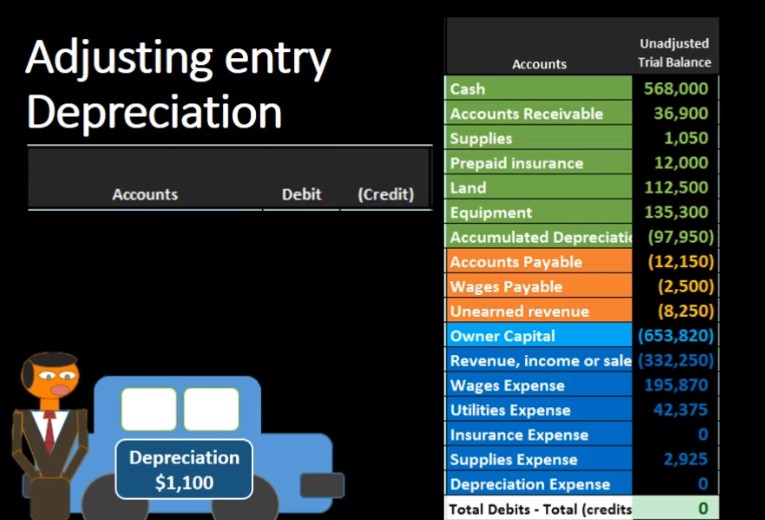

Hello in this lecture, we’re going to record the adjusting entry related to depreciation were recorded on the left hand side, that’s where the journal entry will go. And then we’ll post that to the trial balance on the right hand side trial balance being in the format of assets in green liabilities in the orange. Then we have the equity section in the light blue and the income statement, including revenue and expenses in the darker blue. We’ll first talk about what accounts are affected and then we’ll go back and explain why this is the case. So first, we know that it’s an adjusting entry. So that’s going to have some added rules, you want to keep the adjusting entry separate in your head from just normal journal entries. all entries have at least two accounts and an equal number of debits and credits as well as adjusting entries. But adjusting entries are all made of as of the cutoff date, we’re gonna say 1231 in this case, and they generally have one account above this equity line above the capital meaning a balance sheet account and one account below that line meaning an income statement accounts.

00:55

And if we know that we can look at the trial balance and usually figure out what accounts are affected even if We’re not sure why. So let’s do that first, what account above this blue line is going to be related to depreciation. If we go through these accounts, we could say, Hmm, how about the accumulated depreciation. And then we can look at the accounts below the blue line, including revenue and expenses, look for something related to the appreciation, and we see depreciation expense. So we can see those two accounts just by knowing that it’s an adjusting entry and it’s related to depreciation. We can even know which way they are going, we can say whom depreciation expense, income statement accounts all go up, they all have debit accounts, balances, and they all generally just go up. Therefore, we’re going to debit depreciation expense. And if we debit depreciation expense, what are we going to do to accumulated depreciation? We will credit it, then we can know all this without really even understanding what is going on here. Now let’s talk about what’s really going on here.

01:54

What is depreciation? Why are we doing this? Remember that depreciation is an account that’s going accumulated depreciation is an account that’s going to be related to the equipment account. Here we can see the equipment account, what is happening to equipment, it’s going to go down in value in a similar way as supplies. In a previous lecture, we talked about supplies, we put supplies on as an asset. And then we reduced the supplies as we consumed them, in accordance with our physical count. The difference with equipment is the fact that this was our car. And this was the equipment we’re talking about. If I go physically counted as of the end of the year, or the month, I still have one car, it didn’t go down in amount at all, but I know it went down in value, and therefore we had to determine how it went down in value. So instead of reducing the equipment account directly, we’re going to make this other account called accumulated depreciation so that people can see that it is an estimate.

02:51

They can see how much we bought the equipment for it could be multiple pieces of equipment job, not just one car but multiple things. They can see how much we bought it for and they can see the estimate that we have For the reduction in value, so that’s what we have here. That’s why we have this account being a contra asset account, meaning it’s going to be an asset account. But it’s got a credit balance because we’re really saying it’s going to be this number minus this number. And then we’re going to depreciate it, meaning we’re expensing it over time in a similar way that we expense, basically the supplies but we’re really depreciating or expensing the equipment. Alright, so if we record this out, usually the books gonna give us a number at the beginning. Later we’ll talk about how to calculate it. So right now we’re just gonna say the number is 1100. We’ll talk about calculating it later.

03:37

Once you know that then you can just plug in the numbers here, debit 1100, depreciation expense, credit accumulated depreciation. If we post that out, then depreciation is going to go from zero to 1100. And accumulate depreciation is going to go from a credit of 97 950 up in the credit direction to 99,050. That means that assets are going down note that this is A confusing account because the accumulated depreciation went up in the credit direction, which brought down assets because assets normally have debit balances. Alright and then the liabilities stayed the same and the equity section has gone down. Why? Because expenses went up, expenses going up means net income is going down, which brings down the equity section. If we look at net income, we can see that we had 91,080 that’s going to be revenue minus the expenses, and then we debited 1100 bringing the balance down to 89 980.