QuickBooks Online 2021 bank reconciliation month two or for the second month of operation, we’re going to be focusing in on cash decreases in the bank reconciliation process. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice problem, we’re going to be continuing on with our bank reconciliation, first opening up our balance sheet and duplicating the tab up top. To do so we’re going to go up to the tab up top right click on it, duplicate the tab up top down to the reports on the left hand, then selecting our favorite report that being the balance sheet report opening up the balance sheet report.

Posts with the owner tag

Adjust Opening Balance Equity Accounts 6.85

QuickBooks Online 2021 adjust opening balance equity accounts. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars a practice problem, we’re going to continue on entering our beginning balances into our QuickBooks system. In prior presentations, we’ve been taking this trial balance, we’ve been entering all the beginning balances in these accounts, our objective and goal being to enter the beginning balance account by account, and then having the other side be placed by QuickBooks in the equity section in one way or another, either by putting it into the default account of opening balance equity, or into an income statement account as of the prior year to the one that we’re going to start our business in.

Deposits From Owner & Loan 7.05

QuickBooks Online 2021. Now, deposits from owner and from alone. Now, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, we’re now going to move on to some data inputs starting with a deposit from the owner and a deposit from a loan. Let’s first take a look at our financial statements, we’re going to be opening up the balance sheet, the income statement and the trial balance, I’m going to make three new tabs up top by right clicking on the tab, duplicating it, we’re going to duplicate it again, right click and duplicate and then one more time duplicating again.

Balance Sheet Report Overview 2.10

QuickBooks Online 2021 that balance sheet report overview. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive file, which you can find by searching in your favorite browser for QuickBooks Online at test drive are in Craig’s design and landscaping services practice file, we’re going to go down to the balance sheet by going to the reports down below, the balance sheet should be one of your favorite reports one of two favorite reports, not a matter of opinion, if it’s not one of your favorite reports, then your favorite thing is wrong, because it should be one of them. So we’re going to be opening up the balance sheet.

Financial Statements Overview 205

Corporate Finance PowerPoint presentation. In this presentation, we will give an overview of financial statements Get ready, it’s time to take your chance with corporate finance, financial statement overview, the financial statements will be the primary tool that will be used to value the company, the financial statements are going to be generated from the company.

Types of Business Organizations 120

Corporate Finance PowerPoint presentation. In this presentation, we will discuss types of business organizations, including the corporation, partnership, and sole proprietorship Get ready, it’s time to take your chance with corporate finance types of business organizations. Now, as we go through here, note that we’re focusing in on corporate finance, and therefore on the corporate type of business organization, but many of the concepts that we will learn will be applicable to all types of business organizations. Therefore, we want to have a general idea of the different main kind of components or main types of business organizations. So those will include a sole proprietorship, partnership, and a corporation.

Post Closing Trial Balance & financial statements

Hello in this presentation we will discuss the post closing trial balance and financial statements. When considering the financial statement relationship to the trial balance, we typically think of the adjusted trial balance that being used to create the financial statement. It’s important to note, however, that any trial balance that we use can be generated into financial statements. It’s just that the adjusted trial balance is the one that we have totally completed and prepared and ready. In order to create the financial statements to be as correct as possible as of the date we want them, which is usually the end of the month or the end of the year. Note that the names of the unadjusted trial balance the adjusted trial balance and the post closing trial balance are really a convention they’re all basically trial balances.

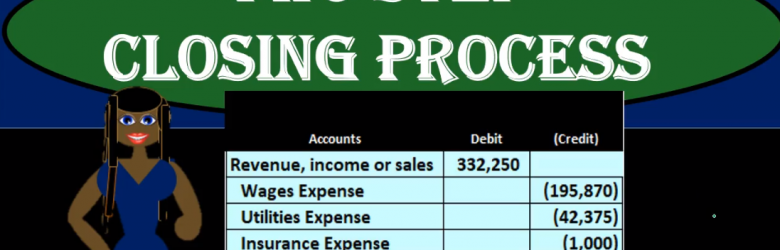

Closing Process Step 4 of 4 Closing Journal Entry Draws or Withdraws

Hello in this lecture we’re going to continue on with the closing process with step four, the final step of the process which will be to close out the draws. Remember that the objective is to have the adjusted trial balance be converted to the post closing trial balance. adjusted trial balance is what we use to create the financial statements. And the difference between the adjusted trial balance and the post closing trial balance will be that we want to have all temporary accounts including draws revenue and expense accounts to be converted to zero and have all that be in the owner capital account meaning the owner capital account will now be including all these accounts underneath it crunched into basically one number, we’re going to do that with a four step process.

Closing Entries Journal Entry 3 of 4 Step 3 Income summary

Hello in this lecture, we’re going to talk about the closing process step three of the four step closing process, which will include the close of the income summary to the capital account. Remember that our objective is to close out all the temporary accounts, which are all the accounts below capital, including drawers, and the income statement accounts of revenue and expenses. So we want the adjusted trial balance to be converted to the post, post closing trial balance, which means that everything from capital on down will be zero. The way we do that is the four steps and that includes step one we did in a prior video closeout income to the income summary. Step two was to close out expenses to the income summary. Step three is what we’re going to do now close out the income summary now having net income in it to the capital account, then we’re finally going to close out the draws to the capital account.

Two Step Closing Process

Hello in this presentation we will take a look at a two step closing process. In other words, we will perform the closing process using two journal entries. There’s a couple different ways we can see the closing process, each of them having a pros and cons. The two step process is nice because it allows us to see net income broken out and being closed out directly to the capital account, followed by draws, which is similar to what we see when we actually do the statement of equity, meaning that when we do the statement of owner’s equity, we start with beginning balance and then we increase it by net income and decrease it by drawers or dividends. Because this process is similar to that process, it’s often easy to remember it’s the easiest for me to remember in any case, so we will take a look at the two step closing process.