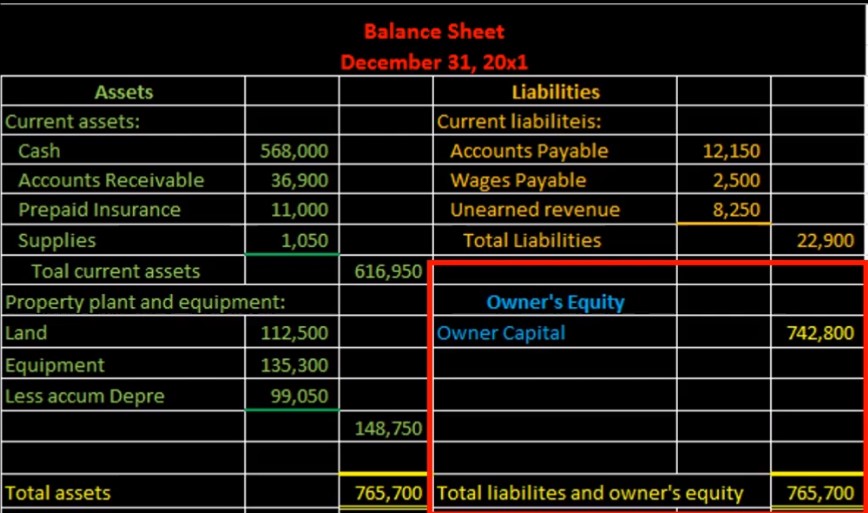

Hello in this lecture we’re going to be creating the equity section of the balance sheet. In prior lectures, we have taken a look at the current assets section, the property plant and equipment section and then the liability section. This will be rounding out the balance sheet where we will finally get to total assets being equal to total liabilities and equity represent in the double entry accounting system. In terms of the balance sheet in terms of the accounting equation, we of course, are pulling these numbers from the adjusted trial balance. the adjusted trial balance also represents the double entry accounting system. However, it represents that double entry accounting system in the format of the building blocks of debits and credits. All we’re doing is taking those building blocks in terms of debits and credits, rearranging them to the accounting equation, so that readers who don’t understand debits and credits can then read them. Now when we look at the equity section, this is a bit confusing when we convert from the trial balance to the equity section.

00:54

Because when we think the equity section you might say, huh, those are the light blue accounts here the owner’s capital and withdraws. But remember that the equity section also accounts for the entire blue area here. Why? Because the trial balance represents both a period of time and the time frame represents both the income statement and the balance sheet. How could we do that? on one statement? How can the trial balance represent basically balance sheet accounts and income statement accounts? The answer is that this owner’s capital account basically represents the capital as of the beginning of the time period, in this case, the beginning of the month. Now we are looking at the end of the month 1231. And the reason that only represents the beginning of the month plus investments which there are none for this example, is because the activity for the month is shown below. So this is what happened during the month, people drew up money. These are temporary accounts, revenue happened during the month that’s temporary.

01:50

Then we have wages, utilities and whatnot, all happened during the month. Therefore, in terms of the balance sheet account, this is all one number. In terms of equity. It’s the equity section. But in terms of the financial statements as a whole, this portion down here is the income statement. So that’s going to be the most tricky piece when we try to piece together the financial statements. In terms of the balance sheet, we can represent all this blue account as basically one part of the balance sheet been equity section. Therefore, under the equity section, we only have one account, we have the owner’s capital account. Now again, you might be saying, well, owners capital account is this 663 820? Where did we come up with this 740 to 800. And the thing about that is that, remember, this capital account represents the beginning capitalized the beginning of time period. We don’t have a date here to tell us that. But that’s basically going to be the case.

02:43

We don’t have a date up here telling us that this is the end of the time period. Why? Because it’s on the balance sheet. It says it’s as of 1231. That means all the accounts as of the point in time on the balance sheet are as a 1231. What is this? What does this number really represent? How do we get that number All we’re doing is taking all these accounts, you can think of that in a few different ways you could think of it as the credits minus the debits meaning the capital accounts or credit credits are going to win for the entire capital accounts, meaning we have the credit minus the debit plus the credit of income minus the debit of all the expenses, that will give us this 740 to 800. You can also think of it as the capital account section, the light blue section, meaning the 663 820 minus the draws, and then simply add net income to it, which is basically what we will do when we create the financial statements. Or we can list it out in terms of the equity section being the owner’s capital account, just being a positive number in terms of total equity, and then we’re going to subtract out draws draws, decreases the equity, we’re going to add to it revenue.

03:51

And then we’re going to subtract out the wages, the utilities, the insurance expense, the supplies the depreciation, so on All we’re doing is summing these up in terms of credits minus debits, or the things that increase the total equity minus the things that decrease it. And that’s what we’re getting with this 740 to 800. But point we want to get to here is that the balance sheet represents everything in terms of it has total assets and have the liabilities and it has the total equity section. However, the equity section has crammed in all this information, meaning it’s included all the time and accounts into this one number. So we can look at the double entry accounting system without basically the income statement, or the statement of owner’s equity, the timing statements, because we’re basically looking at the accounting equation as of a point in time. But we’re going to want to know more about this number, we’re going to want to know how we got to that point in time.

04:42

So if we look at the balance sheet now, what we’ve done is we’ve seen current assets we’ve seen property, plant and equipment, we’ve done the liabilities, we now can see that all the other blue accounts on the trial balance we put together into this one number and therefore we’ve accounted for all the accounts on the trial balance that Why total assets then equals total liabilities plus owner’s equity, we’ve converted the trial balance from a debit and credit format of the double entry accounting system to a plus and minus format of the double entry accounting system created a format that people can now read without knowing debits and credits.

05:17

However, we want to know more about this number right here. That number tells us where we are at at a point in time meaning assets minus liabilities gives us this 742. It’s kind of the book value of the company. But we want the story we want to know how we got there. How did we do last year in terms of how much of that was contributed to this book value of the company. That of course will include the timing statements, the income statement, and the statement of the equity. So we’re going to reconstruct the blue accounts and reconstruct this number with the income statement and the statement of owner’s equity.