QuickBooks Online 2021 create invoice for the sale of an inventory item. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, we’re going to be entering an invoice. But before we do, let’s open up our reports balance sheet income statement, trial balance, and consider what will happen first, then record the invoice and then check out if what we thought was going to happen actually does happen. So we’re going to go up top, duplicate the tab, right clicking on it duplicating the tab, we’re going to do it two more times, right click Duplicate, right click Duplicate.

Posts with the pay tag

Payroll & Employee Reports & Bank Reconciliation Report 4.40

QuickBooks Online 2021 payroll and employee reports and bank reconciliation reports. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive file, which you can find by typing into your favorite browser, QuickBooks Online test drive or in Craig’s design and landscaping services, we’re going to go down to the reports down below.

Form 1099 & Expenses by Vendor Reports 4.30

QuickBooks Online 2021 form 1099. And expenses by vendor reports. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive practice file, which you could find by searching in your favorite browser. For QuickBooks Online test drive, we’re gonna be looking at our reports down below looking at a 1099 report, you could simply type in the search menu for 1099. But I’m going to locate it down here by scrolling down.

Pay Bills Form 1.22

QuickBooks Online 2021 pay bills form. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search page, we’re going to be searching for QuickBooks Online test drive. And then we’re going to be selecting QuickBooks Online test drive from Intuit. It’s then going to be verifying that we are not a robot, which I don’t think is very fair. It’s like they’re saying my good buddy see, threepio is not allowed in the QuickBooks establishment.

Vendor, Expense, Purchases, or Accounts Payable AP Cycle 1.15

QuickBooks Online 2021 vendor expense purchases or accounts payable AP cycle, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google browser, we’re going to search for QuickBooks Online test drive. And then we’re going to go into the QuickBooks Online test drive from Intuit to get to our practice file, verifying that we are not a robot that keep on trying to think I’m a robot, but I’m not. So I’m going to say no and continue here.

Purchase Order Form – P.O. 1.24

QuickBooks Online 2021 purchase order form otherwise known as a p OE form, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search page, we’re going to be searching for QuickBooks Online test drive, then we’re going to select the QuickBooks Online at test drive for Intuit. Once again, it’s going to ask us if we’re a robot. I’m starting to think I am a robot. You know, Wildwood asked me this so many times, but I’m gonna say no anyways, even though I’m starting to think maybe maybe I am a robot.

Check & Expense Forms 1.28

QuickBooks Online 2021. Check and expense forms. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search page, we’re going to be searching for QuickBooks Online test drive, then we’re going to be selecting and QuickBooks Online test drive. And then QuickBooks is going to try to call us a robot. Again, we’re gonna say we’re not a robot, you’re the robot, you’re you’re the robot, QuickBooks. And then we’re gonna log in there, we’re still looking at our vendor section. So if we hit the drop down over here, we’ve got the new drop down, we’re in the vendor section, we talked about, basically the accrual process, which is the entering of the bill and then the pain of the bill.

Pledge 135

This presentation, we’re going to enter a transaction related to a pledge and our accounting system. Get ready, because here we go with aplos. Here we are in our not for profit organization dashboard, let’s jump on over to Excel to see what our objective will be. We are in Excel, we’re in tab number three, we’re now recording a pledge. Now the pledge is going to be similar to the contribution. However, we haven’t got the money yet. So it’s a promise to pay. If you compare this to a for profit type of organization, the contribution would be similar to us doing the goods or services at the same point in time that we get paid. And you can imagine given a sales receipt, like at the register, at that point, and then the pledge is going to be similar to us doing a service or providing goods before we get paid.

Cash Budget 415

Corporate Finance PowerPoint presentation. In this presentation, we will be discussing the cash budget Get ready, it’s time to take your chance with corporate finance, cash budget, as we consider the cash budget, let’s take a step back and think about the budgeting process. So we can think about where the cash budget will fit in it. So we got to start off with the sales projection, that’s going to be our first step. So we can think about the production plan if we manufacture inventory, or we think about the purchasing plan. If we purchase and sell inventory, then we can think about the pro forma income statement. Now the pro forma income statement is going to be on an accrual basis. But we also want to be considering the cash budget. So obviously, once we have once we start to construct the income statement, on an accrual basis, we can also think about what the cash flows will be.

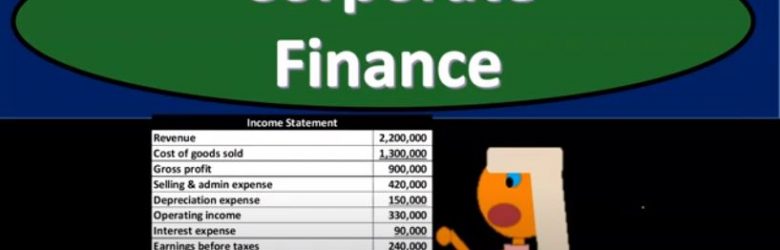

Income Statement Overview 225

Corporate Finance PowerPoint presentation. In this presentation, we’re going to continue on discussing the income statement. Get ready, it’s time to take your chance with corporate finance income statement continued. Remember that as we think about the financial statements, we can break them out into basically two objectives that an investor might have the investor would want to know two general things one, where does the company stand at a point in time with their approximate value as of a point in time? And two? What is the likelihood of their performance in the future? What how well, will they do in the future? How can we predict how well they will do, we’re going to base it on past performance. So the point in time statement is going to be the balance sheet. So remember, if you’re looking at financial statements, for the year ended, say, December 31, the balance sheet will be as of a point in time and therefore as of December 31, it will not be a range. Whereas if you’re looking at a time frame, meaning the beginning to the end of the period, so if you’re looking for financial statements for the period ended, or the year ended, December 31, then the income statement, the primary timing statement, will be represented, it’ll say January through December or for the year ended December 31.