Corporate Finance PowerPoint presentation. In this presentation, we will discuss breakeven analysis, get ready, it’s time to take your chance with corporate finance. Break Even analysis includes our fundamental tools for making projections and predictions into the future. Now note, when we think about breakeven analysis, the fundamental calculation within a breakeven analysis will be the break even point. But when we hear breakeven analysis in general, you can think of it that as a more broad kind of perspective, to use some of these tools in order to think about projections into the future. So when you hear breakeven analysis, you’re typically thinking kind of projections, budgeting, future based analysis, as opposed to some financial accounting, which is typically going to be based on the past prior performance.

Posts with the cash flow tag

Pro Forma Balance Sheet 420

Corporate Finance PowerPoint presentation. In this presentation we will discuss a pro forma balance sheet or budgeted balance sheet. Get ready, it’s time to take your chance with corporate finance pro forma balance sheet. As we think about the pro forma or budgeted balance sheet, let’s take a step back and see where it fits in with our projections with our pro forma statements, you’ll recall that the place we need to start then is going to be the sales projections, we need the sales projection, we’re first going to think about how far we’re going basically the activity type of statement. And then we’ll take that change that activity statement how far we went, like miles driven in and our income statement, and then we’ll tack on the beginning balance where the odometer was at at the beginning to get to the ending point, which is going to be the ending balance sheet.

Cash Budget 415

Corporate Finance PowerPoint presentation. In this presentation, we will be discussing the cash budget Get ready, it’s time to take your chance with corporate finance, cash budget, as we consider the cash budget, let’s take a step back and think about the budgeting process. So we can think about where the cash budget will fit in it. So we got to start off with the sales projection, that’s going to be our first step. So we can think about the production plan if we manufacture inventory, or we think about the purchasing plan. If we purchase and sell inventory, then we can think about the pro forma income statement. Now the pro forma income statement is going to be on an accrual basis. But we also want to be considering the cash budget. So obviously, once we have once we start to construct the income statement, on an accrual basis, we can also think about what the cash flows will be.

Statement of Cash Flows 235

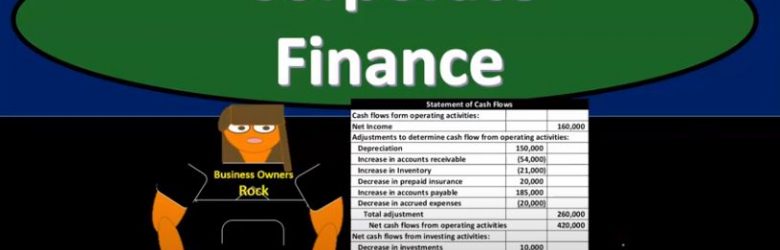

Corporate Finance PowerPoint presentation. In this presentation, we will discuss Statement of Cash Flows Get ready, it’s time to take your chance with corporate finance statement of cash flows. So remember when we’re thinking about the financial statements, we can think about them as answering two major questions to users of the financial statements. For examples, if we’re thinking about investing to the company in some type of way, and are using the financial statements to help us make a decision with regards to that, we want to know where does the company stand at this point in time, what’s basically their worth at this point in time. For that we get help from the balance sheet, which is going to give us the assets liabilities, equity, assets, minus liabilities equals equity, which is basically the book value as of a point in time.

Consolidated Statement of Cash Flows

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss consolidated Statement of Cash Flows get ready to account with advanced financial accounting, consolidated statement of cash flows. So the consolidated Statement of Cash Flows we have a parent subsidiary relationship parent owning over 51% of the subsidiary therefore, we have the consolidated financial statements which of course includes the consolidated statement of cash flows. So, when we think about the consolidated statement of cash flows, we’re basically thinking about those areas where the cash flow statement will be different from a normal cash flow statement, which is one company or one business if you want to learn more about the cash flow statement, and I do recommend looking more into the cash flow statement because it’s one area where even in public accounting, oftentimes people don’t have as good a grasp on it as they could and some people are really good at reading it but don’t really understand as much of how to put it together in a room. systematic way even if there’s going to be, or especially when there’s going to be complexities to it. So we do have a course on the statement of cash flows, which we believe puts together a nice, simple, simple way in a systematic way to go through putting the statement of cash flows in such a way that, that you can do it in a step by step process. And then if you make an error, you can go back and you should be able to find that error easily and not have to kind of start the whole thing over again.

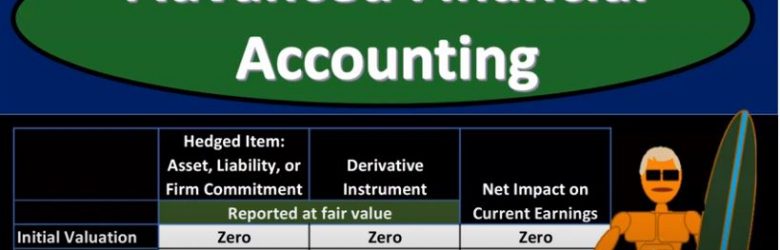

Forward Exchange Financial Instruments

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss forward exchange of financial instruments get ready to account with advanced financial accounting, forward exchange financial instruments let’s start off with some definitions starting off with financial instrument itself will be either cash evidence of ownership or a contract that imposes on one entity on contractual obligation to deliver cash or another instrument and conveys to the second entity, the contractual right to receive cash or another financial instrument. That of course, being the most complex component here. So let’s read that one more time. The financial instrument a contract that imposes on one entity a contractual obligation to deliver either cash or another instrument and conveys to the second party the second party in this item, the second entity, the contractual right to of course, receive the cash or another financial instrument derivative. So a derivative, financial instrument or other contract whose value is derived from some other item that has a value that varies over time. So let’s think about that one more time again, derivative financial instruments or other contracts whose value is derived from, they’re going to get the value from some other item that has a value. That is that varies over time, meaning of course, that it will be changing over time. So let’s think about the derivative characteristics. And then we’ll apply these to the component of what we’re considering here. foreign currency and foreign currency transactions in terms of typically foreign currency type hedge transactions.

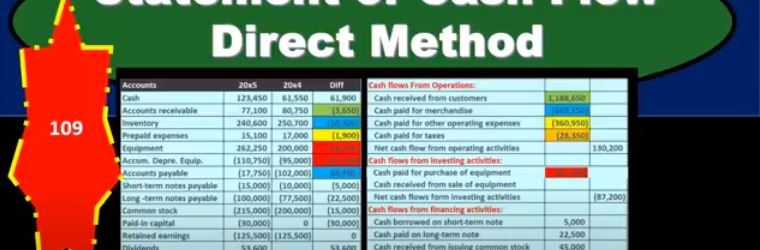

Statement of Cash Flow Direct Method

In this presentation, we will take a look at the statement of cash flows using the direct method. Here’s going to be our information we got the comparative balance sheet, the income statement and some additional information. And we will use this information to put together our worksheet which will be the primary source used to create the statement of cash flows using the direct method. This is going to be our worksheet. Now most of this worksheet will be similar to what we have done for the indirect method, in that we took the difference in the balance sheet accounts. So we’re taking the current year and the prior year, the current period, the prior period, all the balance sheet accounts, we’ve got cashed down to the retained earnings for the balance sheet accounts. But we’re also in this case going to give us the income statement accounts for the current period. So in other words, we’re going to break out the retained earnings the amount to its component parts, meaning we’ve got net income being broken out on the income statement. We’ve got sales cost of goods sold, the income statement accounts. So it’s going to be our same kind of worksheet here, we’re going to be in balance, we’ve converted it from a plus and minus format, we’ve removed all of the subtitles as we did under the indirect method.

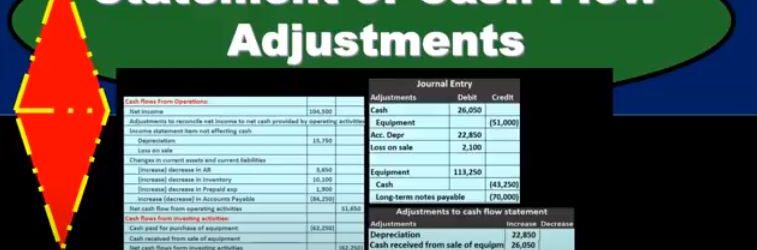

Statement of Cash Flow Adjustments

This presentation we will continue on with our statement of cash flows, we’re not going to enter the final adjustments that we will need to finalize the statement of cash flows to bring those last few numbers to the correct balances. In order to do that, we’re going to use this information we’ve got our comparative balance sheet, our income statement and additional information. We put together most of our information so far with the comparative balance sheet, which we made into a worksheet. Now we’re going to use some of these other resources, the income statement, the additional resources to make those final adjustments, those fine tunings that are needed to get those few numbers that we have left and noted into balance. And this is going to be part of the normal practice where once we get this information set up, we can then make some comparisons such as net income does it tie out, such as depreciation does it tie out on the cash flow statement to what we see here on the income statement, then we can have this other information which will be given in both problems in practice, of course, we’ll just go to the gym. General Ledger. And we’ll get this information in a book problem, we don’t want to give all the detail of a general ledger or just when we’re going over an example.

Statement of Cash Flow Investing Activities Cash Paid for Purchase of Equipment

In this presentation, we will continue on with our statement of cash flows. Taking a look at the investing activities, specifically the purchase of equipment, we’re going to be using the comparative balance sheet, the income statement and additional information focusing here on the comparative balance sheet, which we use to make this worksheet. So this worksheet is our comparative balance sheet. We’ve been going through this worksheet and really looking for the differences. We’re finding a home for all the differences. Once we do that, we’re feeling pretty good. We have done this all the way through the operating activities. So are the cash flows from operations. So we’ve gone through here we’ve kind of picked and choose the items that are going to be cash flows from operations, which is probably the way most people approach this. But just note that as we’ve done that, we’ve tried to pick up the exact differences here. We haven’t gone to the income statement and thought about it separately outside of this worksheet, and then we’re going to go back and make adjustments. So we found a home for the difference in cash because that’s Kind of like our bottom line. And then we’ve got accounts receivable, inventory prepaid expenses, and then we skipped equipment and went down to accounts payable.

Statement of Cash Flow Indirect Method Change In Accounts Payable

In this presentation, we will continue on with our statement of cash flows using the indirect method looking in on the change in accounts payable, we’re going to be using this information or a comparative balance sheet income statement and other information focusing primarily on comparative balance sheet creating a worksheet with it, looking like this. This basically being the comparative balance sheet. But in a post closing trial balance format, we have our two periods and the difference between those periods here. Our goal is to find a home for all of these differences. Once we do so we’ll end up with basically the change in cash. That being our bottom line that we’re looking for. We’ve gone through this information in terms of the cash flows from operations. We’re currently looking through the current assets, and now we’re moving on to the current liabilities. So we’ve looked at the accounts receivable, the inventory, prepaid expenses, we have these here. We’re moving on now to a liability and notice when we do that, when we’re working From the worksheet, we’re kind of skipping over some things here.