Corporate Finance PowerPoint presentation. In this presentation, we will discuss financial markets Get ready, it’s time to take your chance with corporate finance, financial markets, financial markets help to provide indicators for maximizing shareholder value. So when we’re thinking about financial markets, we’re thinking about markets. In general, we’re thinking about purchasing and selling things, a place where people purchase and sell items, that means there’s competition, there’s different people competing within a market, that will typically lead to better information about the value of the items being sold.

Posts with the securities tag

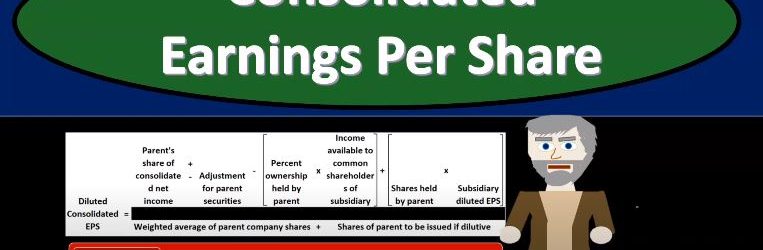

Consolidated Earnings Per Share

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss consolidated earnings per share, get ready to account with advanced financial accounting, consolidated earnings per share, how do we calculate the earnings per share for a consolidated entity, the basic calculation for the earnings per share will in essence be the same as for a single Corporation. So there’s not too much difference between the consolidated earnings per share calculations and the basic earnings per share for one entity one Corporation. So the basic earnings per share is is computed by deducting income to the non controlling interest and any preferred dividend requirement of the parent from the consolidated net income. So we’re going to take the net income and then we’re going to deduct income to the non controlling the non controlling interest and any preferred dividend requirement. In other words, we’re going to take the consolidated net income and then remove or deduct income to the non controlling interest and and in preferred dividend requirement, then we’re going to take that number, the amount resulting is divided by the weighted average number of the parents common shares outstanding during the period covered. So it’s a pretty straightforward calculation for the basic earnings per share, we do have practice problems on it. However, if you want to brush up on calculating the basic earnings per share, we have that there. diluted consolidated earnings per share is going to be a more complex calculation.

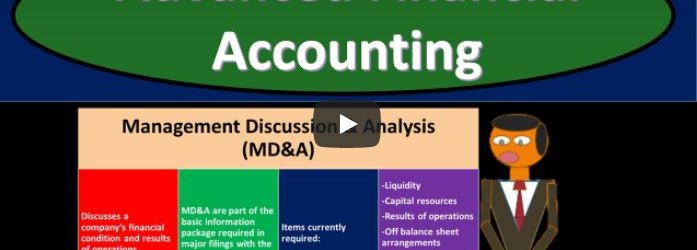

Disclosure Requirements

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss disclosure requirements get ready to account with advanced financial accounting disclosure requirements. We have the management discussion and analysis that’s often referred to as the M D and A discusses a company’s financial condition and results from operations. The MD and a are part of the basic information package required in major filing with the SEC, the Securities and Exchange Commission. Items currently required in the MD and a the management discussion and analysis include liquidity, capital resources, results of operations, off balance sheet arrangements, tabular disclosure of contractual obligations, disclosure requirements, pro forma disclosures, pro forma disclosures, financial presentations generally taking the form of summarized financial statements. demonstrate the effect of major transactions that happen after the end of the fiscal period or that happened during the year, but are not fully reflected in the company’s historical cost financial statements.

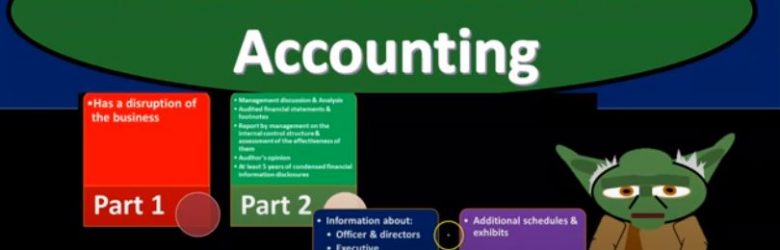

Periodic Reporting Requirements

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss periodic reporting requirements for publicly traded companies get ready to account with advanced financial accounting, periodic reporting requirements, companies that have more than 10 million in assets and whose securities are held by over 500. Persons must file annual and other periodic reports to provide updates on their economic activities. So remember the general rule here we’re talking about publicly traded companies that have a benefit of being able to be publicly traded to the public on the exchanges. And in exchange for that we want to see some more basically transparency, and therefore you’ve got the filing process that needed to take place. We see some regulation by the SEC that we talked about in prior presentations. And then going forward, we want to keep and maintain the transparency the information so that there’s both the investors and the companies have the information necessary in order to enter into a agreements. And therefore we’re going to need some continuing reporting, what are the what’s going to be the requirements in terms of the continuing reporting. So once again, companies that have more than 10 million in assets and whose securities are held by over 500 persons must file annual and other periodic reports to provide updates on their economic activities. And that’s going to increase that transparency so that investors know what is happening and they can invest with full information to do so. three basic periodic reporting forms used for this updating our form 10 k form 10 Q and form eight K. Let’s start with the form 10 k form 10 k is the annual filing to the SEC the Security and Exchange Commission.

Registering Securities with SEC Process

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss the process of registering securities with the SEC, the Securities and Exchange Commission get ready to account with advanced financial accounting, issuing securities. If a company wants to sell debt or stock securities in interstate offerings to the general public, they are usually required by the Securities Act of 1933 to register those securities with the SEC. So one more time, we’re talking about the issuing of securities if a company wants to sell debt or stocks securities in interstate offerings to the general public, so now we got the interstate offerings going to the general public, in order to have that benefit. They are usually required by the Securities Act of 1933 to register those securities with the SEC. And you can see we saw a little bit of history in the prior presentation on how this could develop. Obviously, it’s going to be a benefit to the businesses in order to To generate capital typically to be able to offer the stock to the general public in interstate offerings. But in order to do so then you would think you’d want to have some transparency that will be involved in it so that both sides of the negotiation will be involved. That’s where the SEC came into play here. So we talked a bit about the SEC and its role in a prior presentation we’ll get more into the process of the registration here. General financial statement required for this process will typically include two years of balance sheets three years of statements of income, three years of statements of cash flows, three year of statement of stockholders equity, prior years statements are generally presented on a comparative basis with the current years it will typically have a comparative basis. For the for the comparative years prior and current year.

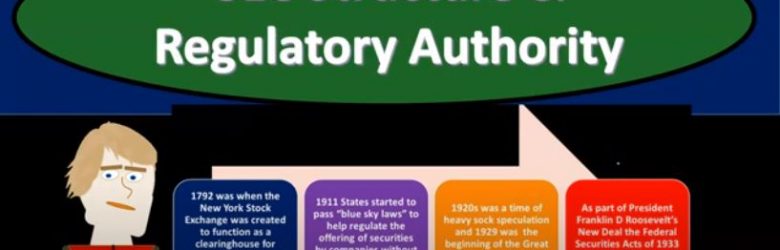

SEC Structure & Regulatory Authority

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss sec structure and Regulatory Authority get ready to account with advanced financial accounting in sec structure and regulatory authority, Securities and Exchange Commission the SEC What is it? It’s an independent federal agency It was created in 1934. It’s going to regulate and it does regulate the securities markets, the SEC helps maintain an effective marketplace for companies issuing securities and for investors seeking capital investments. Now we’ll take a look at a brief history of leading up to the creation of the SEC and a little bit about the SEC itself. So if we have an understanding of the history, then it gives us a little bit better of an understanding of why the SEC does what it does today and how it how it was created or came to be. So in 1792, was when the New York Stock Exchange was created to function as a clearing house. For the securities trades between its invit its investors. So now we have the New York Stock Exchange that will function as the clearing house. But then in 1911, states started to pass, quote, blue sky laws in quotes to help regulate the offerings of securities by companies without a solid financial base. So in other words, they saw a need for regulation, now that you have the securities that are on the New York Stock Exchange and can then be offered basically, to more to the public, more people will have access to purchasing them and putting capital into the market, then there’s a lack of transparency, the people that are putting money in maybe doing it solely on speculation, and we don’t have the information to really support the claims possibly that could be made by the stocks that are that are being traded and therefore, you could have situations and did have situations where you had stocks that had no supporting you know, value or very little supporting value to them.