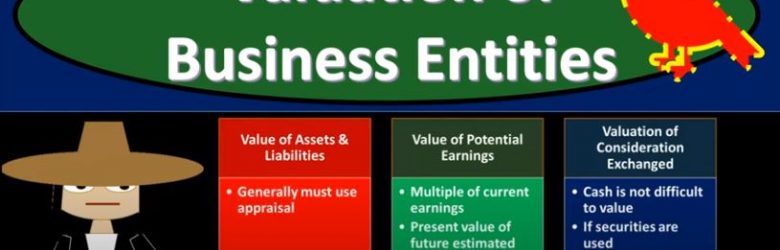

In this presentation we’re going to talk about valuation of business entities when there’s going to be an external expansion. In other words, a merger or consolidation, get ready to act because it’s time to account with advanced financial accounting. We’re continuing on with our discussion of external expansion. That means we’re have two separate entities that are going to be combining in some way shape or form. The two types that we want to keep in mind at this point is the acquisition of assets and the acquisition of stocks. So if the acquisition of assets we have one company acquired another assets using negotiation with management, so that means you have two separate entities and one entity is basically going to be purchasing the assets of the other entity versus the acquisition of stock, where we have a majority of outstanding voting shares is generally required, unless other factors result in the gaining of control. So in other words, you have two entities, one entity in essence buying a controlling share or controlling ownership over 50% typically 51 and above. Have another entity. So from an accounting perspective, then the question is, well, how are we going to value the assets and liabilities. Now when we think about the assets and liabilities, we may have to use an appraisal oftentimes, in order to do so because remember, if you’re talking about some assets, they might may be on a fair value method, because you might be talking about cash or something like that, or possibly stocks or investments in that way, that may be easy to value with a market method. However, if you’re talking about things like property, plant and equipment, then it’s going to be more difficult to know what the value is. That’s the problem because there hasn’t been a market transaction for that exact same piece of equipment for some time.

Posts with the stock tag

Forms of Business Combinations

This presentation we’re going to talk about forms of business combinations, which is basically external expansion, two types of entities that are going to be related in some way, shape or form, get ready to act because it’s time to account with advanced financial accounting, forms of business combinations. Now remember, we’re talking about expansion. Here, we’re thinking about expansion. We’ve got the two categories, we’ve got the internal expansion and external expansion. We’re considering here, the external expansion, we have an organization that now wants to expand and they’re going to be consolidated in some way or have two separate entities that will be combining. So now we’re talking about two separate legal entities typically separate legal entities that are now going to be combined in some way shape or forms. The forms of business combinations can be the statutory merger, the statutory consolidation, and the stock acquisition. So if you think about, in other words to separate legal entities and say, Alright, well how can these two separate legal entities be combined in some type of way, you can imagine some different Kind of scenarios in which that could take place. So and when you’re imagining those different types of scenarios, you’re going to be thinking about, okay, well, what’s going to be the key factor here, it’s going to be the controlling interest. So what’s going to be a situation where you had two separate legal entities, and now they’re they’re going to be have some controlling relationship, which could be that they’re combined together under one entity at some point or they are having a parent subsidiary type of relationship, in which case the control would be over the 50%. So that control concept is what you want to keep in mind here.

Allocate Expenses to Classes

This presentation we’re going to take a closer look at external business expansion, which includes things like mergers and business combinations, get ready to act, because it’s time to account with advanced financial accounting. Before we move into the external expansion, you want to give a review and keep your mind on what our focus is we’re talking about a business that is expanding. When we think of it about expansion, we can break that expansion into internal and external expansion. So we have a business expanding into new areas do segments, we can think of it as an internal or external expansion. In a prior presentation, we talked a little bit more on the internal expansion, in which case you might have a situation where a parent creates a subsidiary or a parent basically just creates another division possibly, and expands in that format. Now we’re going to be going to the external expansion, in which case we’re talking about two entities. So we have two separate legal entities that in some or two separate entities in some case in some way, shape reform are coming together. So now we’re going to have an expansion where we have an external expansion. So if we’re thinking of thinking about this, from the from the standpoint of one company, we’re thinking about ourselves as one company and we are expanding, then we’re thinking about the expansion externally, that we are going to be combining in some way shape or form with another company. Now, the format and form in which that combination can take place can be various we can have various forms of that combination, it could result in a parent subsidiary type of relationship, or it could result in the parent basically consuming that another company and bringing them into the overarching parent company.

Internal Business Expansion

In this presentation, we’ll take a closer look at internal business expansion, get ready to act because it’s time to account with advanced financial accounting. In our previous presentation, we talked about the types of expansion that a company can take. And we broke those out into the general categories of internal expansion and external expansion. The internal expansion, meaning we have a corporation or a company that needs to expand wants to do so internally might result in other divisions or might result in a creation of a subsidiary, the external expansion meaning we have two entities that are separate and somehow come together, which still could result in something like a parent subsidiary type relationship, or some type of division. So we’re going to be considered here the internal ideas the internal concept or internal expansion. So we have one organization, the organization wants to grow and expand possibly into a different sections or segments are different industry, and therefore they’re going to expand in some way shape. shape or form. Typically, we’re thinking of the creation in this case of a subsidiary type of relationship, in which case, they might create a separate legal entity. And that would be the giving of the assets and possibly liabilities to a separate legal entity that would be created. In other words, the parents company, setting up a subsidiary in some way, shape or form. And then given the subsidiary some assets and the liabilities that were formerly the parents organization, and then having a parent subsidiary type relationship with that subsidiary unit, us from an accounting standpoint, then having to think about how are we going to account for that with regards to financial accounting with that parent subsidiary type of relationships. So types of business entities that could be involved with this, we could have a subsidiary company and that’s the one you’d probably most be considering.

Accounting Related to Ownership & Control

In this presentation, we will take a look at accounting methods which will relate to and depend on ownership and control, get ready to account with advanced financial accounting. Accounting related to ownership and control methods used to account for investments in common stock will depend on the extent of influence or control, the investor can exercise over the investi. So in other words, we’re gonna have different methods depending on the level of control. Now, if we’re going to use different methods, we need to have some kind of definition we need to have some lines in terms of when we’re going to apply these different methods. What does it mean to have different levels of control? And then how do we apply those in practice so we can have some kind of standardization for that.

Accounting Related to Ownership & Control

In this presentation, we will take a look at accounting methods which will relate to and depend on ownership and control, get ready to account with advanced financial accounting. Accounting related to ownership and control methods used to account for investments in common stock will depend on the extent of influence or control, the investor can exercise over the investi. So in other words, we’re gonna have different methods depending on the level of control. Now, if we’re going to use different methods, we need to have some kind of definition we need to have some lines in terms of when we’re going to apply these different methods. What does it mean to have different levels of control? And then how do we apply those in practice so we can have some kind of standardization for that.

Securities Carried at Fair Value Accounting

In this presentation, we’re going to focus in on situations where we have securities carried at fair value using fair value accounting, this will typically be the case if one company is investing in another company, and they do not own above the 20%. That’s going to be basically the general rule. In other words, they don’t have significant influence, and therefore, we’re going to be using the fair value accounting method for them get ready to account with advanced financial accounting. In a prior presentation, we discussed in general different accounting methods we were going to use depending on the level of control or influence that one company has on another company we set what can be kind of arbitrary kind of points, which means zero to 20%. We’re going to use one method that they carried value 20% to 50%, the equity method and then 51 through to 100. We might be having a consolidation at that point. So now let’s break that down and concentrate on each of these in a little bit more detail This time, let’s focus in on this first category. Now this would be the category where typically most of the time you would be you would be accounting for something as in most cases, if you’re just investing if one company is just investing like a normal type of investment, just like an individual’s investing, they don’t expect to have really influence over the decision making process, because they have, they don’t have a controlling interest in order to do so it’s just a normal type of investment type of situation, that’s going to be the norm kind of here. And then once once the ownership gets over to a certain percentage 20% 20% being quite large, I mean, if you think about the number of shares that are out there for a large company or something like that, like apple or something like that, you would need a lot of shares to basically be constituting 20% ownership.

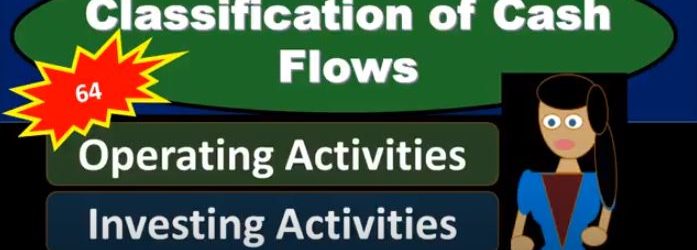

Classification of Cash Flows

In this presentation, we will take a look at classifications of cash flows on the statement of cash flows, there’s going to be three major categories on the statement of cash flows. Those will be operating activities, investing activities, and financing activities. So our goal here, when we go through the statement of cash flow as we work through the statement of cash flows is going to be in part to decide which area these cash flows should go, should they go into operating, investing or financing. It’s going to be common questions and common problems and really just information we need to know when reading the statement of cash flows. So we’ll start off with the operating activities. We’re just going to look at the major components of the cash flows within the operating activities. So we’ll talk about inflows and outflows. Remember what we’re talking about here is cash. So when we’re talking about the statement of cash flows, we’re talking about cash flows, the cash that goes into the company, they cashed out goes out to the company. We’re going to talk about inflows and outflows here related to operating activities. Before we go into the list of inflows and outflows related to operating activities, we want to know first, that operating activities is going to be similar to us thinking about the income statement on a cash basis. So when we think about the operating activities were really thinking or one way to think about it would be that if we were to have the income statement on a cash basis, then what would the inflows and outflows be that’ll basically be what are in the operating activities when we get to the thought process in terms of how to determine operating investing and financing activities.