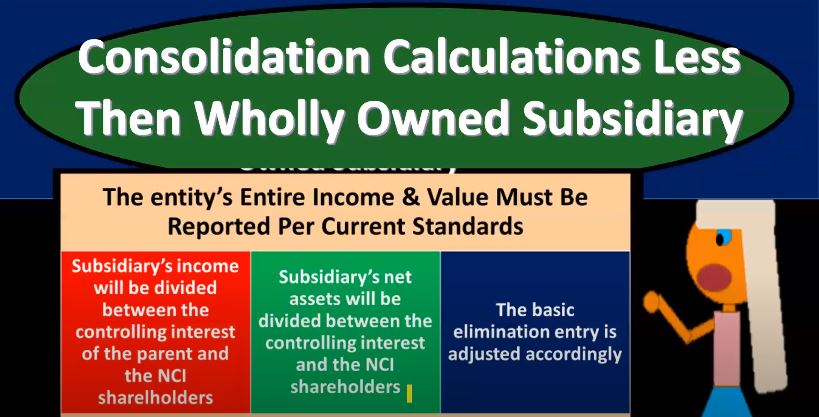

Advanced financial accounting. In this presentation we’re going to talk about consolidation calculations for less than wholly owned subsidiaries. So we have a parent subsidiary relationship, we’re going to be looking at the consolidation process to put the financial statements of the parents and the subsidiaries as if they are one entity, but we don’t have a wholly owned subsidiary. In other words, the parent does not own 100% of the subsidiary. How do we do the consolidation? in bad case, consolidation calculations less than wholly owned subsidiaries, that entities entire income and value must be reported per the current standards? So in other words, once again, we might think, well, on the income statement, maybe we would just report the part of the subsidiary that belongs to or is controlled by the parent, but that’s not typically the case. That’s not the case under generally accepted accounting principles.

They want to see the entire thing on the subsidiary which kind of makes sense because you would say hey, the the parent company has control of Over the allocation of the assets and therefore, they have control over kind of a performance to some degree, even though again upon liquidation, there would be the minority interest for for who has rights to you know the net assets. So in any case, the income statement then we want to see the entire income statement for the consolidation, including the majority minority and majority part of the subsidiaries. Subsidiaries income will be divided between the controlling interest and and the parent and the non controlling interest for the shareholders. So, we’re gonna have a similar type of situation.

01:37

We saw in the equity section of the balance sheet, we want to show the income, but then we also kind of want to show those non controlling interest format within it. So how can we have kind of the best of both worlds to show basically income and expenses fully consolidated 100% consolidated and then also show this non controlling interest for the non controlling shareholders. subsidiaries that net assets will be divided between the controlling interest and the non controlling interest for the shareholders. The basic elimination entry is adjusted accordingly. So what we’re going to do, we started off thinking about the adjusting entry. Obviously, if you have a fully owned subsidiary, the elimination entries are going to be easier because then you have a fully owned subsidiary. So we would just do those elimination type of entries. Now we got to adjust the elimination entries to account for these non controlling interest is meaning we’re gonna have these two new accounts that will be in place one on the balance sheet in the equity section for the non controlling interest in one on the income statement acting kind of like an expense. So this will make a lot more sense when we do actual problems. So when we work problems, this will make more sense, but this is just an example here of an adjustment. Now note the this is a long adjusting entry. We’re not putting the debits on top and the credits on the bottom. This is how I would think about constructing it As we will do in practice problems, we have the parent company, we have the subsidiary, we have the consolidation, adding the parent and subsidiary trial balances up. Once that is the case, then as we saw in the past, we would remove the investment in s. So that’s going to be eliminated. We’ve got the, the basically equity section four s that we’re going to remove. In other words, the 183, the 148, the 36. So the 183, the 148, the 36 been removed here.

03:28

Now these, you might think, well, that’s kind of strange, because we should only be removing the proportion that is of S that is controlled by p. So if p owns 90% of s, in other words, wouldn’t we just remove the SS portion? That would be the other way that you can kind of think about that. And again, this they’re saying, No, we’re gonna we’re gonna basically consolidate the entire thing. So how’s that? how’s that gonna look? Well, we’re gonna remove the entire basically, we’re removing In basically the equity section, and then we’re going to show in one line item, the non controlling interest here. So there’s the non controlling interest showing, basically the minority interest in one line. So in any case, we remove those three, then we have the invent the income in s. So notice that, that here, this account needs to be removed. So that account needs to be removed. We can see down here that 94,500 94,500 represented the net income, revenue minus expenses for S, only a portion of that the controlling interest went to P that was reported here in the equity method that’s got to be removed, but it doesn’t equal the amount of net income down here as it would if they were fully owned and using the equity method. So so we’re going to remove that. And then the difference then is going to be these non controlling interest accounts that we’ll have to be dealing with with these non controlling interest. We need to have them because we have the equity section kind of broken out here. In the equity section up top, and then we’ve got the income statement down below. So we’re going to take the income, which is going to be basically the proportional amount of the income. So we’ll take the net income here, take the proportional amount for the non controlling interest, and that will go here, notice it’s posted acting kind of like an expense, bringing basically down the net income. And then we’ve got the non controlling interest on the balance sheet, non controlling interest in the equity section. So that basically represents kind of like in one line item, the non controlling interest kind of portion. So we basically removed it up here, and then put it kinda like that one line item representing the non controlling interest. Again, this will make a lot more sense when we go through the practice problems and actually kind of put this together line by line in journal entries, consolidated net income, parents income from its operations plus the net income from each of the consolidated subsidiaries and excluding any investment income from The consolidated subsidiary.

06:01

So in other words, we’re basically, you know, combining together the full net income. In other words, we’re not just taking into consideration the non, the controlling portion in the consolidation. We’re basically saying that the consolidated net income should be included in, you know, in essence 100% of the parents net income in its operations, plus net income from each of the subsidiaries and then we would exclude any any investment income from the consolidation subsidiaries like the elimination entry. In situations where the subsidiary is wholly owned, total consolidation, net income accrues to the parent company or the controlling interest when one or more of the consolidated subsidiaries is not wholly owned, which is obviously the case we’re thinking here. A portion of the consolidated net income accrues to non controlling interest shareholders. So that’s when we have the more complicated situation where we have a non controlling interest that we’re going to be basically showing on the income statement income attributable to the subsidiaries non controlling interest will be deducted for consolidated net income on the income statement to get to consolidated net income attributable to the controlling interest. So, we saw that basically on the trial balance if we were to take a look at a financial statements here on the income statement, these are very short, just kind of basic financial statements. But the bottom line here being it’s like, Okay, we’ve got the sales This is include sale this includes everything combined together 100% of the of the subsidiaries, and the parent companies, right, because this is going to be a consolidated income statement. Then we have the expenses including including, again 100% of subsidiaries and the parent, then we have instead of net income down below we have the consolidated net income. So here’s going to be basically the consolidated net income, you know, adding up the income, the net income in essence you can take out between parent and subsidiaries after removing any kind elimination entries that are necessary, then we’re going to account for this less than non controlling to to s, which is the subsidiary.

08:09

So this is the non controlling interest that acts kind of like an expense. In other words, if you were to put this kind of like up here, you know, you get down to the net income, it’s going to be decreasing this consideration, consolidated net income. And then you’re going to get to the bottom line here, which is the consolidated net income to the controlling interest. So basically, you got the two line items, you’re gonna say, Hey, this is this is the performance up top this line represents how the company performed given the fact that P basically kind of has control over the net assets of the company, right? The assets minus liability, even though they don’t have you know, the right like upon liquidation, you could say to the non controlling interest, right, they have kind of kind of control over it. But in this is the performance the income statement, how did they do over time And so you can kind of attribute that performance to how well p ultimately allocated their resources, net assets. And then there’s this one line item that says of those consolidated net income. This is part of a net income that’s not attributable part of net income that is increasing the equity section representing assets minus liabilities, that is not attributable to, to the the controlling interest the parent. So that means that on the on the balance sheet assets, liabilities equity, now we’ve got this non controlling in interest here, representing this app component, assets minus liabilities, including total assets and liabilities for parent and subsidiaries. showing that this is what basically p as the parent has control over ultimately, and then there’s one line item showing what they don’t have claim to and you can think about that basically in case of liquidation. Of course, they wouldn’t have claimed to that 36 200 this income statement showing how well the consolidated entity performed given the allocation of the net assets, which basically are in control of by the parent there, and then the portion of that net income that has been received this one line item that would be allocated into the subsidiary and then the statement of retained earnings down below.