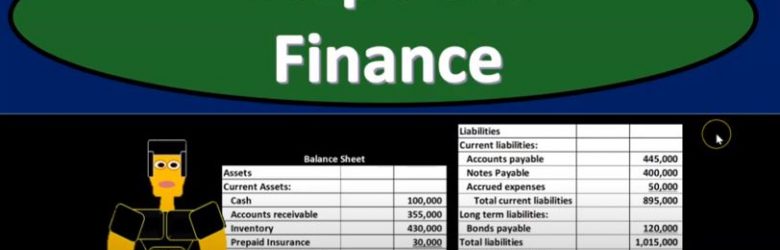

Corporate Finance PowerPoint presentation. In this presentation, we will go into more detail about the balance sheet. Get ready, it’s time to take your chance with corporate finance, balance sheet continued. Remember when we’re thinking about the financial statements, we can break them out to two separate objectives. If we’re considering this from an investor standpoint, that is, where does the company stand at a point in time, and what’s the likelihood or their earnings potential in the future, which we will typically based on past performance, therefore, you’re going to have the timing statement and the point in time type of statement. So when we think about the balance sheet, that’s going to be the point in time type of statements. So if you’re looking at the financial statements for the year ended December 31, the balance sheet will be as of the end of the period, in this case, December 31, as opposed to the timing statements, which are going to be the income statement being the primary statement that should come to mind measuring performance, which will be as of January through December 31 measure and how well we did for that range of time. So our focus over here is going to be on the balance sheet.

Posts with the corporation tag

Financial Markets 130

Corporate Finance PowerPoint presentation. In this presentation, we will discuss financial markets Get ready, it’s time to take your chance with corporate finance, financial markets, financial markets help to provide indicators for maximizing shareholder value. So when we’re thinking about financial markets, we’re thinking about markets. In general, we’re thinking about purchasing and selling things, a place where people purchase and sell items, that means there’s competition, there’s different people competing within a market, that will typically lead to better information about the value of the items being sold.

Types of Business Organizations 120

Corporate Finance PowerPoint presentation. In this presentation, we will discuss types of business organizations, including the corporation, partnership, and sole proprietorship Get ready, it’s time to take your chance with corporate finance types of business organizations. Now, as we go through here, note that we’re focusing in on corporate finance, and therefore on the corporate type of business organization, but many of the concepts that we will learn will be applicable to all types of business organizations. Therefore, we want to have a general idea of the different main kind of components or main types of business organizations. So those will include a sole proprietorship, partnership, and a corporation.

Allocate Expenses to Classes

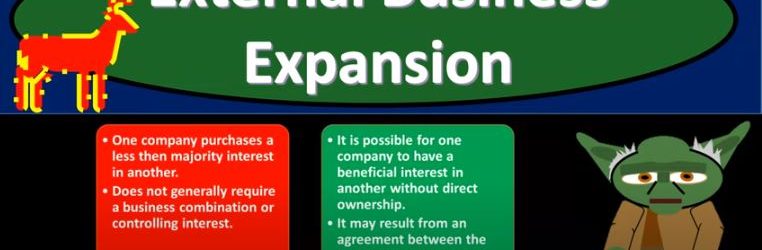

This presentation we’re going to take a closer look at external business expansion, which includes things like mergers and business combinations, get ready to act, because it’s time to account with advanced financial accounting. Before we move into the external expansion, you want to give a review and keep your mind on what our focus is we’re talking about a business that is expanding. When we think of it about expansion, we can break that expansion into internal and external expansion. So we have a business expanding into new areas do segments, we can think of it as an internal or external expansion. In a prior presentation, we talked a little bit more on the internal expansion, in which case you might have a situation where a parent creates a subsidiary or a parent basically just creates another division possibly, and expands in that format. Now we’re going to be going to the external expansion, in which case we’re talking about two entities. So we have two separate legal entities that in some or two separate entities in some case in some way, shape reform are coming together. So now we’re going to have an expansion where we have an external expansion. So if we’re thinking of thinking about this, from the from the standpoint of one company, we’re thinking about ourselves as one company and we are expanding, then we’re thinking about the expansion externally, that we are going to be combining in some way shape or form with another company. Now, the format and form in which that combination can take place can be various we can have various forms of that combination, it could result in a parent subsidiary type of relationship, or it could result in the parent basically consuming that another company and bringing them into the overarching parent company.

Why Learn Accounting 100

In this introductory presentation, we will start where every introductory presentation should start, and that is what is in it for us. Why would we want to learn accounting? What are the reasons for learning accounting? We are going to start off to answer that question and say because it’s, we will return to this after we see the objectives. The objectives been, we will be able to at the end of this presentation, list and describe reasons for learning accounting, list and explain types of accounting list and describe types of entities. Back to our question, why would we want to learn accounting? I’m gonna say the first reason is, because it’s fun.

Corporation Introduction – What is a Corporation & Pros and Cons of Being Incorporated

We will discuss the corporation for of business entity. As we think about he corporate form of business it is useful to make comparisons to other forms of business entities like a sole proprietorship and partnership. We also have other entities like LLC and S corporation. I think of business ententes in a similar way as a color wheel. We have the three prime components of sole proprietorship, partnership, and corporations and we have hybrids of S corporations and LLC. It is best to understand the prime components first, to know their pros and cons before considering how the hybrids are trying to get the best of each world. A corporate form of entity is is a separate legal entity. Being a separate legal entity means a corporation has more liability protections then other entities but it also causes problems like more paperwork to maintain and double taxation. In other words, the corporation must pay taxes as well as the owners, the stockholder when those earnings are distributed as dividends. The corporation is great for raising capital because it can sell stock. The owners of a corporation are stockholder. They have voting power to elect the board of directors who then hires management. For more accounting information see website. http://accountinginstruction.info/cou…

What Entity Type Should My Business Be?

There are many useful ways to separate and categorize business entities, one being by business form, by type of business structure, another being by a business’s relation to inventory, whether the business is selling inventory and whether they produce the inventory they are selling.

Three broad categories of business structure are a sole proprietorship, partnership, and corporation.

Sole Proprietorship Business Structure

A sole proprietorship is a business owned by one person and is the most common type of business in the United States. The benefits of a sole proprietorship are that they are easy and inexpensive to form. An individual who starts acting as a business, generating revenue, is a sole proprietor by default unless they create some other type of organizations. The income from a sole proprietor is taxable but will be reported on the individual tax return, on Form 1040 supported a supplemental Schedule C.

The disadvantages of a sole proprietor include limited personal liability protection and a limited ability to generate capital when compared to other types of organizations.

Partnership Business Structure

A partnership is similar to a sole proprietor except that the business now has two or more partners. A partnership has the same benefit of easy formation and the same drawbacks of liability exposure and limited capital generation options.

A partnership is similar to a sole proprietor except that the business now has two or more partners. A partnership has the same benefit of easy formation and the same drawbacks of liability exposure and limited capital generation options.

Corporation Business Structure

A corporation is a separate legal entity. Corporations are less common than the sole proprietorship but generate the largest percentage of total U.S. revenue.  The benefits of a corporation include that they provide liability protection through being a separate legal entity, the theory being that the assets of the corporation are at risk but personal assets are not, personal assets having more protection when compared to other types of organizations. The disadvantages of a corporation include that they are more costly to form, more complicated to maintain, and can result in double taxation.

The benefits of a corporation include that they provide liability protection through being a separate legal entity, the theory being that the assets of the corporation are at risk but personal assets are not, personal assets having more protection when compared to other types of organizations. The disadvantages of a corporation include that they are more costly to form, more complicated to maintain, and can result in double taxation.

Strategy for Learning Accounting Transactions

Much more can be said about types of entities, but this will provide a starting point. A good way to learn accounting concepts is to start out examining transactions related to a sole proprietorship and then move to a partnership and then a corporation. The reason for starting with the sole proprietorship is that it is a business form that most people can relate to and because many of the transactions found in a sole proprietorship will be the same for all entity types.

Once we understand transactions related to a sole proprietorship we can then move to a partnership, concentrating on the areas that are different from a sole proprietorship. Many of the transactions and processes will be the same, both entities needing to record the paying of the rent, employees, and utilities, both entities recording revenue. Transactions will differ, however, in the equity section because a partnership will have two or more owners, so the equity section is where to spend much of our time learning new concepts.

Once we understand a sole proprietorship and partnership we can then move to a corporation, concentrating on the areas that are different. Many transactions will remain the same, but the equity section is one area that will differ, the owners now being stockholders.

How and Why to Categorize Businesses by Inventory Use

Another useful way to categorize businesses is by industry or by whether they  use inventory and whether they produce inventory. A service company does not sell inventory, a merchandising business purchases and sells inventory, and a manufacturer produces inventory to sell.

use inventory and whether they produce inventory. A service company does not sell inventory, a merchandising business purchases and sells inventory, and a manufacturer produces inventory to sell.

A company’s relationship with inventory has a significant impact on many accounting transactions and reporting. A useful strategy for learning accounting concepts is to start out with a service company, using similar logic as we did when starting out with a sole proprietorship. Service companies have many of the same transactions as companies that deal with inventory, but they do not need to track inventory. We can then move to merchandising companies, companies that buy and sell inventory, adding the items that are different, items related to inventory. We can then move to manufacturing companies, companies that produce inventory, adding things that differ, the tracking of inventory from raw materials to work in process and then to finished goods, goods ready for sale.

For more check out the book available on Amazon

http://accountinginstruction.com/

http://www.youtube.com/c/AccountingInstructionHelpHowToBobSteele

Corporation Definition – What is Corporation?

Corporation definition. Analyzing the definition of key term often provides more insight about concepts. Corporation can be defined as: Business that is a separate legal entity under state or federal laws with owners called shareholders or stockholders. A corporation basically has some rights generally only given to humans like the right to own property. One of the benefits of this right is that it results in liability protection for the owner, the owner’s personal assets having more protection under a corporation then under a sole proprietorship or general partnership. The downside is that with the right granted to the corporation of ownership comes the responsibility to pay taxes. Corporations are typically taxed at both the corporate level and at the individual level at the point of distribution, at the point of dividend.