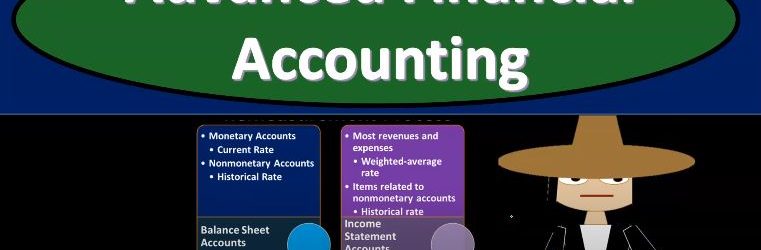

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss the remeasurement process for financial statements of a foreign subsidiary. Get ready to account with advanced financial accounting remeasurement financial statement of foreign subsidiary remeasurement overview so we’re going to go through the process of the remeasurement. As you think of the measurement process, you want to be comparing and contrasting it to the translation process. So you’re envisioning basically you got a parent company. The parent company has a subsidiary the subsidiary is a foreign subsidiary. The subsidiary then conducts their books. Typically we’re thinking in a foreign currency right, that subsidiary is conducting their books in a foreign currency. If we need to consolidate the subsidiary into the parents financial statements, the parent uses dollars to measure their books subsidiary uses a foreign currency on the bookkeeping side, how do we get them over $2 so we can do the consolidation process. two methods generally we can use a translation method or a remeasurement method, and we have to determine which method we’re going to use by determining what the functional currency is. And once we know what the functional currency is, then we can determine whether we need to use the translation method or the remeasurement method. And they’re going to be slightly different. Now note, there’s also a third kind of option where we might have to use translation and remeasurement if there was a situation where the foreign currency has the financial statements, and something other than the US dollars and then the functional currency was not the currency that their bookkeeping was in, and it’s not the US dollar.

Posts with the Transactions tag

Accounting Cycle Steps in the Accounting Process

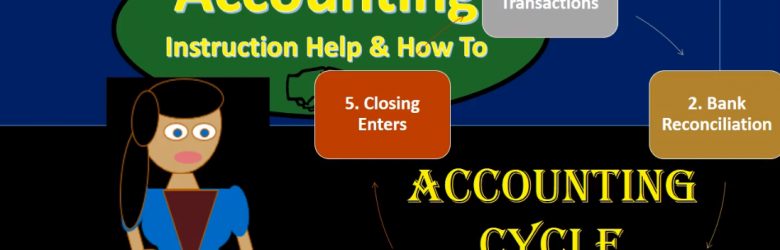

Hello, in this presentation, we’re going to be talking about the accounting cycle or the accounting process, that process that the accounting department will go through on a systematic basis over and over and over again, typically thought of as a monthly process. Although it could be thought of as a yearly process or some other process in terms of the amount of time that will pass. But these are going to be the steps that we’ll be going through in terms of the accounting process, always keeping in mind that in goal of financial accounting, which are the financial statements, some texts will have more steps than five as we have here. Some texts will have less than five steps. But the goal here is to really have a broad picture big picture, so that when we think about the accounting process, we can break down that that big picture view, five is a pretty good number for us to be able to memorize and keep in our mind if we have more than that, it can start to kind of muddy the picture.

Bank Reconciliation-Accounting%2C Financial

Hello, in this lecture, we’ll discuss a bank reconciliation. At the end of this, we will be able to describe what a bank reconciliation is perform a bank reconciliation, make a needed adjustments to our books in the reconciliation process, as well as record those adjustments. So this is going to start off the bank reconciliation process. We’ll start off with, of course, the bank statement. So the bank statement is going to come from the bank, generally, it happens at the end of the month, although we could get it electronically at any timeframe. But typically, it’s still good to get it as of the end of the month so that we can have a set timeframe as to when we’re going to reconcile our account and deal with the timing differences at that time. So this bank statement coming from the bank is going to be as of the end of February in this case, and we’ll have a typical information on a bank statement, which will be that we will have the beginning balance, and then we’re going to have the additions to it generally our deposits and then we’re going to have the corrections to it.

Cash Payments Journal Service Company 50

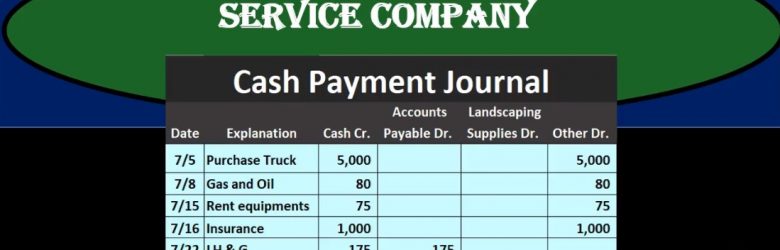

In this presentation, we will take a look at a cash payments journal for a service company, the cash payment journal we’ll be dealing with transactions where we have cash payments, that’s going to be the factor that will be the same for all transactions with cash payments meaning this column here cash payments will always be affected wish they kept cash payments journal cash payments journal will be used when using more of a manual system rather than an automated system. However, it’s good to know what the cash payments journal is, even if using an automated system because it’s possible that we or it’s very likely that we would need to run reports that will be similar in format to a cash payments journal. And it’s useful to see this format or how different types of accounting structures can be built.

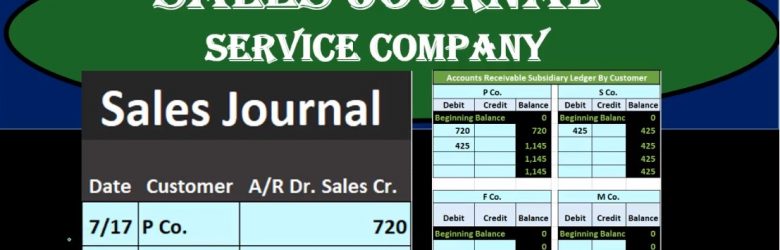

Sales Journal Service Company 10

In this presentation, we will take a look at the sales journal for a service company. We’ll use the sales journal in a manual system or a system we do by hand. When we make sales. However, it’s a little bit more complicated than that because if sales journal really means sales that we make on account, meaning we’re not receiving cash at the point in time we make the sale. If we do receive cash at the point in time we make sale even though we have sales being recorded or revenue accounts being recorded. It should be going into the cash receipts journal, because that’s the journal we use whenever we get cash. So the better term for this journal may be something like accounts receivable, or more specifically, sales made on accounts or sales and accounts receivable, but it’s typically called the sales journal. So don’t let that confuse you.

Special Journals Subsidiary Ledgers 2

In this presentation, we’re going to talk about special journals and subsidiary ledgers. First, we’re going to list out the special journals and talk about when we would use them, why we would use them and how they fit into the accounting system. The special journals are basically going to group types of transactions. So when we think about all the transactions that happened during the month, we typically see them in order of when they happen in the accounting system, we’re going to record transactions in other words, by date as they occur. But if we are able to group those transactions into special journals that can simplify the process.

Accounting Cycle Steps in the Accounting Process 1

Hello, in this presentation, we’re going to be talking about the accounting cycle or the accounting process, that process that the accounting department will go through on a systematic basis over and over and over again, typically thought of as a monthly process. Although it could be thought of as a yearly process or some other process in terms of the amount of time that will pass. But these are going to be the steps that we’ll be going through in terms of the accounting process, always keeping in mind that in goal of financial accounting, which are the financial statements, some texts will have more steps than five as we have here. Some texts will have less than five steps. But the goal here is to really have a broad picture big picture, so that when we think about the accounting process, we can break down that that big picture view, five is a pretty good number for us to be able to memorize and keep in our mind if we have more than that, it can start to kind of muddy the picture. So once we get into each of these individual steps, we want to get into more detail, obviously.

General Ledger 245

Hello, in this presentation we will discuss the general ledger. At the end of this, we will be able to define what the general ledger is. We’ll list components of the general ledger and explain how the general ledger is used. When looking at transactions in terms of journal entries and posting those journal entries in track prior presentations, we were posting those journal entries mainly to a worksheet in order to see a quick computation over the beginning balance and what is happening to that balance, posting it to a format of a trial balance than an adjusting column and then an adjusted trial balance. Note, however, that we typically think of the journal entries being posted to a general ledger. The general ledger can be very complex when we look at it which is why it is often useful to not look at it when we first start posting the transactions but to see that how those transactions affect interest Visual accounts.

Ethic & Profession 150

Hello in this presentation we will discuss ethics and profession objectives, we will be able to at the end of this define profession define ethics as it relates to accounting. Explain the factors that increase the likelihood of fraud, describe internal controls profession, the definition of a profession, a profession is a calling or requiring specialized knowledge and often long and intensive academic preparation. When thinking about profession, we often think about a doctor or a lawyer being two of the primary professions that we first think of. And when we consider those professions, we note that the major component of those professions are that they’re providing a service and a service which most people do not have intimate knowledge about.

Accounting Equation 115

Hello in this presentation we will discuss the accounting equation. At the end of this we will be able to name the accounting equation, explain the components of the accounting equation and explain the balancing concept related to transactions. The double entry accounting system can be recorded in a few different ways, at least three different ways. It’s useful to understand these three different ways. The first way the one we will be concentrating on here will be in the format of the accounting equation, assets equal liabilities plus owner’s equity or just equity.