As we enter the 2023 tax season, it’s important to know when and where to file your income tax return. Filing your taxes correctly and on time can help you avoid penalties and interest, while also preserving your wealth. In this blog post, we will provide an overview of the income tax filing requirements for tax years 2020 to 2023.

Posts with the tax tag

Purchase & Finance Equipment Add Sub-Accounts 8.79

QuickBooks Online 2021 purchase and finance equipment and add sub accounts. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, we’re going to be opening up a few reports up top balance sheet income statement trial balance,

Pay Sales Tax 8.60

QuickBooks Online 2021. pay sales tax. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, we’re going to be opening up a new tab to open up the trial balance, I’m going to go up top, right click on the tab up top, duplicate that tab to open up, then the trial balance, which is going to be found then on the left hand side in the reports, going to type up top to find the trusty TB trial balance typing into the find score, trial balance, trial balance.

Setup Sales Tax 6.65

QuickBooks Online 2021 setup sales tax. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file we’re going to be discussing turning on and setting up the sales tax. Before we do, let’s just recap the sales tax and how it will be working so that the setup will make more sense as we go through it. When we apply the sales tax, it’ll be on a sale.

Managing Users 6.30

QuickBooks Online 2021 managing users, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, we’re going to go up to the user settings, which is up in the cog in the upper right hand side. So we’ll select the cog, we’re in the your company area or the your company section, we want to go down to the Manage Users. So then within the Manage Users, you can basically break them out first into two categories, one being the user category.

Account & Settings Company Tab 6.15

QuickBooks Online 2021 account and settings company tab. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, this is a new company file with no data in it so that we can practice the data input from scratch from the point where there’s nothing in it at the starting point. So in other words, this is not the free QuickBooks Online test drive company file, but rather a new company file that we can save the data as we go through the comprehensive practice problem.

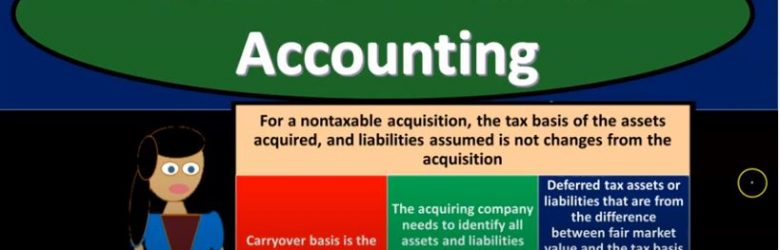

Consolidation & Income Taxes

Advanced financial accounting PowerPoint presentation. In this presentation we’ll talk about consolidation and income taxes get ready to account with advanced financial accounting. For a non taxable acquisition, the tax basis of assets acquired and liabilities assumed is not changed from the acquisition. In this case, then the carrying basis is the acquire ease basis, the acquiring company needs to identify all assets and liabilities acquired and their fair market value when the acquisition takes place, and then the deferred tax assets or liabilities that are from the difference between the fair market value and the tax basis when allocating the purchase price must be recorded by the acquiring company. So we have the tax expense allocation. When consolidated return is filed. What are we going to do with this tax expense allocation, the parent company and subsidiaries can file a consolidated income tax return or they can choose to file separate returns. So this is one of the things that we kind of have to consider here we’ve got a controlling interest that’s going to be involved. So we have two entities, one has a controlling interest and the other obviously parents subsidiary type of relationship question, then should we report just one tax return? Or should we have two tax returns, this is going to be a decision that needs to be made. But if we file one tax return, then at least 80% of its stock must be held by the parent company or another company included in the consolidation return for a subsidiary to be eligible to be included in a consolidated tax return.

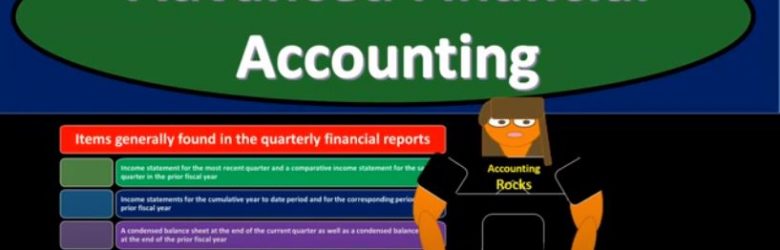

Interim Financial Reporting Rules

Advanced financial accounting PowerPoint presentation. In this presentation we will take a look at interim financial reporting or rules get ready to account with advanced financial accounting. Interim financial reporting rules started off with interim report. So interim reports they will cover a time period of less than a single year. So when we’re thinking about the interim reports, when we’re thinking about interim information, we have the year in information when we think about financial statements, we often what pops into most people’s head most of the time are going to be for the year ended financial statements income statement covering January through December balance sheet covering the year end. If it’s a fiscal year calendar year in interim, then we’re going to be talking about the financial statements at some interim period typically quarterly, quarterly meaning first, second, third quarter and then you got the yearly information for the fourth quarter. Therefore, the interim reports they will cover a time period of less than a single year. The goal is to provide timely information about the company’s options. Throughout the year, so obviously more information is nice. We want timely information for the decision makers, we got the year end reports, it would be nice if we have the quarterly reports, which we have now, to give us more timely information as the year goes by. quarterly reports are required to be published for publicly held companies. So if you’re a publicly held company, that company’s stock is being traded on stock exchanges and whatnot, then people need current information. The market needs current information. Therefore, it’s a requirement to have the quarterly reporting for that timely information. The quarterly reports can generally be thought of as smaller versions of the annual report. So when we think about the annual reporting, what’s going to be included in it, the quarterly reports is, as you would kind of expect, right a smaller version of that as we’re doing the reporting for a timeframe that’s going to be less than the entire year. Here some type of interim reporting requirements form q 10 q or form 10 q sec s quarterly report.

Depreciation Adjusting Entry 10.45

This presentation and we’re going to enter and adjusting entry related to depreciation. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. Let’s go down and open up our reports, we’re going to go down to the reports down below, open up our favorite reports at the end the balance sheet reports, we’re going to open that one up, we’re going to be changing the dates up top going to go up top and change those dates from a one on one to zero to 1231. Let’s make it as of the cutoff date here, Ode to 29 to zero, and then run that report and duplicate the tab up top by right clicking on it and duplicating it.

Sales Receipts & Deposit 8.25

This presentation and we’re going to record a sales receipt and deposit. In other words, we’re going to imagine there’s a sale that takes place, we’re going to make that sale, record that sale with the sales receipt and then go to the bank with that deposit, deposit that into the bank and record that deposit as well into our system. Let’s get into it with Intuit QuickBooks Online.