This presentation we’re going to focus in on investments using the equity method. In other words, we’re going to have a situation where we have one company that’s investing in another company, this time they have significant influence. And therefore, we will be using the equity method to account for that investment, get ready to account with advanced financial accounting. In prior presentations, we gave an overview about different accounting methods that could be used based on different levels of influence and control those general rules being that if there is 20, or zero to 20%, ownership, we use the carried value 20 to 50%, which is where we’re going to focus in on now, the equity method, idea of there being that there is now significant influence. So in other words, if we own zero to 20%, that would be kind of like you investing in a large company like apple or whatnot. We’re the assumption being, we don’t have significant influence, even though we do have a vote of what happens However, when our vote gets to be 20% Have the total, that’s kind of a shady line or not completely solid line. But that’s kind of an arbitrary line that’s been drawn, then you’re thinking, Okay, now there’s pretty much significant influence. And therefore, we’re going to use a different method equity method, then if we’re over 51%, which is a more solid line, if you have more than 51%, and you’re voting on things, and you have like more than 51%, then you pretty much win. And that would mean control for that situation typically. And then we may use a different method, such as a consolidation. So we’re going to be focusing in here on the middle method, where we have significant influence where we have that lower line that’s a little bit fuzzy that 20% arbitrarily drawn. And then if you’re over the 51%, then it’s more likely that then you do have control and may be using the consolidated method. In that case. So equity method we’re focusing in on investments using the equity method, the equity method will reflect the investors changing interest in the investi. So we’re going to try to basically reflect what’s going on on the investor side with the change investment in the investi, the company that we are investing in that company, we have a significant influence over investment is recorded at the starting purchase price.

02:10

So we’re going to start off basically in a similar situation as the carrying value we’re going to have the purchase price is what we’re going to be putting on the books when we purchase the investment under the equity method. And I believe the rationale would be that it’s still a market driven transaction. So when we have the initial investment, we’re gonna still record it at that price. Because if it’s an arm’s length transaction, it happened on the market. And we’re trying to if we’re trying to value something that’s a good, you know, starting point typically to value something at because there’s an actual transaction that took place on the market at that point, then the investment is adjusted each period for the investors share of the investees profit or losses and dividends that are declared by the investi. And this is where the major difference will be. You’ll recall that if we don’t have significant influence, then we may wait until we Get the dividends to recognize. In other words, we’re not going to recognize if we don’t have significant influence the revenue when the investi receives the revenue, we would be waiting until we get the dividends to record dividend income. In this case, rather, the investment is adjusted each period for the investors share in the investees profits. So as the investing mixed profits, we’re going to say, Hey, we have significant influence idea there being that we could influence them to give us the money possibly now we don’t have 51%, we can’t force them to give us the dividends, but they would have to declare the dividends to give us the money we have 20% interest or over or that’s going to be like kind of that that line. So that’s pretty significant influence that we make be able to get access to that money if we wanted to. And that might justify us recording the profit when the investi gets it rather than basically waiting for the dividends and dividends, okay, so the profits and or losses and the dividends that are declared by the investi. So in other words, we are going to record them the dividends. We’re going to show The dividends, it’s going to adjust our investment account, right.

04:04

But we’re not going to record income. In this case on the equity method as we did. Under under the prior method. If we don’t have significant influence, we recorded dividend income when they gave us the dividends. This time, what we’re going to say is when they give us the dividends, we’re going to make an adjustment to our asset accounts, the investment account, we’re going to record the income at the same point in time that the investi gets the income. And that’s that’s when we will record it. So we’ll take a look at some more examples of that shortly. Investment using the equity method. Equity method is used for joint ventures companies where the investors voting stock interest provides the invest or the ability, the ability to exercise significant influence over the operating and financing policies. So that’s going to be the general rule that you want to have here. This is the main quote, the idea, the terminology that you want to have employees the ability to exercise significant influence Over operating and financing policies. So in other words, you’re probably going to memorize more easily the the rule, the general rule of 20%. And over, that’s what most people have in their head. But that’s more of an arbitrary number. And what that number is trying to get at is to get some point that we can measure easily where this would take place where there would be a bit and ability to exercise significant influence. So you want to have both those in place. This is what we’re aiming at, with that 20% number for one company to have the ability to exercise significant influence over the other. So significant influence quotes 20% rule, if there is is not evidence to the contrary and investor holding 20% or more of the investing voting stock is presumed to have the ability to exercise significant influence over the investi. So there’s that 20% rule so we’re looking for significant influence. And if someone is 20% or more not, and again, less than 51% because 51% would be controlled, but if 20% or more, and we’re looking at that 20% line, then we’re going to assume that there’s going to be significant influence, unless unless there’s some reason not to.

06:09

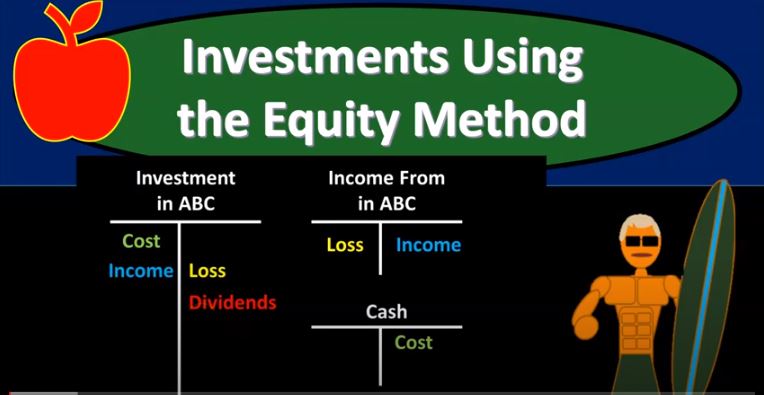

So if there is not evidence to the contrary, in other words, an investor holding 20% or more of the investments, voting stock is presumed to have the ability to exercise significant influence over the investi. When might that not be the case? You might say, well, we have 20%, it would be it would presume, but I have evidence to the contrary, what would that evidence be? Possibly somebody else owns 51% of the stock, and we have 20% we can’t significantly influence anything when someone else has a 51% voting share, right? So that would be the most obvious kind of exception to the general rule. Okay, so what would the journal entries look like? Let’s look at this in terms of T accounts now. So we’re gonna say if we’re the company that are investing in ABC Company, we’re gonna have an asset account, that’s going to be the investment account investment in ABC, we’re gonna have an income account that’s going to be income that’s going to be related to ABC. company, and then we’re going to we’ll have the cash account down here. So first we’re going to invest in it. So we’re buying the stock. And this would be similar to if we didn’t have significant influence, right, we’re just going to record it at cost just like we normally would, for any type of investment. Again, this would be assumed to be a market transaction. And therefore the cost is a good number to use. If it were a market transaction, so we’re going to debit the investment, the asset account, we’ll credit let’s say, cash down here, then let’s say that there’s income. Now we’re going to say that there was income that was reported on ABC company’s income statement at the end of the month, quarter or a year, when they get the income, then we’re going to we’re going to automatically record that on our books. So we’re going to say they made income. In other words, this is where a difference we’re not waiting until they give us the dividend here. We’re recording the income when they earned it. So that would be an increase to the investment. So whatever we started at the cost at market value plus the income that we got the other side, then go into our income account. Our income statement, so our income statement is going up related to our portion.

08:04

So if we own 21%, or whatever of this other company, we get to say 21%, basically, of their bottom line net income there. Now, if there was a loss, this is an either or situation, right? If there were a loss, then of course, we would represent our portion of their loss, same concept here, that time decreasing with a credit, we would be decreasing our investment. In other words, the investment would be on the books at cost, then we would be decreasing it for the loss, basically, on their income statement, our portion, our 21%, or whatever we own of their laws, we would be represented as a credit, decreasing our investment, and then the other side go into the income statement as a debit, which would represent a loss in this case, a negative income, right? We put a loss on the income statement, and then we’re going to say, Well, what happens when they have dividend. In the case of dividends, if the company that we’re investing in we’re a company that invested in ABC Company, they’re going to give us dividends, which we’re going to assume be cash now when they declared it, it would dividends receivable. But let’s just say we’re going to get the cash to the dividends, right? So cash is going to be going up, we got cash. Now, if we were not you if we did not have significant influence, we were not if we were not using the equity method, then we would have, we wouldn’t have recorded the gain or loss here. If we would, we would be recording the dividends as basically dividend income.

09:19

So we would have gotten cash into that method and then recorded basically income up top as dividend income. here though, we recorded the income when we got the money, right, what I mean when the investi earned the money, not when we got the money. So note that the relationship here is between the dividends and let’s say the income, right, if we’re talking about this company, we’ve got the dividends that they give out and the income if we don’t have significant influence, when ABC makes the money, we can’t we can’t really force them in any way or influenced them significantly to give us the money. And therefore we’re more of a passive investors is kind of the idea of this if we’re under 20% Therefore, that’s when we don’t if that were the case, if we weren’t a 20% owner, we wouldn’t recognize income at that point, but rather wait until the dividends are given to us, and then represent the income because that’s when we actually have it in our hands. That’s when it’s, it’s ours for sure. In this case, if we have significant influence, when the ABC company that we’re investing in earns revenue, now we can basically we have significant influence to force them to give that money to us, if we if we so choose, they don’t have to, because the fact that they made income doesn’t mean they’re going to give dividends out related to the full amount of earnings that they made, they might just keep the money in the company and hope and try to generate more, more revenue with it. And that’d be fine. But but we don’t have significant influence over that decision if we don’t have a significant voting power over the company. So if we have over 20%, we’re going to say hey, we if we wanted to, we don’t necessarily make them give us a dividend but if we possibly could With our with our influence we have and therefore, it would make more sense for us to recognize the income at the point in time that ABC makes it in other words represent our 20% of the income at the point in time they earn it. If we do that, then we’ve increased our investment by the income that they have earned are 20% of their income. Well, what happens when they give us the dividend, then? Well, we have already basically recognized the income up here, but of which you would think that the dividend came from. In other words, if ABC company made income, then the decision to give dividends you would think might be a result of part of the income that they earned, or at least for the lifetime of the earnings, right? So so the dividends you would think we’d have to net these two out.

11:42

So if I record the income up here, then when they give me the dividend, I’m in essence, netting that out against the against the income that I have, I have recorded in other words, I’m not going to record the dividend income again, over here on the income statement. I’m just simply going to reduce the The amount of the investment, I’ve increased the investment here by the total income, I’ve recorded the total income on the income statement, then when they give me the dividend, I’m going to reduce the amount of the investment. And I’m not going to record an income because presumably, the income has already gone up by the amount of the income that was generated by the company, right, which is usually greater than the dividend, the dividend is usually only going to be a portion of the income that was created by the company generally And generally speaking, so so that’s going to be that’s going to be the process here in terms of T accounts. Now, what are the pros and cons based on economic activity instead of dividend policy? So that’s one of one of the better things here is that when you use an equity method, you’re not you know, if you’re, if you’re recording things based on when the other company gives a dividend, then really you can, you can kind of manipulate the system because, you know, when they record dividends might not make a lot of sense if you’re actually recording on an equity method, you’re recording your investment based on, you know what’s economically happening. So it’s kind of the difference between a cash based method and an accrual method. And then an accrual method is typically more thought to be more representative of the actual what’s actually happening. And here, the economic method of an equity method is typically better in that sense, as well. It’s also fairly simple. It’s like a one line kind of consolidation. So it’s similar to basically having one line item, you know, that shows basically the consolidation process and in other words, we’re showing our whatever percent interest in kind of like one line item and recording the increases in decreases in the actual earnings on like that one line item on our balance sheet for the investment that we own cons, continual adjustments are needed. So one of the one of the negative sides here is it’s it, you know, you gotta adjust it continually.

13:52

So that can be you know, a little bit more difficult if you record if you don’t have significant influence and you’re just recording dividend income. In essence, just the dividend incomes a little might be actually a little bit easier to do than the equity method, but you still have to record the market. I mean, if you’re adjusting to market value, so you still need a periodic adjustment in either case, and and that might be something again done at the end of the period something that’s kind of like a an adjusting entry adjusting journal entry type of process. So let’s let’s take a look at the journal entries is just a general couple journal entries related to the equity method. So when we purchase ABC Company, so we’re a company, we purchased investments in the stock of another company, we’re going to say ABC company. So we’re going to debit then and investment in ABC company. So we bought some stock in ABC. And we’re going to say that that puts us over the 20% influence method and we’re going to record it as a debit to the investment and a credit to cash This is the same whether we have influencers or not this is a market transaction. So that so the idea there being that to record at the market price whether we are significant in influence or not, is a good way to record that initial transaction given it’s a market transaction, then we have the recognition of income, usually a year end adjusting entry. So at the end of the year, typically we’re going to have the recognition of income. So whatever income was reported on ABC company’s books, we’re going to, we’re going to take our portion of it, if it’s 20%, if it’s 30%, or whatever, if we own 30% of ABC, we’re going to say whatever they made, you know, times 30%, is our portion. And we’re going to record a debit to the investment in ABC company. So when on the books at the market price, whatever we pay for it, but we’re increasing it by the financial statements of ABC, our portion, our 30%, in this case, of what ABC earned, the other side is going to the income statement for the for ABC Company, our income statement, you know, we’re going to record it as income from ABC company on our income statement, increasing income, and then what happens when They have dividends.

16:01

So record dividends from ABC company. So then we’re going to have the dividends receivable or you can think of it as cash if we haven’t gotten when they declare the dividends will have dividends receivable if we wait till we get the cash, we would debit cash, right? So dividends receivable, and then we’re going to be crediting not dividend income, because again, we already recorded the income up here. So notice up here, like if you were thinking about this process, you would think generally, a company generates income, if they make 100,000 of income, then they might decide, hey, we should give dividends out for part of that. And the dividends are probably going to be thought about they’re probably going to be less than the income they generated. So if they made 100,000 of income, you would think that the, the dividends they give out usually will be less, it could be more because they could be taken out of retained earnings. But usually the concept here would be okay, if they made 100,000 of income, they might give out some dividends related to that maybe 80,000. So dividends we already recognize the income up here, of our portion the 30% of 100,000 our poor The 30% of the dividends then down here shouldn’t be credited to income again, it’s actually going to reduce the investment because we we increase the investment by the full amount of the earnings. And so so we need to bring it back down by the the amount of the dividends, because we’re going to get the dividends in cash, it’s in a receivable now, then we’re going to basically get cash. So now we’re going to get the cash and in essence, what’s happening, it’s coming, it’s coming out of, we’re going to say we cashed in part of our investment, has now been cashed in, it’s going to go eventually into cash, and we’re going to be decreasing the investment. Now, you might be thinking, Okay, that’s fairly straightforward. And it’s not once you get it down, you’re like, that’s not too bad. But there are some kind of kind of quirks that could happen. You could say, well, what if the acquisition happened in the middle of the year that can kind of complicate things a little bit.

17:50

So if the investor may not accrue income earned by the investi before the date of acquisition, so So in other words, if you say okay, we bought the thing in the middle of the year, we put it on the books at the cost. And then you’re thinking, well, now I got to think about the income that was earned. And if you’re looking at the year end earnings for this company, you can’t record really the year in earnings because that would be recording income for the entire year and you’ve only you’ve only owned the stock for part of the year. So the amount of the income earned by the investi from the date of acquisition to the year end may need to be estimated by the by the investor when recording the equity accrual adjusting entry. So in other words, you’re like, Okay, I bought I purchased this thing, you know, in the last quarter and October, and then I’ve got so I’ve only got two months really that I’ve had it on the books, I put it on the books app, the cost, and now I’m looking at this in the income statement, which is typically yearly or quarterly for the company that I invested into, how am I going to fit I mean, I can’t record the income, you know, adjustment for the entire year because I’ve only had it for like two months and then so there might be a situation where you have to basically do some type of adjustment which might be just, you know, a ratio or whatever. If it was a seasonal business, it might be a little bit more difficult but some type of adjustment, maybe maybe needed for that first year and the second year, it should be all straightforward and not a problem. Okay, sale of shares, what shares what happens when you sell a share, that’s your accounting for using the equity method, investment account needs to be adjusted to the date of sale for the investors share of the investees earnings. So the first thing you need is basically if you’re selling the shares that you had a 20% over 20% or significant influence in, then you need to make sure that you’re recognizing the income up to the point of date of sale.

19:34

So like if you’re selling it on November 15. Ideally, you would like to be able to recognize the income that the company that you have invested in, look at their income up to that point in time and record that income on the books right, so now you have properly valued your your investment as of the point in time of the sale. Again, that’s not the easiest thing to do. Because the sale date could be an odd, you know, an odd period of time. But that’s what that’s the idea here. And then a gain or loss is recognized for the difference between the proceeds received and the carrying amount of the shares sold. So that’s going to be similar to just kind of a normal once you’ve Once you’ve done this step, then it’s kind of like just a normal transaction, you’ve got these shares on the books now that have the value, and you’re going to be comparing that to what you sell them for in a market type of transaction, then, if only part of the investment is sold, the investor needs to decide whether to continue using the equity method or change to fair value. So in other words, what if you What if you had something that you had significant influence over presumably over 20% investments, you’re still part of it, but not all of the stock? So you still have some stock of it left over? Then you got to say, all right, well, now, after that sale took place, does that take away my ability to have significant influence at this point? I mean, do I no longer at this time have significant influence? If so, then I need to basically think about whether I need to change my accounting method to stop using The equity method in that case if I still have significant influence that I can carry forward and use the equity method, so presumably then you would be saying all right did that take me under the 20% which is usually the the line to be presumed to have significant influence over the company. We are investing in