Advanced financial accounting PowerPoint presentation. In this presentation we will discuss a situation where we have a consolidation process and in the period of consolidation the parent sells subsidiary shares to a non affiliated entity. In other words, we have a consolidation process we have a parent subsidiary relationship parent owning a controlling interest over 51% of subsidiary. The parent then in that period sells some of the shares that they own in the subsidiary to a party that’s not affiliated in the consolidation, what will be the effect in the consolidation process of that get ready to account with advanced financial accounting?

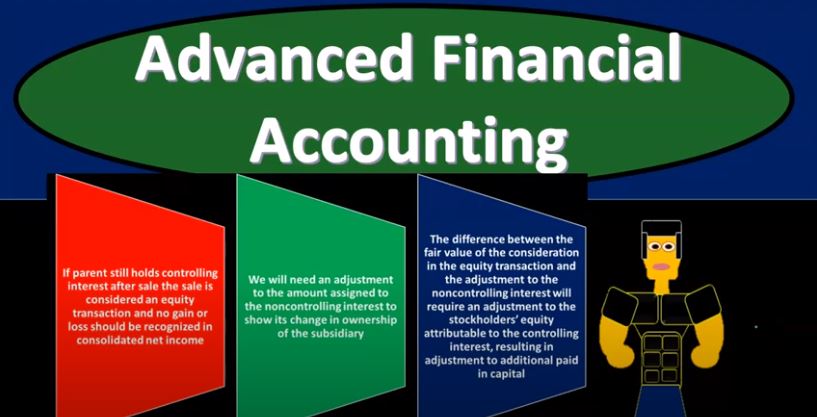

So we are talking about a situation where we have a parent subsidiary relationship a controlling interest in other words, the parent owns over 51% and in the time period of consolidation the parent then is selling some of the shares of the subsidiary what will be the impact. So if the parent still holds a controlling interest after the sale, they still have over 50 1% the general rule for sale is considered an equity transaction, and no gain or loss should be recognized in the consolidated net income. So we shouldn’t have any gain or loss in the net income of the consolidation with respect to a sale that would happen to a non affiliated party. If the controlling interest still has control after the sale of the shares of the subsidiary, we will need to adjust to the amount assigned to the non controlling interest to show its change in ownership of the subsidiary.

01:31

So in other words, because there was a sale that took place, if you think about percentages in terms of percent to the controlling and non controlling, then the non controlling percentage has gone up controlling interest you would think would go down with the sale that would be taking place. However, they still have a controlling interest meaning they have basically over 51% being the general rule. Now the difference between the fair value of the consideration in the equity transaction and the adjustment to the non controlling interest will require an adjustment to these stockholders equity attributable to the controlling interest, resulting in adjustment to additional paid in capital. And this is kind of the most unusual component of this. Because if if you’re talking about a transaction that would have basically a gain or loss and we’re saying we’re not going to record the gain or loss, what is in essence happening, there’s going to have to be an adjustment somewhere, it’s basically going to be additional paid in capital. Now, I recommend taking a look at the practice problem for this. It’s not a very long problem with relation to a problem such as this, but so I recommend actually working through the journal entries for it.