Corporate Finance PowerPoint presentation. In this presentation, we will give an introduction to ratio analysis. Get ready, it’s time to take your chance with corporate finance, Introduction to ratio analysis. So once we have the financial statements, then we want to think about how best to use those financial statements for decision making purposes. So remember, then the two primary financial statements being the balance sheet and the income statement, we can think of them answering primary questions that a user of the financial statements may have, such as an investor or someone who’s thinking about investing into the company may want to know where the company stands as of a point in time, that once again, is the balance sheet.

Posts with the average tag

Translate Financial Statements of Foreign Subsidiary

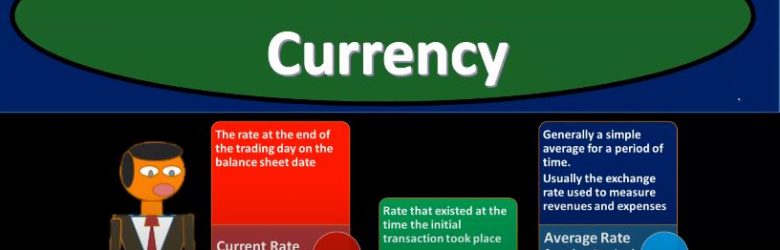

Advanced financial accounting PowerPoint presentation. In this presentation, we will discuss translate financial statements of foreign subsidiary, get ready to account with advanced financial accounting, translate financial statements of foreign subsidiary. So we’ll go through the general process of the translation process for the revenue and expenses, the average exchange rate for the period covered by the statement is the rate that is generally going to be used. And again, this would make sense, because if we’re talking about the revenue and expenses, we can’t really pick one rate, because that is a statement of how the performance did over time from beginning to the end. And therefore we need to use some kind of rate that would be representative and it wouldn’t really make sense to use the rate at the end of the timeframe but possibly some average of it. So a single material transaction is translated using the rate in effect on the translation date. So then there could be an argument that could be made we could say okay, so We’re not going to use just one rate, like at the end of the time period like we’re using on the balance sheet generally, because that would make more sense on the balance sheet because it’s reported as of a point in time. But on the income statement, yeah, it makes more sense for us to use some rate that’s kind of reflective of the timeframe. So possibly we’ll use an average rate. But what if we have this really material type of transaction that’s really large transaction, maybe in that case, we should we should deviate from just an average rate and use the rate as of that point in time or like a historical rate at that point in time. assets, liabilities and equity. So now we’re talking about the balance sheet. So for the most part on the balance sheet, you would think all right, it would make more sense then for us to be using the current exchange rate, which would be as of the date of the balance sheet date. So which says as of the end of the time period, if we’re talking for the for 1231 income statements or financial statements for the year ended 1231 then we’re talking 1231. The end of the time period is when all the balance sheet accounts are reporting as Oh, As of that point in time, and therefore, for the most part, you would think that the current exchange rate, the rate as of that point in time would work. However, you can also think that the historical exchange rate might be used for some items, some, again, some kind of large items power, possibly for the property, plant and equipment.

Functional Currency

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss functional currency get ready to account with advanced financial accounting, functional currency. When financial statements are restated from a foreign currency into US dollars, we must consider which exchange rate should be used to translate the foreign currency amounts to the domestic currency. So, when we translate the foreign currency to the domestic currency, we’ll have to determine what our exchange rate Are we going to be using in order to do so how will we account for translation gains and losses? So if there’s going to be a translation gain or loss, what are we going to do with that? In other words, should we put the translation gains and losses as part of the income statement reporting it on the income statement, the gains and losses that are due to the translation process exchange rates that may be used? So what kind of exchange rates might we use during this exchange process? Well, we could use the current rates probably the first thing that comes to mind you say, Hey, we got the financial status. As of the year ended of this time period, why don’t we just use the current rate. And that’s typically what we will do for the balance sheet amounts. And that typically makes sense for the balance sheet amounts, because remember, the financial statements, of course on the balance sheet represents where we are at a particular point in time. So simply converting them makes some sense on the balance sheet. But you also might think, Well, what about those things, you know, that we purchased, like fixed assets at a point in time, maybe we should use the point in time that we had the purchase took place. So you could argue on that on the balance sheet, but the current rate on the balance sheet and makes the most sense, but if you’re looking at the income statement, the current rate might not make as much sense because we’re measuring a timeframe that from a year will, let’s say, for a year’s timeframe from the beginning to the end, so maybe it doesn’t seem quite right to use simply the current rate, which would be the rate as of the end of the financial statements if we’re talking like December 31, rather than using some type of race. That would be representative of the period that would covered being January through December, we could use the historical rate, that’s gonna be the rate that exists at the time the initial transaction took place. And again, this one is often would make sense to us if we’re talking about a situation like if we bought equipment or something like that fixed assets, property, plant and equipment, large purchases that are on the books, we might say, well, maybe we should be putting those on the books at the rate that we should be using at the time, basically, the transaction took place. So maybe we would argue for the historical right there. And then we have the average rate for the period, generally a simple average for a period of time, usually the exchange rate used to measure revenues and expenses.

Average Inventory Method Explained

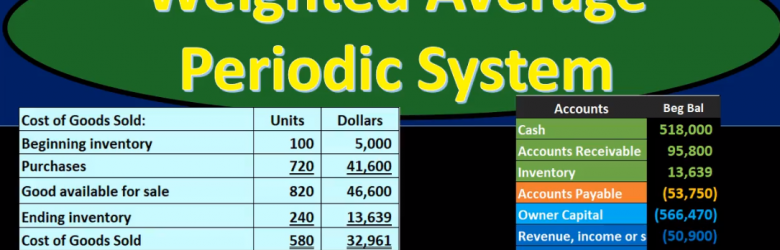

Hello in this lecture we’re going to be talking about the average inventory cost method we will be selling our coffee mugs again we will not be using a specific identification but rather a cost flow assumption VAT assumption being the average method, we will be using the same worksheet I highly recommend working on a worksheet such as this when when doing any cost flow assumption for inventory, which will include a purchases section, a cost of merchandise section and an ending inventory section in which pieces we can then calculate the unit cost times the quantity to give the total cost for each of the sections. This can answer the most amount of questions that can be asked for this top. If we take a look at a trial balance, we can see that the inventory on the trial balance is at 5000.

Weighted Average Periodic System

In this presentation we will discuss the weighted average inventory method using a periodic system. The weighted average method as opposed to a first in first out or last In First Out method, the periodic system as opposed to a perpetual system. We want to keep the other systems in mind as we work through this comparing and contrasting. We’re going to be working with this worksheet entering this information here. It’s important to note that this worksheet is a worksheet that can typically be used with any of these inventory flow type problems of which there are many. We have first out last in first out the average method. And then we have a perpetual and periodic system which can be used with any of those methods. It’s also possible for questions to ask for just one component such as cost of goods sold or Indian inventory, and therefore it can seem like there’s more types of problems that we can have in that format as well. If we set up everything in a standard way, even if that weighs a little bit longer for some types of problems, it may be easier because we can just memorize that one format to set things up, this would be a format to do that.

Inventory Methods Explained and compared FIFO LIFO 15 600

Hello in this lecture we’re going to talk about estimating inventory methods methods such as first in first out last in first out and the average method. Last time we talked about specific identification when we were selling the inventory of forklifts. We use specific identification meaning we had an ID number for each particular forklift and knew exactly which forklift we sold and the cost of that particular forklift. reason that makes sense for forklifts is because they’re relatively large, they could be distinct in nature, and they have a fairly large dollar amount in comparison to other types of inventory. If we’re selling something else, like coffee mugs over here, we may have a large amount of coffee mug they may be all completely the same.