Advanced financial accounting PowerPoint presentation. In this presentation we will discuss requirements for management reporting laws. We’ll discuss major laws and the reporting requirements related to them get ready to account with advanced financial accounting requirements for management reporting laws, we’re going to be starting off with the Foreign Corrupt Practices Act of 1977. The fcpa Congress passed it as a major amendment to the Securities Exchange Act of 1934, which we’ve discussed in prior presentations. It has two primary sections first section Part One prohibits bribing foreign governmental or political officials for the purpose of securing a contract or otherwise increasing the company’s business and part two requires publicly held companies to maintain accurate records. It also requires an adequate system of internal control. So internal controls again, taking more of a central point focus a lot of times with the regulations related to large companies, we have then the Sarbanes Oxley act of 2002, also known as s o x Sox signed to law July 30 2002. So July 30 2002, Sarbanes Oxley gained traction after the accounting and financial mismanagement of Enron, WorldCom and other large companies. So there’s there’s big large scandals that were happening. And it was feared that and I think rightly so to a large extent that there was going to be faith lost in the financial reporting system. And once again, that’s the foundation really, that’s a huge component to why people invest in US companies because they have some more measure of trust than many other areas where they can put their money in. So if the financial statements are going to lose, lose that trust, that’s going to be a very big problems. So Sarbanes Oxley was a reaction to some of these large scandals which were reflecting missed. statements in the financial statements that looked like deceptive misstatements in the financial statements in an attempt to regain security to people who are investing and users of the financial statements to have faith in the contents of them, they’ll help the law has many implications for accountants. So there’s going to be a lot of changes. accounting firms have many implications related to it. We’ll go through it in some detail here. Not a whole lot of detail, but some detail we’ll go through some of the major parts of it. It was intended to minimize corporate governance, accounting and financial reporting abuses, resulting in restoration of investor confidence in the financial reporting of publicly traded companies.

02:41

So we want to basically restore the confidence in the financial statements to say to see that they are reflected in accordance with you know, the generally accepted accounting principles so that people that use them, have faith in them and therefore will be more likely to facilitate trade because that information that information that people have If there’s not information, if there’s not a free flow of information, then you may have short term gains, but in the long term, then people will lose trust, once trust is lost, then business does not happen. And so the attempt here was to regain trust. Now, there is a huge cost to it, of course, because as you implement some of these changes to build the trust, that’s going to increase the amount of regulation that’s going to be involved and there’s going to be a cost to comply with these these different changes that will take place. So there’s always a pro and a con to argue there’s a cost benefit analysis from a regulatory standpoint, as well with regards to these laws to see what is working, what is building trust, and what might be some burdensome policy, or burdensome components that aren’t, you know, providing the benefit that that we’re looking for. So that’s always going to be ongoing process with these, with these regulations to find the nice best spot to maximize performance to increase the market and have things Well, so Sarbanes Oxley act of 2002 Sox. So we’ll go through the parts real quickly here and then we’ll go into more detail with the major components. So we’ll talk about the major components just briefly and then we’ll go into more detail for each or part of or some of those components.

04:18

So Title One, public company Accounting Oversight Board, title to the auditor, independence, auditor independence, title three is corporate responsibility, title for enhanced financial disclosure. Now we’ll go through some of these items in more detail, starting with Title One public company Accounting Oversight Board, the pcaob. This was established by the Sarbanes Oxley Act established a new Accounting Oversight Board, it regulates accounting firms and is responsible for establishing or modifying auditing and attestation standards. So there’s going to be some regulation of the accounting firms and for modifying auditing and attestation standards and those of course are going to be the providing opinion type of reporting. We’re going to provide an opinion about something at test station. Generally thinking the primary function being the audit report providing an opinion about the financial statements as to their accuracy. The SEC Securities and Exchange Commission administers the PCA ob. So the securities exchange commission administers the pcaob. The public company Accounting Oversight Board is responsible for appointing the five full time members, the board manager, regulate inspections of the registered accounting firms operations and processes. Then we have title two, this is going to be the auditor independence. So there’s going to be obviously within the audits if you’ve worked in with an auditing independence is going to be a big deal. When people are learning audits that it’s often it seems like an easy concept but it’s more difficult than you would think because many times when we think about it Independence, we often think about things and say, Well, I’m doing my due diligence, and this transaction and just because I have this relationship or some other thing going on, that doesn’t just that won’t affect my ability to do due diligence and do the right thing here.

06:17

But notice independence, obviously, we need independence, or from a third party standpoint, independence needs to be there, it would be more beneficial from a third party standpoint to build trust in the community, if we had independence, in fact, and appearance right, as much as possible. So even in other words, even if you were going to, if it wouldn’t affect your decision making process, if you would go forward with your due diligence, if there are certain things that are going to be involved that would affect the appearance of independence, then even though then it could still lower the value of the audit itself, which is supposed to be something that’s going to be an independent kind of process by an independent third party. So There’s obviously a lot of due to that there’s going to be a lot of focus in on the issue of, of what is independence. So independent auditors are prohibited from offering certain non Audit Services to their audit clients, including the information system design and implementation, appraisal or Valuation Services, internal audits, human resources, services, legal or expert services not related to Audit Services, bookkeeping services.

07:30

Now, when this first started, this was this was a big deal because it makes sense that some of these services, like if you were to get an audit, from a from a CPA firm, they would basically be reviewing your internal controls or they should be basically have some expertise in terms of the proper internal controls and whatnot and to review the internal controls and if they say, Hey, you, you should have better internal controls here. There are the other within the audit process, it would be natural to go to them to help them They can help you fix the internal controls. But the more interaction there is between the auditor’s and the company, then the less independence you have. So that this this rule is basically saying we want to break that up. Same with the bookkeeping, it would be natural for an accounting firm to do basically some maybe some bookkeeping process if not, not not the decision making process but bookkeeping, right? But then again, the line gets shaded between the two so so on say no, no bookkeeping, processes and whatnot here as well. So this this was a big deal when when it was still is a big deal in terms of independence in terms of CPA firms, because some of these things that you would naturally think, you know, could start to go together they kind of cross the line or make the line blurry in terms of what is what is independence, and therefore, there was more stringent line being put in place with this law in order to in order To give that independence so now accounting firms need to decide whether they want to provide audit or non Audit Services to a company. So now the audit, the accounting firm could do these services for a company but not for a company that they’re doing the audit for at the same time. So they need to do one or the other. And, and oftentimes large, more established companies that focus in on audits, that means now audits become more specialized, there may be a larger profit margin with the audits so the larger firms will typically pick the audits pick the larger profit margin, and then and then maybe depend on others which might actually make other industries that can specialize in different areas to pick up some of these other items that that may have in the past before that been something that the audit can that the accounting firms the auditing firms could have done before that point in time. So you can see what kind of happens here you see more specialization that could result from something like this. CPA firms needing to decide do I focus in on the audit, or, you know, I need to pick one or the other for a particular client audit or some of these other items.

10:05

And then if you pick audits, then how you know, then, you know, any any kind of other work then might lead to more specialization with other firms that don’t do audits, but focusing on some of these other items. So they may not provide both to the same companies. That is the point, the lead audit partner and the audit review partner are publicly traded companies need to be changed every five years. And this is another thing where you could see Well, if the same partner is in charge of the audit year after year, then the thought here would be that it would be more likely that that one individual if something happened or whatnot, they may be able to perpetuate whatever wrongdoing happened or it may even lead to them wanting to perpetuate in order to cover up an error even or something that happened in the past, right. So if you were to have some other person that’s going to be involved with the of the audits have some turnover, then it’s Thought is and it makes sense that you would have less likelihood for some one individual to then, you know, be in charge and do something that wouldn’t be caught at a later point in time. So that makes sense. But again, it kind of goes against some of the structure of an audit firm where oftentimes you have a partnership of an audit firm. And, and it’s almost like the partners have their own clients like, you know, they typically in charge of, of the clients and whatnot. So it’s a, it’s a little bit different for the audit firm, it makes a change for the structure of the audit firms or it could make a change for the structure of the audit firm, but you can see how it there’s a cost benefit analysis there. It leads to what you would think would be more accountability, given the fact that more eyes will be in that that lead position. So once again, the lead audit partner and the audit review partner for public traded companies need to be changed every five years. The CEO, controller CFO, Chief accounting officer or equivalent may not be employed by the company’s audit firm during one year proceeding and audit.

12:05

So this is another problem that is often there because oftentimes the people that go into accounting, they go into the large CPA or the public accounting firms, they then work with the companies and the companies get to work with them. And then they often go work for the company as as you know, possibly one of these big roles like a CEO or controller, CFO and whatnot. And that’s kind of a problem because now you’re getting the audit, you can see how the lines getting blurred once again, between the public accounting firm and the companies that are happening because the public accounting firms are now populating people that were their employees, possibly into lead position decision making positions in these companies. So they’re, so they’re saying here, well, you’ve got Let’s set a time limit in terms of how long it could be, you know, between that between that taking place, so there’s going to be They’re trying to put some divide in in that, in that as well to remove that relationship. All right, so then we got the title 30 corporate responsibility, the audit committee needs to be composed of non management members of a company’s board of directors. So once again, the Audit Committee, which is in charge of, you know, that’s who the auditors are dealing with, they need to be they need needs to be composed of non management members of a company’s board of directors. Why? Because the audit is basically reviewing their performance, right? Their performance is basically the financial statements, and the auditors are reviewing that. So so they want to be dealing with a board of directors. That isn’t the people that they’re directly, you know, reporting on or giving some some standard of judgment about. So the auditors need to report to the audit committee and have their work overseen by it.

13:53

So the auditors are going to be reporting then to the audit committee and the audit committee reviewing that information to CEO and CFO f of a publicly traded company needs to provide a signed statement to accompany each annually and quarterly financial report. So the CFO, the CEO and the CFO of the publicly traded companies need to have a signed statement. The statement they will, the statement will state that they certify that the financial statements and disclosures fairly present in all material respect the issuer’s operations and conditions. So they’re kind of putting the CEO and the CFO on the line there by giving them more liability by making Of course, that you know statement because again, one of the problems with a company note that if a company has a problem, you sue the company, right? you sue the company and now the company has a problem but all the employees including the top management, CEO and CFO or agents of the company, so then you have an agency Are they really liable as agent you know, who is liable for the company Who are you gonna hold accountable when you’re suing a company which is just, you know, like it, you know, it’s like a made up thing that’s consistent of of this whole this whole structure So who are you gonna hold accountable? Well, they’re saying here we’re gonna hold the CEO and CFO more accountable by the fact that they’re signing the this year which supposedly would give them more accountability over over them. So then we have the title for enhanced financial disclosure. Financial Reports filed with the SEC need to reflect all material correcting adjustments and all my material off balance sheet transactions and relationships that have a material effect on the issuers financial status and internal control report must be contained in each annual filing of stock issuer. The internal control report by management reports on the existence and effectiveness of the company’s internal control over financial reporting and this is another item that was really a big, it’s kind of a big deal here, because the focus has been more and more to the internal controls, even within the audits here.

16:08

Because notice these really large publicly traded companies, you can’t, you can’t really do enough standardized testing, in order to give the type of insurance that you assurance that you would like to do. And therefore there needs to be some reliance on the internal controls. So you can see the shift happening now saying, Hey, we need to we need if we can, we need to audit the controls, to make sure that the controls are strong. And if the controls are strong, then we can do we can do less reliance on the substantive testing within the audit because we just can’t do enough of that to give the level of sufficient opinion on the reports. So you can see that shift is gonna basically happen here now again, if there’s a weakness there and that weaknesses, well if management is corrupt, and they’re not, you know, reporting properly on the on the internal controls, then the internal controls won’t be effective and whatnot, but But But the goal is to say hey, if we if we can get the internal controls to be effective, then we’ll have more assurance there so that you can see that shift happening and continuing to happen. The internal control report must include the statement that management is responsible for establishing and maintaining an adequate system of internal control. So once again, they’re kind of holding management you know, as responsible here, over the internal controls, we want to see what the internal controls ours, we want to see that you’re saying that the internal controls are in place and that management in some sense has you know, responsibility and therefore accountability over the internal controls. The identification of the framework used to evaluate the internal controls the statement on whether the internal control is effective as of your in the disclosure of any material weakness in the internal control system. Title five analyst conflicts of interest research analysts, broker And dealers need to report these items for any company they prepare a research report for.

18:06

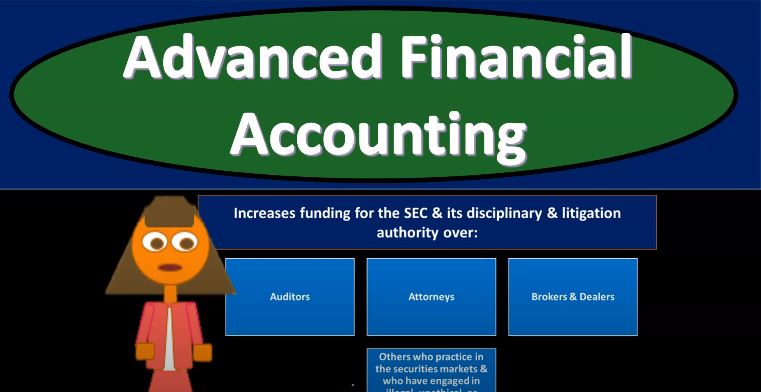

So any securities held in the company, any compensation received from the company. And if the company was a client of the broker, dealer, title five, title six, commission resources and authority increases, increases funding for the SEC and its disciplinary and litigation authority over so we got increased funding for the SEC and its disciplinary and litigation authority over so once again, now that this is holding people accountable and how right so now they want to, they want to implement these procedures and laws and whatnot. And then the other thing that you need to do with any kind of legislation, of course, is if you say, if you put in these more rules, you got to enforce them somehow. So, authority over the auditor’s the attorneys, the brokers and dealers and others who practice In the securities market and who have engaged in illegal unethical or improper professional conduct, so you’re going to have more more increase in funding for the SEC and its disciplinary and and litigation authority over these items so that they can continue to to process any wrongdoing it related to them. Title seven studies and reports. The Government Accountability Office, the GAO and and sec Security and Exchange, are tasked with performing various studies concerning topics like such as factors leading to consolidation of public accounting firms, impacts of that consolidation, the role of credit rating agencies in the securities markets, whether investment banks and financial advisors, assisted assisted public companies in earnings manipulation. Then we have the title eight that was the corporate and criminal fraud accountability Put in put in place penalties for anyone who so we have penalties for those who destroy records, commit securities and fraud or fails to report fraud. So once again, this is an in the accountability side of things, that it’s going to put in place more penalties related to these items, Whistleblower Protection given to employees of companies or accounting firms who lawfully help an investigation of fraud or other criminal contact by federal regulators, Congress or supervisors.

20:34

So then they’re going to encourage the ability for people that see wrongdoing, to be able to report it without you know, without with having some protection, so we want some whistleblower protection so if there is some corrupt activity that the whistleblower can blow the whistle without, without as much fear at least so we’ve titled nine white collar crime penalty, minimum penalty for mail wire fraud increased from five to 10 years when increasing the penalty there to tamper with a record or impede official proceeding is made a crime. So to tamper with a record or impede official proceedings is now a crime permits the SEC Security and Exchange to prohibit any anyone convicted of securities fraud from being an officer or director of publicly traded companies. So they’re gonna say you can’t be an officer director if you have securities fraud in an attempt to increase the public’s ability to trust the companies by trusting the people that are in these these rules. criminal liability of up to five years for corporate officers that fail to certify financial reports or who willfully certify financial statements knowing they do not comply with the act. Then we have title 10 cents of Congress regarding corporate tax returns CEOs should sign a corporation’s federal tax. tax return. So once again, they’re trying to get say that, and this seems seems obvious, but if you think about it again, you’re like, well, the corporate tax returns prepared, who’s gonna sign the corporate tax return once again, that the corporation is a is a structure, it’s just a thing. So and everybody in it all employees are the agents of it. But the corporate tax return was created from the financial statements, which you would think that management has ultimate responsibility over. So therefore, you would think that the CEO would be the one that signs the tax return. And in so doing, the attempt, I would assume here would be to hold the CEO more accountable for the tax return being prepared, because again, if you were to sue or take some kind of action against the company, the question is Who exactly are you holding accountable the companies is a structure the agents of the companies are all the employees. The CEO is simply an employee of the company, as well. If you’re able to help Hold some of the key players more accountable than the likelihood is that you will have you know, better or more more thorough behavior in terms of the processing of some of this information have title 11 corporate fraud and accountability penalties for persons using deceptive devices engaging in fraudulent transactions or otherwise acting to impede an official proceeding increased so increased penalties here penalties for violations of the Securities Exchange Act of 1934 increased to $25 million and up to 20 years in prison.

23:36

Next, we have Dodd Frank Wall Street Reform and Consumer Protection Act became effective July 21 2010. Established established new government agencies. We have the Financial Stability Oversight Council and orderly liquidation authority oversees the financial stability of firms that have a significant influence on the economy. So recall in 2008, there was basically A crash that happened in 2008, there was concerned about the stability of, in essence, the the banking system, the financial institutions, and the financial institutions got bailed out, quote, bailed out. And so now there’s going to be concerned, of course, going forward about the financial institution. So notice we’re talking about those those items that those areas that have significant influence over the economy. And the reason the banks typically fall into that and financial institutions is because the things that they work with cash cash is going to be used by every every other business. So unlike some some other businesses, you may have very large companies but but the things that they’re working in is is not really the lifeblood of every other of every other company. Whereas if you talk about obviously the banking system, and the cash flow system within the economy, some would call it like the blood of the economy, right. the lifeblood of the economy is the flow. cash. So if there’s a major problem within the banking institution, it was argued that, that that can cause problems in every every sector of the economy. And that would be a justification for having some action taken there or the quote too big to fail type problem. So then the question is, well, how do you deal once once that took place? How do you how do you deal with these concerns over those areas that have significant influence within the economy.

25:30

Next, we have the Consumer Financial Protection Bureau, the CFPB responsible for preventing predatory mortgage lending and making sure that consumers understand the mortgage terms prior to finalizing paperwork. So notice, again, this thing happened after the crash in 2008, which was due in part to the mortgage backed securities and whatnot. And the whole process of that is is a bit complicated in terms of what you know in terms of what exactly happened or who to hold accountable for that. But in Port what what happened here is that prior to that, you know, usually when you were to buy a home, you’d put some money down 10 to 20% down on the home, and then you have usually a 15 to 30 year mortgage that would would usually the rate, it would be fixed and whatnot and the mortgage oftentimes would kind of be like the standard type of thing. And then even if the home went down in value, it wouldn’t it wouldn’t go down past the 10 or 20%. You would think that’s why there’s a downpayment on it later on because of different various different reasons, selling the mortgages on a secondary market, as well as different basically regulations and different different bundling in terms of securities, mortgage backed securities, and whatnot, it seemed that it was easier to get loans, you can have loans that were given out basically or have have mortgages on the house, were basically no money was down on it, in essence so now, so now the home was you know, basically Completely financed, which makes the mortgage backed securities less valuable in that case, because if there was a decline in the market, then as there was that was what happens eventually that’s going to happen, then the now now the loan is worth more than the home and and that’s going to have an effect on on the markets and everything. And so part of that problem they’re going to say is the responsibility of predatory mortgage lending. So they’re going to oversee credit meaning people that are pushing mortgages for for individuals who really don’t have the financial means to pay to pay the mortgage. So you can you could, so that’s basically putting the blame on the predatory lending practices. Again, there’s other areas that where you could think of who is at fault and where to where to make the judgment on that, but that’s what we have in the Dodd Frank here, the SEC Office of credit ratings, make sure that agencies provide meaningful and reliable credit ratings. So they People can depend on the credit ratings when making decisions for lending. Next, we have jumpstart our business startup. The jobs act that was created in April 5 2012, increases job creation and economic growth through improving access to the public capital markets for emerging growth companies.

28:19

So the attempt here is to say, Hey, we want to give access to capital for the emerging growth companies, which would hopefully stimulate more emergence and growth of these companies has provisions designed to ease the raising of capital to private companies. So we want to make it easier the goal here making it easier for the private companies to grow and those would typically be the smaller companies that may not have access to raise capital. So the larger companies being publicly traded, typically have an easier job of raising capital. We want to give smaller companies if they have a good idea and what not to give the chance to raise the capital if done so you would think that more would succeed increase increasing, you know growth of the economy provides financial statements require requirements based on amounts raised annually. It also has specific provisions about how those funds can be raised defines any emergency emerging growth company under $1 billion in annual revenues provides financial statements, requirements and exception from certain accounting requirements.