In this presentation, we’re going to take a look at the setup process for the free trial of aplos. aplos is an accounting software that’s designed specifically for not for profit organizations they typically have and at this time do have a free trial component for it, which is a great tool to get used to the software and go through a practice problem as we will do here. Get ready, because here we go with aplos.

Posts with the price tag

Subsidiary Sells Additional Shares to Nonaffiliate

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss a consolidation process where we have a parent subsidiary relationship and the subsidiary sells additional shares to a non affiliate. So we have the subsidiary selling shares not to the parent, but to a non affiliate what will be the effect on the consolidation process? Get ready to account with advanced financial accounting. We are talking about a situation here where the subsidiary is selling more stock or additional stock to someone outside of the organization, someone who is not affiliated not to the parent or some other subsidiary, what will be the effect in the consolidation process? It’s going to increase the total stockholders equity of the consolidated entity by the amount received by the subsidiary in the sale. That of course would make sense because if you imagine the transaction taking place, then if they got cash for it, for example, cash would be going up the other side going to the equity so it’s going to be increasing the total stockholders equity will increase total shares outstanding for the subsidiary reducing the percent ownership of the parent company. So if the subsidiary then issues more shares and they didn’t go to the parent, then that means there’s going to be more shares outstanding. That means the shares that the parent owns will go down, therefore, their percentage ownership will typically go down. In that case, we’ll increase the amount assigned to the non controlling interest.

Bond Issued at Premium

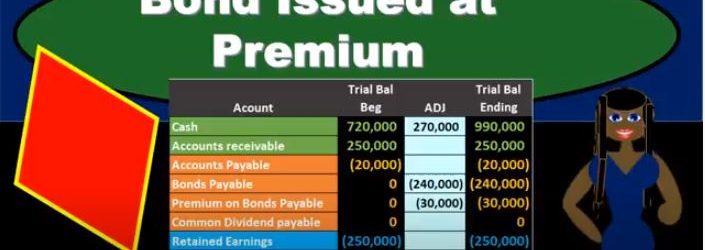

In this presentation, we will take a look at the journal entries related to issuing a bond at a premium. When considering the journal entry for a bond, remember what can change and what is the same for a bond. When we think about a bond, it’s already been printed, we know the amount of the bond, the interest on the bond, the maturity date of the bond, these are already set. So if we’re making a negotiation with the bond after it had already been printed, then we can’t change the face amount. We can’t change the interest due dates. What can we change in order to negotiate and make a sales price on the bond, we can change the amount that we issue it for. So keep that in mind. Whenever you think about these bond problems. That’s the thing that’s going to differ from a bond to a note. The thing that changes when we want to loan is the interest rate. The thing that changes when we want to issue a bond that’s already been made is going to be the amount we receive For the bond being different than the face amount of the bond if there’s a difference in the market rate and the contract rate. So in this example, we’re saying that we issued a bond. Now note that when we think about the issuance of the bond, just like a note, we often have more information than we really need. And that can be a little bit confusing for us.

Lower of Cost or Market

In this presentation we will discuss the concept of lower of cost or market. We will define this concept first and then see it and talk about how it would apply to inventory. The definition of lower of cost or market according to fundamental accounting principles, while 22nd edition is required method to report inventory at market replacement cost when that market cost is lower than recorded cost. So, what we’re saying here is we have we’re talking about the inventory, of course, and we’re saying that we have to record it at the replacement cost. When that replacement cost that market cost is lower than the recorded cost, what we actually purchased it for. So this looks like a confusing type of definition. However, it’s pretty straightforward. What we’re applying here is going to be the conservative principle meaning that if our inventory has declined in value, we have to record it at the lower cost. We don’t want to be overstating our income mentoree obviously regulations are very concerned about us overstating something, when we’re talking about an asset, and making the financial statements look better than they would rather than understating it.

Inventory Methods Explained and compared FIFO LIFO 15 600

Hello in this lecture we’re going to talk about estimating inventory methods methods such as first in first out last in first out and the average method. Last time we talked about specific identification when we were selling the inventory of forklifts. We use specific identification meaning we had an ID number for each particular forklift and knew exactly which forklift we sold and the cost of that particular forklift. reason that makes sense for forklifts is because they’re relatively large, they could be distinct in nature, and they have a fairly large dollar amount in comparison to other types of inventory. If we’re selling something else, like coffee mugs over here, we may have a large amount of coffee mug they may be all completely the same.