In this presentation, we will take a look at accounting methods which will relate to and depend on ownership and control, get ready to account with advanced financial accounting. Accounting related to ownership and control methods used to account for investments in common stock will depend on the extent of influence or control, the investor can exercise over the investi. So in other words, we’re gonna have different methods depending on the level of control. Now, if we’re going to use different methods, we need to have some kind of definition we need to have some lines in terms of when we’re going to apply these different methods. What does it mean to have different levels of control? And then how do we apply those in practice so we can have some kind of standardization for that.

Posts with the investing tag

Accounting Related to Ownership & Control

In this presentation, we will take a look at accounting methods which will relate to and depend on ownership and control, get ready to account with advanced financial accounting. Accounting related to ownership and control methods used to account for investments in common stock will depend on the extent of influence or control, the investor can exercise over the investi. So in other words, we’re gonna have different methods depending on the level of control. Now, if we’re going to use different methods, we need to have some kind of definition we need to have some lines in terms of when we’re going to apply these different methods. What does it mean to have different levels of control? And then how do we apply those in practice so we can have some kind of standardization for that.

Securities Carried at Fair Value Accounting

In this presentation, we’re going to focus in on situations where we have securities carried at fair value using fair value accounting, this will typically be the case if one company is investing in another company, and they do not own above the 20%. That’s going to be basically the general rule. In other words, they don’t have significant influence, and therefore, we’re going to be using the fair value accounting method for them get ready to account with advanced financial accounting. In a prior presentation, we discussed in general different accounting methods we were going to use depending on the level of control or influence that one company has on another company we set what can be kind of arbitrary kind of points, which means zero to 20%. We’re going to use one method that they carried value 20% to 50%, the equity method and then 51 through to 100. We might be having a consolidation at that point. So now let’s break that down and concentrate on each of these in a little bit more detail This time, let’s focus in on this first category. Now this would be the category where typically most of the time you would be you would be accounting for something as in most cases, if you’re just investing if one company is just investing like a normal type of investment, just like an individual’s investing, they don’t expect to have really influence over the decision making process, because they have, they don’t have a controlling interest in order to do so it’s just a normal type of investment type of situation, that’s going to be the norm kind of here. And then once once the ownership gets over to a certain percentage 20% 20% being quite large, I mean, if you think about the number of shares that are out there for a large company or something like that, like apple or something like that, you would need a lot of shares to basically be constituting 20% ownership.

Investments Using the Equity Method

This presentation we’re going to focus in on investments using the equity method. In other words, we’re going to have a situation where we have one company that’s investing in another company, this time they have significant influence. And therefore, we will be using the equity method to account for that investment, get ready to account with advanced financial accounting. In prior presentations, we gave an overview about different accounting methods that could be used based on different levels of influence and control those general rules being that if there is 20, or zero to 20%, ownership, we use the carried value 20 to 50%, which is where we’re going to focus in on now, the equity method, idea of there being that there is now significant influence. So in other words, if we own zero to 20%, that would be kind of like you investing in a large company like apple or whatnot. We’re the assumption being, we don’t have significant influence, even though we do have a vote of what happens However, when our vote gets to be 20% Have the total, that’s kind of a shady line or not completely solid line. But that’s kind of an arbitrary line that’s been drawn, then you’re thinking, Okay, now there’s pretty much significant influence. And therefore, we’re going to use a different method equity method, then if we’re over 51%, which is a more solid line, if you have more than 51%, and you’re voting on things, and you have like more than 51%, then you pretty much win. And that would mean control for that situation typically. And then we may use a different method, such as a consolidation. So we’re going to be focusing in here on the middle method, where we have significant influence where we have that lower line that’s a little bit fuzzy that 20% arbitrarily drawn. And then if you’re over the 51%, then it’s more likely that then you do have control and may be using the consolidated method. In that case. So equity method we’re focusing in on investments using the equity method, the equity method will reflect the investors changing interest in the investi. So we’re going to try to basically reflect what’s going on on the investor side with the change investment in the investi, the company that we are investing in that company, we have a significant influence over investment is recorded at the starting purchase price.

Creating a Statement of Cash Flow-Indirect Method-Accounting%2C financial

Hello in this lecture we’re going to talk about creating a statement of cash flows using the indirect method, we will be able to define a statement of cash flows, create a statement of cash flows explain a process of creating a statement of cash flows designed to limit mistakes and define the indirect method. So what we’ll do is we’ll work through basically a problem and look through the statement of cash flows. We want to think about a few things we want to think about how to create a statement of cash flows, we want to think about a few definitions of what is a statement of cash flows, we want to kind of explain what the purpose is of a statement of cash flows and going through the process can help us to do that. Also want to point out that creating the statement of cash flows can help us with setting up a problem in such a way that we can limit the amount of mistakes that we will make. So a statement of cash flows is something that in a lot of firms, people generally often have problems to create the statement of cash flows. And it’s good practice to go in there and and create the statement of cash flows and try to create a system in which it’s easy for us to have checkpoints and see where a problem is going to happen.

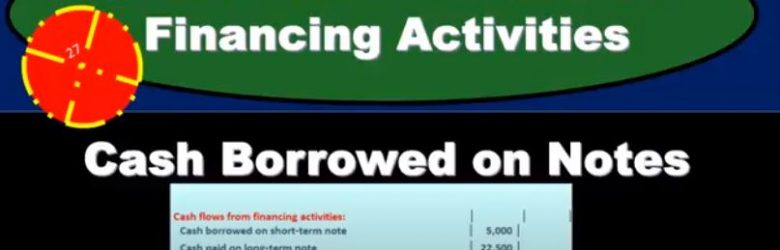

Statement of Cash Flow Financing Activities Cash Borrowed on Notes

In this presentation, we will continue on with the statement of cash flows. Looking at the financing activities looking at cash borrowed on notes, we’re going to be using the information with our comparative balance sheet, the income statement and the additional information focusing on the comparative balance sheet. First, it will be used to create this worksheet, we have going through this worksheet looking for all the differences and finding a home for them starting Of course, with cash down here, and then we kind of skipped around to pick up all of the cash flows from operating activities. And that’s really how people usually start this thing out. And rather than going just from top to bottom, picking out the operating activities, then we went back and we picked up the cash flows from investing activities. Now we’re going to go down and pick up the financing activities. And those deal with notes payable here. So we have the notes payable, and we have this common stock issuance. So those are going to be things that are typically going to be in the final financing. And you might think of as well, how would I know this? What? Why would I know that’s going through? Well, if we go through these, remember that the cash is obviously down here, that’s where we started. And then the current assets versus current liabilities, most of them are going to be up here. And that’s going to be the accounts receivable, the inventory, prepaid expenses, and then equipment.

Statement of Cash Flow Investing Activities Cash Paid for Purchase of Equipment

In this presentation, we will continue on with our statement of cash flows. Taking a look at the investing activities, specifically the purchase of equipment, we’re going to be using the comparative balance sheet, the income statement and additional information focusing here on the comparative balance sheet, which we use to make this worksheet. So this worksheet is our comparative balance sheet. We’ve been going through this worksheet and really looking for the differences. We’re finding a home for all the differences. Once we do that, we’re feeling pretty good. We have done this all the way through the operating activities. So are the cash flows from operations. So we’ve gone through here we’ve kind of picked and choose the items that are going to be cash flows from operations, which is probably the way most people approach this. But just note that as we’ve done that, we’ve tried to pick up the exact differences here. We haven’t gone to the income statement and thought about it separately outside of this worksheet, and then we’re going to go back and make adjustments. So we found a home for the difference in cash because that’s Kind of like our bottom line. And then we’ve got accounts receivable, inventory prepaid expenses, and then we skipped equipment and went down to accounts payable.

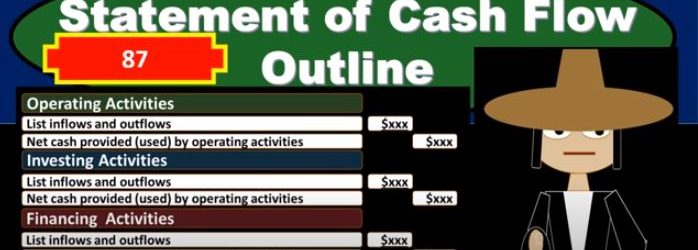

Statement of Cash Flow Outline

In this presentation, we will take a look at a basic outline for a statement of cash flows. In order to do this, we first want to give an idea of how the statement of cash flows will be generated. So we can think about these components of the statement of cash flows and where they come from. Typically, we will have a worksheet such as this that we will use in order to generate the statement of cash flows. That statement of cash flows, having three major components, operating activities, investing activities, and financing activities. Our goal here is going to be to fill out these three components and typically we will use a worksheet such as this on the left. The worksheet is just basically a comparative balance sheet that we have here that we’ve reformatted from a balance sheet to just a trial balance type format, a debit and credit type format. So you can see that we have our balance sheet accounts, and we are imbalanced by having the debits the positive and the credits be negative or debits. Minus the credits equaling zero, given it’s an indication that this period, the current period that we are working on, is in balance, the prior period, same thing. So we have two points in time for to balance sheet points the prior year, or period the prior year in this case and the current year. And then we just took the difference between these two columns. And if we have something that’s in balance, here, the debits minus the credits equals zero, something that’s in balance here, the debits minus the credits equals zero. And then we take the difference of each line item in these columns. And some of those differences, it too must add up to zero. So in essence, what we’re going to do in order to create the statement of cash flows is find a home for all these differences. And that’ll give us a cash flow, a concept of the cash flow statement. We’ll get into more detail on how to do that when we create the cash flow statement. But as we look at the outline, keep that in mind. So here’s going to be the basic outline for the state. cash flows, we’re going to have the operating activities. That’s going to include a list of inflows and outflows from the operating activities. And then we’re going to have the net cash provided by the operating activities. Now, this list of inflows and outflows for the operating activity will be the most extensive list because the operating activities are in relation to you can think of it as similar to the income statement.

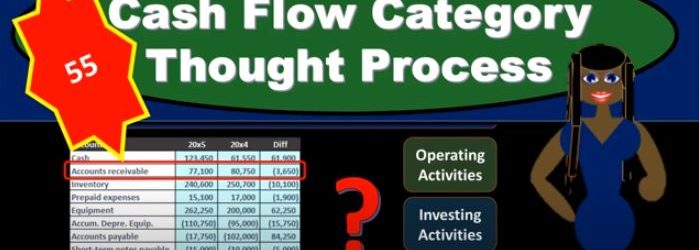

Cash Flow Category Thought Process

In this presentation, we will think about the thought process to know which category a cash flow should be entered into whether it should be operating, investing or financing activity. When putting together the statement of cash flows, we’re usually going to have a worksheet, which will typically have a comparison of balance sheet accounts. And we also might just have test questions that will ask us, where should this cash flow go? And that’s going to be a common kind of question that we’re going to have whether we build the entire cash flow statement from scratch, or whether we’re just asking test test questions and trying to know what types of Cash Flows we’re talking about. It’s also important for practice as well so that we can understand when we’re thinking about cash flows, where do they belong? What are these cash flows mean? What are they doing for us? What are they doing for the company? Are they part of the operations? Are they part of investing? Are they part of financing? If we look at a worksheet like this to build the statement of cash flow, typically we’re going to look at a balance sheet for two periods. So here our balance sheet for these two periods. And we’ll have the difference between the two periods in terms of the balance for these balance sheet accounts. So we’ve got cash, accounts receivable, inventory, prepaid expenses.

01:13

Now what we’re going to do is we’re going to take the change in cash, that’s going to be the end result on our statement of cash flows. And we’re going to kind of back in to that end result by looking at the change in the other balance sheet accounts and tried to figure out what’s causing this change. So we’re going to go through all the other balance sheet accounts, look through these changes. And we know that if we look if we add them all up, they add up to zero. Why? Because the debits and credits for one year, add up to zero the debits and credits for the other year add up to zero. In other words, the debits minus the credits equals zero. And therefore the difference between the two years debits and credits the change will add up to zero. So we know that’s the case and we know that if we add up then everything except cash Then the result will be the difference in cash. So that’s how we’re going to kind of work and put together our statement of cash flows. So what we need to do then is we’re going to take a look at these changes in receivables, changes in inventory changes in prepaid expenses, and then try to determine where does that change belong? Before we get into any other question is, is the change of inventory and operating, investing or financing activity? And is the change in long term notes payable? Is that going to be an operating investing or financing activity? Our goal here is to go through a thought process to see if we can think through more clearly which category these these should be belong to. So what’s the most common journal entry in this account? It’s going to be our first question.

02:48

Whatever account they’re given us here, we’re going to say it let’s think about the most common journal entry that’s related to this account, there’s typically going to be one or two journal entries that are going to be very common and we want just right down first, once we know the most common journal entry, then we’re going to ask is an income statement account involved? So when we think about whatever account we’re dealing with, we’d write down the journal entry and say, Okay, is there an income statement account involved? Is there a revenue account or an expense account involved? If the answer is yes, then it’s probably the change that we’re dealing with is probably something that should be in the operating activities. Because remember, the operating activities is kind of like the income statement on a cash basis. So if we’re dealing with something that’s this change has something to do with the income statement, then it’s going to be something on the operating activities. Typically, if the journal entry has nothing to do with the income statement, there’s no revenue or expense accounts involved in the normal journal entries related to these accounts, then we’re going to ask the question, are we purchasing or selling an asset? Because it’s so if it’s not operating, this means that it’s not operating therefore, We’re trying to see if it’s going to be investing activity. And that typically means we’re purchasing or selling an asset. If it has to do with, for example, property, plant and equipment, or some other type of investment, then it’s going to be an investing activity. And then if it’s not, then it’s going to be financing. And of course, financing is going to be dealing with notes, something that we’re dealing with that doesn’t deal with operating activities in terms of the income statement, no revenue and expenses, and typically doesn’t have assets involved either, because what we’re doing is funding the company. So that’s typically going to be something that deals with cash and subtype of liability or the equity section. So this is going to be our thought process if we go through each of those line items, and think about each account on the balance sheet.

04:46

And then try to go through this thought process and think okay, which category are we going to be putting this change to? Now, this looks a little less intuitive than we might think at first glance here because no one We’re doing we’re looking at the balance sheet accounts. And we’re trying to see what category these things are going to fit into. And remember that the operating activities I’m keep on comparing that to the income statement. And you might be thinking, well, these are all balance sheet accounts. Why do you keep mentioning the income statement. And note, what we’re doing here is we’re really kind of backing into the activity is happening by looking at the change in two points in time. So we’re kind of still looking at the income statement activity type of accounts, we’re looking at change, we’re looking at activity, even though we’re doing that by looking at the change in two points in time to balance sheet accounts, which are points in time. So when we look at the change in accounts receivable for example, if we go through our thought process, we’re going to say okay, accounts receivable was at 80,007 50. In the prior year, end of the current year, it’s at 77,100.

05:51

That means it went down by 3650. So our goal here is just to determine which category That change belongs to it’s an operating, investing or financing. And if we think about that, then we could think Well, what’s the normal journal entry related to accounts receivable? We’re going to have a debit to accounts receivable and a credit to sales. That’s going to be our normal journal entry that we’ll have related to accounts receivable. And we can see there that sales is an income statement account. So we know that it is an income statement account involved, we’re going to say yes, therefore, it’s an operating activity. So note what we’re doing here, we’re looking at the change in a balance sheet account. We’re looking at the change in the balance sheet account, then ask yourself, what’s the normal journal entry related to this account? And if we think about the normal journal entry related to accounts receivable, that’s a sale of something on account. So accounts receivable goes up when we make a sale on account, and we credit revenue and revenue is clearly an income statement account. So this Change, then that’s what we’re going to think through, we’re going to say that change looks like it belongs somewhere in the operating activities. Because we’re dealing, we’re really kind of backing into sales. That’s what we’re really looking at. And we’re going to do that by writing down the journal entry. Let’s look at another account. We’re going to pick equipment now. So we’re just going to go through all these changes. And we just got to find a home for all these changes.

07:21

When we when we make the statement of cash flows. We got to find a home for them in either operating, investing or financing. And we’ll end up with the change in cash, which is kind of like the bottom line. The bottom line will be cashed at the end of the day. So we’re going to find a home for the equipment. Where’s that going to go that change? Well, if we think about the journal entry for equipment, then if we buy equipment, we’re going to debit equipment, and credit cash and possibly credit like a note payable, some type of financing. But if we pay cash for it, this would be the most simplified journal entry. Even if we had a note there’d be no Part of it that would be on the income statement, one asset went up, the other asset is going down. So therefore, is the is an income statement account involved? No. So we’re purchasing or weren’t, so it’s not going to be an operating activity. And then the next question is, are we purchasing or selling an asset? In this case, yeah, we’re purchasing an asset. And that means that it’s going to be an investing activity. So and this was the confusing thing for me when I first started learning this thing, because investing activities, I had a different conception of what investing is to invest in something like any asset any anything we purchase in the business that we’re not consuming now is an investment to the future. In terms of the cash flow statement, we’re trying to spend our cash in order to put our money somewhere that’s going to help us make money in the future. That’s going to be some type of investment. So in this case, it’s going to be an investing activity.

Classification of Cash Flows

In this presentation, we will take a look at classifications of cash flows on the statement of cash flows, there’s going to be three major categories on the statement of cash flows. Those will be operating activities, investing activities, and financing activities. So our goal here, when we go through the statement of cash flow as we work through the statement of cash flows is going to be in part to decide which area these cash flows should go, should they go into operating, investing or financing. It’s going to be common questions and common problems and really just information we need to know when reading the statement of cash flows. So we’ll start off with the operating activities. We’re just going to look at the major components of the cash flows within the operating activities. So we’ll talk about inflows and outflows. Remember what we’re talking about here is cash. So when we’re talking about the statement of cash flows, we’re talking about cash flows, the cash that goes into the company, they cashed out goes out to the company. We’re going to talk about inflows and outflows here related to operating activities. Before we go into the list of inflows and outflows related to operating activities, we want to know first, that operating activities is going to be similar to us thinking about the income statement on a cash basis. So when we think about the operating activities were really thinking or one way to think about it would be that if we were to have the income statement on a cash basis, then what would the inflows and outflows be that’ll basically be what are in the operating activities when we get to the thought process in terms of how to determine operating investing and financing activities.