Hello in this presentation we’re going to talk about adjusting entry rules. In order to talk about adjusting entry rules. We first want to distinguish what adjusting entries are from normal journal entries. Normal journal entries being those transactions we will be recording throughout the month including the payment of the utility bill pain of wages, purchasing something on account the things that the accounting department typically does. Within the adjusting process, we’re going to draw a line or head and say the adjusting department is done in a separate department or as a separate process have a separate set of rules. Some of those rules being the same as for every journal entry, some different, the adjusting process is going to adjust accounts such as prepaid insurance, depreciation, unearned revenue, those types of accounts that need to be adjusted as of the end of the time period as a financial statement date in order to make the accounts on an accrual basis as of that date.

Posts with the journal entries tag

Accounting Cycle Steps in the Accounting Process 1

Hello, in this presentation, we’re going to be talking about the accounting cycle or the accounting process, that process that the accounting department will go through on a systematic basis over and over and over again, typically thought of as a monthly process. Although it could be thought of as a yearly process or some other process in terms of the amount of time that will pass. But these are going to be the steps that we’ll be going through in terms of the accounting process, always keeping in mind that in goal of financial accounting, which are the financial statements, some texts will have more steps than five as we have here. Some texts will have less than five steps. But the goal here is to really have a broad picture big picture, so that when we think about the accounting process, we can break down that that big picture view, five is a pretty good number for us to be able to memorize and keep in our mind if we have more than that, it can start to kind of muddy the picture. So once we get into each of these individual steps, we want to get into more detail, obviously.

General Ledger 245

Hello, in this presentation we will discuss the general ledger. At the end of this, we will be able to define what the general ledger is. We’ll list components of the general ledger and explain how the general ledger is used. When looking at transactions in terms of journal entries and posting those journal entries in track prior presentations, we were posting those journal entries mainly to a worksheet in order to see a quick computation over the beginning balance and what is happening to that balance, posting it to a format of a trial balance than an adjusting column and then an adjusted trial balance. Note, however, that we typically think of the journal entries being posted to a general ledger. The general ledger can be very complex when we look at it which is why it is often useful to not look at it when we first start posting the transactions but to see that how those transactions affect interest Visual accounts.

Accounts Receivable Journal Entries 230

Hello in this presentation we will be recording that journal entries for business transactions related to accounts receivable otherwise known as the revenue cycle. We will be recording these using debits and credits. At the end of this we will be able to list transactions involving accounts receivable record transactions involving accounts receivable using debits and credits and explain the effect of transactions on assets liabilities, equity, revenue, expenses and net income. We’re going to be recording these transactions up here on the left hand side constructing those journal entries in accordance with our thought process our list of questions to most efficiently construct the journal entries.

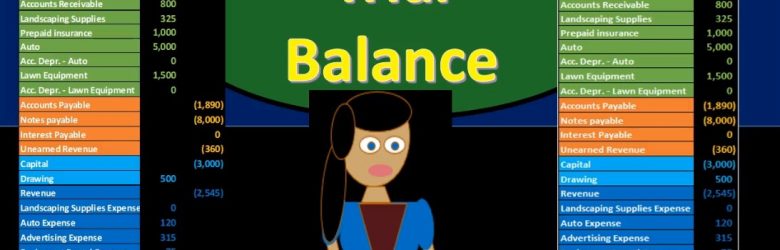

Trial Balance 220

Hello in this presentation we will be discussing a trial balance objectives at the end of this, we will be able to define a trial balance list components of a trial balance and explain how a trial balance is used. When considering the trial balance, we first want to think about where the trial balance falls within the construction of the financial statements. In other words, what processes go before the trial balance, what goes after the trial balance, where’s the trial balance fit into our process? Remember, the ending goal, the ending process of the accounting been to compile the data in such a way to create the finance financial statements. Those financial statements have been the end product. Typically if we’re thinking about a linear process, then we’re thinking about all the transactions that would happen during the month.

Rules for Using Debits & Credits 210

Hello. In this presentation we’re going to discuss rules for debits and credits, how to make accounts go up and down using debits and credits. objectives, we will be able to at the end of this define rules to make accounts go up and down, apply rules to make accounts go up and down and explain how rules are used to construct journal entries. When considering these rules that will be applied, the rule will be very simple to apply once we understand the normal balances or have memorized or are using a cheat sheet in order to know what those normal balances are. There’s no getting around just memorizing the normal balances. That’s where most of the time will take place. Once we know what those normal balances are, we’re going to want to do things to those normal balances. We’re going to want to be increasing or decreasing those normal balances in some way.

Financial Transaction Thought Process 160

Hello in this presentation we will be discussing the transaction thought process, a thought process used to record transactions in a systematic way. Objectives. At the end of this we will be able to list steps for recording transactions. Explain reasons for using a process when recording transaction and apply a thought process to recording transactions. First, we’re going to recap those rules we talked about in the prior presentation. If you have not seen the rules for the prior presentation, we recommend taking a look at that these rules are the rules we are going to use in order to construct a thought process. The rules being something that are just part of the process things that have to happen, the thought process being a system that we are going to use in order to learn this information as quickly and efficiently as possible and be able to record transactions as quickly and efficiently as possible.

Journal Report & Financial Statements 10.57

This presentation and we’re going to take a look at our reports our financial statement reports and journal entry reports. After we have entered the adjusting entries, we’ll take a look at the familiar balance sheet and income statement. We’ll also take a look at a journal entry report. That’s going to be a very useful report when we enter adjusting journal entries because it will reflect those adjusting journal entries. Let’s get into it with Intuit QuickBooks Online.