In this presentation, we’ll take a closer look at internal business expansion, get ready to act because it’s time to account with advanced financial accounting. In our previous presentation, we talked about the types of expansion that a company can take. And we broke those out into the general categories of internal expansion and external expansion. The internal expansion, meaning we have a corporation or a company that needs to expand wants to do so internally might result in other divisions or might result in a creation of a subsidiary, the external expansion meaning we have two entities that are separate and somehow come together, which still could result in something like a parent subsidiary type relationship, or some type of division. So we’re going to be considered here the internal ideas the internal concept or internal expansion. So we have one organization, the organization wants to grow and expand possibly into a different sections or segments are different industry, and therefore they’re going to expand in some way shape. shape or form. Typically, we’re thinking of the creation in this case of a subsidiary type of relationship, in which case, they might create a separate legal entity. And that would be the giving of the assets and possibly liabilities to a separate legal entity that would be created. In other words, the parents company, setting up a subsidiary in some way, shape or form. And then given the subsidiary some assets and the liabilities that were formerly the parents organization, and then having a parent subsidiary type relationship with that subsidiary unit, us from an accounting standpoint, then having to think about how are we going to account for that with regards to financial accounting with that parent subsidiary type of relationships. So types of business entities that could be involved with this, we could have a subsidiary company and that’s the one you’d probably most be considering.

01:53

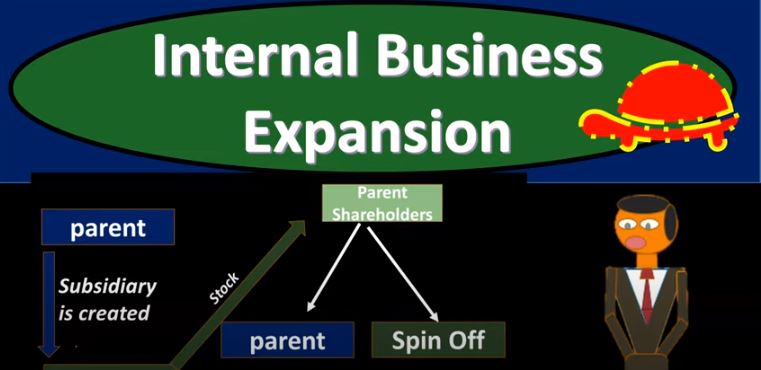

We have one type of business entity, they’re going to expand. They want to go into a new industry and they want to have some type of liability protection are some of the other benefits that we talked about with regards to a separate legal entity that’s going to be owned by in some way or controlled by the parent, you will be thinking typically of a subsidiary company. We can also have, however, a partnership and have a similar relationship with regards to a partnership, a joint venture, or some type of special entities in a similar type of relationship with regards to the expansion process and how we would structure or format the expansion process for an internal expansion. Now, we also want to be aware or the idea of a spin off so a spin off is something that’s going to happen when subsidiary ownership is distributed to the partner stockholders and the parent stockholders did not surrender any of their stock. So that might happen it would look something like this if we have a spin off type of situation. The parent then creates the subsidiary is going to be putting the assets and liabilities possibly into the CIP the subsidiary resulting in a parent subsidiary type of relationship. And then the stock of the subsidiary is going to go to the parent shareholders. So in other words, your if we think about the hierarchy that we have here in a spin off, why would this happen? By the way, possibly, you have a segment of the of the organization, which the company does not want is saying this segment of the organization no longer lines up to our principal objectives. It still is a value, of course, we have the assets regarding this segment. But we would like to spin it off so that we can focus in on what we want to do. And note that you’re seeing here that that different kind of perspective with regards to do you want to diversify? Should we grow? Or should we or should we not? Or should we focus in on what we do and that’s going to be from a managerial perspective. And we’ve seen periods of growth where many companies are in the in the trend of just making basically conglomerates, where they’re going to be where they’re really focused on. growing and diversification, and we’ve seen trends, where there’s a big contraction, a lot of times we’re a company saying, hey, look, you know, I’m gonna be focusing in on the thing that I do well, and you have a period of contraction, and and then focus. so if you’re saying here that it’s going to be a period of contraction, the company might be saying, look, we got a lot of things here that we don’t think is our core, our core business, we think they could do well.

04:25

But what we want to do is focus in on one thing, well, how can we then spin off or get get out of these type of areas and and just and still be generating utilizing the assets related to them? Well, you can say, all right, well, the parent, how about they create a parent subsidiary. So we’ve created a new company, we’ve taken those assets that we’re not, we don’t want to be focusing in on that division. You can think of it and putting it into the subsidiary, then we’re going to be providing the stock of that subsidiary to the parent shareholders. Now remember, if you’re talking about the parent corporation, The shareholders own the stock and basically that’s the ownership of the parent corporation. The parent corporation now spins off the subsidiary and they give the stock of the subsidiary to the parent shareholders. So the result then if you’re a shareholder if you’re an owner of this corporation, then you used to have your shareholder owns, then owning the parents company, the parent and then the parent company made the subsidiary right then the subsidiary was owned by the parent the parent own this, the shareholders of the subsidiary, you the shareholder then owned the stocks of the parents. So you would see a relationship between shareholders then owning the parents company, the parent company, now making another subsidiary, which the parent company owns, then the stocks from the parent company are transferred to the the parent shareholders. So now you as the shareholder own, the parents company. And then as a separate legal entity that’s not a subsidiary of the parent company also owns the new company, or the spin off. So in this relationship, what has happened here, now the parent company does not have a subsidiary relation with the spin off company. But the stockholders are still in the same situation and that they haven’t really lost anything here, right, because they still own the assets that are in the parent company, and the assets that have been spun off to the subsidiary company.

06:31

So that that’s going to be a spin off type of situation. That means that lets the parent company then focus in on what they what they believe is their core value that allows the spin off company hopefully to focus in on their core value without any relationship between the two because the assumption here of course, would be that these are actually two different industries that can pursued different goals are not going to be related not even divisions or parent subsidiary relationship, and the shareholders then, again, result in that same type of situation. Where they still have ownership of the net value, the net assets of the whole the whole package here, the parent and the subsidiary. Okay, so then we have a split off, which is going to be a little bit different happens when the subsidiary ownership shares are exchanged for the shares of the parent. So we had a spin off now we have a split off so the split off happens when subsidiary ownership shares are exchanged for the shares of the parent. The result in the split off is a reduction in the shares of parent company that are outstanding.