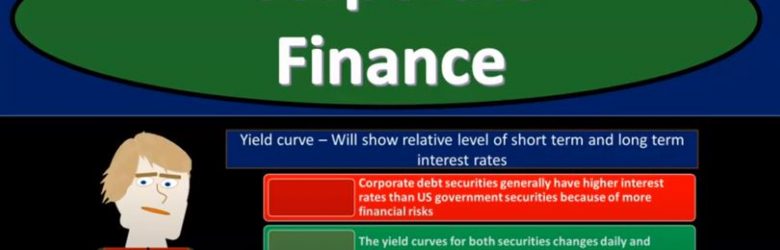

Corporate Finance PowerPoint presentation. In this presentation, we will discuss patterns of financing, get ready, it’s time to take your chance with corporate finance patterns of financing. As we think of financing patterns, let’s first think of our accounting equation assets equal liabilities plus equity assets are what the company has, we have those assets in order to help us to generate the revenue, we need to finance those assets, either with liabilities or equity, equity being the retaining of earnings over time, the earnings that have not been paid out in dividend and or investments that have been put into the company for the distribution of stocks.

Posts with the case tag

Pro Forma Income Statement 410

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the pro forma income statement, get ready, it’s time to take your chance with corporate finance pro forma income statement. Let’s first take a step back and think about the pro forma financial statements in general, remembering the fact that we got to do them in some type of order in order to do them in a logical fashion. And that would mean that we would first need the sales projection information, the production plan, we can use those in order to create the pro forma income statement.

Intercompany Debt Transfers Overview

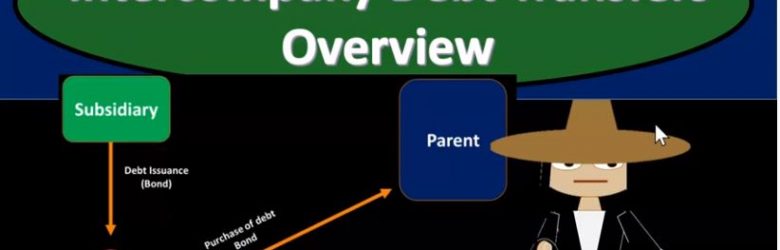

Advanced financial accounting PowerPoint presentation. In this presentation we will give an overview of intercompany debt transfers. In other words within the concept of our consolidation process where we have parent subsidiary relationships we have intercompany debt debt going from one entity to the other, from parent to the subsidiary or subsidiary to the parent could be in the form of, of notes payable or in the form of bonds payable, get ready to account with advanced financial accounting. When we think of intercompany debt, we can break it out basically into two categories intercompany debt the debt from one to the other from parent to subsidiary or subsidiary to parent, two categories, one direct intercompany debt transfer and the other is the indirect intercompany debt transfer.

Consolidation Calculations Less Then Wholly Owned Subsidiary

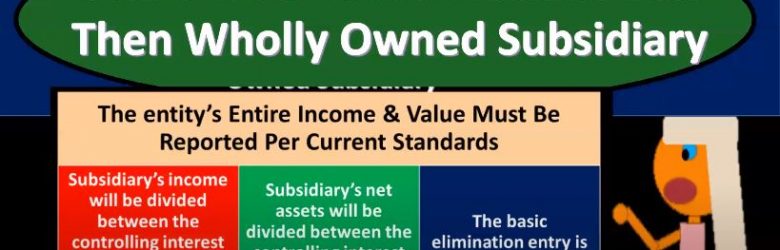

Advanced financial accounting. In this presentation we’re going to talk about consolidation calculations for less than wholly owned subsidiaries. So we have a parent subsidiary relationship, we’re going to be looking at the consolidation process to put the financial statements of the parents and the subsidiaries as if they are one entity, but we don’t have a wholly owned subsidiary. In other words, the parent does not own 100% of the subsidiary. How do we do the consolidation? in bad case, consolidation calculations less than wholly owned subsidiaries, that entities entire income and value must be reported per the current standards? So in other words, once again, we might think, well, on the income statement, maybe we would just report the part of the subsidiary that belongs to or is controlled by the parent, but that’s not typically the case. That’s not the case under generally accepted accounting principles.

Translation vs Remeasurement

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss translation versus remeasurement. Get ready to account with advanced financial accounting, translation versus remeasurement methods to restate to foreign entities statements to US dollar. So the most straightforward methods can be translation of foreign entities functional currency statement to US dollars. So the translation is what we’ll use the most straightforward method when the entity statement is using the functional currency. So typically, if the if the entity is using the functional currency, and we need to translate it, then we’ll simply translate it from the functional currency to the US dollars. And then there’s remeasurement of foreign entities statement into its functional currency. So remeasurement means that the entity is running their bookkeeping in a currency that is not the functional currency. Right? So then we’re going to have to re measure we’re going to use this term re measure rather than translate the To the functional currency, so after we remeasure to the functional currency, after remeasurement statements need to be translated to the reporting currency if the functional currency is not the US dollar. So in other words, if we’re assuming, in this case, in the case of the remeasurement, or let’s say, we have an entity that we’re going to be consolidating a subsidiary entity in another country, and we’re in the US and we need to basically consolidate these data together in terms of US dollars at the end of the day, if the entity is using the functional currency as as their financial statements, their bookkeeping is in the functional currency, then we can simply use the term translate it to the US dollars, which will be the parent currency that we’re talking about here. If however, the foreign entity is having their books in some currency, that is not the functional currency, then what we’re going to have to do is re measure it. We want to use remeasurement To the functional currency, we want to make remeasure at first to the functional currency rather than straight to the US dollar. So we’re going to use remeasure to the functional currency. And after we re measure to the functional currency, if the functional currency is the US dollar, then then we should be able to stop there. That’s okay. If however, the functional currency is not the US dollar, then we would have to go from the functional currency and then translate to the US dollar. So we’ll talk a little bit more about that as we go. So let’s think about translation.

Accounting Related to Ownership & Control

In this presentation, we will take a look at accounting methods which will relate to and depend on ownership and control, get ready to account with advanced financial accounting. Accounting related to ownership and control methods used to account for investments in common stock will depend on the extent of influence or control, the investor can exercise over the investi. So in other words, we’re gonna have different methods depending on the level of control. Now, if we’re going to use different methods, we need to have some kind of definition we need to have some lines in terms of when we’re going to apply these different methods. What does it mean to have different levels of control? And then how do we apply those in practice so we can have some kind of standardization for that.

Consolidation Process Overview

In this presentation, we will take a look at an overview of the consolidation process, get ready to account with advanced financial accounting, consolidation process overview we’re talking about a situation where we have two or more separate entities that are under a common control. So the basic kind of format of that you’re imagining here, then you have a parent and a subsidiary, these are going to be connected in some way shape or form because the parent has control over the subsidiary, we can imagine more complex situations, for example, having one parent and multiple subsidiaries as well. The entities will be showing as if they are one entity. So if we have a situation like this, if there’s a control type of situation, it’s quite possible then we’re going to have the the subsidiary and the parent These are two separate companies have a consolidated basically a financial statement. So the financial statement the idea of that being we’re going to take these two financials and represent them as if these two separate entities in this case, two or more can be more than two are one entity. This means two or more sets of books are merged into one set of financial statements. So obviously, what does that look like from a practical standpoint, we have the parent company, we have this subsidiary company, they have two sets of books, we’re gonna have to take those two sets of books and put them together for the financial statements. Here is an example of a slightly more complex situation where we still have parent subsidiary relationships but multiple pole subsidiaries in this case, so we have the parent subsidiary one where there’s a 75% ownership. So we’re over we have a controlling interest, we’re over that 51, we’re going to say there’s a controlling interest here, therefore there’s going to be a consolidation. So we’re gonna have a consolidation subsidiary to is owned 52%. So we’re still over the 51.

Accounting Related to Ownership & Control

In this presentation, we will take a look at accounting methods which will relate to and depend on ownership and control, get ready to account with advanced financial accounting. Accounting related to ownership and control methods used to account for investments in common stock will depend on the extent of influence or control, the investor can exercise over the investi. So in other words, we’re gonna have different methods depending on the level of control. Now, if we’re going to use different methods, we need to have some kind of definition we need to have some lines in terms of when we’re going to apply these different methods. What does it mean to have different levels of control? And then how do we apply those in practice so we can have some kind of standardization for that.

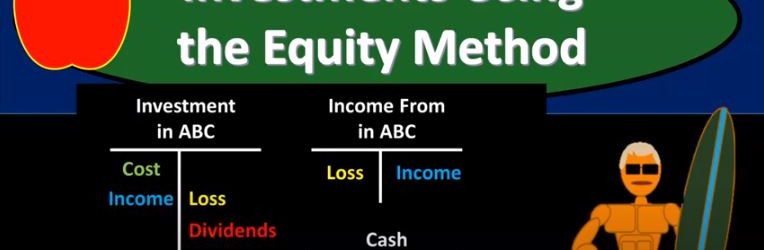

Investments Using the Equity Method

This presentation we’re going to focus in on investments using the equity method. In other words, we’re going to have a situation where we have one company that’s investing in another company, this time they have significant influence. And therefore, we will be using the equity method to account for that investment, get ready to account with advanced financial accounting. In prior presentations, we gave an overview about different accounting methods that could be used based on different levels of influence and control those general rules being that if there is 20, or zero to 20%, ownership, we use the carried value 20 to 50%, which is where we’re going to focus in on now, the equity method, idea of there being that there is now significant influence. So in other words, if we own zero to 20%, that would be kind of like you investing in a large company like apple or whatnot. We’re the assumption being, we don’t have significant influence, even though we do have a vote of what happens However, when our vote gets to be 20% Have the total, that’s kind of a shady line or not completely solid line. But that’s kind of an arbitrary line that’s been drawn, then you’re thinking, Okay, now there’s pretty much significant influence. And therefore, we’re going to use a different method equity method, then if we’re over 51%, which is a more solid line, if you have more than 51%, and you’re voting on things, and you have like more than 51%, then you pretty much win. And that would mean control for that situation typically. And then we may use a different method, such as a consolidation. So we’re going to be focusing in here on the middle method, where we have significant influence where we have that lower line that’s a little bit fuzzy that 20% arbitrarily drawn. And then if you’re over the 51%, then it’s more likely that then you do have control and may be using the consolidated method. In that case. So equity method we’re focusing in on investments using the equity method, the equity method will reflect the investors changing interest in the investi. So we’re going to try to basically reflect what’s going on on the investor side with the change investment in the investi, the company that we are investing in that company, we have a significant influence over investment is recorded at the starting purchase price.

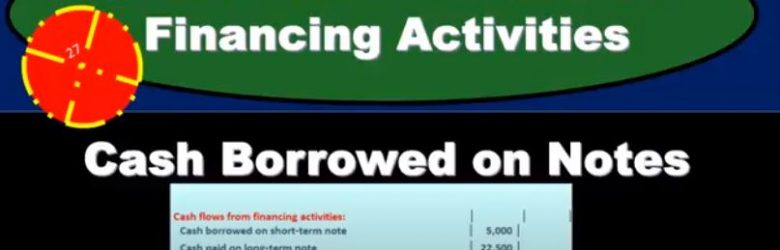

Statement of Cash Flow Financing Activities Cash Borrowed on Notes

In this presentation, we will continue on with the statement of cash flows. Looking at the financing activities looking at cash borrowed on notes, we’re going to be using the information with our comparative balance sheet, the income statement and the additional information focusing on the comparative balance sheet. First, it will be used to create this worksheet, we have going through this worksheet looking for all the differences and finding a home for them starting Of course, with cash down here, and then we kind of skipped around to pick up all of the cash flows from operating activities. And that’s really how people usually start this thing out. And rather than going just from top to bottom, picking out the operating activities, then we went back and we picked up the cash flows from investing activities. Now we’re going to go down and pick up the financing activities. And those deal with notes payable here. So we have the notes payable, and we have this common stock issuance. So those are going to be things that are typically going to be in the final financing. And you might think of as well, how would I know this? What? Why would I know that’s going through? Well, if we go through these, remember that the cash is obviously down here, that’s where we started. And then the current assets versus current liabilities, most of them are going to be up here. And that’s going to be the accounts receivable, the inventory, prepaid expenses, and then equipment.