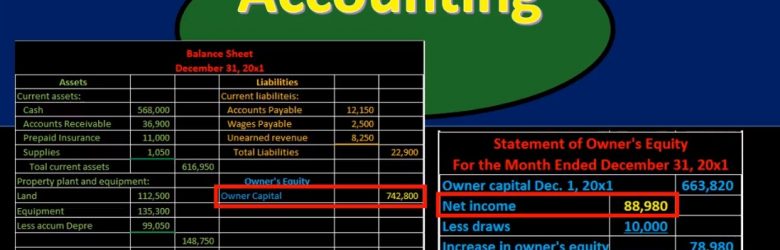

Hello in this presentation we’re going to take a look at financial statement relationships. In other words, how do these financial statements fit together? How do these financial statements represent the double entry accounting system in the format of the accounting equation that have assets equal liabilities plus equity? First, we’ll take a look at the balance sheet. Note that most textbooks will talk about this relationship and constructing the financial statements by first saying to construct the income statement, then the statement of equity and then the balance sheet. If you’re constructing things by hand with a paper and pencil, that does reduce the number of calculations that you would need to do, however, if you’re using something like Excel, then it’s a lot easier to sum up columns of numbers and it might be useful to take a look at the balance sheet. In any case, the relationships will be the same when we consider the relationships between the financial statements.

Posts with the account tag

Adjusting Entry Depreciation 10

Hello in this lecture, we’re going to record the adjusting entry related to depreciation were recorded on the left hand side, that’s where the journal entry will go. And then we’ll post that to the trial balance on the right hand side trial balance being in the format of assets in green liabilities in the orange. Then we have the equity section in the light blue and the income statement, including revenue and expenses in the darker blue. We’ll first talk about what accounts are affected and then we’ll go back and explain why this is the case. So first, we know that it’s an adjusting entry. So that’s going to have some added rules, you want to keep the adjusting entry separate in your head from just normal journal entries. all entries have at least two accounts and an equal number of debits and credits as well as adjusting entries. But adjusting entries are all made of as of the cutoff date, we’re gonna say 1231 in this case, and they generally have one account above this equity line above the capital meaning a balance sheet account and one account below that line meaning an income statement accounts.

Adjusting entry unearned revenue 6

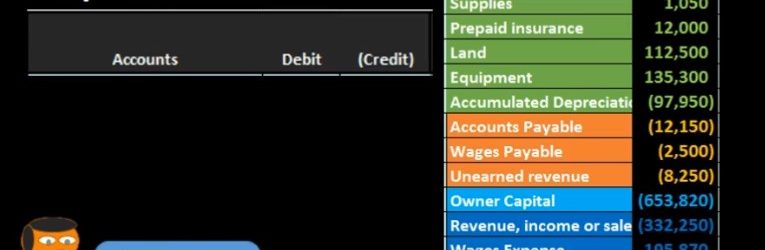

Hello in this lecture we’re going to record the adjusting entry related to unearned revenue. Remember that the adjusting entry is going to be a separate process. It’ll have the same rules as every journal entry. But we can add some added rules when we know that we are working with the adjusting entry process. For example, all adjusting entries will be as of the time period, the end of the month, or the end of the year. In this case, we have the unearned revenue. We know that all adjusting entries for the most part will have an account above the owners capital meaning and balance sheet account. So if we look at our trial balance, looking for an account related to unearned revenue, we see here unearned revenue. So we know that that’s going to be part of our journal entry.

Adjusting Entry Supplies 5

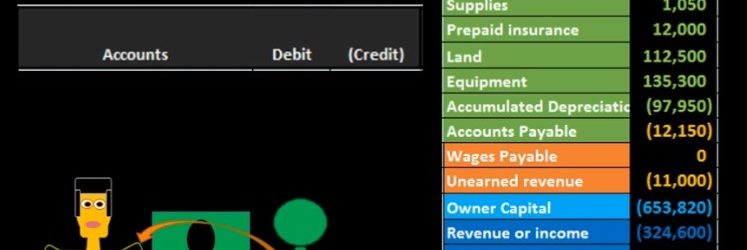

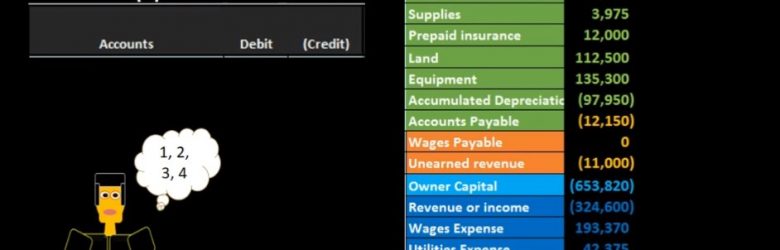

Hello in this lecture, we’re going to record an adjusting entry related to supplies. Remember that adjusting entries are going to have their own set of rules, you want to keep them separate in your head. They are still journal entries, and they follow the journal entry rules. But if we know that we are dealing with adjusting entries, we can apply an additional set of rules to help us to understand what the journal entry will be. For example, the adjusting entries will all be at the end of the time period, the end of the month or the end of the year. And if we take a look at the supplies account, we also know that typical adjusting entries will always have an account in the balance sheet section in terms of the trial balance that’s going to be somewhere up above this owner’s capital account. So we look for an account on the trial balance related to this supplies. on the balance sheet we said how about supplies and we also note that the supplies, the adjusting entries will have an account below the equity section below the owner’s capital in the income statement, revenue and expenses.

Rules for Using Debits & Credits 210

Hello. In this presentation we’re going to discuss rules for debits and credits, how to make accounts go up and down using debits and credits. objectives, we will be able to at the end of this define rules to make accounts go up and down, apply rules to make accounts go up and down and explain how rules are used to construct journal entries. When considering these rules that will be applied, the rule will be very simple to apply once we understand the normal balances or have memorized or are using a cheat sheet in order to know what those normal balances are. There’s no getting around just memorizing the normal balances. That’s where most of the time will take place. Once we know what those normal balances are, we’re going to want to do things to those normal balances. We’re going to want to be increasing or decreasing those normal balances in some way.

Financial Transaction Thought Process 160

Hello in this presentation we will be discussing the transaction thought process, a thought process used to record transactions in a systematic way. Objectives. At the end of this we will be able to list steps for recording transactions. Explain reasons for using a process when recording transaction and apply a thought process to recording transactions. First, we’re going to recap those rules we talked about in the prior presentation. If you have not seen the rules for the prior presentation, we recommend taking a look at that these rules are the rules we are going to use in order to construct a thought process. The rules being something that are just part of the process things that have to happen, the thought process being a system that we are going to use in order to learn this information as quickly and efficiently as possible and be able to record transactions as quickly and efficiently as possible.

Depreciation Adjusting Entry 10.45

This presentation and we’re going to enter and adjusting entry related to depreciation. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. Let’s go down and open up our reports, we’re going to go down to the reports down below, open up our favorite reports at the end the balance sheet reports, we’re going to open that one up, we’re going to be changing the dates up top going to go up top and change those dates from a one on one to zero to 1231. Let’s make it as of the cutoff date here, Ode to 29 to zero, and then run that report and duplicate the tab up top by right clicking on it and duplicating it.

Prepaid Insurance Adjusting Entry 10.40

In this presentation and we’re going to enter an adjusting entry related to insurance recording prepaid insurance and insurance expense. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re going to be opening up our reports. First, we’re going to go down to the reports on the bottom left. So we’re going to be opening up our favorite report that being the balance sheet report changing the dates up top from a one on one to zero, this time to our cutoff date at Oh to 29 to zero.

Accrued Interest Adjusting Entry 10.15

This presentation we will enter and adjusting entry related to accrued interest. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. We’re going to start off by opening up our reports. Once again, we’re going to go to the reports on the bottom left hand side, we’re opening up the trusty balance sheet or our favorite report the balance sheet, not the trustee trial balance the balance sheet up top, we’re going to go back up top, we’re going to change dates from 1012020 229 to zero, remembering that this is the cutoff date that we want to enter our adjusting entries as of we’re going to go back up top and then duplicate the tab by right clicking on it and duplicating it.

Short Term Portion Of Loan Adjusting Entry 10.11

This presentation and we’re going to break out the short term portion of a loan, this time taking a look at a loan that has both a short term and long term portion to it. Let’s get into it with QuickBooks Online. Here we are in our get great guitars file. Let’s start off by opening up our report our favorite report that being the balance sheet report. So we’re going to go into the reports we’re going to go into the balance sheet, we’re going to be changing the dates up top.