QuickBooks Online 2021 vendor expense purchases or accounts payable AP cycle, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google browser, we’re going to search for QuickBooks Online test drive. And then we’re going to go into the QuickBooks Online test drive from Intuit to get to our practice file, verifying that we are not a robot that keep on trying to think I’m a robot, but I’m not. So I’m going to say no and continue here.

Posts with the purchases tag

Cash Budget 415

Corporate Finance PowerPoint presentation. In this presentation, we will be discussing the cash budget Get ready, it’s time to take your chance with corporate finance, cash budget, as we consider the cash budget, let’s take a step back and think about the budgeting process. So we can think about where the cash budget will fit in it. So we got to start off with the sales projection, that’s going to be our first step. So we can think about the production plan if we manufacture inventory, or we think about the purchasing plan. If we purchase and sell inventory, then we can think about the pro forma income statement. Now the pro forma income statement is going to be on an accrual basis. But we also want to be considering the cash budget. So obviously, once we have once we start to construct the income statement, on an accrual basis, we can also think about what the cash flows will be.

Subsidiary Purchases Shares from Parent

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss a consolidation process where we have a subsidiary that purchases shares from the parent. So what’s going to be the effect on the consolidation process? When we have a subsidiary that purchases shares from a parent get ready to account with advanced financial accounting. We are talking about a situation here where this subsidiary is purchasing shares from the parent what’s the effect on the consolidation process? In the past, the parent has often recognized a gain or loss on the difference between the selling price and the change in the carrying amount of its investment. So in the past, it’s often been recorded as a gain or loss on parent companies that difference as a gain or loss on the parent company’s income statement.

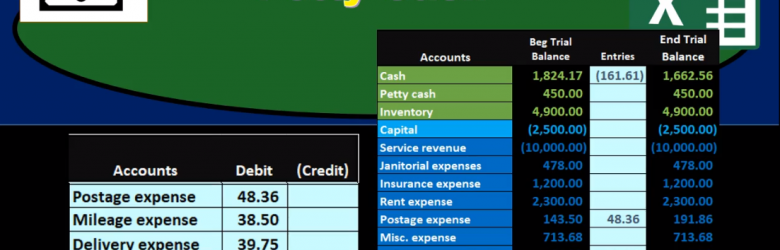

Petty Cash

In this presentation we will talk about how to set up and record a petty cash fund. Setting up a petty cash fund seems like an easy thing to do to have a minimal amount of cash that we can have expenditures for small purchases for however, it can be a little bit tricky to set up the petty cash fund and there is kind of a shortcut to recording transactions for the petty cash fund. So we’ll go over the process of setting up the petty cash fund recording the initial investment in the petty cash fund and then recording the activity from the petty cash fund. Now the objective of course in this will be to have not just the checking account where we need authorization in order to take money out of the checking account, we would typically want anything going out of the checking account to be by electronic fund transfer or by cheque so that we have a clear paper trail of what is going on the petty cash However, if we just have some small items that we need to take care of with cash and as to convenient to have small items with cash to be paid.

First In First Out FIFO Explained

Hello in this lecture we’re going to be taking a look at first in first out inventory method, we will be selling coffee mugs and we won’t be specifically identifying the coffee mugs. In this case, as we’ve talked about in a prior lecture of this time, we’re going to be using a cost flow assumption VAT cost flow assumption being the first in first out assumption this time to set up this problem in any cost flow assumption, I highly recommend putting together a worksheet that worksheet including headers of purchases columns, and then we got the cost of merchandise columns, then we have the ending inventory. I highly recommend setting up a worksheet like this, whether it’s by hand or in a computer or in Excel because it answers all the types of questions that could come up with an inventory cost flow type of assumption within those sections, we will then have the quantity and then the unit cost and the total cost we’re gonna have, if we sell something, we’re calculating the cost of that sale.

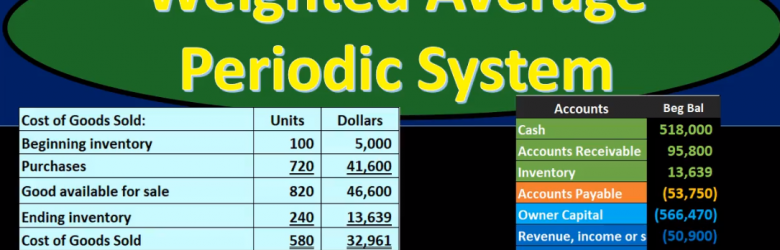

Weighted Average Periodic System

In this presentation we will discuss the weighted average inventory method using a periodic system. The weighted average method as opposed to a first in first out or last In First Out method, the periodic system as opposed to a perpetual system. We want to keep the other systems in mind as we work through this comparing and contrasting. We’re going to be working with this worksheet entering this information here. It’s important to note that this worksheet is a worksheet that can typically be used with any of these inventory flow type problems of which there are many. We have first out last in first out the average method. And then we have a perpetual and periodic system which can be used with any of those methods. It’s also possible for questions to ask for just one component such as cost of goods sold or Indian inventory, and therefore it can seem like there’s more types of problems that we can have in that format as well. If we set up everything in a standard way, even if that weighs a little bit longer for some types of problems, it may be easier because we can just memorize that one format to set things up, this would be a format to do that.

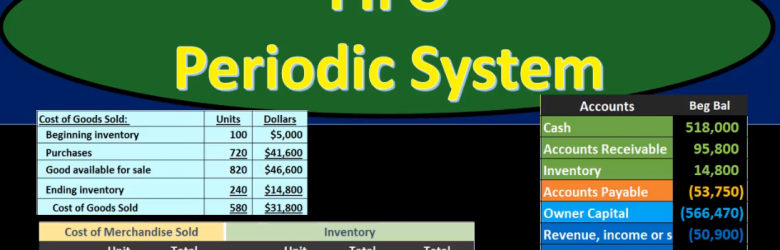

First In First Out (FIFO) Periodic System

In this presentation we will discuss first in first out or FIFO using a periodic system as compared to a perpetual system. As we go through this, we want to keep that in mind all the time that been that we are using first in first out as opposed to some other systems lastin first out, for example, or average cost, and we’re doing so using a periodic system rather than a perpetual system. Best way to demonstrate is with examples. So we’ll go through an example problem. We’re going to be using this worksheet for our example problem. It looks like an extended worksheet or large worksheet, but it really is the best worksheet to go through in order to figure out all the components of problems that deal with these cost flow assumptions, including a first in first out lastin first out, or an average method, and using a periodic or perpetual for any of them.

Special Journals Subsidiary Ledgers 2

In this presentation, we’re going to talk about special journals and subsidiary ledgers. First, we’re going to list out the special journals and talk about when we would use them, why we would use them and how they fit into the accounting system. The special journals are basically going to group types of transactions. So when we think about all the transactions that happened during the month, we typically see them in order of when they happen in the accounting system, we’re going to record transactions in other words, by date as they occur. But if we are able to group those transactions into special journals that can simplify the process.