Advanced financial accounting PowerPoint presentation. In this presentation we will discuss forward exchange of financial instruments get ready to account with advanced financial accounting, forward exchange financial instruments let’s start off with some definitions starting off with financial instrument itself will be either cash evidence of ownership or a contract that imposes on one entity on contractual obligation to deliver cash or another instrument and conveys to the second entity, the contractual right to receive cash or another financial instrument. That of course, being the most complex component here. So let’s read that one more time. The financial instrument a contract that imposes on one entity a contractual obligation to deliver either cash or another instrument and conveys to the second party the second party in this item, the second entity, the contractual right to of course, receive the cash or another financial instrument derivative. So a derivative, financial instrument or other contract whose value is derived from some other item that has a value that varies over time. So let’s think about that one more time again, derivative financial instruments or other contracts whose value is derived from, they’re going to get the value from some other item that has a value. That is that varies over time, meaning of course, that it will be changing over time. So let’s think about the derivative characteristics. And then we’ll apply these to the component of what we’re considering here. foreign currency and foreign currency transactions in terms of typically foreign currency type hedge transactions.

01:46

So derivative characteristics financial instrument must contain one or more underlying and one or more notional amounts that detail the terms of the financial instrument. So let’s go over those terms. Then the underline What does underline mean underline any financial or physical variable that has observable or objective objectively variable changes. So, underline is any financial or physical variable that has observable or objectively verifiable changes a no to No amount is a number of currency units shares, bushels pounds or other units specified in the financial instruments. So, therefore, the derivative characteristics then financial instrument must contain one or more underlyings and one or more no to no amounts that detail the terms of the financial instrument alright then the financial instrument does not require initial net investment or if it does, and initial net investment that is smaller than required for other types of contracts expected to have a similar response to changes in market factors. So, one more time let’s just read the beginning of this one the financial instrument does not necessarily require the initial net investment. And then if it does have the initial net investment and initial net investment that is smaller than required for other types of contracts expect it to have a similar response to changes in market factors. So the contract terms then require or allow the net settlement. So net settlement basically, at the settlement component provide for the delivery of an asset that puts the recipient in an economic position not substantially different from net settlement or allows for the contract to be readily settled net by a market or other mechanism outside of the contract. Now let’s think of the derivative created as a hedge which is basically the application that we’ll be taking a look at most of the time with the example problems with regards to the foreign currency.

03:58

So we have a foreign derivatives to qualify as hedging instrument, two criteria need to be met first, at the beginning of the hedge term sufficient documentation must be given to identify the objective and strategy of the hedge. So what’s the hedge for what’s the objective of the hedge? What’s the strategy of the hedge, the hedging instrument and the hedging item, and how the hedges effectiveness will be assessed on an ongoing basis. So let’s go through that one more time at the beginning of the hedge term, sufficient documentation must be given to identify the objective and strategy of the hedge the hedging instrument and the hedged item, what is it that’s being hedged and how the hedges effectiveness will be assessed on an ongoing basis? So notice when we’re talking about a hedge, you can kind of think of it as basically a counterbalance here, we’re going to set up the hedge and we have to determine what the objective will be. So oftentimes, when you’re thinking about a hedge, you’re thinking about something that’s going going up to moderate the risk in some way. So there For, if you’re talking about one item that’s taking place on the financial item, the hedge should be going the opposite direction. So if something happens, like a currency changes value for for an asset or liability for a receivable or payable, let’s say and it results in a gain or loss, then you would think that a hedging instrument of course, being a hedge would would counteract that and basically go the other way, basically offsetting the changes in the gains or loss that’s going to be kind of the general you know, the general concepts of what you’re doing with a hedge. So the hedge needs to be highly effective throughout its term effectiveness will be measured by evaluating the hedging instruments ability to generate changes in fair value that offset the changes in the value of the hedged item. So if you’re setting something up as a hedge, we got to make sure that it’s going to be a highly effective hedge. And then you got to determine Well, how do you know if it’s going to be a highly effective hedge effectiveness will be measured by evaluating the hedging instruments ability to generate changes in fair value that offset because it is a hedge here, it’s going to offset the changes in the value of the hedged item, the thing that you’re hedging against, in our case, typically being an accounts receivable or accounts payable.

06:18

So say you bought something on accounts, you have an accounts payable, the accounts payable is going to be paid in foreign currency, then the fluctuation in the exchange rates will have an effect on the accounts payable that you will be making in the foreign currency. And so you might consider, you know, the hedge, then if you’re going to set something up as basically an offset to that potential, that potential change, then you would be setting it up basically to have the opposite effect. And and that would, and in doing so, then you can think about the effectiveness of the hedge or if you’re predicting that you’re going to have a transaction in the future or something like that. And it involves foreign currency, then you can think about An instrument that would basically be offsetting going the opposite direction as, as, as the conditions that could result in a gain or loss from the hedged instruments. So that’s, that’s where the hedged item. So typically we’re thinking about something that’s going to be happening that could, you know, have a factor that’s gonna, that’s going to cause it to change over time. And then of course, the hedge would basically counteract that change typically would be the concept. So the derivative created as a hedge. fair value hedges are designed to hedge the exposure to potential changes in the fair value of a recognized asset or liability, like available for sale investments or an unrecognized firm commitment for which a binding agreement exists. So if we have something like a recognized asset or liability, like available for sale investments, then those things obviously available for sale investments in like stocks or bonds could change over Time, and then the hedge could be set up basically to offset what the potential changes could be an unrecognized firm commitment for which a binding agreement exists might be a situation where you basically think that you have an agreement, a contract to do something in the future possibly make a purchase or something like that in a foreign currency. So you have a binding agreement about something that that exists in the future.

08:26

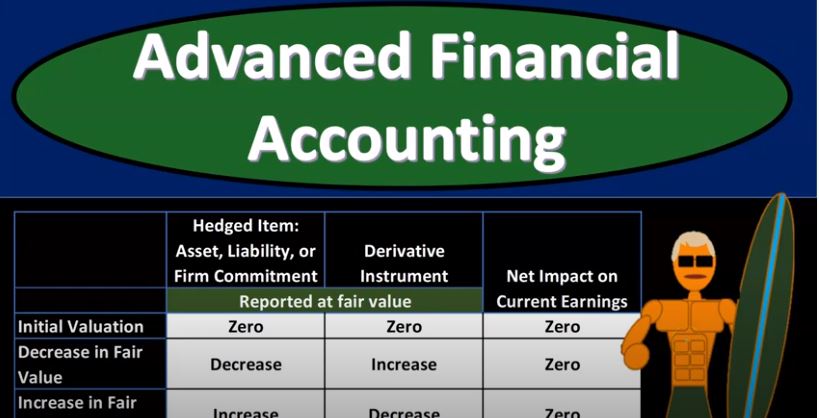

But if you have a variable factors such as the currency that you will be using, that could that could change, then that could be something that you might think about setting up a hedge against the net gains and losses on the hedged assets or liabilities and the hedging instrument are recognized in current earnings, there will be no net impact on earnings because they are always offset. So let’s consider this in a table format. So if we have a table we have the initial valuation, a decrease in fair value and an increase in the fair value on The left hand side of the table top of the table, we’re going to say the header is the hedged item, which is the asset liability or firm commitment, and then the derivative instrument related to it, and then the net impact on the current earnings. So the initial valuation 000 for the reported at fair value, then if there’s a decrease in the fair value, then the hedged item the asset liability or firm commitment, then it’s going to decrease, then that’s the, that’s the hedged item, then the derivative instrument would then increase which is counter balancing that then we have the net impact on the current earnings then being zero. If there conversely would be an increase in the fair value than the hedged item. The item being hedged asset liability or firm commitment increases, the derivative instrument then would decrease and then once again, the net impact on the current earnings, no impact zero cash flow hedges created to hedge the exposure to potential changes in anticipated cash flows either into or out of the company for a recognized asset or liability, like future interest payments on variable interest debt or a forecasted cash cash transaction, like a forecasted purchase or sale. forecasted cash transactions are transactions that are expected to occur, but for which there is not yet a solid commitment. So that’s usually the case that we’re going to be looking at with our forward with our transaction in our foreign currency types of transactions. So for example, if we were going to make a purchase or something like that in foreign currency in the future, and we if we have a contract for it, then that’s going to be a different situation.

10:43

However, if we don’t have a contract for it, but we think it’s gonna happen, we’re pretty confident it’s gonna happen. Although it’s not in a contract. That’s when we would be designating basically a cash flow hedge and we would have a forecasted cash transaction like a forecasted purchase or sale. Note we don’t have a contract for it. But we believe that this transaction is going to take place. So the forecast cash transactions are transactions that are expected to occur, but for which there is not yet a solid commitment derivative created as a hedge cash flow hedges changes in the fair market value are separated into an effective portion and an ineffective portion, the net gain or loss on the effective portion of the hedging instrument will be reported and the other comprehensive income so it’s going to be affecting then other comprehensive income and the what the gain or laws on the ineffective portion will be reported in the current earnings on the income statement. So if we see this in some tables, let’s set up some tables here where we have the initial valuation the increase in the fair value and the decrease in the fair value on the left side of the table. The headers up top is the change in the anticipated cash flow is not reported. The derivative instrument reported at fair value and then other comprehensive income and net impact on the current earnings. So the initial valuation, not reported no change reported at fair value zero other comprehensive income zero net impact on current earnings is zero. And then if there’s an increase in the fair value, then the change in the anticipated cash flows, that increase is not reported, the derivative instrument is going to be reported at fair value. So in this case, that being a decrease, and then the other comprehensive income is where that loss is going to be reported, not not in the normal income but within other comprehensive income. And so the net impact on the current earnings then is zero, the decrease in the fair value. So if there’s a decrease conversely, in the fair value, change in the anticipated cash flows not reported is going to be a decrease. The deferred derivative instrument which is going to be reported at fair value is going to increase and then that In the other comprehensive income is going to be reported in other comprehensive income that gain the net impact on the current earnings then once again, zero. So then what happens on the settlement date because now you’ve had, what happens then during this process is you’ve got these changes taking place in other comprehensive income.

13:19

So now you’ve got this other comprehensive income that’s been accumulated what happens then at the settlement dates, so on the left hand side, we’ve got the increase in the cash flow, the decrease in the cash flow, and on the top headers, we have the actual cash flow, other comprehensive income, net impact on the current earnings. So if there’s an increase in cash flows, the actual cash flow then increases a gain or we have a gain or we have revenue of some kind on the other comprehensive income, then what we’re going to do is reverse the prior loss in other comprehensive income and loss in the current earnings. So I’m going to offset at this point. So at this point in time, once again, note what has been happening happening would have been accumulating in the other comprehensive income. And then at this point in time at the settlement date, were resulting in an increase or gain which has a revenue on the income statement, then we’re going to be reversing or a gain or some type of revenue, then we’re going to be reversing the other comprehensive income at that point in time, which will which has a loss in the current earnings and then the net effect then net impact on current earnings will be zero. If the decrease in cash flows happens then on the actual cash flows, now we have a decrease a loss or an expense as a result, then, then the other comprehensive income, we’re going to do the same thing we’re going to reversal some spelling error but reverse prior gain in other comprehensive income and gain in current earnings and then again, the net effect effect at that point in time at the settlement date being zero. A foreign currency hedge is a hedge with a hedged item is denominated in a foreign currency and So an entity may designate the following types of hedges of foreign currency risk. And that’s where we’re going to be concentrating here we’re concentrating on the foreign currency. So we’re thinking about the the types of hedges that could be related to foreign currency hedge. So an entity may designate the following types of hedges of foreign currency risk, we might have a fair value hedge of a firm commitment to enter into a foreign currency transaction.

15:26

So we might have a commitment to enter into a transaction that deals with foreign currency possibly we’re going to be buying something with foreign currency in the future. If we have a commitment, then there’s a question as to whether we have an actual agreement like a contract to do it or if it’s if it’s something that we don’t have a solid contract to do, but something that we expect to have in the future, right, we have in cash flow hedges for a forecasted foreign currency transaction. So that’s the case where we’re forecasting we believe that there’s going to be a foreign currency foreign currency transaction in the future and then a hedge of a net investment in for an operation