QuickBooks Online 2021 bank reconciliation month one, in other words, the first bank reconciliation for our data input as we entered into the QuickBooks on line system, we’re going to be focusing in on the report, the bank reconciliation report. Well, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars a practice problem, we’re now going to take a look at the bank reconciliation report after the first month of the bank reconciliation process to do so let’s first open up our report, go to the tab up top right click on it, duplicate that tab, we’re going to be opening up then our balance sheet report going down to the reports.

Posts with the numbers tag

Account & Settings – Expenses, Payments, & Advanced Tabs 6.25

QuickBooks Online 2021 account and settings, expenses, payments and advanced tabs. Let’s get into it with Intuit QuickBooks Online 2020. Here we are in our get great guitars practice file, we’re going to be continuing on with what would be similar to the preferences in the desktop version by going up to the cog up top in the upper right, going into the your company column. And taking a look at the account and settings group. We last time looked at the company tab, the billing and subscription tab, the usage tab, the sales tab.

Vertical Analysis Profit & Loss, P&L, Income Statement 3.25

QuickBooks Online 2021 vertical analysis, profit and loss, p&l or income statement, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online practice file, which you can find by searching in your favorite browser. For QuickBooks Online test drive, we’re in the Craig’s design and landscaping services, we’re going to go down to the reports down below modifying another P and L profit loss income statement.

Preferences – Account & Settings 30

QuickBooks Online 2021 preferences, account and account settings. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search page searching for QuickBooks Online test drive. And then we’re going to be picking QuickBooks Online test drive for Intuit, the owner of QuickBooks, we’re gonna verify that we are not a computer, or a robot, kind of the same thing, I guess, I mean, a computer can be a robot, but a robot doesn’t necessarily have to be. But in any case, we’re here on the Craig’s design and landscaping services, we want to touch in on the preferences or account settings, because when you set up a new company file, this is often one area that you’re going to zoom in on towards the beginning of the setup process.

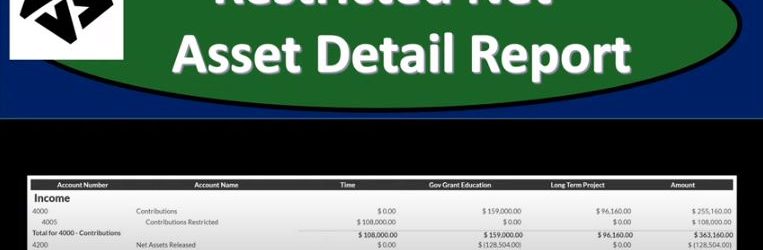

Restricted Net Asset Detail Report 190

This presentation we will generate, analyze, print and export to an Excel a restricted net asset detailed report and get ready because here we go with aplos. Here we are in our not for profit organization dashboard, let’s head on over to Excel to see what our objective will be. We’re currently in the 10th, tab, tab number 10. And last time and a few prior presentations, we’ve been creating the statement of activities, including three columns, two columns, for width restrictions, without restrictions, we then broke out the width restriction column out into the expenses by both function and by their nature.

Combined Leverage 525

Corporate Finance PowerPoint presentation. In this presentation, we will discuss combined leverage, get ready, it’s time to take your chance with corporate finance, combined leverage. Remember when we’re thinking about the term leverage, there’s typically two types of leverage that come into our minds. One is going to be the financial leverage the others the operating leverage the financial leverage, probably the one that pops into most people’s mind, if they’re familiar with leverage that being related to the debt in the organization and the risk and reward related to different levels of debt depending on the circumstances. And then we have the operating leverage, which has to do with the mix between the variable costs and the costs and the in the fixed costs.

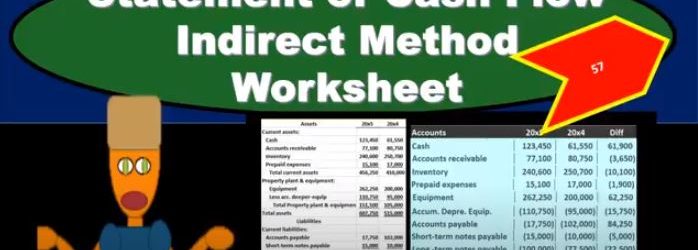

Statement of Cash Flow Indirect Method Worksheet

In this presentation, we will put together a worksheet that will then be used to create the statement of cash flows using the indirect method. To do this, we’re going to use our resources which will include a comparative balance sheet, and income statement and added information. Remember that in practice, we’re typically going to have a comparative balance sheet RS here being for the current year 2005 and 2000. x for the prior year. So we need a comparative to time periods in order to create our worksheet. This will be the primary components that we’ll use to create our worksheet. We will need the income statement when I’m creating the statement of cash flows mainly to check up on some of the differences that we will have in our worksheet. And then in a book problem will typically be told some other things related to for example, purchases of or sales of equipment, borrowings, if we had any cash dividends or any dividends at all, this is added information we would Need. In practice, of course, we would just be checking on these things by looking at the difference and going back to the GL. And just taking a look at those differences in order to determine if we have any added information that needs to be adjusted on our statement of cash flows.

Comparative Financial Statements 8.95

This presentation and we’re going to take a look at the month in financial statements. And this time since we have two months to compare, we’re going to be creating comparative financial statements comparing the two months that we have a comparative balance sheet, a comparative income statement, we’ll also take a look at the transactions by date, the great report for checking our numbers, reviewing numbers for an employee, and possibly even for billing purposes to see how many transactions has been made. So you can possibly bill by transaction.

Generate Report Export to Excel 7.80

This presentation and we will generate, analyze, print and export to Excel our month in financial statement reports that’s going to include the profit and loss report or income statement report, the balance sheet report, and then we’ll take a look at that transaction detailed report that’s going to give us a lot of information to see what we have done over the month. It’s really good information that some people use for billion for the month.