, you didn’t have to reappraise everything or anything like that. The acquisition method, you’re gonna have to do, of course, the appraisals to get it in place and but generally, you’re thinking that the purchase the price that you paid for it, if it was just cash, it would be something easy to value. But if it’s cash and stock, then you got to value the stock that’s publicly traded stock, then maybe it’s not too difficult because you can look at the what it’s trading for at a given point in time to value the stock. And if it’s property that’s being paid, then then you have to value possibly take appraisals. On the property so we’ll talk more about that in future presentations but at this point in time, just note acquisition method. That’s the current method.