As we enter the 2023 tax season, it’s important to know when and where to file your income tax return. Filing your taxes correctly and on time can help you avoid penalties and interest, while also preserving your wealth. In this blog post, we will provide an overview of the income tax filing requirements for tax years 2020 to 2023.

Posts with the accounting tag

Bank Reconciliation Month #1 Reports 9.14

QuickBooks Online 2021 bank reconciliation month one, in other words, the first bank reconciliation for our data input as we entered into the QuickBooks on line system, we’re going to be focusing in on the report, the bank reconciliation report. Well, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars a practice problem, we’re now going to take a look at the bank reconciliation report after the first month of the bank reconciliation process to do so let’s first open up our report, go to the tab up top right click on it, duplicate that tab, we’re going to be opening up then our balance sheet report going down to the reports.

Inventory Reports 4.35

QuickBooks Online 2021 inventory reports. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive file, which you can find by searching in your favorite browser. For QuickBooks Online test drive, we’re in Craig’s design and landscaping services. going on down to the reports, we’re going to be opening up now inventory reports, which you can find and which I probably will be looking for in the future by simply typing in inventory in the search field.

Set up Funds & Tags 120

In this presentation, we’re gonna set up and customize our funds and tax features within our accounting software. Get ready, because here we go with aplos. Here we are in our not for profit organization dashboard, we’re gonna go into our chart of accounts over here. Now, we’re going to go into the fund accounting tabs and the fund accounting tab up top, then you’ll see another bar here with our drop downs, we want to go to the accounting drop down on the far left hand side, we’re going to first go to that first item, which is going to be the accounting tab, we’re going to be going into the accounting tab. And then right up top, we have our funds features.

Finance, Accounting, & Economics 110

Corporate Finance PowerPoint presentation. And this presentation we will discuss the differences between finance, accounting and economics, the differences between the fields of finance, accounting and economics Get ready, it’s time to take your chance with corporate finance, there’s a lot of overlap and differences between the fields of finance, accounting and economics, what we want to do is think about those differences. And where that overlap is, as we do so we will do so from the perspective of corporate finance, because that’s the objective of our viewpoint here for this particular course.

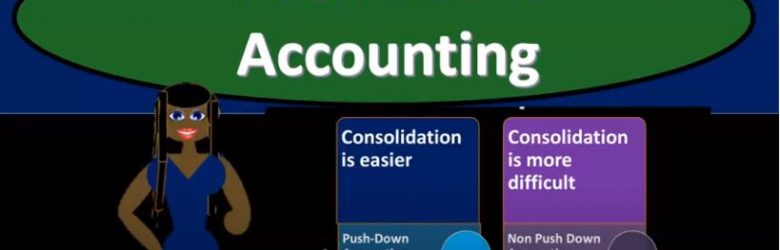

Push Down Accounting

Advanced financial accounting. In this presentation we will discuss push down accounting as it relates to parent subsidiary relationships controlling interest interest over 51%, where we have consolidation accounting taking place, we’re going to be applying pushdown accounting to it, get ready to account with advanced financial accounting. So the concept of pushdown accounting will take place when we have the parent subsidiary type of relationship and we have a situation where the purchase price when the parent purchased the subsidiary, the purchase price was more than the book value of the subsidiary, which could complicate of course the consolidation process as we’ve talked about in prior presentations. So we have a couple different options that we could do.

Forward Exchange Contracts

Advanced financial accounting a PowerPoint presentation. In this presentation, we will discuss forward exchange contracts get ready to account with advanced financial accounting, forward exchange contracts. Now we’re going to go over some of the components of the foreign exchange contracts here, we’ll go into them on a lot more detail as we work through practice problems related to the forward exchange contracts. But just to visualize the basic kind of layout of a foreign exchange contract as you think about these items, and there’ll be a lot more concrete once we look at practice problems, we’re basically have a setup where we’re going to be working with a bank or a dealer, typically a bank, and we’re going to be setting up a foreign exchange contract which is basically going to say, we have a receivable and payable on the books at this point in time and we’re either going to put the receivable or the payable that is going to be due to us or something that we will pay in foreign currency at the end of the time period. Whereas the other side the receivable or the payable, the other side that’s not in foreign currency will be in US dollars. In other words, we We will determine the amount that will that we’re talking about. And then we’ll use an exchange rate which we’ll talk a little bit more about the exchange rate that we will use to value it in today’s dollars will put either the receivable or the payable in US dollars and either the receivable or the payable and foreign dollars as of this point in time. And then as time changes, as the rate of the foreign currency changes, then that could result in the difference between, you know, what we thought the value would be, at the point in time we went into the forward contract between the US dollar and the foreign currency as that difference changes over time that could result in basically a gain or loss.

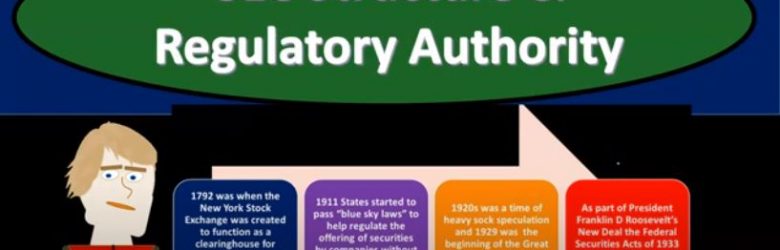

SEC Structure & Regulatory Authority

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss sec structure and Regulatory Authority get ready to account with advanced financial accounting in sec structure and regulatory authority, Securities and Exchange Commission the SEC What is it? It’s an independent federal agency It was created in 1934. It’s going to regulate and it does regulate the securities markets, the SEC helps maintain an effective marketplace for companies issuing securities and for investors seeking capital investments. Now we’ll take a look at a brief history of leading up to the creation of the SEC and a little bit about the SEC itself. So if we have an understanding of the history, then it gives us a little bit better of an understanding of why the SEC does what it does today and how it how it was created or came to be. So in 1792, was when the New York Stock Exchange was created to function as a clearing house. For the securities trades between its invit its investors. So now we have the New York Stock Exchange that will function as the clearing house. But then in 1911, states started to pass, quote, blue sky laws in quotes to help regulate the offerings of securities by companies without a solid financial base. So in other words, they saw a need for regulation, now that you have the securities that are on the New York Stock Exchange and can then be offered basically, to more to the public, more people will have access to purchasing them and putting capital into the market, then there’s a lack of transparency, the people that are putting money in maybe doing it solely on speculation, and we don’t have the information to really support the claims possibly that could be made by the stocks that are that are being traded and therefore, you could have situations and did have situations where you had stocks that had no supporting you know, value or very little supporting value to them.

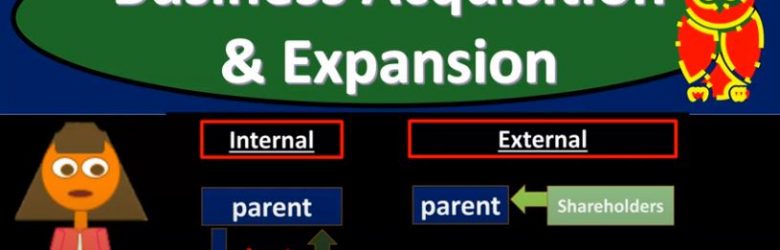

Business Acquisition & Expansion

In this presentation, we’re going to discuss an Introduction to Business acquisition and expansion, get ready to act, because it’s time to account with business, Advanced Accounting, advanced financial accounting will have to do with the concept of expansion and the accounting related to it. So first we need to know well, what is expansion? What are the types of expansion that can take place? What are the problems with regards to the accounting for it? And then what type of accounting principles can we apply in order to deal with the accounting related to those problems? So when we think about expansion in general of a business, we’re thinking about the growth of a business, typically, you have either internal expansion or external expansion. So those are two categories of expansion. We want to start to visualize in our mind and we got our mind our mind is visualizing a business that is trying to expand how are they going to do that? Are they going to do it with some type of internal growth or some type of external growth? Then we want to think about the legal structure of the of the expansion for example, an expansion often results in a parent subsidiary type of relationship. So, we have different legal entities that are associated in some way shape or form.

Closing Process Step 1 of 4 – Journal Entry 1 of 4

Hello, in this lecture, we’re going to talk about the closing process step one of the step four process. Last time, we talked about the objectives of the closing process, which in essence was to close out the temporary accounts, all the accounts from the draws, and the revenue and expenses on down to zero. Putting that balance into the capital account, we talked about how we were going to do that, we’re going to do a four step process, including closeout, the income to the income summary, and then close out the expenses to the income summary. And then we’re going to close out the entire income summary to the capital account. And finally closeout draws to the capital account. We’re going to start off with step one of those four step processes. In order to do this. We are adding this new account you’ve probably been wondering, income summary account, what is that? Where did it come from? Why is it there? The income summary can be called a clearing account, meaning it’s going to start at zero and it’s going to end at zero right when we’re done with this four step process which we’re going to do basically at the same point. Time.