QuickBooks Online 2021 that statement of cash flows. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our QuickBooks Online test drive file, which you can find by searching in your favorite browser for QuickBooks Online test drive or in Craig’s design and landscaping services, we’re going to go down to the reports down below, opening up the other report, that’s going to be a financial statement report, but not really our two favorite ones, the two favorites being the balance sheet and income statement, the other financial report being the statement of cash flows, so we’re going to be opening up the statement of cash flows, I’m going to right click on the statement of cash flows.

Posts with the operating tag

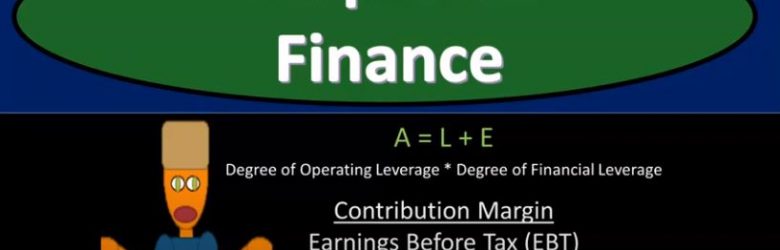

Combined Leverage 525

Corporate Finance PowerPoint presentation. In this presentation, we will discuss combined leverage, get ready, it’s time to take your chance with corporate finance, combined leverage. Remember when we’re thinking about the term leverage, there’s typically two types of leverage that come into our minds. One is going to be the financial leverage the others the operating leverage the financial leverage, probably the one that pops into most people’s mind, if they’re familiar with leverage that being related to the debt in the organization and the risk and reward related to different levels of debt depending on the circumstances. And then we have the operating leverage, which has to do with the mix between the variable costs and the costs and the in the fixed costs.

Financial Leverage 520

Corporate Finance PowerPoint presentation. In this presentation, we will discuss financial leverage, get ready, it’s time to take your chance with corporate finance, financial leverage. Now remember, when you hear the term leverage, you’re typically thinking of two different categories, that being financial leverage. And then the operating leverage the financial leverage, usually the one that most people think of when they think of leverage having to do with the leverage related to the debt, the operating leverage having to do with their leverage related to the cost structure between the variable cost and the fixed cost, the operating leverage having the leverage component when you have the in the fixed costs.

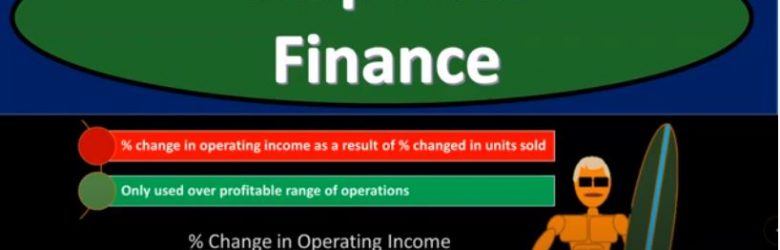

Degree of Operating Leverage 515

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the degree of operating leverage, get ready, it’s time to take your chance with corporate finance, degree of operating leverage. Now remember, when you hear this term leverage, there’s two things that pop into your mind that generally categories of leverage. The first one is probably related to debt debt leverage or financial leverage. And the other related to the cost structure, the one that we’re going to be focusing in on here, the structure between variable costs and fixed costs. So what’s going to be the structure of the variable cost fixed costs, that’s kind of what we’re measuring here, with the degree of operating leverage the fixed costs being the thing that’s going to have more leverage related to it.

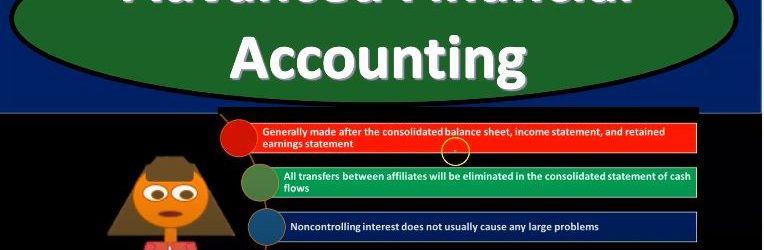

Consolidated Statement of Cash Flows

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss consolidated Statement of Cash Flows get ready to account with advanced financial accounting, consolidated statement of cash flows. So the consolidated Statement of Cash Flows we have a parent subsidiary relationship parent owning over 51% of the subsidiary therefore, we have the consolidated financial statements which of course includes the consolidated statement of cash flows. So, when we think about the consolidated statement of cash flows, we’re basically thinking about those areas where the cash flow statement will be different from a normal cash flow statement, which is one company or one business if you want to learn more about the cash flow statement, and I do recommend looking more into the cash flow statement because it’s one area where even in public accounting, oftentimes people don’t have as good a grasp on it as they could and some people are really good at reading it but don’t really understand as much of how to put it together in a room. systematic way even if there’s going to be, or especially when there’s going to be complexities to it. So we do have a course on the statement of cash flows, which we believe puts together a nice, simple, simple way in a systematic way to go through putting the statement of cash flows in such a way that, that you can do it in a step by step process. And then if you make an error, you can go back and you should be able to find that error easily and not have to kind of start the whole thing over again.

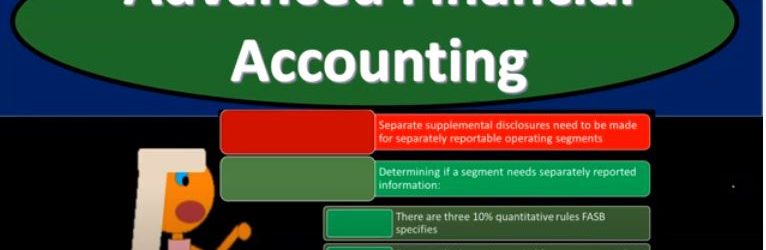

Threshold Tests for Segment Reporting

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss threshold tests for segments reporting, get ready to account with advanced financial accounting threshold tests for segment reporting separate supplemental disclosures that need to be made for separately reportable operating segments. So we’ve got these separately reportable operating segments, we have to then determine what type of reporting needs to be taking place for them. determining if a segment needs separately reported information. There are 310 percent quantitative rules FA SB specifies separate disclosure is needed for any segment that meets at least one of the three tests that follow. So we have the segment we got to think about Okay, do we need separate disclosure for this segment, and in order to determine that we’re going to use these 310 percent tests, they only need to meet one of these tests in order for the separate disclosure to be necessary that being 10% revenue test 10% profit or loss test and 10% assets tests. We’re going to go into more detail on each of these tests. Now some we’re going next slides we’ll be focusing in on these three items. So we’re going to start of course with the 10% revenue test. If an operating segments revenue, including both external sales and intersegment sales or transfers is 10% or more of total revenues from external sales plus intersegment. transactions of all operating segments, then segment is separately reported and supplemental disclosures must be provided for it in the annual report so that we have the 10% of revenue basically top line of course on the income statement to determine if the segment is separately reportable. Then we have the 10% of profit and loss. So now the next test now looking at the bottom line, of the income statement, as opposed to The top line if the absolute value of the segments profit or loss or absolute value, so, if we have a income or loss is 10% or more of the higher in absolute value of a the total profit of all operating segments that did not report a loss or be total loss of all operating segments that did report a loss, then the segment is separately reportable and supplementary disclosures must be provided for it in the annual report. So, you can think about these tests you got the 10% of the top line of the income statement, the revenue, basically 10% of the bottom line, profit or loss on the income statement. Now, we’re looking at the balance sheet 10% of assets tests. If these segments assets are 10% or more of the total assets of all operating segments, then the segment is separately reportable and supplementary disclosures must be provided for it in the annual report.

Threshold Tests for Segment Reporting

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss threshold tests for segments reporting, get ready to account with advanced financial accounting threshold tests for segment reporting separate supplemental disclosures that need to be made for separately reportable operating segments. So we’ve got these separately reportable operating segments, we have to then determine what type of reporting needs to be taking place for them. determining if a segment needs separately reported information. There are 310 percent quantitative rules FA SB specifies separate disclosure is needed for any segment that meets at least one of the three tests that follow. So we have the segment we got to think about Okay, do we need separate disclosure for this segment, and in order to determine that we’re going to use these 310 percent tests, they only need to meet one of these tests in order for the separate disclosure to be necessary that being 10% revenue test 10% profit or loss test and 10% assets tests. We’re going to go into more detail on each of these tests. Now some we’re going next slides we’ll be focusing in on these three items. So we’re going to start of course with the 10% revenue test. If an operating segments revenue, including both external sales and intersegment sales or transfers is 10% or more of total revenues from external sales plus intersegment. transactions of all operating segments, then segment is separately reported and supplemental disclosures must be provided for it in the annual report so that we have the 10% of revenue basically top line of course on the income statement to determine if the segment is separately reportable. Then we have the 10% of profit and loss. So now the next test now looking at the bottom line, of the income statement, as opposed to The top line if the absolute value of the segments profit or loss or absolute value, so, if we have a income or loss is 10% or more of the higher in absolute value of a the total profit of all operating segments that did not report a loss or be total loss of all operating segments that did report a loss, then the segment is separately reportable and supplementary disclosures must be provided for it in the annual report. So, you can think about these tests you got the 10% of the top line of the income statement, the revenue, basically 10% of the bottom line, profit or loss on the income statement. Now, we’re looking at the balance sheet 10% of assets tests. If these segments assets are 10% or more of the total assets of all operating segments, then the segment is separately reportable and supplementary disclosures must be provided for it in the annual report.

Segment Reporting Overview

Advanced financial accounting PowerPoint presentation. In this presentation, we will give an overview of segment reporting, get ready to account with advanced financial accounting, overview segment reporting. So when we think about segment reporting, we’re thinking about a company breaking that company into the segments. And when we think about the segments, two questions we want to consider are what is a segment? How does one qualify or how does a segment qualify as a segment and once qualifying for a segment, then what are going to be the financial reporting that needs to be done for the segment? So three characteristics of an operating segment, the component units, business activities, generate revenue and incur expenses. So the component unit that unit you can think about like a separate unit incurs revenue and has expenses including any revenue or expenses in transactions with other business units of the company? So we’re including the transactions if you’re thinking about it as a different segment, a different unit? You’re thinking okay, they have revenue and expenses with In the revenue worth, we’re also including any revenue or expenses, in transactions with other business units of the company. So you’re kind of thinking about a segment as being somewhat autonomous in and of itself here, and therefore having its own basically revenue and expenses, although it can be connected to other segments, the component units, operating results are regularly reviewed by the entities Chief Operating mark, operating decision maker.

Creating a Statement of Cash Flow-Indirect Method-Accounting%2C financial

Hello in this lecture we’re going to talk about creating a statement of cash flows using the indirect method, we will be able to define a statement of cash flows, create a statement of cash flows explain a process of creating a statement of cash flows designed to limit mistakes and define the indirect method. So what we’ll do is we’ll work through basically a problem and look through the statement of cash flows. We want to think about a few things we want to think about how to create a statement of cash flows, we want to think about a few definitions of what is a statement of cash flows, we want to kind of explain what the purpose is of a statement of cash flows and going through the process can help us to do that. Also want to point out that creating the statement of cash flows can help us with setting up a problem in such a way that we can limit the amount of mistakes that we will make. So a statement of cash flows is something that in a lot of firms, people generally often have problems to create the statement of cash flows. And it’s good practice to go in there and and create the statement of cash flows and try to create a system in which it’s easy for us to have checkpoints and see where a problem is going to happen.

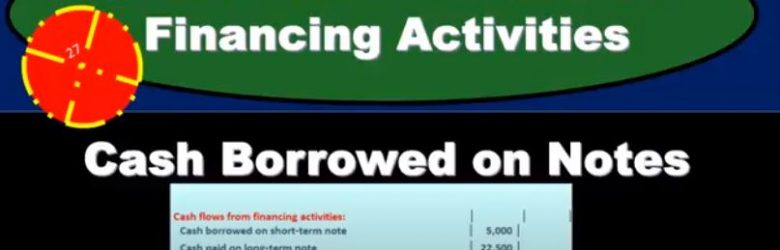

Statement of Cash Flow Financing Activities Cash Borrowed on Notes

In this presentation, we will continue on with the statement of cash flows. Looking at the financing activities looking at cash borrowed on notes, we’re going to be using the information with our comparative balance sheet, the income statement and the additional information focusing on the comparative balance sheet. First, it will be used to create this worksheet, we have going through this worksheet looking for all the differences and finding a home for them starting Of course, with cash down here, and then we kind of skipped around to pick up all of the cash flows from operating activities. And that’s really how people usually start this thing out. And rather than going just from top to bottom, picking out the operating activities, then we went back and we picked up the cash flows from investing activities. Now we’re going to go down and pick up the financing activities. And those deal with notes payable here. So we have the notes payable, and we have this common stock issuance. So those are going to be things that are typically going to be in the final financing. And you might think of as well, how would I know this? What? Why would I know that’s going through? Well, if we go through these, remember that the cash is obviously down here, that’s where we started. And then the current assets versus current liabilities, most of them are going to be up here. And that’s going to be the accounts receivable, the inventory, prepaid expenses, and then equipment.