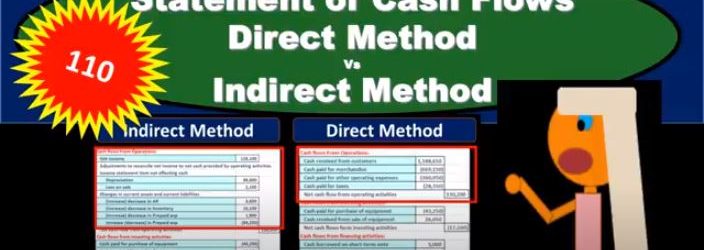

In this presentation, we will compare and contrast the direct method versus the indirect method for the statement of cash flows. It’s important to note that when we’re comparing the direct and indirect methods, we’re really only talking about the top part, the operating activities portion of the statement of cash flows. In other words, the investing activities and financing activities and in result will remain the same, we’re going to end up with the same result, which of course, will be the Indian cash that we can tie out to the balance sheet. And we’ll have the change of cash here, which is really kind of the what we’re looking for in the statement of cash flows. What’s going to differ is the operating activities, why are they going to differ? Why would we have the operating activities differ? Remember that the operating activities have to do with kind of the income statement you can think of it basically as the income statement being reformatted to a cash flow statement versus an accrual statement. So the income statement that we use is on an accrual basis, and we recognize that Revenue when it’s earned rather than when cash is received expenses when expenses are incurred rather than when cash is paid, that’s gonna be on an accrual basis.

Posts with the method tag

Allowance Method % Accounts Receivable vs % Sales Method

In this presentation, we will be taking a look at the allowance method for accounts receivable focusing in on the calculation of the allowance for doubtful accounts. There are two methods that can be used in order to calculate the allowance for doubtful accounts accounts. One being the percentage of accounts receivable, the other is the percentage of sales, we will take a look at them both and look at the pros and cons of them. First, we’re going to look at the accounts receivable method. We’re going to start off with the percentage of accounts receivable method for a few different reasons. One, it’s the one that’s most often tested. And two is the one that may be most often used in practice often making the most sense to people that are looking at the two methods. It’s also a bit more complicated. So when we’re looking at test questions, they typically would focus on this method in order to have a bit more complicated process to do the calculation.

Allowance Method VS Direct Write Off Method

In this presentation, we will take a look at a comparison between the allowance method and the direct write off method. When considering both the allowance method and the direct write off method, we are considering the accounts receivable account. Remember that the accounts receivable account represents some money that is owed to the company, typically from sales made in the past, on account haven’t yet received the funds for sales made in the past and therefore, the company is owed money. We see this amount on the trial balance in this case 1,000,001 91. We then want to know information about that, including who owes us that money. We can’t find that typically in the GL as we have a GL for every account the GL only giving us the information by date. Typically, we want to see that information also broken out in the subsidiary ledger saying who owes us this money.

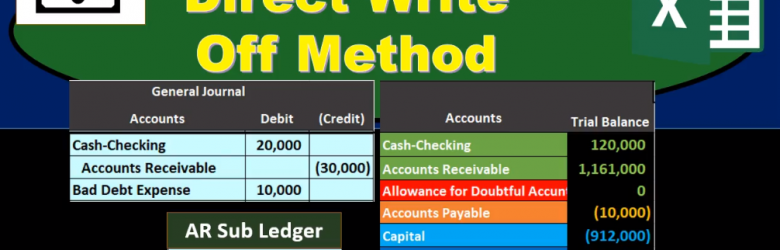

Direct Write Off Method

This presentation we will be discussing the direct write off method. The direct write off method as it relates to accounts receivable, quick summary of accounts receivable accounts receivable is a current asset, it’s an asset with a debit balance, we are going to be writing off certain amounts for accounts receivable that will become not due or not collectible at some point in the future. There are two ways to do this one is called the allowance method. The other is the direct write off method, we will be using the direct write off method here the non generally accepted accounting principles method being this direct write off method. However, a method that is typically much easier to use. Therefore, when considering whether or not to use an allowance method or direct write off method, we want to consider one do we have to use an allowance method due to the fact that we need to make our financial statements in accordance with generally accepted Accounting Principles, or are we able to choose between having an allowance method or direct write off method? If we choose to have a direct write off method, it’s probably because we’re thinking that the receivables that will be written off are not significant.

Average Inventory Method Explained

Hello in this lecture we’re going to be talking about the average inventory cost method we will be selling our coffee mugs again we will not be using a specific identification but rather a cost flow assumption VAT assumption being the average method, we will be using the same worksheet I highly recommend working on a worksheet such as this when when doing any cost flow assumption for inventory, which will include a purchases section, a cost of merchandise section and an ending inventory section in which pieces we can then calculate the unit cost times the quantity to give the total cost for each of the sections. This can answer the most amount of questions that can be asked for this top. If we take a look at a trial balance, we can see that the inventory on the trial balance is at 5000.

Consistency Concept

In this presentation we will discuss the consistency principle as it relates to inventory and inventory assumptions. First, we’re going to define the consistency principle and then apply it to an assumption such as the flow assumption such as do we use something like a first out last In First Out average inventory system, the definition of consistency principle according to fundamental accounting principles, while 22nd edition is a principle that prescribes use of the same accounting method methods over time so that financial statements are comparable across periods. So, here we’re considering the assumptions that we’re making with the flow of inventory those being either first in first out last in first out or the average method typically for the cost flow assumptions, because those are assumptions.

Inventory Methods Explained and compared FIFO LIFO 15 600

Hello in this lecture we’re going to talk about estimating inventory methods methods such as first in first out last in first out and the average method. Last time we talked about specific identification when we were selling the inventory of forklifts. We use specific identification meaning we had an ID number for each particular forklift and knew exactly which forklift we sold and the cost of that particular forklift. reason that makes sense for forklifts is because they’re relatively large, they could be distinct in nature, and they have a fairly large dollar amount in comparison to other types of inventory. If we’re selling something else, like coffee mugs over here, we may have a large amount of coffee mug they may be all completely the same.

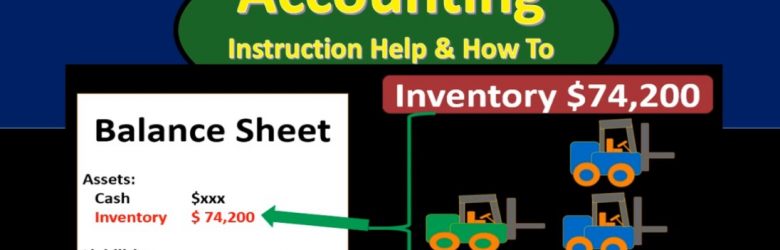

Inventory Tracking Explained – Introduction-Specific 10 600

Hello. In this lecture we’re going to talk about the idea of tracking inventory and recording inventory, both in terms of the balance sheet as well as the income statement in the format of cost of goods sold. In our example, we’re going to be purchasing and selling forklifts, meaning we’re going to purchase forklifts from the factory and then we’re going to sell those forklifts. That means that forklifts to us will be inventory their inventory because we are purchasing the forklifts in order to resell them for the generation of revenue. That’s really going to be the definition of inventory the purchasing of something for the resale of it as opposed to if we were someone else purchasing the forklift in order to help us generate revenue in another way through the use of the forklift, in which case it would then be property plant and equipment.