QuickBooks Online 2021 vertical analysis, profit and loss, p&l or income statement, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online practice file, which you can find by searching in your favorite browser. For QuickBooks Online test drive, we’re in the Craig’s design and landscaping services, we’re going to go down to the reports down below modifying another P and L profit loss income statement.

Posts with the similar tag

Fund Raising Purposes 121

In this presentation, we’re going to set up and analyze the function of purposes within our accounting software, the purposes are going to be similar or serve a similar function as the items like inventory items and service items in a for profit organization. Get ready, because here we go with aplos. Here we are on our not for profit organization dashboard. Last time, we were over here in the accounting section, and we set up our chart of accounts and we set up our tags. Now we’re going to be going into the donations section we’re going to go into the donations, this is going to be our revenue type of site of section if you’re thinking about this as a comparison to a for profit type of organization, is how we’re going to be generating revenue with those donations.

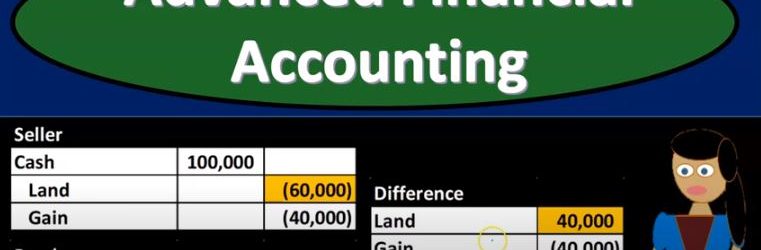

Depreciable Asset Transfer

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss the depreciable asset transfer. In other words, a transfer intercompany transfer with the context of our consolidation process. In essence, a transfer from parent to subsidiary or subsidiary to parent get ready to account with advanced financial accounting. In prior presentations, we talked about the transfer of land and we talked about the transfer of inventory. So the depreciable assets are going to be similar to the transfer of land but now we’ve got that added depreciation we’re going to have to deal with so it’s going to be similar to the transfer of land except that depreciation adds a level of complexity because we are now dealing with an asset that has a change in value over time.

Equity Method and Land Transfer

Advanced financial accounting PowerPoint presentation. In this presentation we’ll take a look at the equity method and land transfer get ready to account with advanced financial accounting, land transfer intercompany. Within the context of our consolidation, then we’re talking about situations where land is transferred from subsidiary to parent like a sale from subsidiary to parent or from parent to subsidiary. That resulting in basically an intercompany type of transaction we’re going to have to deal with with the consolidation process and possibly with the recording of the equity method by the parent as they reflect their investment in the subsidiary. We talked a little bit last time about the land transfer being similar to the inventory transfer because typically you’ll have like a gain that will be involved in it and your physical inventory that is changing hands. It does not have the added complexity as the property plant and equipment type of transfer. That would be depreciable assets with regards to accumulated appreciation and appreciation.

Segment Reporting Overview

Advanced financial accounting PowerPoint presentation. In this presentation, we will give an overview of segment reporting, get ready to account with advanced financial accounting, overview segment reporting. So when we think about segment reporting, we’re thinking about a company breaking that company into the segments. And when we think about the segments, two questions we want to consider are what is a segment? How does one qualify or how does a segment qualify as a segment and once qualifying for a segment, then what are going to be the financial reporting that needs to be done for the segment? So three characteristics of an operating segment, the component units, business activities, generate revenue and incur expenses. So the component unit that unit you can think about like a separate unit incurs revenue and has expenses including any revenue or expenses in transactions with other business units of the company? So we’re including the transactions if you’re thinking about it as a different segment, a different unit? You’re thinking okay, they have revenue and expenses with In the revenue worth, we’re also including any revenue or expenses, in transactions with other business units of the company. So you’re kind of thinking about a segment as being somewhat autonomous in and of itself here, and therefore having its own basically revenue and expenses, although it can be connected to other segments, the component units, operating results are regularly reviewed by the entities Chief Operating mark, operating decision maker.