Advanced financial accounting PowerPoint presentation. In this presentation we will discuss a situation where we have a consolidation process and in the period of consolidation the parent sells subsidiary shares to a non affiliated entity. In other words, we have a consolidation process we have a parent subsidiary relationship parent owning a controlling interest over 51% of subsidiary. The parent then in that period sells some of the shares that they own in the subsidiary to a party that’s not affiliated in the consolidation, what will be the effect in the consolidation process of that get ready to account with advanced financial accounting?

Posts with the sale tag

Transfer of Long-Term Assets & Services Overview

Advanced financial accounting PowerPoint presentation. In this presentation we’re going to take a look at an overview of the transfer of long term assets and services. In other words transfers between related entities. If we’re thinking about a consolidation process then transfers that we will have to deal with with the consolidation process with consolidating or eliminating journal entries, you’re ready to account with advanced financial accounts. intercompany transactions need to be removed in the consolidation process.

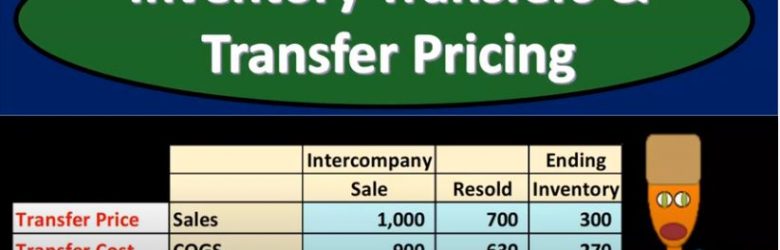

Inventory Transfers & Transfer Pricing

Advanced financial accounting. In this presentation we will discuss inventory transfers and transfer pricing. Our objective will be to get an idea of what inventory transfers are what will be the effect of inventory transfers and how to account for inventory transfers when considering a consolidation process, get ready to account with advanced financial accounting, inventory transfers and transfer pricing. So in essence, we’re talking about the inventory going from one organization to another, we can think about this in terms of parent subsidiary type of relationships.

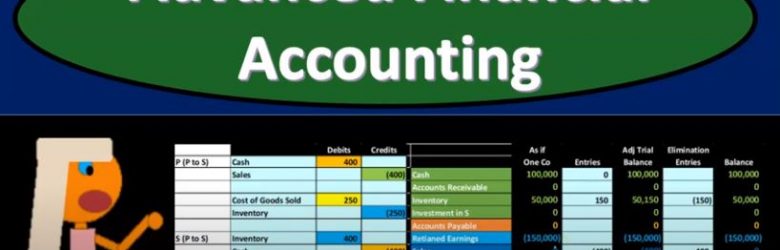

Sale From Parent to Sub Sub Has Not Resold

Advanced financial accounting PowerPoint. In this presentation we will discuss a situation where there is a sale of inventory or transfer of inventory from parent to subsidiary, the subsidiary not having yet sold the inventory. So in that sense, we have an intercompany type of transfer. When we consider the parent and subsidiary as a whole with regard to a consolidation process, the parent sold to the subsidiary the inventory, the subsidiary still holding on to that inventory has not resold it externally at this point, get ready to account with advanced financial accounting. What we want to do now is think about the transaction on p side and then on SSIS, and then what the elimination entry will be. So there’s a couple ways you can think about this, you can kind of memorize what the elimination process will be what the elimination entry will be and put together worksheets to do that elimination process kind of by just routine by just filling out the worksheet. And then you also want to analyze the worksheet and think about it in detail in terms of what is actually happening.

Eliminating Intercompany Transactions

Advanced financial accounting. In this presentation we will discuss eliminating intercompany transactions, the objective will be to have an overview of the intercompany transactions, the types of intercompany transactions and the basic elimination entry for those intercompany transactions get ready to account with advanced financial accounting intercompany transactions, we’re going to start off by listing the intercompany transactions as we list them. Remember, our objective is in essence to remove the intercompany transactions.

Statement of Cash Flow Indirect Method Adjustments to Reconcile Net Income to Net Cash Provided

In this presentation, we will continue putting together a statement of cash flows using the indirect method focusing in on adjustments to reconcile net income to net cash provided by operating activities. So this is going to be the information we will be using, we have the comparative balance sheet, the income statement added information, we took this comparative balance sheet to create our worksheet. So here is our worksheet for two time periods. This is the difference we’re basically looking to find a home for all of these differences we have done so with cash, and we’ve done so with a difference in retained earnings. So here’s cash, here’s net income, the difference in retained earnings, we will have to adjust net income shortly or at the end of the problem. We’ll we’ll take a look at that we’ll make an adjustment for it. We’re going to now find the difference for all the rest of these. Also note that of course cash is going to be the change in cash will be our bottom line. Never we’re going to recalculate this But it’s nice to know where we are ending up at. So this is kind of like even though it’s at the top of our worksheet, that’s where we want to end up by finding a home for everything else. So now we’re going to take a look at the adjustments to reconcile net income to net cash provided by operating activities. So these are going to be those types of things that we look at the income statement, and we’re going to say that these are non cash activities, meaning income is calculated as revenue minus expenses. And the cash flow.

Statement of Cash Flow Tools For Completion

This presentation we will take a look at the tools needed in order to complete a statement of cash flows. to complete a statement of cash flows, we are typically going to need a comparative balance sheet that’s going to include a balance sheet from the prior period, whether that be the prior month or the prior year and a balance sheet from the current period, then we’re going to have to have an income statement. And then we’ll need some additional information in a book problem, it’ll typically give us some additional additional information often having to do with things like worth an equipment purchases, whether equipment purchases or equipment sales, were their investments in the company where their sales of stocks, what were the dividends within the company. In practice, of course, we would have to just know and recognize those types of areas where we might need more detail. And we would get that additional information with General Ledger we’d go into the general ledger, look at that added information. Now once we have this information, our major component we’re going to use is going to be the comparative balance sheet. That’s where we will start. So that comparative balance sheet is going to be used to make a worksheet such as this.

Average Inventory Method Explained

Hello in this lecture we’re going to be talking about the average inventory cost method we will be selling our coffee mugs again we will not be using a specific identification but rather a cost flow assumption VAT assumption being the average method, we will be using the same worksheet I highly recommend working on a worksheet such as this when when doing any cost flow assumption for inventory, which will include a purchases section, a cost of merchandise section and an ending inventory section in which pieces we can then calculate the unit cost times the quantity to give the total cost for each of the sections. This can answer the most amount of questions that can be asked for this top. If we take a look at a trial balance, we can see that the inventory on the trial balance is at 5000.

First In First Out FIFO Explained

Hello in this lecture we’re going to be taking a look at first in first out inventory method, we will be selling coffee mugs and we won’t be specifically identifying the coffee mugs. In this case, as we’ve talked about in a prior lecture of this time, we’re going to be using a cost flow assumption VAT cost flow assumption being the first in first out assumption this time to set up this problem in any cost flow assumption, I highly recommend putting together a worksheet that worksheet including headers of purchases columns, and then we got the cost of merchandise columns, then we have the ending inventory. I highly recommend setting up a worksheet like this, whether it’s by hand or in a computer or in Excel because it answers all the types of questions that could come up with an inventory cost flow type of assumption within those sections, we will then have the quantity and then the unit cost and the total cost we’re gonna have, if we sell something, we’re calculating the cost of that sale.

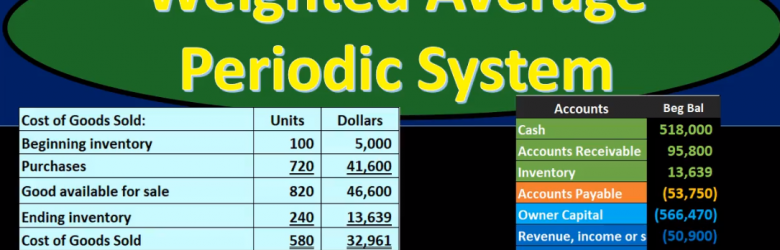

Weighted Average Periodic System

In this presentation we will discuss the weighted average inventory method using a periodic system. The weighted average method as opposed to a first in first out or last In First Out method, the periodic system as opposed to a perpetual system. We want to keep the other systems in mind as we work through this comparing and contrasting. We’re going to be working with this worksheet entering this information here. It’s important to note that this worksheet is a worksheet that can typically be used with any of these inventory flow type problems of which there are many. We have first out last in first out the average method. And then we have a perpetual and periodic system which can be used with any of those methods. It’s also possible for questions to ask for just one component such as cost of goods sold or Indian inventory, and therefore it can seem like there’s more types of problems that we can have in that format as well. If we set up everything in a standard way, even if that weighs a little bit longer for some types of problems, it may be easier because we can just memorize that one format to set things up, this would be a format to do that.