Corporate Finance PowerPoint presentation. In this presentation, we will discuss the DuPont system of analysis Get ready, it’s time to take your chance with corporate finance, the DuPont system of analysis, the DuPont system of analysis is going to be focusing in on a key financial ratio, that being the return on equity or our OE, the ROI he is calculated most simply as net income divided by equity, what we’re going to do is take this return on equity and break it out into components, those components drilling down on areas in the business, allowing us a better analysis in those areas and given us some opportunities to improve different components of the business. So it allows us to basically drill down and get more detail on the return on equity.

Posts with the Equity tag

Ratio Analysis Introduction 305

Corporate Finance PowerPoint presentation. In this presentation, we will give an introduction to ratio analysis. Get ready, it’s time to take your chance with corporate finance, Introduction to ratio analysis. So once we have the financial statements, then we want to think about how best to use those financial statements for decision making purposes. So remember, then the two primary financial statements being the balance sheet and the income statement, we can think of them answering primary questions that a user of the financial statements may have, such as an investor or someone who’s thinking about investing into the company may want to know where the company stands as of a point in time, that once again, is the balance sheet.

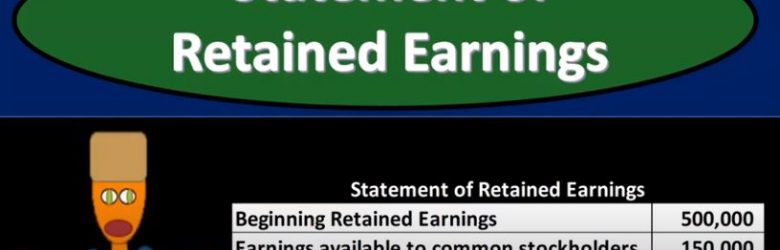

Statement of Retained Earnings 230

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the statement of retained earnings Get ready, it’s time to take your chance with corporate finance statement of retained earnings. So remember that as we think about the financial statements in total, the financial statements are basically answering questions that users of the financial statements would have. So for example, if we were thinking about investing into a company, the financial statements would help us answer the question as to how does the company stand at this point in time? How does the company look from a financial standpoint at this point, that is the balance sheet, the balance sheet gives you the assets, liabilities, equity, assets minus liabilities, being basically the book value being basically where the company stands at a point in time.

Income Statement Overview 220

Hello in this presentation we will discuss the income statement objectives. At the end of this presentation, we will be able to describe what an income statement is list the parts of the income statement and explain the reasons for an income statement. First, we’ll start off with a question we’ll which will explain the timing of the income statement or introduce us to an explanation of the timing of the income statement? And that is the question of asking somebody, how much do you make when we work through if we were to ask somebody how much they make? They would mentally make some type of assumption in order to answer that question, or they would ask you the question if they chose to answer at all. The question, What do you mean? Do you mean per month? Do you mean per year? Do you mean per week? And this is going to be something that needs to be answered in order to answer the question.

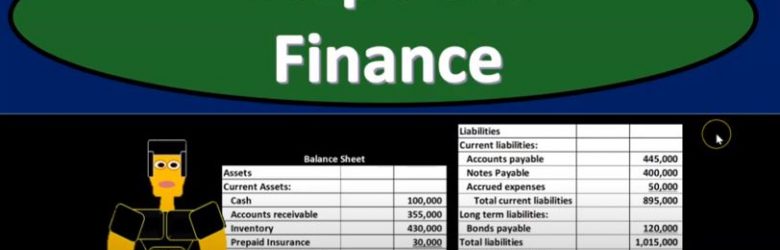

Balance Sheet Continued 215

Corporate Finance PowerPoint presentation. In this presentation, we will go into more detail about the balance sheet. Get ready, it’s time to take your chance with corporate finance, balance sheet continued. Remember when we’re thinking about the financial statements, we can break them out to two separate objectives. If we’re considering this from an investor standpoint, that is, where does the company stand at a point in time, and what’s the likelihood or their earnings potential in the future, which we will typically based on past performance, therefore, you’re going to have the timing statement and the point in time type of statement. So when we think about the balance sheet, that’s going to be the point in time type of statements. So if you’re looking at the financial statements for the year ended December 31, the balance sheet will be as of the end of the period, in this case, December 31, as opposed to the timing statements, which are going to be the income statement being the primary statement that should come to mind measuring performance, which will be as of January through December 31 measure and how well we did for that range of time. So our focus over here is going to be on the balance sheet.

Financial Statements Overview 205

Corporate Finance PowerPoint presentation. In this presentation, we will give an overview of financial statements Get ready, it’s time to take your chance with corporate finance, financial statement overview, the financial statements will be the primary tool that will be used to value the company, the financial statements are going to be generated from the company.

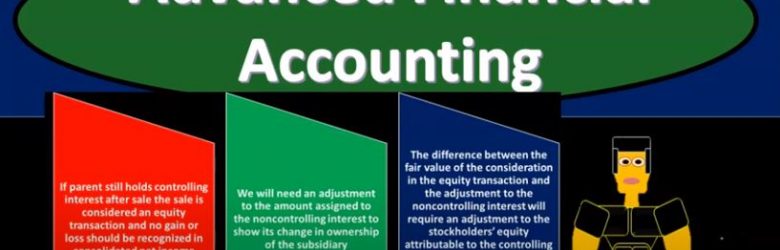

Consolidation Parent Sale of Subsidiary Shares

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss a situation where we have a consolidation process and in the period of consolidation the parent sells subsidiary shares to a non affiliated entity. In other words, we have a consolidation process we have a parent subsidiary relationship parent owning a controlling interest over 51% of subsidiary. The parent then in that period sells some of the shares that they own in the subsidiary to a party that’s not affiliated in the consolidation, what will be the effect in the consolidation process of that get ready to account with advanced financial accounting?

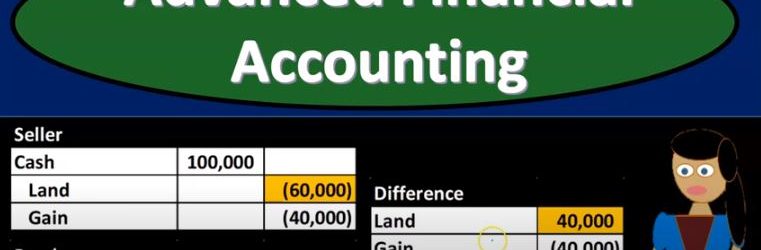

Equity Method and Land Transfer

Advanced financial accounting PowerPoint presentation. In this presentation we’ll take a look at the equity method and land transfer get ready to account with advanced financial accounting, land transfer intercompany. Within the context of our consolidation, then we’re talking about situations where land is transferred from subsidiary to parent like a sale from subsidiary to parent or from parent to subsidiary. That resulting in basically an intercompany type of transaction we’re going to have to deal with with the consolidation process and possibly with the recording of the equity method by the parent as they reflect their investment in the subsidiary. We talked a little bit last time about the land transfer being similar to the inventory transfer because typically you’ll have like a gain that will be involved in it and your physical inventory that is changing hands. It does not have the added complexity as the property plant and equipment type of transfer. That would be depreciable assets with regards to accumulated appreciation and appreciation.

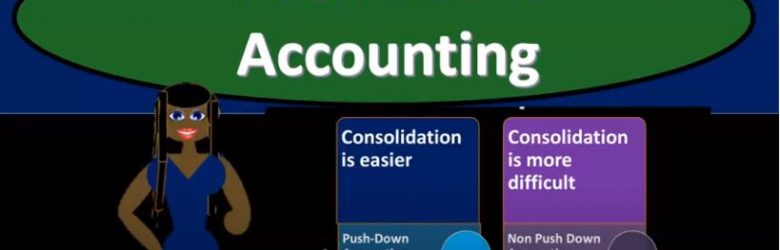

Push Down Accounting

Advanced financial accounting. In this presentation we will discuss push down accounting as it relates to parent subsidiary relationships controlling interest interest over 51%, where we have consolidation accounting taking place, we’re going to be applying pushdown accounting to it, get ready to account with advanced financial accounting. So the concept of pushdown accounting will take place when we have the parent subsidiary type of relationship and we have a situation where the purchase price when the parent purchased the subsidiary, the purchase price was more than the book value of the subsidiary, which could complicate of course the consolidation process as we’ve talked about in prior presentations. So we have a couple different options that we could do.

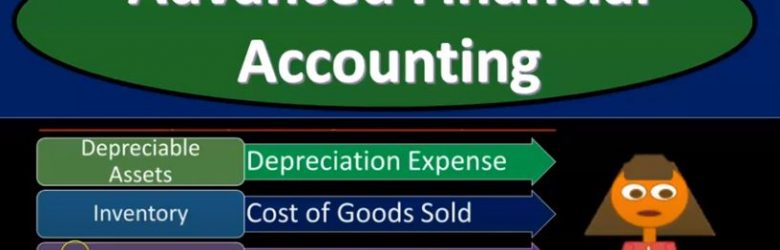

Consolidation When There is a Book & Fair Value Difference

Advanced financial accounting. In this presentation we’re going to take a look at a consolidation process when there is a book and fair value difference. In other words, we’ll have a consolidation. We have two companies, we have a parent subsidiary type of relationship, and the parent has a controlling interest of the subsidiary. Therefore consolidation is what we’re going to be doing. That means we’re going to take two separate sets of books combine them together as if they were one. And we had some complications with the fact that when the purchase took place, there was a difference between the book value and the fair value, what will be the effect of that difference on the consolidation process, elimination entry example. So when we consider this difference, we want to think about what’s going on with the parents books and the subsidiaries books and then what would be the process to consolidate them and what type of problems would be caused if there was a difference between the book and fair value of the net assets so the parents books investment accounts starts out containing the acquisition costs at the fair market value of net assets and goodwill, so we have, that’s basically what’s going to be on the parents books, right. And we’re thinking here typically have an equity method being used. So we have the parents books, we have the subsidiary books that we’re gonna have to consolidate together, and then do our elimination entries. And on the parents books, you’re accounting for the subsidiaries.