QuickBooks Online 2021 sales by item reports, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive file, which you can find by searching in your favorite browser. For QuickBooks Online test drive, we’re in Craig’s design and landscaping services, we’re going to go to the reports on the left hand side, scrolling down to the reports that are going to be related to the income statement, including the sales and customers types of report.

Posts with the information tag

Vendor Center Expenses or Vendor Tab 1.17

QuickBooks Online 2021 vendor center or expenses or vendor tab. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search page, we’re searching for QuickBooks Online at test drive, we’re going to open up the test drive from Intuit verify that we are not a robot.

Customer Center Or Sales Tab 1.32

QuickBooks Online 2021 customer center or sales tab. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search page, we’re going to be searching for QuickBooks Online at test drive, then we’re going to be selecting QuickBooks Online test drive from Intuit, we’re gonna be verifying that we’re not a robot, even though I’m not totally sure at this point, I mean, how would you even know really, if you were a robot or not? I mean, if you think about it, it’s kind of it’s kind of a deep question.

Navigation Overview .20

QuickBooks Online 2021 software navigation overview. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search engine browser, we’re going to be typing in QuickBooks Online test drive to get to our QuickBooks Online at test drive that I’m going to enter into that QuickBooks Online test drive here. Here we are in our Craig’s design and landscaping services Test Drive File, we’re going to start off with a broad overview of how to get around the quickbooks online format. We’ll be doing some comparisons as we do so to the desktop version.

Bank Feeds .25

QuickBooks Online 2021 Bank feeds. Let’s get into it with Intuit QuickBooks Online 2021. Here we are online in our Google search engine. We’re typing in the QuickBooks Online test drive to get to our QuickBooks Online at Test Drive File, we’re going to be clicking on QuickBooks Online at test tribe, verifying that we are not a computer here, and then continue. Here we are in the Craig’s design and landscaping services practice file, we’re going to be touching in on the bank feeds. And the first thing we want to note is that we will be going into bank feeds in more detail, but it will be after the primary practice problem where we will focus specifically on bank feeds.

Office Space Donated 125

This presentation, we’re going to record a transaction related to the contribution or donation of office days to our not for profit organization. Get ready because here we go with aplos. Here we are in our not for profit organization dashboard, we’re going to jump on over to Excel to see what our objective will be, we’re going to be on tab one. So I’m on tap one here, and number one says it’s going to be office space donated. So it’s going to be a bit of a tricky transaction for the first transaction here we got a contribution, but that contribution isn’t cash and which would be the normal type of contribution what was contributed instead, the use of the facilities the use of office space.

Financial Markets 130

Corporate Finance PowerPoint presentation. In this presentation, we will discuss financial markets Get ready, it’s time to take your chance with corporate finance, financial markets, financial markets help to provide indicators for maximizing shareholder value. So when we’re thinking about financial markets, we’re thinking about markets. In general, we’re thinking about purchasing and selling things, a place where people purchase and sell items, that means there’s competition, there’s different people competing within a market, that will typically lead to better information about the value of the items being sold.

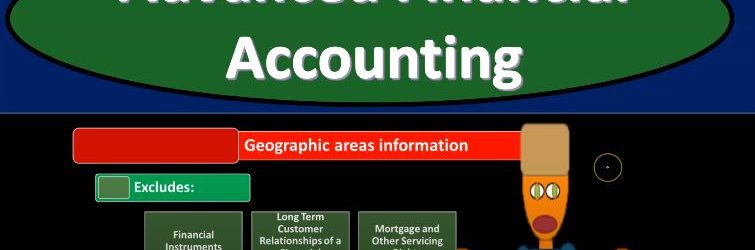

Enterprisewide Disclosures

Advanced financial accounting a PowerPoint presentation. In this presentation we will discuss enterprise wide disclosure, get ready to account with advanced financial accounting. enterprise wide disclosures established by ASC 280 standards provide users more information about the company’s risks generally made in a footnote to the financial statements. First category of required information to include under ASC 280 is information about products and services so information about products and services disclosure related to them. Companies are generally required to report revenues from external customers for each major product and service or each group of similar products and services. Unless doing so is not practical. primary reason for this is that the company could have organized its operating segments on a different basis from the organization of the entities product lines. So we’ve got then again, companies are generally required to report revenues and external customers for each major product and service. You might be saying, hey, well, they already have the segment’s reporting. But it’s possible that those two things don’t exactly line up in the way they put the segment reporting together and therefore, you know, you have this requirement. second category of required information to include under ASC 280 is going to be related to geographic areas information. The following needs to be reported unless it would be impractical to do so. revenues from external customers attributed to the company’s home country of domiciled revenue from external customers attributed to all foreign countries in which the enterprise generates revenues.

Threshold Tests for Segment Reporting

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss threshold tests for segments reporting, get ready to account with advanced financial accounting threshold tests for segment reporting separate supplemental disclosures that need to be made for separately reportable operating segments. So we’ve got these separately reportable operating segments, we have to then determine what type of reporting needs to be taking place for them. determining if a segment needs separately reported information. There are 310 percent quantitative rules FA SB specifies separate disclosure is needed for any segment that meets at least one of the three tests that follow. So we have the segment we got to think about Okay, do we need separate disclosure for this segment, and in order to determine that we’re going to use these 310 percent tests, they only need to meet one of these tests in order for the separate disclosure to be necessary that being 10% revenue test 10% profit or loss test and 10% assets tests. We’re going to go into more detail on each of these tests. Now some we’re going next slides we’ll be focusing in on these three items. So we’re going to start of course with the 10% revenue test. If an operating segments revenue, including both external sales and intersegment sales or transfers is 10% or more of total revenues from external sales plus intersegment. transactions of all operating segments, then segment is separately reported and supplemental disclosures must be provided for it in the annual report so that we have the 10% of revenue basically top line of course on the income statement to determine if the segment is separately reportable. Then we have the 10% of profit and loss. So now the next test now looking at the bottom line, of the income statement, as opposed to The top line if the absolute value of the segments profit or loss or absolute value, so, if we have a income or loss is 10% or more of the higher in absolute value of a the total profit of all operating segments that did not report a loss or be total loss of all operating segments that did report a loss, then the segment is separately reportable and supplementary disclosures must be provided for it in the annual report. So, you can think about these tests you got the 10% of the top line of the income statement, the revenue, basically 10% of the bottom line, profit or loss on the income statement. Now, we’re looking at the balance sheet 10% of assets tests. If these segments assets are 10% or more of the total assets of all operating segments, then the segment is separately reportable and supplementary disclosures must be provided for it in the annual report.

Periodic Reporting Requirements

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss periodic reporting requirements for publicly traded companies get ready to account with advanced financial accounting, periodic reporting requirements, companies that have more than 10 million in assets and whose securities are held by over 500. Persons must file annual and other periodic reports to provide updates on their economic activities. So remember the general rule here we’re talking about publicly traded companies that have a benefit of being able to be publicly traded to the public on the exchanges. And in exchange for that we want to see some more basically transparency, and therefore you’ve got the filing process that needed to take place. We see some regulation by the SEC that we talked about in prior presentations. And then going forward, we want to keep and maintain the transparency the information so that there’s both the investors and the companies have the information necessary in order to enter into a agreements. And therefore we’re going to need some continuing reporting, what are the what’s going to be the requirements in terms of the continuing reporting. So once again, companies that have more than 10 million in assets and whose securities are held by over 500 persons must file annual and other periodic reports to provide updates on their economic activities. And that’s going to increase that transparency so that investors know what is happening and they can invest with full information to do so. three basic periodic reporting forms used for this updating our form 10 k form 10 Q and form eight K. Let’s start with the form 10 k form 10 k is the annual filing to the SEC the Security and Exchange Commission.